Understanding the dynamics of housing affordability is crucial in gauging the health of the property market. By examining affordability levels over time, analysts can discern whether a market is overextended, necessitating a slowdown, or poised for recovery due to improved affordability. In this article, we delve into the factors influencing affordability and explore projections for 2024, anticipating a shift that could bolster buyer confidence and drive a tentative recovery.

Factors Influencing Affordability

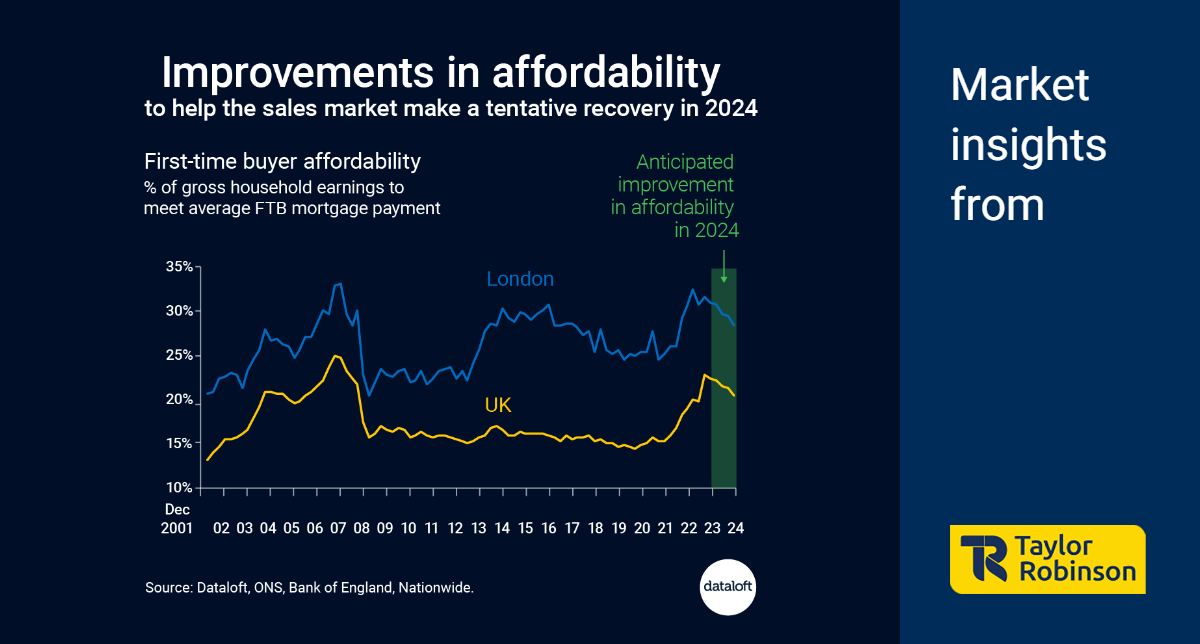

Affordability, in the context of housing markets, is measured by the proportion of household earnings required to meet mortgage payments. Several factors contribute to this metric, including mortgage rates, income growth, and property prices. Examining these elements provides insights into the overall health of the property market landscape.

Anticipated Improvement in Affordability

In the upcoming year, 2024, a confluence of factors is expected to contribute to an improvement in housing affordability. Chief among these factors is the anticipation of better mortgage rates. The outlook for the mortgage landscape suggests a positive trend, with lower recent 5-year swap rates recorded at 4.4% at the end of November. This points towards a potential further reduction in mortgage rates, which is a key driver for improved affordability.

The Role of Mortgage Rates

Mortgage rates play a pivotal role in determining housing affordability. The recent dip in 5-year swap rates is indicative of a favourable trend that could positively impact mortgage rates. As mortgage rates decrease, the financial burden on homebuyers lessens, making homeownership more accessible. This, in turn, contributes to an uptick in affordability, a crucial factor in fostering a healthy real estate market.

Data Sources

To assess affordability, various reliable sources have been considered, including Dataloft, the Office for National Statistics (ONS), the Bank of England, and Nationwide. The analysis is based on first-time buyer (FTB) prices, assuming 1.5 full-time incomes per household, an 80% loan-to-value ratio, and an average new lending mortgage rate. Additionally, forecasted earnings growth of 3.4% for 2024 and an expected improvement in the average new lending rate to 4.5% by the end of 2024 have been factored in. The projection also incorporates a forecasted FTB price fall of -1% for the remaining quarter of 2023, followed by stabilization.

Implications for Market Confidence

As affordability improves, the implications for buyer confidence become evident. A more affordable housing market tends to attract a broader range of prospective buyers, stimulating demand. The expected recovery in buyer confidence, driven by enhanced affordability, may pave the way for a tentative rebound in the real estate sector.

In conclusion, the dynamics of housing affordability are crucial indicators for the health and trajectory of the property market. The anticipation of improved mortgage rates in 2024, as evidenced by lower recent 5-year swap rates, suggests a positive outlook for affordability. This, in turn, has the potential to drive a tentative recovery in buyer confidence. By considering a combination of factors and reliable data sources, analysts can gain valuable insights into the evolving landscape of housing affordability, assisting both industry professionals and prospective homebuyers in navigating the complex world of property.