Blog

As interest rates reach their peak and inflation rates show signs of decline, the market outlook is gradually shifting towards cautious optimism. Several leading indicators, including the Royal Institution of Chartered Surveyors (RICS) Monthly Survey, offer insights into the market's trajectory, particularly concerning house prices in England and Wales.

The RICS Monthly Survey serves as a reliable barometer, often leading trends in housing market dynamics. Its headline net balance indicator, which measures the difference between surveyors expecting a price rise and those anticipating a price fall, provides valuable insights into market sentiment.

According to the February 2024 survey, there are indications of continued stabilization in house prices over the coming months, with a potential return to modest levels of positive price growth. This suggests that the market may be gradually moving towards a more balanced state, offering hope for both buyers and sellers alike.

Furthermore, the survey revealed a promising trend in both buyer enquiries and new seller listings, hinting at a potential uptick in market activity. This increase in buyer interest coupled with a rise in seller listings could contribute to a healthier housing market ecosystem, fostering greater liquidity and transaction volume.

These findings align with broader economic trends, such as peaking interest rates and a moderation in inflation, which are conducive to market stability. With interest rates reaching their zenith, borrowers may find themselves more inclined to enter the market, taking advantage of relatively favourable borrowing conditions before rates potentially begin to decline.

Moreover, a lower inflation rate can alleviate concerns about affordability and purchasing power, thereby bolstering consumer confidence and incentivizing spending and investment. This could translate into increased demand for housing, further supporting the positive trajectory of house prices.

It's essential to consider multiple data sources to gain a comprehensive understanding of market dynamics. Alongside the RICS Monthly Survey, insights from organizations like Dataloft, as well as data from the Land Registry and UK House Price Index (UKHPI), offer valuable perspectives on market trends and conditions.

While cautious optimism pervades the current market outlook, it's important to remain vigilant and adaptable in response to evolving economic conditions. Uncertainties, such as geopolitical tensions or unexpected shifts in monetary policy, could influence market dynamics and warrant careful monitoring.

The convergence of peaking interest rates, lower inflation, and positive indicators from sources like the RICS Monthly Survey suggests a cautiously optimistic outlook for the market. As stakeholders navigate this landscape, leveraging timely insights and maintaining flexibility will be key to capitalizing on emerging opportunities and mitigating potential risks.

This cautious optimism translates well to Crawley, West Sussex. With house prices expected to stabilize and potentially see some low growth, Crawley residents looking to sell can approach the market with more confidence. Additionally, a potential increase in buyer enquiries could benefit those looking to offload their properties. Overall, the signals point towards a more balanced market in Crawley, which could be positive for both buyers and sellers.

- Details

- Hits: 195

The buy-to-let market in the UK has displayed remarkable resilience in the face of ongoing challenges, signalling optimism among investors. Recent data from Simply Business and Property Academy indicates a notable surge in buy-to-let properties, with Glasgow emerging as the frontrunner with a remarkable 12% increase over the past year. Nottingham and Leeds closely trail behind, boasting growth rates exceeding 8% each.

This upward trend is reinforced by insights from Dataloft, revealing a sustained appetite for buy-to-let investments among landlords. More than half of landlords surveyed express confidence in the sector, with a significant proportion planning to expand their portfolios in the foreseeable future. Particularly, landlords with substantial holdings, ranging from 6-10 properties and beyond, are keen on further investment, underscoring the sector's enduring appeal.

Amidst the spotlight on major cities like Glasgow, Nottingham, and Leeds, Crawley, situated in West Sussex, emerges as a compelling contender for prospective investors.

Strategically positioned near vital transportation links such as the M25 motorway and Gatwick Airport, Crawley offers unparalleled connectivity, making it an attractive location for residents and tenants seeking accessibility to London and beyond.

Crawley's robust and diversified economy, driven by prominent players in the technology, manufacturing, and logistics sectors, ensures a stable demand for rental properties. The town's economic vibrancy contributes to the attractiveness of buy-to-let investments, promising steady rental yields.

Furthermore, Crawley is witnessing significant investment endeavours, including the ongoing regeneration of its town centre. These development initiatives are poised to enhance Crawley's appeal further and potentially elevate rental yields, presenting an enticing prospect for investors.

While Glasgow, Nottingham, and Leeds currently dominate headlines with their surging buy-to-let activity, Crawley stands out as a well-rounded option for investors seeking a blend of strategic location, economic stability, and promising growth prospects.

However, it's crucial to note that this article offers a snapshot based on available data and should not be construed as financial advice. Investors are urged to conduct thorough research and seek professional guidance before making any investment decisions. With careful consideration and informed strategies, the UK buy-to-let market continues to offer opportunities for savvy investors amidst evolving market dynamics

- Details

- Hits: 264

Stamp Duty Land Tax (SDLT) has once again taken centre stage in the national conversation, with Rightmove pressing the Chancellor of the Exchequer for reforms in the upcoming Spring Budget. This tax, which varies across regions, has a significant impact on property purchases, particularly for first-time buyers. In England, there's a Stamp Duty threshold of £250,000 (£425,000 for first-time buyers), while in Wales, it's set at £225,000 (under Land Transaction Tax).

For those entering the property market for the first time, Stamp Duty can significantly influence their purchasing power. Recognizing this, first-time buyers must consider strategies to minimize their Stamp Duty liability, which may include widening their search areas for their inaugural home.

Recent analysis by Dataloft has shed light on the regional disparities in Stamp Duty burdens. Throughout 2023, 75% of homes across England and Wales were sold below the Stamp Duty threshold for first-time buyers. However, this figure varied dramatically across regions. In areas like Greater London, only 35% of homes fell below the threshold, while in counties like County Durham, a staggering 98% of homes were accessible to first-time buyers without incurring Stamp Duty.

What's particularly notable is the persistent north-south divide in property prices across the country. This divide presents a unique opportunity for first-time buyers, especially as hybrid working arrangements become increasingly prevalent. With remote work options becoming more permanent, individuals are now afforded the flexibility to consider relocation to areas where property prices are more favourable.

For prospective homeowners in Crawley, West Sussex, this data offers valuable insights. While the south may traditionally be associated with higher property prices, the evolving landscape of remote work opens doors for exploring options further north. By leveraging this opportunity, first-time buyers in Crawley can potentially widen their search radius, tapping into regions where properties are more affordable and Stamp Duty implications are less burdensome.

The implications of Stamp Duty reforms, as advocated by Rightmove, remain to be seen. However, the existing regional disparities underscore the importance of informed decision-making for first-time buyers. By staying abreast of market trends and understanding the broader landscape of property prices and taxes, individuals can navigate the complexities of the real estate market more effectively.

As the Spring Budget approaches, stakeholders in the property market, including first-time buyers, eagerly await potential changes in Stamp Duty regulations. In the meantime, proactive measures, such as considering relocation opportunities and leveraging remote work arrangements, can empower aspiring homeowners to make informed choices that align with their financial goals and aspirations.

- Details

- Hits: 284

As the chill of winter gradually fades away, nature awakens with a burst of colour and vitality, marking the arrival of spring. It's not just the flora and fauna that undergo a transformation during this time; the property market also experiences a significant upswing, making it an opportune moment for homeowners looking to sell their properties. In this article, we delve into why spring is often hailed as the prime season for home sales and explore some key statistics that underline its appeal.

The Spring Advantage

Springtime holds a special allure for both buyers and sellers in the property realm. There are several reasons why this season stands out as an optimal period to list your property:

Aesthetic Appeal: With flowers blooming, trees regaining their lush greenery, and the sun making more frequent appearances, the overall aesthetic of properties is enhanced during spring. This visual appeal can draw in prospective buyers, making them more inclined to envision themselves living in the space.

Improved Curb Appeal: As outdoor spaces come alive with colour and vitality, the curb appeal of homes tends to increase during spring. Well-maintained gardens, manicured lawns, and vibrant landscaping can leave a lasting impression on potential buyers, enticing them to explore further.

Favourable Weather: Unlike the extremes of winter or the scorching heat of summer, spring offers mild and pleasant weather conditions, which are conducive to property viewings. Buyers are more inclined to venture out and attend open houses without having to contend with adverse weather, facilitating smoother and more active engagement in the market.

Optimal Lighting: Longer daylight hours in spring provide ample natural light, showcasing properties in their best possible light. Bright, sunlit interiors can make spaces appear larger, airier, and more inviting, capturing the attention of discerning buyers.

Key Statistics

Data analysis from various sources sheds light on the significance of spring in the real estate calendar:

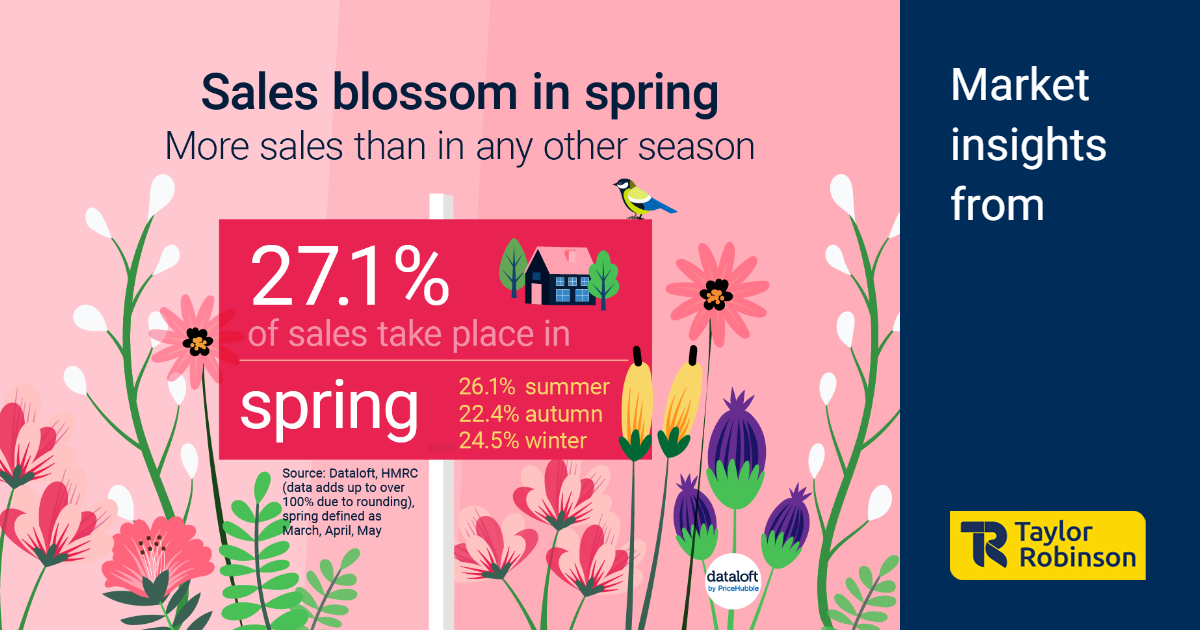

27% of Home Sales: Over the past five years, excluding 2020 due to the COVID-19 pandemic, spring has accounted for 27% of total home sales, surpassing all other seasons in terms of transaction volume.

Quicker Sale Times: Properties listed in spring tend to find new owners at a faster pace, with an average time on the market of just 51 days. This is notably swifter than the 61-day average observed during the winter months.

Heightened Buyer Demand: Current market trends indicate a 7% increase in buyer demand compared to the previous year. This heightened interest, combined with the intrinsic appeal of spring, creates a favourable environment for sellers seeking to capitalize on robust market conditions.

Final Thoughts

As the Property market gears up for the spring selling season, homeowners have a prime opportunity to showcase their properties in the best possible light and capitalize on heightened buyer demand. With its aesthetic charm, favourable weather, and accelerated sale times, spring continues to reign supreme as the preferred season for real estate transactions.

If you're considering selling your property, now is the time to act. Seize the moment and unlock the full potential of your home this spring. Call Taylor Robinson Estate Agents, the Crawley property experts, they we provide tailored assistance and expert guidance to navigate the market with confidence.

Source: #Dataloft, HMRC, Rightmove. Spring defined as March, April, May.

- Details

- Hits: 306

In the bustling town of Crawley, West Sussex, landlords are constantly navigating the ever-evolving rental market landscape. Understanding the dynamics of this market is crucial for maximizing returns and ensuring properties are tenanted efficiently. With data from Taylor Robinson Rental Market Analytics, let's delve into the trends shaping the rental scene over the past year.

Diverse Property Preferences

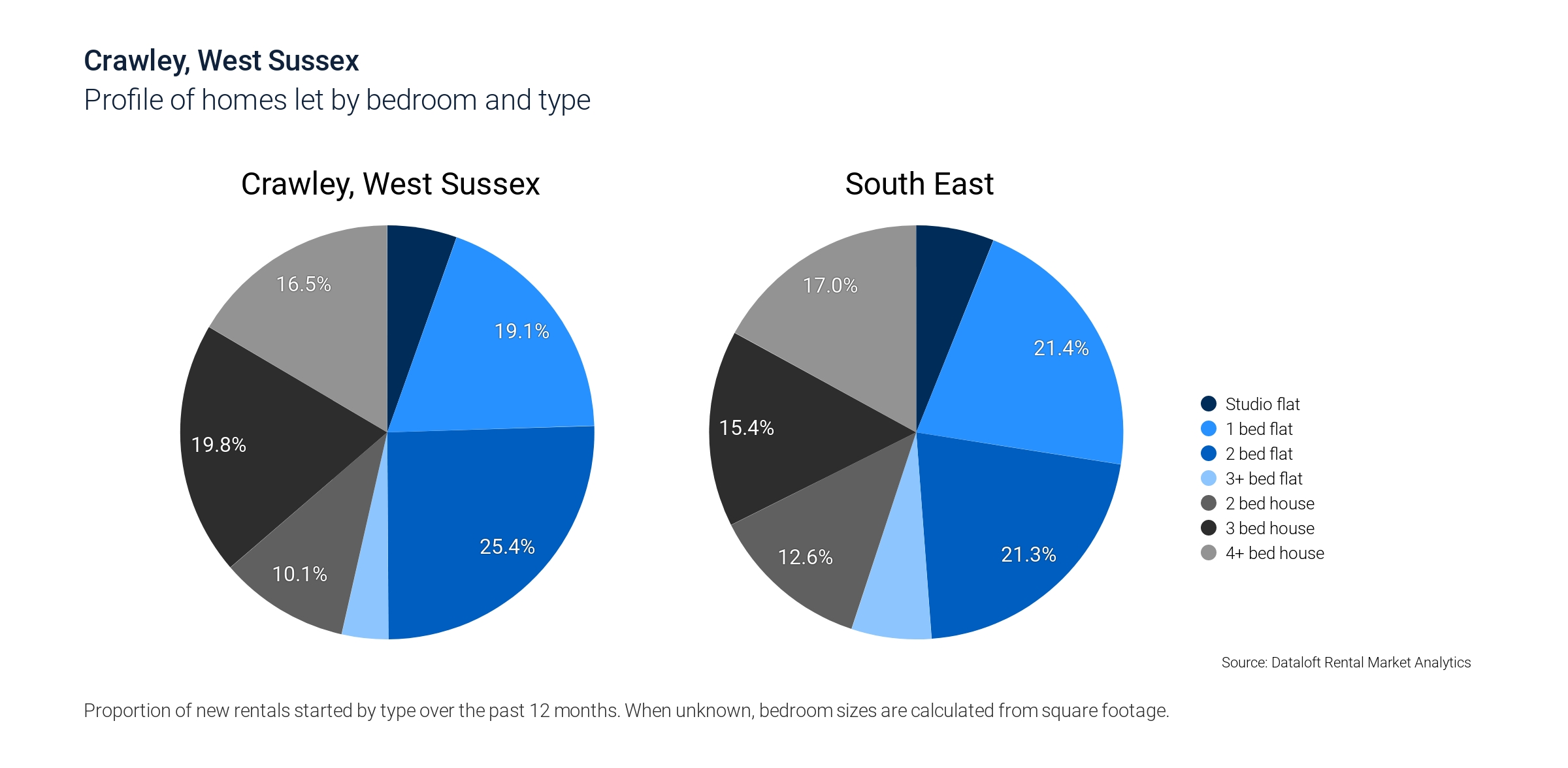

One striking observation is the diversity in property types preferred by renters. Two-bedroom flats emerge as the frontrunners, capturing a significant 25.4% share of all lets. Following closely behind are one-bedroom flats at 19.1%, with three-bedroom houses not far behind at 19.8%. This varied preference underscores the importance of offering a range of property types to cater to the diverse needs of tenants in Crawley.

Flats vs. Houses: A Balanced Ratio

A closer examination reveals an intriguing balance between flats and houses in the rental market. Flats slightly edge out houses, comprising 50.9% of all lets compared to 49.1% for houses. This equilibrium is reflective of Crawley's diverse population makeup, with families and individuals seeking different housing options to suit their lifestyles. Landlords should take note of this trend when considering property investments and portfolio management strategies.

The shortage of Studio Flats

In contrast to the popularity of larger flats and houses, studio flats lag behind, representing just 5.4% of all lets. This low uptake can be attributed to various factors, including their compact size and relatively higher rental costs. Studio flats, often favoured by single occupants or young professionals, may face stiff competition from larger properties offering more space and amenities. Landlords should carefully assess the demand for studio flats in Crawley before investing in such properties.

Speak with a Local Expert like Taylor Robinson

Armed with these insights, landlords in Crawley have a unique opportunity in the rental market. By staying abreast of trends and understanding tenant preferences, landlords can offer tailored letting services that meet the evolving needs of renters. Whether it's optimising property portfolios, setting competitive rental prices, or enhancing property amenities, being attuned to the nuances of the rental landscape is key to success in Crawley's thriving rental market.

In conclusion, the rental market in Crawley presents both opportunities and challenges for landlords. By leveraging data-driven insights and adopting a proactive approach to property management, landlords can navigate the rental landscape with confidence, maximizing returns and fostering tenant satisfaction.

- Details

- Hits: 246