In the ever-evolving landscape of the mortgage market, the winds of change are blowing as big lenders engage in fierce competition, leading to a significant drop in interest rates. This phenomenon is not only a response to market dynamics but is also accompanied by an increased product choice, offering more options to consumers. Recent developments indicate a potential shift in economic trends, influencing both mortgage rates and the overall stability of the market.

Interest Rate Slashing:

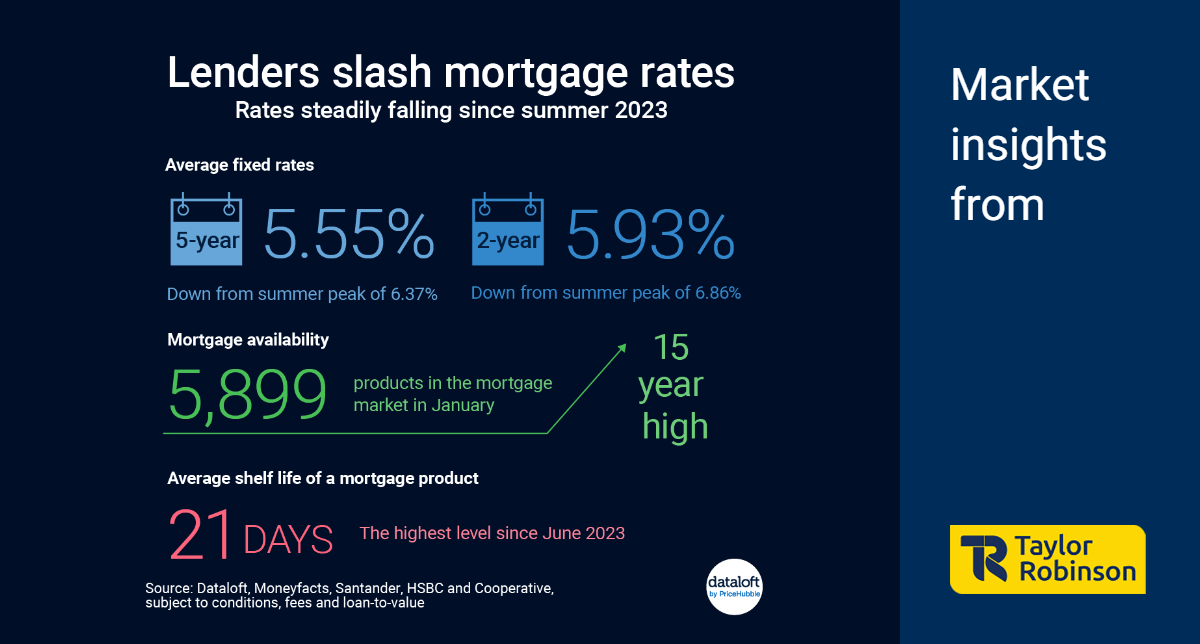

Many prominent mortgage lenders are currently engaged in a relentless battle to attract borrowers by slashing interest rates. The average five-year fixed-rate has plummeted to 5.55%, a notable decrease from its peak at 6.37% in August. Similarly, the two-year fixed-rate has seen a reduction from 6.86% in July to 5.93%. Notably, Santander and HSBC have recently joined the sub-4% club for a five-year fixed-rate, while Barclays has introduced two-year deals tantalizingly close to the 4% threshold. These developments signal a borrower-friendly environment with historically low mortgage rates.

Expanding Product Options:

The competition among mortgage lenders has led to a surge in product choices, reaching 5,899 options. This marks the sixth consecutive month of product choice growth, reaching a 15-year high. The average shelf life of a mortgage product has also extended to 21 days, the longest since June, indicating increased stability in the market. This expansion in product options provides consumers with a diverse range of choices, catering to different financial needs and preferences.

Economic Outlook and Interest Rate Cut Speculation:

The mortgage market's fluctuations are not isolated from broader economic trends. Forecasters at three leading institutions are suggesting a significant decline in the inflation rate, projecting it to halve to 2% by April. This potential drop in inflation has led to speculation that the Bank of England might consider advancing the date of its first interest rate cut. Such a move could have ripple effects on the mortgage market, influencing rates and borrower behaviour.

The current dynamics in the mortgage market, characterized by intense competition among lenders, falling interest rates, and an expanding array of product choices, reflect a dynamic and responsive industry. As economic forecasts hint at a potential shift, borrowers may find themselves in a favourable position to secure attractive mortgage deals. However, it's crucial for consumers to stay informed about market trends and be prepared for possible changes as economic conditions continue to evolve.