As we step into the new year, the UK housing market is under the scrutiny of various experts and institutions, all seeking to decipher the trajectory of property prices in the coming years. A comprehensive analysis of published house price forecasts reveals a nuanced picture, with a marginal softening expected in 2024, followed by renewed growth in 2025. This article delves into the key predictions and factors shaping the UK housing market landscape.

House Price Projections

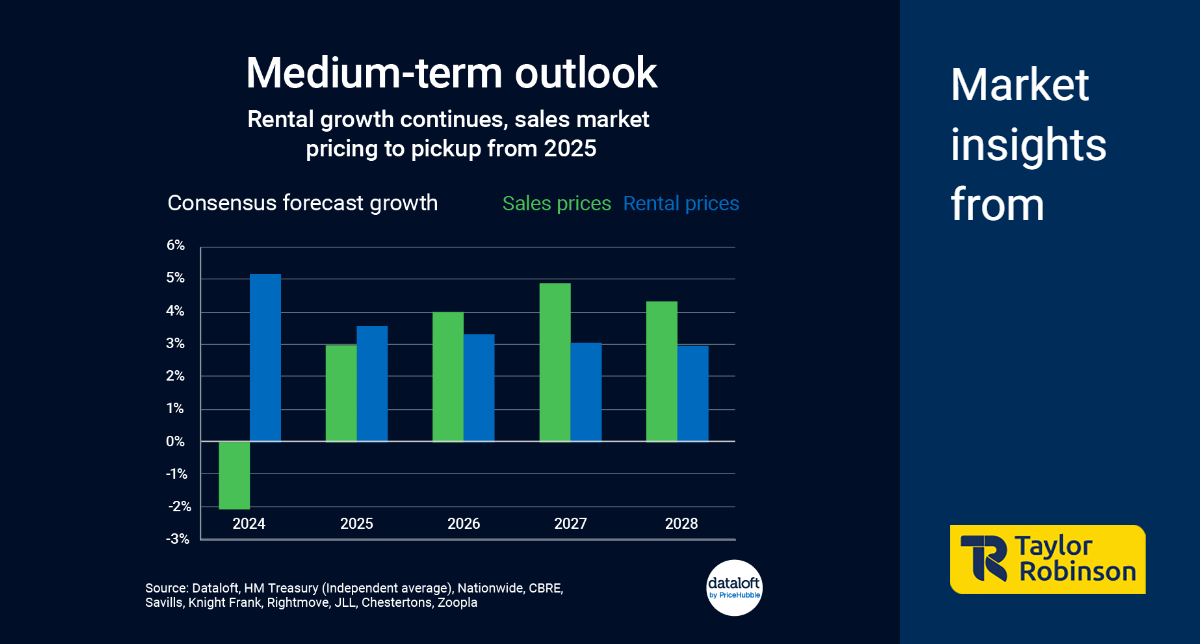

On average, house prices in the UK are anticipated to experience a slight dip in 2024, with forecasts indicating an average decrease of 2.1%. While this may suggest a temporary slowdown in the market, experts are optimistic about a resurgence in 2025, with prices predicted to rise by 3.0%. This projection hints at a cautious but positive outlook for the housing market, indicating a potential recovery and growth in the near future.

Factors Influencing 2024 Trends

The anticipated softening of house prices in 2024 is not expected to be driven by a lack of demand or market stagnation. Instead, experts suggest that the moderation may be influenced by factors such as tentative improvements in affordability and a clearer direction in interest rates. These elements are likely to encourage increased activity levels in the market, signalling a shift towards a more dynamic and responsive real estate landscape.

Rental Market Dynamics

In addition to sales prices, rental market dynamics play a crucial role in shaping the overall housing market scenario. Forecasts indicate that rental price growth is poised to outpace sales price growth over the next two years. While rents are expected to continue their upward trajectory, the pace is projected to be more modest compared to the robust growth witnessed in the past two years. Over the next five years, rental prices are forecasted to average at 3.6%, reflecting a more sustainable and steadier pace of growth.

Data Sources

The insights provided in this analysis draw from a variety of reputable sources, including Dataloft, HM Treasury (Independent average), Nationwide, CBRE, Savills, Knight Frank, Rightmove, JLL, Chestertons, and Zoopla. The collaboration of these esteemed institutions contributes to a comprehensive and well-rounded perspective on the future of the UK housing market.

As the UK housing market navigates the uncertainties of economic fluctuations and external factors, the consensus among experts is cautiously optimistic. While 2024 may witness a marginal softening in house prices, the subsequent year is anticipated to bring about a renewed growth phase. Factors such as improved affordability and clearer interest rate directions are poised to invigorate market activity. Furthermore, the rental market is expected to maintain a steady pace of growth, albeit at a more moderate rate. Investors, homeowners, and renters alike should keep a close eye on these forecasts as they provide valuable insights into the evolving landscape of the UK housing market.