Blog

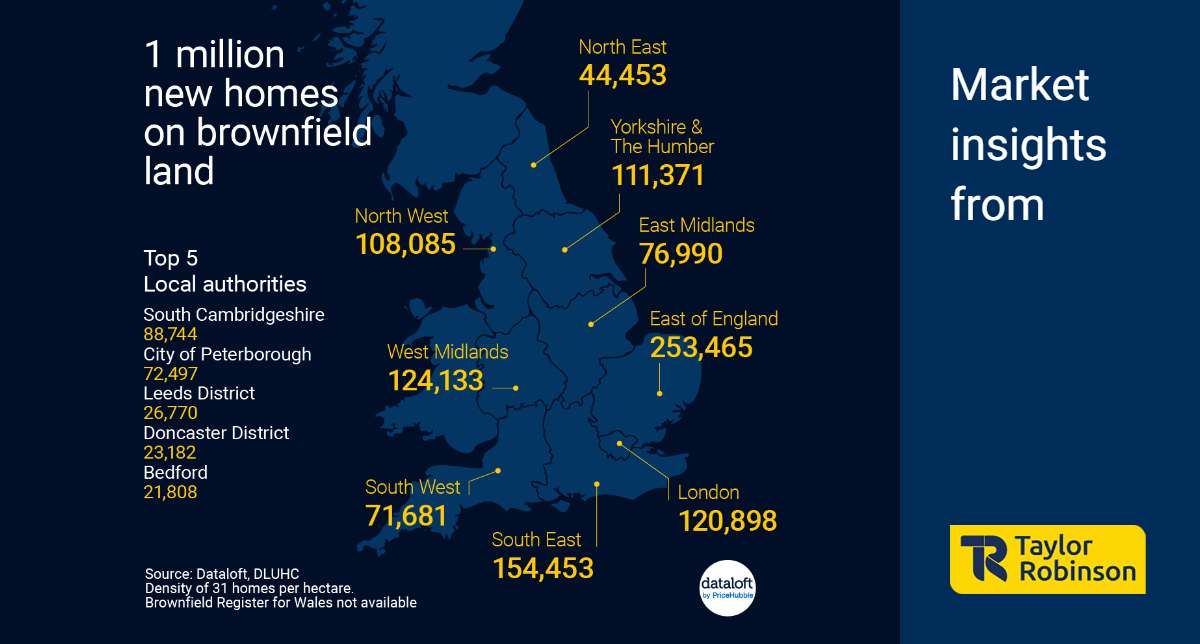

In a bid to tackle the housing crisis gripping England, the Housing Secretary has unveiled bold initiatives aimed at maximizing the potential of brownfield land for residential development. Brownfield land, areas previously developed upon, is set to become a focal point for housing construction under the new proposals, with local authorities mandated to prioritise its development.

According to an analysis conducted by Dataloft, these plans could potentially unlock over 26,000 sites encompassing 34,375 hectares of land across England. With an average density of 31 properties per hectare, this equates to a staggering 1 million new homes if all identified sites are fully developed. This move marks a significant step towards addressing the housing shortage, providing much-needed accommodation for residents nationwide.

The data further reveals regional disparities in brownfield land availability. South Cambridgeshire and Peterborough emerge as areas with the most substantial potential, offering the possibility of over 160,000 new homes combined. The East of England tops the regional charts with 8,176 hectares of brownfield land, presenting an opportunity for approximately 250,000 new homes. Conversely, the North East lags with only 1,434 hectares of identified brownfield land, capable of accommodating around 44,000 new homes. These figures underscore the varying degrees of potential across different regions and emphasise the need for tailored approaches to address local housing needs effectively.

In addition to promoting brownfield development, the Housing Secretary's announcement includes plans to streamline the planning process for property extensions. A consultation has been proposed to explore the possibility of removing planning permission requirements for certain types of property extensions. This move aims to facilitate homeowners in improving and expanding their properties without the bureaucratic hurdles currently in place, potentially fostering a more dynamic housing market.

The proposed initiatives signify a concerted effort by the government to harness the untapped potential of brownfield land and accelerate the pace of housing construction. By prioritizing development on previously used sites and streamlining planning procedures, policymakers aim to not only alleviate the housing shortage but also revitalize urban areas and promote sustainable land use practices.

However, challenges such as infrastructure provision, environmental considerations, and community engagement must be carefully navigated to ensure the success and sustainability of these initiatives. Balancing the need for housing with the preservation of green spaces and heritage sites remains a critical aspect of urban planning.

As the proposals progress through consultation and implementation stages, stakeholders, including local authorities, developers, and communities, will play pivotal roles in shaping the future landscape of housing in England. Collaborative efforts and innovative solutions will be essential in realizing the vision of vibrant, inclusive, and sustainable communities across the nation.

- Details

- Hits: 238

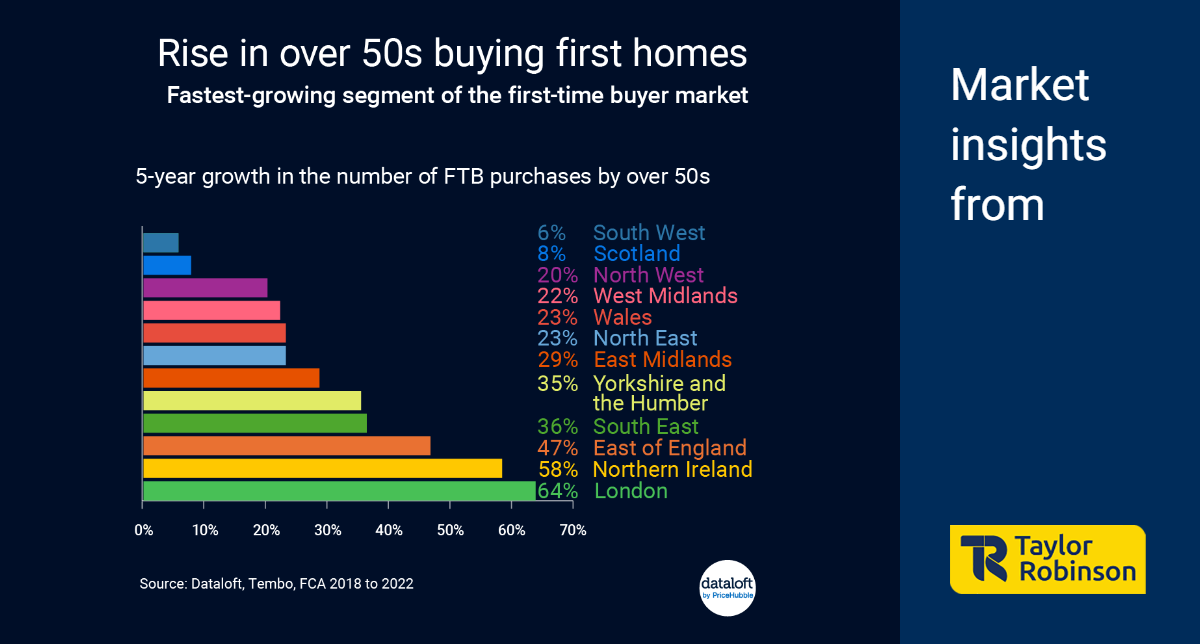

In a striking departure from conventional patterns, there has been a notable surge in individuals aged 50 and above stepping into the realm of first-time homebuyers. Recent data compiled by mortgage specialist Tembo in conjunction with property data company Dataloft reveals a staggering 30% increase in the number of over-50s purchasing their inaugural homes across the UK over the past five years. This contrasts starkly with a 7% decline in younger first-time buyers over the same period.

The trend is particularly pronounced in urban hubs like London, where the figure has soared by an impressive 64%. Moreover, regions such as the South East (36%), the East of England (47%), and even Northern Ireland (58%) have witnessed substantial upticks in this demographic's foray into homeownership.

This burgeoning phenomenon among the over-50 cohort is multi-faceted, reflecting several societal shifts and individual circumstances. Firstly, the prolongation of life expectancy coupled with improved health conditions has rendered individuals more financially stable and empowered to pursue homeownership later in life. Additionally, changing societal norms have seen many delaying major life milestones such as starting a family, thereby deferring the need for homeownership until later stages.

Moreover, the diminishing allure of the buy-to-let market, attributed to regulatory changes and economic uncertainties, has redirected investment intentions towards primary residence acquisition among this demographic. The confluence of these factors has culminated in a notable demographic shift within the property landscape.

The ramifications of this trend extend beyond mere statistical observations, significantly influencing the dynamics of the housing market. Foremost among these is the anticipated surge in demand for smaller, more affordable housing units tailored to the needs and preferences of older first-time buyers. Consequently, this demographic's entry into the market necessitates a re-evaluation of mortgage products and lending practices to accommodate the unique financial profiles and retirement considerations of older borrowers.

In essence, the surge in over-50s embarking on their maiden homeownership journey signals a profound evolution in demographic trends and lifestyle choices. As this demographic continues to assert its presence in the housing market, its impact is poised to reverberate through the property landscape, shaping housing policies, market dynamics, and consumer preferences in the years to come. This paradigm shift underscores the imperative for stakeholders to adapt and innovate in response to the evolving needs of an increasingly diverse and dynamic demographic profile of homebuyers.

- Details

- Hits: 231

Roses are red, violets are blue, and in the UK's property market, a perfect home awaits you. Valentine's Day, traditionally celebrated as a day of love and affection, also sees many couples embarking on the journey of finding their dream home. In 2023, over 1,300 homebuyers sealed the deal on Valentine's Day, creating their own love story amidst the backdrop of the property market.

According to data sourced from Dataloft and the Land Registry for 2023, Valentine's Day transactions in the UK's property market showcased intriguing insights. The average sold price for homes on this romantic day stood at £364,655, marking a 4% increase compared to the rest of the year. This surge in pricing underlines the sentimentality and significance attached to purchasing a home on Valentine's Day.

In matters of the heart, the UK's property market offers a diverse array of options, catering to every preference and budget. From lavish estates to cosy retreats, there's something for every heart's desire. Last Valentine's Day exemplified this diversity, with a staggering £5,546,750 difference between the most and least expensive purchases.

Topping the list as the most extravagant purchase was a luxurious flat located in Gloucester Square, Westminster, fetching a price tag of £5,580,000. This opulent residence epitomized grandeur and sophistication, serving as a testament to the heights of luxury within the UK's property landscape.

However, amidst the allure of high-end properties, love also found a place in more budget-friendly abodes. In Hartlepool, a charming terrace stole hearts with its modest price of £33,250. This humble yet cosy dwelling demonstrated that love knows no bounds, transcending monetary considerations to find solace in the warmth of a home.

The juxtaposition of these diverse transactions highlights the dynamic nature of the UK's property market, where romance intertwines with financial pragmatism. Whether it's a lavish indulgence or a modest haven, Valentine's Day serves as a poignant reminder that home is where the heart is.

As couples across the UK exchange vows and keys on this special day, the property market continues to evolve, offering endless possibilities for those embarking on the journey of love and homeownership. With each transaction, a new chapter unfolds in the ongoing saga of romance and property in the UK.

In conclusion, as roses bloom and violets flourish, so too does the allure of finding the perfect home in the UK's property market. Whether you're dreaming of a lavish sanctuary or a cosy retreat, Valentine's Day beckons with promises of love and opportunity in the realm of property. And if your heart is set on finding your dream home in Crawley, look no further – simply call our office on 01293 552 388 to start your journey towards homeownership and a love-filled future.

- Details

- Hits: 218

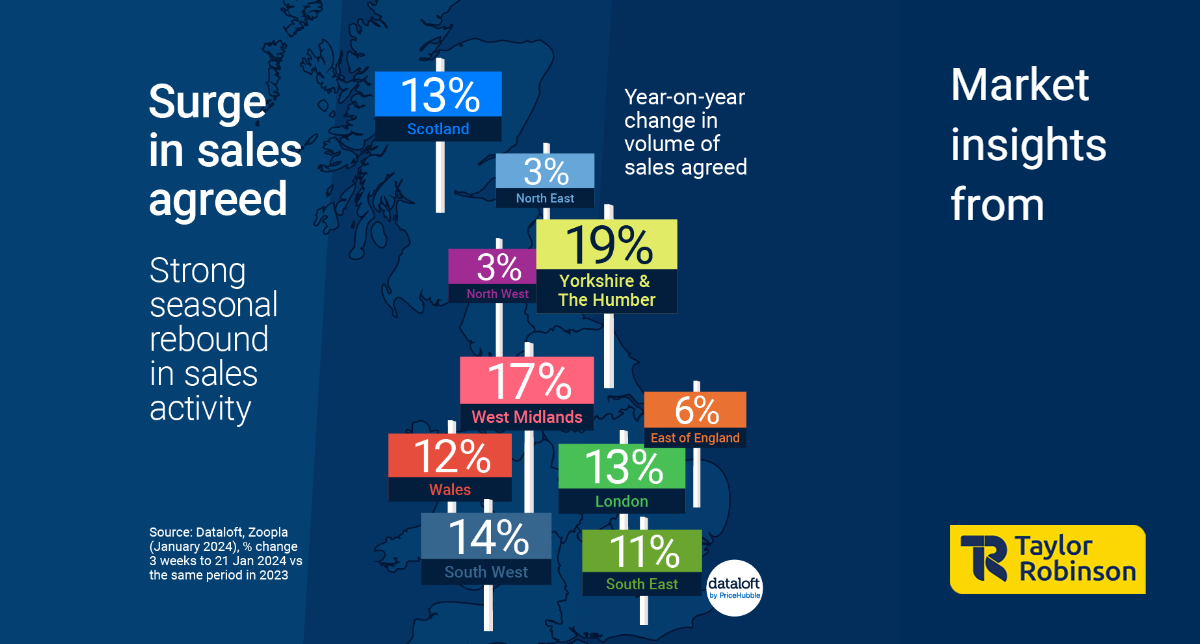

In a promising start to the new year, we at Taylor Robinson, operating from our Crawley office, are witnessing a robust surge in new sales agreements. This significant uptick serves as a crucial indicator of market confidence and activity, reflecting a positive trend in the property sector. According to data obtained from Dataloft and Zoopla for January 2024, new sales agreed have risen by an impressive 13% in the first three weeks, when compared to the same period last year.

National Trends:

The positive momentum in sales activity extends across all regions and countries, with notable spikes in key areas. Yorkshire and The Humber lead the charge with a remarkable 19% increase in new sales agreements, closely followed by the West Midlands, where activity has surged by 17%. These statistics paint a promising picture of a nationwide resurgence in the property market.

Factors Contributing to the Surge:

Several factors contribute to this surge in sales activity. First and foremost, the availability of the best mortgage rates below 4% is a compelling driver, making property ownership more attractive for potential buyers. Additionally, consumer confidence has reached its highest point since January 2022, providing further impetus to the market.

However, it's crucial to acknowledge that this rebound is occurring from a relatively low base, underscoring the challenges the property sector has faced in recent times. The gradual recovery is encouraging, but the market is still navigating its way back to pre-pandemic levels.

Buyer Price Sensitivity:

Despite the overall positive trend, buyers remain particularly price-sensitive. One noteworthy observation is that one in five sellers are willing to accept offers that are more than 10% below the asking price to secure a sale. This trend indicates that while the market is active, buyers are still exercising caution and seeking favourable deals.

In conclusion, the property market is showing signs of resilience and recovery, as evidenced by the increased volume of new sales agreements reported by Taylor Robinson Estate Agents. With mortgage rates at historically low levels and consumer confidence on the rise, the property sector is poised for a positive trajectory in 2024. However, it is essential to remain mindful of the market's sensitivity to pricing, as demonstrated by sellers accepting offers below the asking price. The data sourced from Dataloft, Zoopla (January 2024), and the GfK Consumer Confidence Tracker collectively paint a picture of a market on the mend, cautiously optimistic about the future.

- Details

- Hits: 228

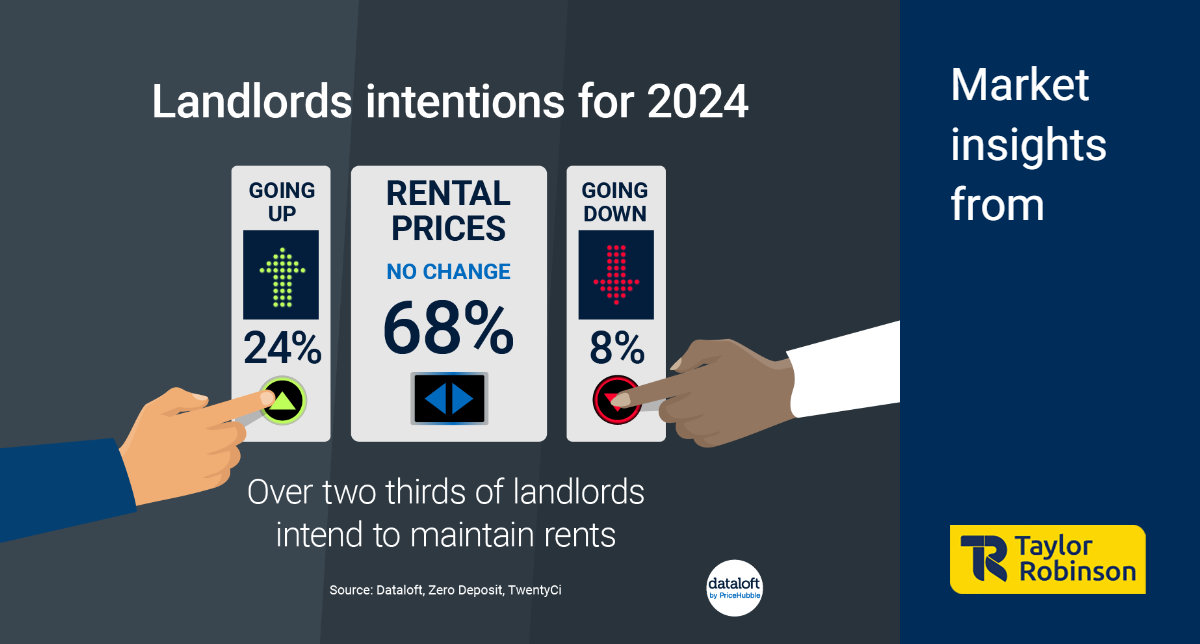

In the ever-evolving landscape of property, landlords play a crucial role in providing housing solutions to tenants. As we step into 2024, a glimpse into the plans and challenges faced by landlords sheds light on the dynamics of the rental market. According to recent data from #Dataloft, Zero Deposit, and TwentyCi, only 24% of landlords intend to increase rents this year, while 68% plan to maintain current levels, and 8% are considering a rent reduction.

Rising Rents:

Over the past few years, the rental market has experienced a notable surge in prices. Since the fourth quarter of 2022, rents have increased by an average of £135 per month. The escalation becomes even more apparent when compared to the same quarter in 2019, with an astonishing rise of £450 per month. This upward trend places additional financial strain on tenants, creating a ripple effect throughout the rental ecosystem.

Prioritizing Tenant Relationships:

In the face of escalating rents, landlords are recognizing the importance of fostering strong relationships with their tenants. Finding and retaining high-quality renters has become a top priority for property owners. This emphasis on relationship-building may explain why the majority of landlords, constituting 68%, are opting to maintain existing rent levels rather than pushing for further increases.

Challenges on the Horizon:

Looking ahead, landlords anticipate encountering several challenges in 2024. The primary concerns include the costs associated with maintaining, repairing, and running properties. As landlords strive to provide comfortable living spaces, the financial burdens of property upkeep become significant. Legislative changes also feature prominently as a challenge, underscoring the need for landlords to stay abreast of evolving regulations to navigate the rental landscape effectively.

Encouraging a Dialogue:

For landlords seeking expertise and guidance in navigating these challenges, it's essential to connect with industry professionals. As an expert in the field, I invite landlords to reach out for personalized insights and strategies tailored to their unique situations. With a deep understanding of the current rental market dynamics, I am well-equipped to assist landlords in optimizing their rental properties and addressing the challenges that lie ahead.

The rental market in 2024 presents a mix of challenges and opportunities for landlords. While rent increases are not the primary focus for the majority, maintaining positive tenant relationships and staying abreast of evolving regulations are crucial elements of success. As landlords navigate this complex landscape, seeking expert advice becomes paramount. Don't hesitate to call me, Ben on 01293 552 388 or email This email address is being protected from spambots. You need JavaScript enabled to view it., to discuss how we can work together to ensure your success in the ever-dynamic world of residential lettings.

- Details

- Hits: 262