Blog

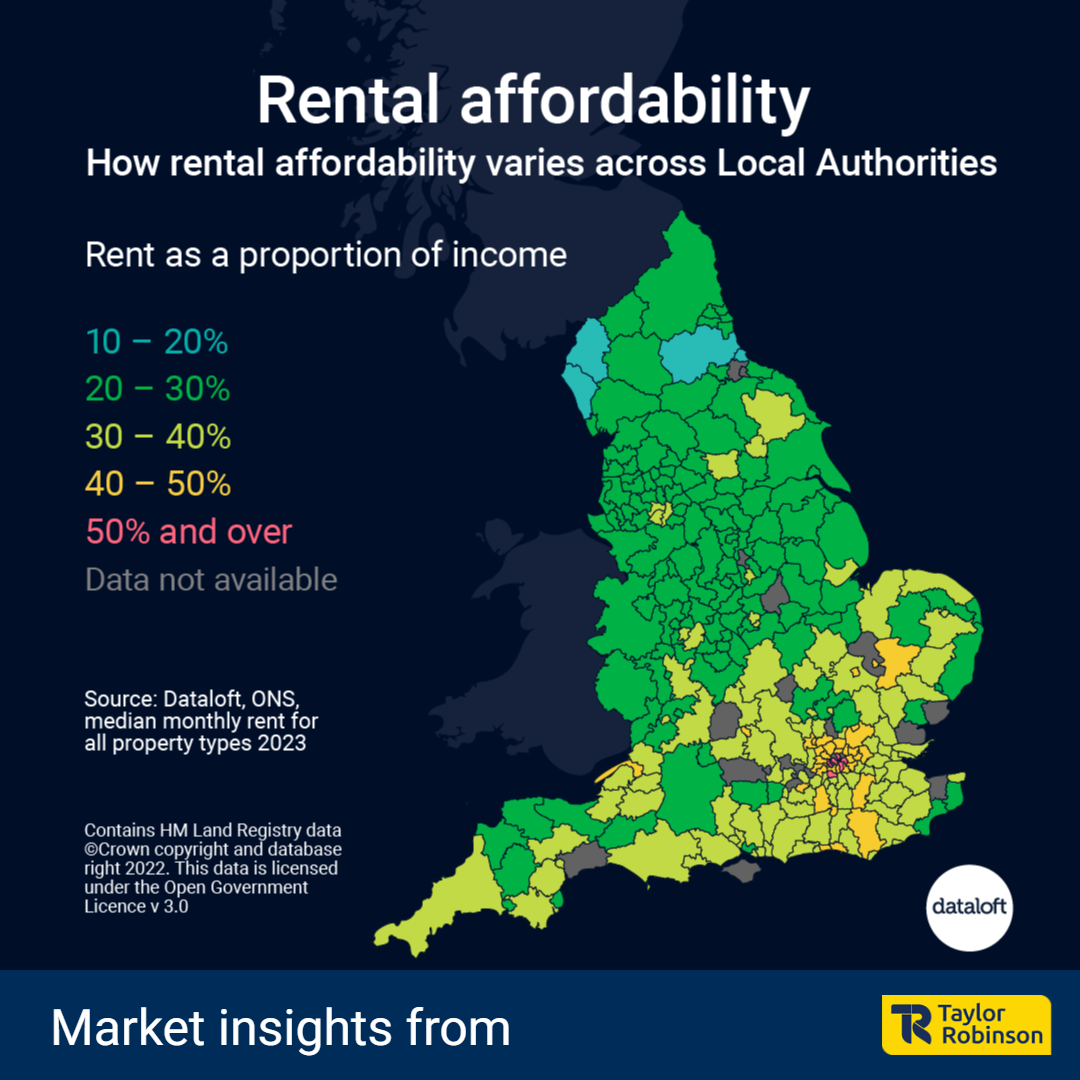

In the intricate landscape of the UK rental market, the southern regions, particularly in the vibrant and bustling South of England, present a unique set of challenges for prospective tenants. Despite the allure of higher earnings, the cost of renting a home in this region requires individuals to allocate a substantial portion of their income to cover living expenses. Understanding the concept of 'rental affordability' serves as a key metric in gauging the pressure within local rental markets, offering valuable insights into the economic dynamics of various areas.

Rental Affordability as an Indicator

Rental affordability is a crucial metric that sheds light on the delicate balance between income and housing costs in any given locality. It is calculated by examining the average rent as a proportion of the average earnings in a specific area, typically measured in Local Authorities. This metric provides a comprehensive view of the financial strain that renting imposes on individuals and families, making it an invaluable tool for assessing the health of a rental market.

The London Conundrum

Nowhere is the impact of rental affordability more pronounced than in the bustling metropolis of London. The city, synonymous with opportunity and prosperity, presents a stark reality for its residents. An average Londoner, earning what is considered an average salary for the capital, must allocate more than 40% of their earnings to cover the average rent. This startling figure underscores the immense pressure on individuals in the capital to balance housing costs with other essential expenses.

Contrastingly, in many other parts of the country, the equivalent proportion hovers between 20% and 30%. This stark contrast highlights the regional disparities in rental affordability and underscores the unique challenges faced by those navigating the rental market in the South of England.

Balancing Act: Earnings versus Expenses

One might assume that higher earnings in the South of England provide a cushion against the soaring costs of rent. Fortunately, for many individuals, the correlation between rising rents and increasing salaries helps to mitigate the financial strain. While rent has seen an upward trajectory, salaries have also experienced growth, providing a degree of relief for tenants in the face of escalating living costs.

Hidden Gems in the Home Counties

Surprisingly, within the home counties, there are pockets where the balance between income and rental costs remains favourable. Areas such as East and North Hertfordshire, Dover, and Folkestone stand out as examples where only 20–30% of incomes are allocated to rent. These locales present an intriguing alternative for those seeking affordable housing options without compromising on their overall financial well-being.

Source: #Dataloft Rental Market Analytics, Information Works, Land Registry

Navigating the rental market in the South of England demands a nuanced understanding of the intricate interplay between earnings and housing costs. As an expert in the field, it is crucial to emphasize the significance of rental affordability as a key indicator of the economic health of local rental markets. By staying informed and exploring hidden gems within the home counties, individuals can make informed decisions that align with their financial goals while securing a place to call home in this dynamic and challenging landscape.

- Details

- Hits: 263

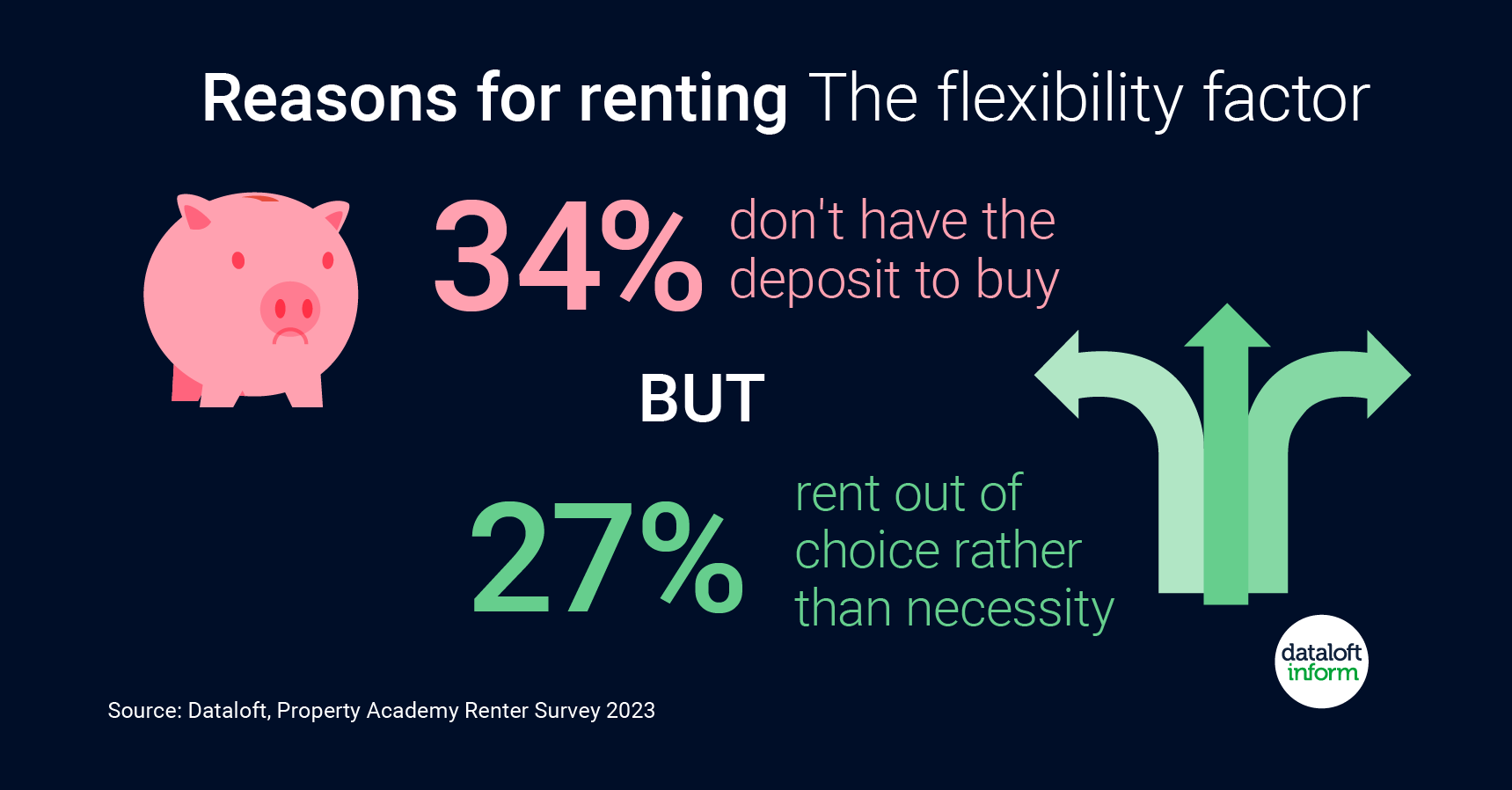

In the ever-evolving landscape of the private rented sector, understanding the needs and preferences of tenants is paramount for landlords and letting agents. The recently released Property Academy Renter Survey 2023 provides valuable insights into the motivations behind renting, shedding light on the diverse reasons that drive individuals to choose the rental route over homeownership. As a seasoned letting agent, we take pride in our ability to decode these findings and tailor our services to meet the unique requirements of both landlords and tenants.

Financial Flexibility and Choice:

One of the standout revelations from the survey is that over a third of renters opt for rental accommodations due to the financial constraint of not having the deposit required for purchasing a home. For letting agents, this underscores the importance of offering flexible good quality rental properties catering to a demographic that may not be ready for the commitment of homeownership but seeks the comforts of a stable residence.

Surprisingly, 27% of renters highlighted that they choose to rent out of choice rather than necessity. This signifies a growing trend of individuals who prefer the flexibility and freedom that renting provides. As letting agents, we recognize the significance of showcasing rental properties as not just a necessity but a lifestyle choice, appealing to those who value the convenience and adaptability that renting affords.

Perks and Advantages:

The survey also delves into the perks that attract tenants to the rental market. A notable 6% of respondents mentioned flexibility as a key factor, emphasizing the importance of promoting properties that cater to the dynamic lifestyles of tenants. For letting agents, this means highlighting the adaptability of rental agreements and the ease with which tenants can transition between properties.

Furthermore, 2% of renters appreciate the ability to enjoy a higher standard of living and access to amenities through renting. Letting agents can leverage this insight by emphasizing the unique features and amenities of each property, showcasing the added value that comes with choosing a rental home.

Remote work has become a significant aspect of modern life, and 2% of tenants cited the option to work remotely as a reason for renting. Letting agents can capitalize on this trend by highlighting properties with conducive home office spaces and reliable internet connectivity, catering to the growing demand for work-from-home arrangements.

Tailoring Services for the Over 65s:

Intriguingly, the survey identifies a distinct trend among renters aged over 65. For this demographic, the allure of renting lies in having home maintenance taken care of, with 6% of respondents citing this as their primary reason for choosing rental accommodations. Letting agents can position properties as hassle-free havens for seniors, emphasizing property management services and maintenance packages to alleviate the concerns of this specific demographic.

As a forward-thinking letting agent, we pride ourselves on staying ahead of the curve and understanding the nuanced motivations of both landlords and tenants. The insights gleaned from the Property Academy Renter Survey 2023 serve as a guiding light, enabling us to tailor our services to meet the evolving needs of the rental market. Whether it's financial flexibility, lifestyle choices, or specific needs of the over 65s, we are committed to providing unparalleled service that not only meets but exceeds the expectations of both landlords and tenants in this dynamic property market landscape.

- Details

- Hits: 305

World Kindness Day, observed annually in November, serves as a global reminder of the importance of kindness in fostering connections and building communities. As we celebrate this day dedicated to spreading goodwill, it's worth examining the role of kindness in the realm of real estate, particularly for renters. Recent findings from the #Dataloft, Property Academy Renter Survey 2023 shed light on the significance of community in the decision-making process for those seeking rental properties.

The Power of Kindness in Building Communities:

At the heart of World Kindness Day is the belief that small acts of kindness can have a ripple effect, creating a positive impact on individuals and communities. This sentiment is echoed in the world of real estate, where forming connections and building a sense of community can greatly influence the decisions of renters.

Key Considerations for Renters:

For almost two-thirds of renters, the local community plays a crucial role when searching for a property to rent. The desire to be part of a welcoming and supportive community is a driving force, with 71% expressing that a sense of community in the local area would significantly influence their decision to stay longer in a rental property.

Meeting People and Making Friends:

In the quest for community, the act of meeting people and making friends is a pivotal aspect for renters. Beyond the physical attributes of a property, the social environment and the potential for forming connections with neighbours are paramount considerations. This aligns with the spirit of World Kindness Day, emphasizing the positive impact of human connections.

The Need for Local Community Information:

Nearly one in four renters expresses a desire to receive local community information. This highlights a growing recognition among renters of the importance of being informed and engaged with the surrounding community. Property seekers are not merely looking for a place to live; they are seeking a home within a thriving and supportive neighbourhood.

Influence on Decision-Making:

The statistics speak volumes about the influence of community on rental decisions. A staggering 48% of renters would choose a property more quickly if it offers a sense of community, emphasizing the urgency with which individuals seek connection and belonging. Furthermore, 7% are willing to pay more for the privilege of residing in a community-oriented environment, underscoring the tangible value placed on a sense of belonging.

We should all try and be kinder.

As we reflect on World Kindness Day and its global message of fostering connections, it is clear that the principles of kindness extend beyond personal interactions to shape our choices in various aspects of life, including the places we choose to call home. For renters, the sense of community is a powerful motivator, influencing decisions, and enhancing the overall living experience. In the pursuit of kindness, let us recognize the significance of being kind and building communities that nurture positive connections, creating spaces where individuals not only reside but truly belong.

- Details

- Hits: 310

The green belt, a fundamental town planning policy in the United Kingdom, has been strategically designed to combat urban sprawl, preserve natural landscapes, and channel development towards sustainable locations. This policy typically encircles major cities, extending approximately 5–10 miles from the peripheries of built-up areas, safeguarding small satellite towns and villages from being engulfed by urban expansion. In recent years, there has been a notable shift in the size of the green belt, sparking discussions about the delicate balance between development and conservation.

Changes in Green Belt Size

Between 2013 and 2021, there was a modest reduction in the total area covered by green belt, decreasing from 16,390 to 16,140 square kilometres. However, the year 2021/22 marked a significant milestone with the first major expansion of the green belt in recent memory. A new extension, spanning 269 square kilometres, was implemented to protect the town of Morpeth in Northumberland. This expansion underscores a commitment to preserving the integrity of green belt areas amidst the ongoing challenges of urbanization.

Property Trends in Green Belt Areas

In the context of property transactions, a noteworthy 5,000 out of the 347,000 properties sold in England within the past year were situated in green belt areas. Additionally, ongoing development activities within the green belt are apparent, with at least 21 large projects currently under construction. These projects encompass a diverse range of developments, including garden villages, retirement communities, and urban extensions. This trend reflects the increasing demand for housing and amenities while navigating the constraints imposed by green belt policies.

Population and Community Impact

A little over one million people currently reside within green belt areas, benefiting from the assurance that local development will be limited and carefully planned. This deliberate approach aims to preserve the tranquillity and natural beauty of the surrounding countryside. Over 2,000 small towns and villages find themselves nestled within the protective embrace of the green belt, ensuring their landscapes remain untouched by rampant urbanization.

The green belt policy stands as a crucial element in the broader landscape of town planning in the United Kingdom. While changes in its size have been noted, the recent expansion signifies a commitment to maintaining a delicate equilibrium between urban development and environmental conservation. The ongoing challenges posed by property transactions and large-scale developments within green belt areas underscore the need for continued vigilance and thoughtful planning. As the UK navigates the intricate interplay between growth and preservation, the green belt remains a key instrument in shaping sustainable and harmonious communities.

Sources:

Dataloft

DLUHC (Department for Levelling Up, Housing and Communities)

Land Registry

Census 2021

- Details

- Hits: 311

Becoming a first-time homeowner is a significant milestone for many individuals. However, the journey to property ownership often involves a complex financial puzzle, primarily centered around the deposit. The average deposit paid by a first-time buyer in the UK stands at £43,693, according to data from Dataloft and the English Housing Survey 2021/22. In this article, we'll explore the key findings related to first-time buyer deposits and trends in the housing market.

The Deposit Dilemma

The £43,693 figure may seem daunting, especially for those entering the property market for the first time. Saving up for such a substantial deposit requires careful financial planning and discipline. It is noteworthy that this is merely the average, meaning that many first-time buyers pay more, while others contribute less.

Income and Deposits

The data reveals an interesting correlation between income and deposit size. Nearly two-thirds (63%) of first-time buyers belonged to the top 40% income bracket. This observation underscores the influence of income levels on the ability to save for a substantial deposit. Higher income individuals tend to have a more substantial financial cushion, making it easier for them to meet the deposit requirement.

Deposit Size Variation

Over two-thirds (68%) of first-time buyers paid less than a 20% deposit when purchasing their first home. A deposit below 20% often means a higher loan-to-value ratio, potentially resulting in higher monthly mortgage payments. This could be a reason for some first-time buyers opting for smaller deposits to secure a property sooner.

On the other end of the spectrum, a fortunate 5% of first-time buyers were mortgage-free. This group either had access to substantial savings, financial support from family, or other means that allowed them to bypass the need for a mortgage. Being mortgage-free provides a significant advantage in terms of long-term financial security and lower housing costs.

Funding the First Home

The majority of first-time buyers (85%) reported that they funded their first home purchase with their own savings. This signifies the importance of disciplined saving and financial planning. A significant portion of these buyers relied on their own financial means to achieve their homeownership dream.

Family and Friends' Support

While most first-time buyers used their savings, 27% received help from family and friends. This support often comes in the form of a gifted deposit or a family member acting as a guarantor, enabling access to better mortgage terms. This assistance can be a crucial step in helping individuals get onto the property ladder.

Inheritance as a Boost

For 8% of first-time buyers, inheritance played a role in making their home purchase possible. An inheritance windfall can significantly expedite the process of buying a first home, providing a financial leg-up for those fortunate enough to receive it.

First-Time Buyers' Impact on the Market

Despite the high costs and challenges associated with buying a first home, first-time buyers accounted for 53% of all home moves in the third quarter of the year. This is the highest proportion in over a year, signalling their continued influence on the housing market. With increasing stability and the likelihood of mortgage rates coming down, it is possible that more first-time buyers will enter the market in the coming months.

The path to homeownership for first-time buyers in the UK is shaped by a range of factors, with the deposit being a significant hurdle to overcome. Income levels, savings, family support, and even inheritance all play a role in helping individuals achieve their dream of owning their first home. Despite the financial challenges, first-time buyers remain a driving force in the housing market, and with favourable conditions, their presence is likely to continue growing in the near future.

- Details

- Hits: 330