Blog

As we step into the new year, the property market is exhibiting signs of positivity, setting the stage for a robust and dynamic year ahead. Key indicators reveal a significant uptick in the market, reflecting both buyer and seller confidence. The property landscape is experiencing a notable surge, with promising statistics that hint at a flourishing market in 2024.

Positive Shift in Asking Prices:

One of the standout trends in the property market is the remarkable increase in the average new seller asking price. January 2024 has witnessed a substantial rise of 1.3%, marking the most significant price surge for this month since 2020. What's even more impressive is that this surge is more than double the 20-year average of +0.6%. This spike in asking prices suggests a growing confidence among sellers, a trend that bodes well for the overall health of the property market.

Impact of Falling Mortgage Rates:

The decline in mortgage rates is playing a pivotal role in boosting buyer confidence. As mortgage rates continue to fall, prospective homebuyers find themselves in a favourable position, making homeownership more accessible. This positive trend is contributing to an improvement in buyer demand, with 42% of agents reporting that buyer demand is higher than it was a year ago. The correlation between falling mortgage rates and increased buyer activity paints a promising picture for the property market's trajectory in the coming months.

Rise in Property Listings:

A notable indicator of sellers' growing confidence is the increase in the number of properties entering the market. In the first week of the year, property listings surged by an impressive 15% compared to the same period last year. This surge in inventory suggests that sellers are increasingly optimistic about the market conditions and are eager to capitalize on the demand. The rise in property listings is a positive sign for both buyers and sellers, fostering a more balanced and dynamic property landscape.

Essential Role of Accurate Pricing:

Amidst these encouraging trends, it's essential for those navigating the property market to maintain accurate and realistic pricing strategies. The success of transactions hinges on understanding the local market dynamics and pricing properties accordingly. Sellers looking to make a move in 2024 should pay close attention to accurate and realistic pricing, ensuring a smooth and successful selling process.

As we kick off the new year, the Crawley property market is experiencing a wave of positivity, marked by a substantial increase in asking prices, improved buyer demand, and a surge in property listings. The combination of falling mortgage rates and a brighter economic outlook sets the stage for a dynamic and flourishing Crawley market in 2024. It remains crucial for both buyers and sellers to stay attuned to these trends and make informed decisions as they navigate the evolving landscape of the property market. Source: Dataloft Poll of Subscribers, Rightmove (January 2024).

- Details

- Hits: 301

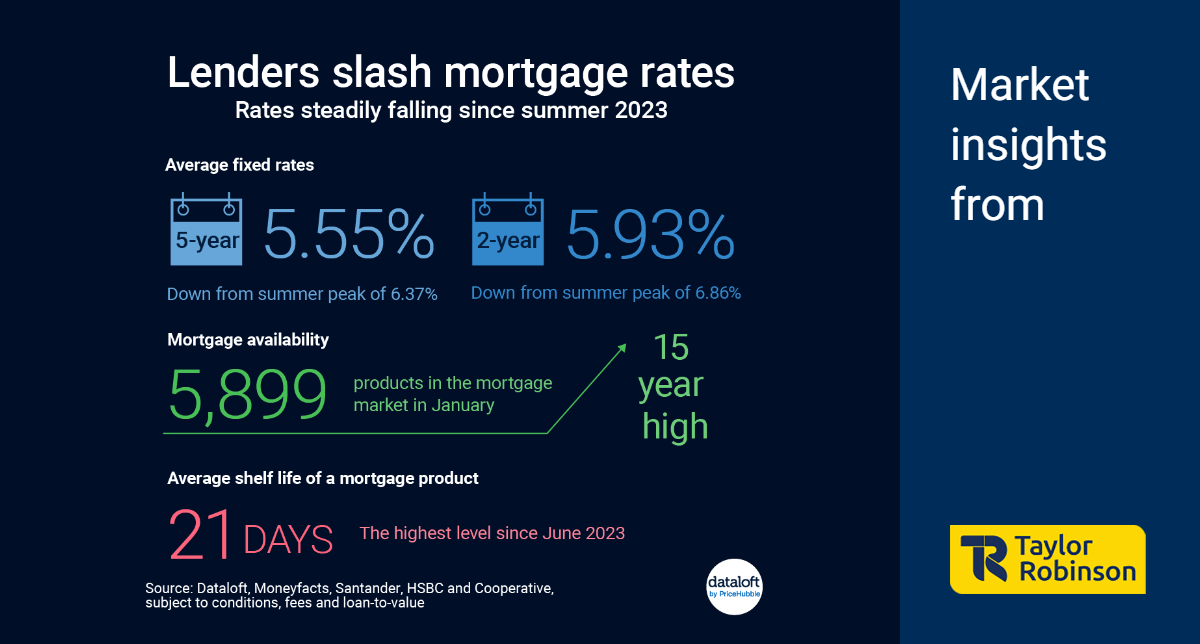

In the ever-evolving landscape of the mortgage market, the winds of change are blowing as big lenders engage in fierce competition, leading to a significant drop in interest rates. This phenomenon is not only a response to market dynamics but is also accompanied by an increased product choice, offering more options to consumers. Recent developments indicate a potential shift in economic trends, influencing both mortgage rates and the overall stability of the market.

Interest Rate Slashing:

Many prominent mortgage lenders are currently engaged in a relentless battle to attract borrowers by slashing interest rates. The average five-year fixed-rate has plummeted to 5.55%, a notable decrease from its peak at 6.37% in August. Similarly, the two-year fixed-rate has seen a reduction from 6.86% in July to 5.93%. Notably, Santander and HSBC have recently joined the sub-4% club for a five-year fixed-rate, while Barclays has introduced two-year deals tantalizingly close to the 4% threshold. These developments signal a borrower-friendly environment with historically low mortgage rates.

Expanding Product Options:

The competition among mortgage lenders has led to a surge in product choices, reaching 5,899 options. This marks the sixth consecutive month of product choice growth, reaching a 15-year high. The average shelf life of a mortgage product has also extended to 21 days, the longest since June, indicating increased stability in the market. This expansion in product options provides consumers with a diverse range of choices, catering to different financial needs and preferences.

Economic Outlook and Interest Rate Cut Speculation:

The mortgage market's fluctuations are not isolated from broader economic trends. Forecasters at three leading institutions are suggesting a significant decline in the inflation rate, projecting it to halve to 2% by April. This potential drop in inflation has led to speculation that the Bank of England might consider advancing the date of its first interest rate cut. Such a move could have ripple effects on the mortgage market, influencing rates and borrower behaviour.

The current dynamics in the mortgage market, characterized by intense competition among lenders, falling interest rates, and an expanding array of product choices, reflect a dynamic and responsive industry. As economic forecasts hint at a potential shift, borrowers may find themselves in a favourable position to secure attractive mortgage deals. However, it's crucial for consumers to stay informed about market trends and be prepared for possible changes as economic conditions continue to evolve.

- Details

- Hits: 247

The property landscape in England and Wales has witnessed a dynamic transformation over the past 12 months, with an impressive 900,000 property transactions taking place. While terraced houses maintained their dominance in terms of sales volume, a notable shift has occurred in the dynamics of detached and semi-detached houses during the year 2023.

Changing Dynamics

Twelve months ago, semi-detached houses constituted 28% of the total property sales, while detached houses accounted for 22%. However, as the year unfolded, a sudden and intriguing change emerged. By the end of 2023, detached house sales experienced a notable upswing, increasing by 3.7%, while semi-detached houses saw a corresponding decrease of 3.0%.

Analysing the Shift

In a market where price growth has remained relatively flat, this shift in the distribution of property sales raises pertinent questions and warrants a more in-depth analysis. Various factors could contribute to this change, and it is crucial to explore potential explanations for the altered preferences among property buyers.

Possible Explanations

The shift in sales dynamics might indicate several underlying trends in the housing market. One plausible explanation could be a growing preference for larger homes, as reflected in the increased demand for detached houses. This trend may be influenced by changing lifestyle preferences, such as the desire for more space or a shift towards remote work, prompting individuals to seek larger, more comfortable living spaces.

Another factor to consider is the economic outlook. The increase in detached house sales could be indicative of a more optimistic economic climate, where buyers feel confident in making long-term investments in larger properties. Economic stability and positive financial indicators often correlate with increased demand for more spacious and luxurious homes.

Monitoring the Trends

As we delve into the complexities of this shift, it becomes evident that the evolving preferences in property transactions are multifaceted. The trend towards detached houses gaining popularity while semi-detached houses experience a decline deserves careful monitoring over the next few months.

The latest data, sourced from Dataloft, HMRC, and Land Registry, paints a dynamic picture of the property market in England and Wales. The surge in detached house sales and the corresponding decline in semi-detached houses underscore the need for a nuanced understanding of the factors influencing buyer behaviour. Whether driven by lifestyle changes or economic optimism, this shift has far-reaching implications for the real estate landscape. As we navigate through the months ahead, it will be crucial to observe and analyse these trends, providing valuable insights into the ever-evolving dynamics of the property market.

- Details

- Hits: 261

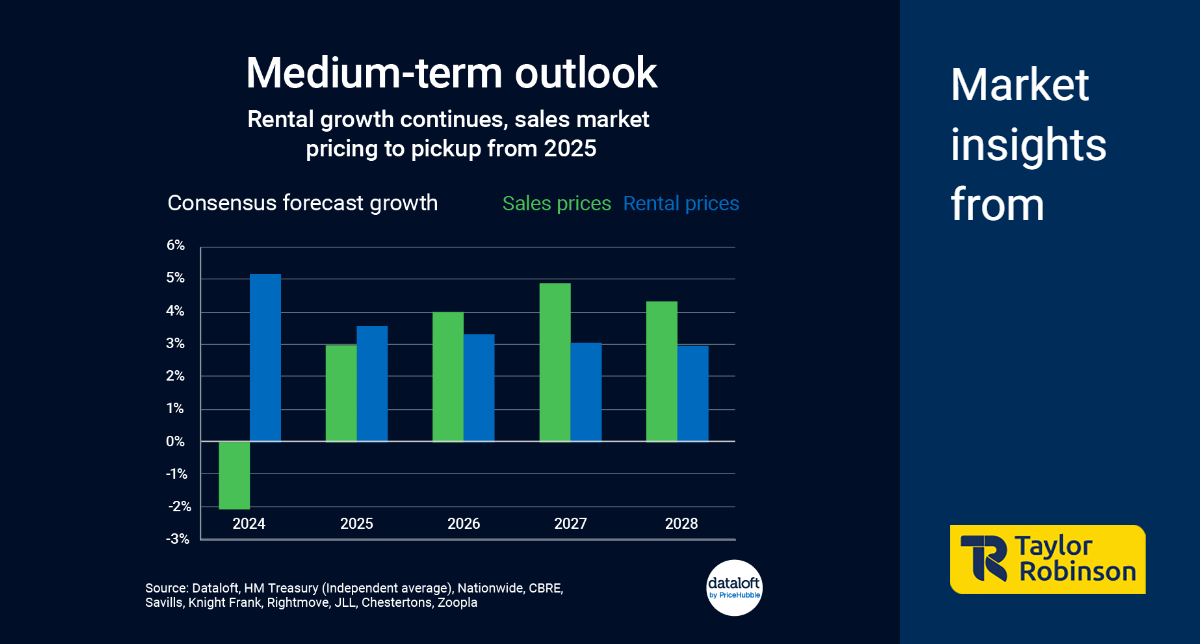

As we step into the new year, the UK housing market is under the scrutiny of various experts and institutions, all seeking to decipher the trajectory of property prices in the coming years. A comprehensive analysis of published house price forecasts reveals a nuanced picture, with a marginal softening expected in 2024, followed by renewed growth in 2025. This article delves into the key predictions and factors shaping the UK housing market landscape.

House Price Projections

On average, house prices in the UK are anticipated to experience a slight dip in 2024, with forecasts indicating an average decrease of 2.1%. While this may suggest a temporary slowdown in the market, experts are optimistic about a resurgence in 2025, with prices predicted to rise by 3.0%. This projection hints at a cautious but positive outlook for the housing market, indicating a potential recovery and growth in the near future.

Factors Influencing 2024 Trends

The anticipated softening of house prices in 2024 is not expected to be driven by a lack of demand or market stagnation. Instead, experts suggest that the moderation may be influenced by factors such as tentative improvements in affordability and a clearer direction in interest rates. These elements are likely to encourage increased activity levels in the market, signalling a shift towards a more dynamic and responsive real estate landscape.

Rental Market Dynamics

In addition to sales prices, rental market dynamics play a crucial role in shaping the overall housing market scenario. Forecasts indicate that rental price growth is poised to outpace sales price growth over the next two years. While rents are expected to continue their upward trajectory, the pace is projected to be more modest compared to the robust growth witnessed in the past two years. Over the next five years, rental prices are forecasted to average at 3.6%, reflecting a more sustainable and steadier pace of growth.

Data Sources

The insights provided in this analysis draw from a variety of reputable sources, including Dataloft, HM Treasury (Independent average), Nationwide, CBRE, Savills, Knight Frank, Rightmove, JLL, Chestertons, and Zoopla. The collaboration of these esteemed institutions contributes to a comprehensive and well-rounded perspective on the future of the UK housing market.

As the UK housing market navigates the uncertainties of economic fluctuations and external factors, the consensus among experts is cautiously optimistic. While 2024 may witness a marginal softening in house prices, the subsequent year is anticipated to bring about a renewed growth phase. Factors such as improved affordability and clearer interest rate directions are poised to invigorate market activity. Furthermore, the rental market is expected to maintain a steady pace of growth, albeit at a more moderate rate. Investors, homeowners, and renters alike should keep a close eye on these forecasts as they provide valuable insights into the evolving landscape of the UK housing market.

- Details

- Hits: 404

As the festive season unfolds and families gather in the warmth of their homes, the tranquil ambiance often prompts contemplation about the living spaces we inhabit. The chaos of hosting guests or the challenges of maintaining older properties during the winter months can spark a desire for change. For many, this contemplation evolves into thoughts about redecorating, renovating, or even embarking on the journey of moving altogether. Interestingly, research indicates a noticeable surge in interest in 'New Build' properties immediately after Christmas Day, shedding light on the compelling allure of brand new homes during this time of year.

The Post-Christmas Surge:

According to data from Dataloft and Google, there is a rapid and significant increase in searches for 'New Build' properties right after Christmas Day. The Google search interest index witnesses a remarkable rebound, bouncing from a yearly low of 49 in mid-December to a high of 80 at the beginning of the new year. This surge in interest implies that, for many individuals, the contemplation of change during the holiday season translates into active exploration of new homes as a tangible option.

Benefits of Brand New Homes:

Several factors contribute to the appeal of new builds, especially during the post-Christmas period. Let's explore some of the key benefits:

Modern Amenities and Design:

New builds often boast modern amenities and contemporary design elements, catering to the evolving needs and preferences of homeowners. This can include open floor plans, energy-efficient features, and smart home technology, providing a seamless blend of style and functionality.

Energy Efficiency:

With a growing emphasis on sustainability and energy efficiency, new builds tend to incorporate the latest technologies and materials to reduce environmental impact. This not only aligns with the global push towards greener living but also offers potential cost savings on utility bills for homeowners.

Reduced Maintenance Requirements:

Older properties may come with hidden maintenance challenges, especially during the winter months. New builds, on the other hand, often require less immediate attention and come with warranties that provide peace of mind for homeowners.

Customization Opportunities:

Opting for a new build allows homeowners to personalize their living spaces according to their preferences. From choosing finishes and colour schemes to selecting specific upgrades, the customization options are extensive, ensuring that the home reflects the unique style of its occupants.

Financial Incentives:

Developers often provide attractive incentives to entice buyers, especially during the post-holiday season. These incentives may include reduced prices, special financing options, or added perks, making the prospect of purchasing a new build even more appealing.

The surge in searches for 'New Build' properties immediately after Christmas highlights a trend that extends beyond mere contemplation, indicating a proactive interest in making significant changes to living spaces. The benefits of brand new homes, including modern amenities, energy efficiency, reduced maintenance, customization opportunities, and financial incentives, contribute to the growing allure of new builds during this time of year. As individuals look towards the future, the prospect of starting anew in a thoughtfully designed and efficiently built home becomes a compelling consideration for those seeking a fresh beginning in the coming year.

- Details

- Hits: 316