Blog

For the past five consecutive years, LadBaby has clinched the coveted UK Christmas number 1 single, securing a unique place in the nation's festive tradition. With chart-topping hits like 'Food Aid,’ 'Sausage Rolls for Everyone,’ 'Don’t Stop Me Eatin', 'I Love Sausage Rolls,' and 'We Built This City,’ LadBaby's success has not only marked a musical phenomenon but also coincided with a noteworthy trend in the UK property market.

The Last Contender Before the Sausage Roll Sensation:

The last time someone else held the top spot at Christmas was in 2017, when Ed Sheeran's 'Perfect' graced the airwaves. During that period, the average house price in the UK stood at £225,330. Fast forward to September 2023, and the property landscape has undergone a substantial transformation, with the average house price soaring to £291,385—an impressive 29% increase in just over five years.

LadBaby's Christmas Reign and Property Price Growth:

LadBaby's meteoric rise to becoming the undisputed Christmas chart champion has been accompanied by a parallel surge in UK property prices. The correlation between LadBaby's festive success and the property market is striking, and it raises intriguing questions about the possible influence of pop culture on economic indicators.

Surpassing the Beatles:

LadBaby's achievement of securing more Christmas number ones than any other artist, including surpassing the iconic Beatles, adds an extra layer of significance to the discussion. As the Sausage Roll sensation continues to break records, it prompts speculation about whether a new contender will emerge this year to challenge LadBaby's festive reign.

Property Price Growth: A Statistical Perspective:

Drawing from data provided by Dataloft, the Office for National Statistics (ONS), and the UK House Price Index (HPI) for September 2023, the figures reveal a compelling narrative. The 29% increase in average house prices since Ed Sheeran's last Christmas chart-topper showcases the dynamic nature of the UK property market.

LadBaby's consistent Christmas chart dominance, coupled with the impressive surge in property prices, creates a unique intersection between the world of music and the property landscape. As the nation eagerly awaits this year's Christmas number one, the question remains: will LadBaby continue its festive supremacy, or will a new contender rise to the occasion? The unfolding of events will undoubtedly offer intriguing insights into the intersection of pop culture and economic trends in the UK.

- Details

- Hits: 321

As the festive spirit twinkles across the United Kingdom, a grand celebration of generosity is set to unfold, making the holiday season brighter than ever before. According to the latest data from Dataloft and UK HPI, the nation is gearing up to spend a staggering £27.6 billion on Christmas gifts in 2023. This marks a remarkable 37% increase from the £20.1 billion spent in 2022, transforming the upcoming season into a true extravaganza of giving.

Diving into the figures, this festive spending frenzy accounts for just over one quarter (27%) of the total amount invested in property transactions throughout the year. To put it into perspective, the property market has seen exchanges amounting to an impressive £104 billion this year alone. The festive season's economic impact is not only spreading joy but also leaving a substantial mark on the landscape of consumer spending.

In the spirit of giving, a commendable 45.8 million adults in the UK, comprising a robust 86%, have pledged to partake in the joyous tradition of exchanging Christmas gifts in 2023. While this represents a slight dip from the 89% of adults who participated in the gift-giving festivities in 2022, the enthusiasm for spreading holiday cheer remains steadfast and unwavering.

Delving deeper into the data reveals an intriguing trend among different age groups, with Generation Z taking the lead in the spirit of generosity. Gen Z, the torchbearers of the future, are gearing up to open their hearts and wallets, planning to spend an impressive average of £828 each on Christmas gifts. This festive fervour not only showcases the unique preferences and tastes of the younger generation but also underscores the significance of the season in fostering connections and creating lasting memories.

Beyond the joyous exchange of gifts, the data illuminates the interconnectedness of festive spending and property transactions. The £27.6 billion earmarked for Christmas gifts this year, signifying the profound impact of the season on consumer behaviour.

As we unwrap the layers of data, it becomes evident that the season of gift-giving is not merely about material exchange; it's a celebration of the warmth of human connection, the joy of giving, and the spirit of togetherness. With the holiday season fast approaching, let's embrace the magic of generosity, celebrate the diversity of gifting traditions, and make this Christmas a time to remember. After all, the true essence of the season lies not in the price tag of the gifts but in the love and thoughtfulness that accompany them. May your holidays be filled with laughter, love, and the joy of giving!

- Details

- Hits: 302

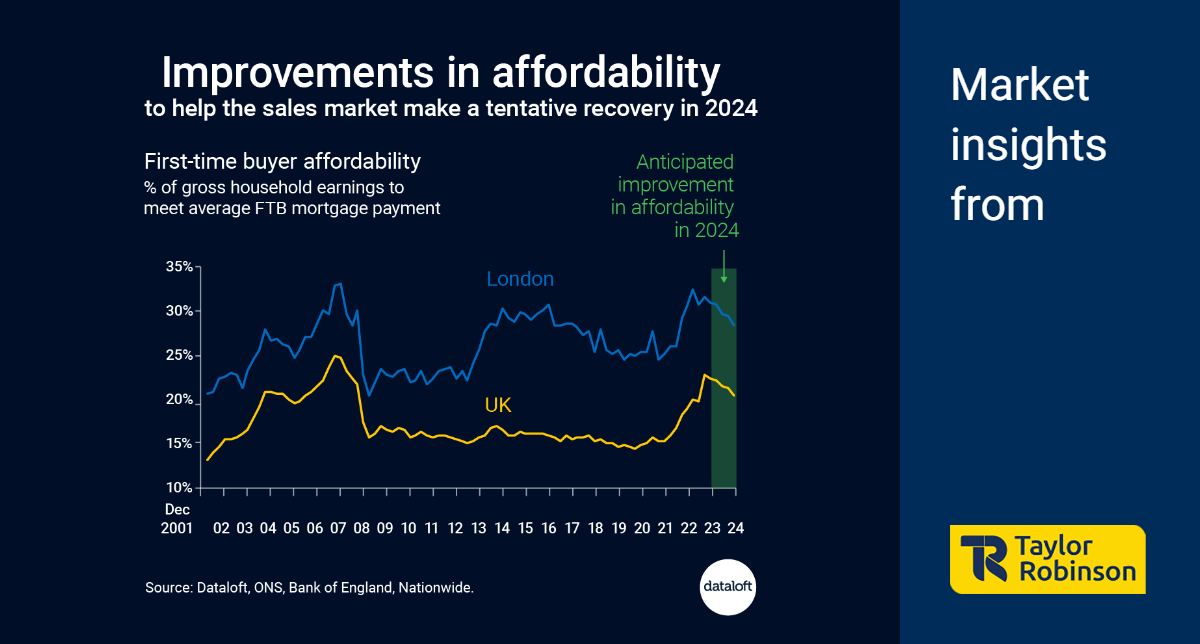

Understanding the dynamics of housing affordability is crucial in gauging the health of the property market. By examining affordability levels over time, analysts can discern whether a market is overextended, necessitating a slowdown, or poised for recovery due to improved affordability. In this article, we delve into the factors influencing affordability and explore projections for 2024, anticipating a shift that could bolster buyer confidence and drive a tentative recovery.

Factors Influencing Affordability

Affordability, in the context of housing markets, is measured by the proportion of household earnings required to meet mortgage payments. Several factors contribute to this metric, including mortgage rates, income growth, and property prices. Examining these elements provides insights into the overall health of the property market landscape.

Anticipated Improvement in Affordability

In the upcoming year, 2024, a confluence of factors is expected to contribute to an improvement in housing affordability. Chief among these factors is the anticipation of better mortgage rates. The outlook for the mortgage landscape suggests a positive trend, with lower recent 5-year swap rates recorded at 4.4% at the end of November. This points towards a potential further reduction in mortgage rates, which is a key driver for improved affordability.

The Role of Mortgage Rates

Mortgage rates play a pivotal role in determining housing affordability. The recent dip in 5-year swap rates is indicative of a favourable trend that could positively impact mortgage rates. As mortgage rates decrease, the financial burden on homebuyers lessens, making homeownership more accessible. This, in turn, contributes to an uptick in affordability, a crucial factor in fostering a healthy real estate market.

Data Sources

To assess affordability, various reliable sources have been considered, including Dataloft, the Office for National Statistics (ONS), the Bank of England, and Nationwide. The analysis is based on first-time buyer (FTB) prices, assuming 1.5 full-time incomes per household, an 80% loan-to-value ratio, and an average new lending mortgage rate. Additionally, forecasted earnings growth of 3.4% for 2024 and an expected improvement in the average new lending rate to 4.5% by the end of 2024 have been factored in. The projection also incorporates a forecasted FTB price fall of -1% for the remaining quarter of 2023, followed by stabilization.

Implications for Market Confidence

As affordability improves, the implications for buyer confidence become evident. A more affordable housing market tends to attract a broader range of prospective buyers, stimulating demand. The expected recovery in buyer confidence, driven by enhanced affordability, may pave the way for a tentative rebound in the real estate sector.

In conclusion, the dynamics of housing affordability are crucial indicators for the health and trajectory of the property market. The anticipation of improved mortgage rates in 2024, as evidenced by lower recent 5-year swap rates, suggests a positive outlook for affordability. This, in turn, has the potential to drive a tentative recovery in buyer confidence. By considering a combination of factors and reliable data sources, analysts can gain valuable insights into the evolving landscape of housing affordability, assisting both industry professionals and prospective homebuyers in navigating the complex world of property.

- Details

- Hits: 262

Resplendent with twinkling lights and cherished ornaments, the Christmas tree stands as a beacon of warmth, tradition, and the spirit of giving. As we adorn our homes with these festive evergreens, we find not only a celebration of tradition but also an opportunity to reflect on the positive aspects of change, even in the realm of rising rental costs.

The Christmas Tree Tradition:

The tradition of decorating Christmas trees traces its roots to 16th century Germany when evergreen trees were adorned with decorations symbolizing the paradise tree of the Garden of Eden. Today, this ritual has evolved into a beloved global tradition, uniting families in the joy of decorating their trees and creating lasting memories.

The Growth of Christmas Trees:

Much like the time and care invested in cultivating a Christmas tree, these festive symbols undergo a 15-year journey before they are ready for sale. This patient cultivation process mirrors the enduring spirit of the holiday season, where the joy of giving and the warmth of tradition take centre stage.

Rising Rents in the Rental Market:

However, as we revel in the glow of our Christmas trees, let us consider the changing economic landscape with optimism. Over the same 15-year period it takes for a Christmas tree to mature, rents have surged by almost 40%. According to #Dataloft Rental Market Analytics from October 23, the average monthly rent has reached £1,417, a testament to the dynamic growth in the housing market.

The Changing Landscape:

This significant increase in rental costs reflects not only challenges but also opportunities for growth and development. The rising rents signify a thriving rental market, bringing with it new possibilities for urban development and improved living standards. As we appreciate the glowing lights of our Christmas trees, let us also recognize the bright spots in the changing landscape outside our festive havens.

As we gather around our resplendent Christmas trees, adorned with the symbols of tradition and joy, let us embrace the positive aspects of change. The enduring journey of a Christmas tree from seedling to centrepiece mirrors the enduring spirit of the holiday season. In this season of giving, let us celebrate not only the warmth of our homes but also the optimism that comes with navigating the challenges of the contemporary rental market.

- Details

- Hits: 216

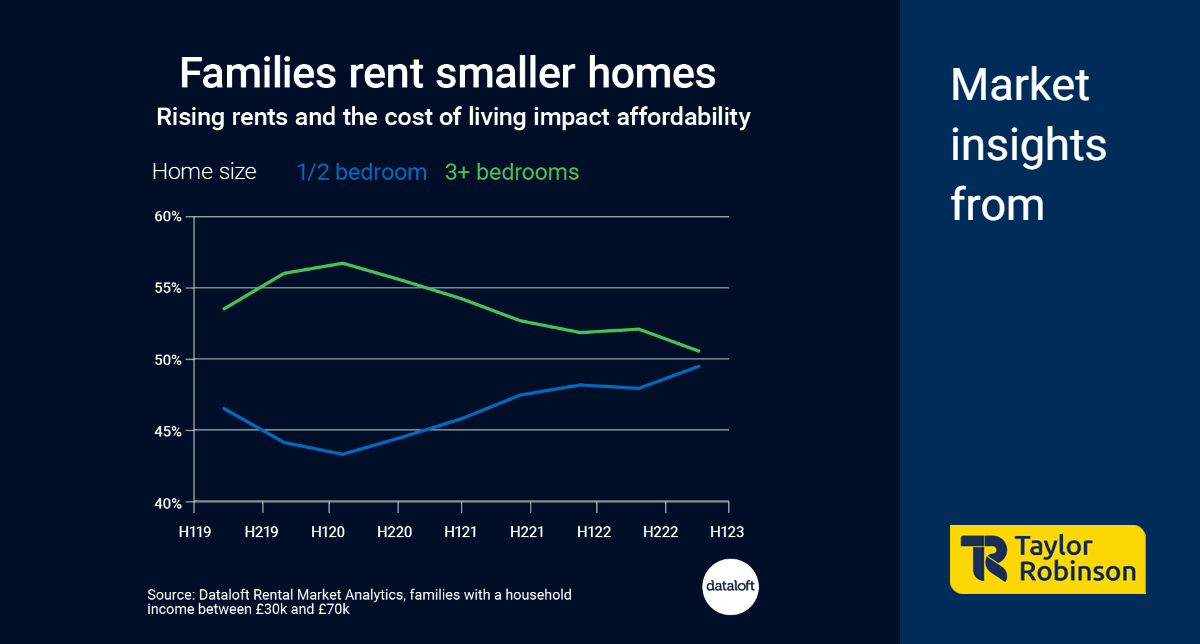

With the rise in the cost of living, an increasing number of renters are facing tough decisions when it comes to selecting their homes. The correlation between rising rents and shifting housing preferences has become a significant trend, with families in particular feeling the impact. According to #Dataloft Rental Market analytics, in the year leading up to June 2023, nearly half of families with a household income ranging from £30,000 to £70,000 opted for smaller homes, a notable increase from 43% in the first half of 2020.

Choosing Smaller Homes:

The data reveals a significant shift in housing choices among families, highlighting the economic pressures they face. Families are now more likely to select homes with just 1 or 2 bedrooms, showcasing the compromises renters are willing to make in response to escalating rents. This trend reflects the challenging trade-offs many renters are navigating to secure affordable housing amid financial constraints.

Relocating for Affordability:

For a considerable number of renters, the compromise doesn't end with downsizing; it extends to choosing a lower-cost location. The data indicates that, in the year leading up to June 2023, renters over the age of 30 were more inclined to move to areas with lower rents rather than opting for higher rent locations. This suggests a growing trend of prioritizing financial prudence over other considerations when deciding on a place to live.

The Call for Increased Rental Housing Supply:

One potential solution to address the challenges posed by rising rents and shifting housing preferences is the delivery of new rental homes at scale. As the data underscores the growing demand for smaller, more affordable housing options, the need for an increased supply of such homes becomes evident. It is hoped that this issue will find its way to the forefront of the political agenda in 2024, signalling a commitment to tackling the housing affordability crisis.

The intersection of rising rents and the cost of living has prompted renters, especially families with moderate incomes, to reassess their housing choices. The data from #Dataloft Rental Market Analytics underscores the shift towards smaller homes and lower-cost locations, highlighting the ongoing challenges faced by renters in the current economic climate. As we look ahead, addressing the housing affordability crisis will require concerted efforts, including policy changes and a substantial increase in the supply of affordable rental homes. The hope is that policymakers will prioritize this issue in the coming years to ensure a more sustainable and equitable housing landscape for all.

- Details

- Hits: 274