Blog

Becoming a first-time homeowner is a significant milestone for many individuals. However, the journey to property ownership often involves a complex financial puzzle, primarily centered around the deposit. The average deposit paid by a first-time buyer in the UK stands at £43,693, according to data from Dataloft and the English Housing Survey 2021/22. In this article, we'll explore the key findings related to first-time buyer deposits and trends in the housing market.

The Deposit Dilemma

The £43,693 figure may seem daunting, especially for those entering the property market for the first time. Saving up for such a substantial deposit requires careful financial planning and discipline. It is noteworthy that this is merely the average, meaning that many first-time buyers pay more, while others contribute less.

Income and Deposits

The data reveals an interesting correlation between income and deposit size. Nearly two-thirds (63%) of first-time buyers belonged to the top 40% income bracket. This observation underscores the influence of income levels on the ability to save for a substantial deposit. Higher income individuals tend to have a more substantial financial cushion, making it easier for them to meet the deposit requirement.

Deposit Size Variation

Over two-thirds (68%) of first-time buyers paid less than a 20% deposit when purchasing their first home. A deposit below 20% often means a higher loan-to-value ratio, potentially resulting in higher monthly mortgage payments. This could be a reason for some first-time buyers opting for smaller deposits to secure a property sooner.

On the other end of the spectrum, a fortunate 5% of first-time buyers were mortgage-free. This group either had access to substantial savings, financial support from family, or other means that allowed them to bypass the need for a mortgage. Being mortgage-free provides a significant advantage in terms of long-term financial security and lower housing costs.

Funding the First Home

The majority of first-time buyers (85%) reported that they funded their first home purchase with their own savings. This signifies the importance of disciplined saving and financial planning. A significant portion of these buyers relied on their own financial means to achieve their homeownership dream.

Family and Friends' Support

While most first-time buyers used their savings, 27% received help from family and friends. This support often comes in the form of a gifted deposit or a family member acting as a guarantor, enabling access to better mortgage terms. This assistance can be a crucial step in helping individuals get onto the property ladder.

Inheritance as a Boost

For 8% of first-time buyers, inheritance played a role in making their home purchase possible. An inheritance windfall can significantly expedite the process of buying a first home, providing a financial leg-up for those fortunate enough to receive it.

First-Time Buyers' Impact on the Market

Despite the high costs and challenges associated with buying a first home, first-time buyers accounted for 53% of all home moves in the third quarter of the year. This is the highest proportion in over a year, signalling their continued influence on the housing market. With increasing stability and the likelihood of mortgage rates coming down, it is possible that more first-time buyers will enter the market in the coming months.

The path to homeownership for first-time buyers in the UK is shaped by a range of factors, with the deposit being a significant hurdle to overcome. Income levels, savings, family support, and even inheritance all play a role in helping individuals achieve their dream of owning their first home. Despite the financial challenges, first-time buyers remain a driving force in the housing market, and with favourable conditions, their presence is likely to continue growing in the near future.

- Details

- Hits: 336

![]()

Crawley-based agency, Taylor Robinson, clinched the coveted Gold award in both the landlords and tenants categories for the Sussex region. Their outstanding achievement also included securing the title of "Best in Postcode" for both sales and lettings at the illustrious ESTAS Customer Service Awards 2023, sponsored by Coadjute – the most significant awards ceremony in the UK property industry, winning for a third year in a row. The winners were announced at the grandest event in the property sector, held at the Grosvenor House in London and impeccably hosted by the nation's beloved TV property presenter, Phil Spencer, before an audience of 1,000 distinguished guests.

Inaugurated 20 years ago, these awards fuel the ESTAS' own customer review platform, recognizing estate and letting agents for their exceptional customer service, based on feedback from clients who have navigated the complete process with an agent. This year's results were tabulated from an impressive tally of over 300,000 customer reviews.

Phil Spencer, the ever-present host of The ESTAS since their inception in 2003, shared his thoughts with the live audience, saying, "Everyone shortlisted here today has achieved the ESTAS Standard of Excellence, founded solely on service ratings from customers at the culmination of their moving journey. This gives a highly precise portrayal of the service standard provided to the end client. This, in itself, is a remarkable achievement, so whatever unfolds this afternoon, you should all take immense pride in your accomplishment."

Estate and letting agents across the UK were recognized regionally and by postcode. National Grand Prix Awards were also bestowed upon the Best Single Agent Office in sales and lettings.

Ben Marley, Commercial Director at The ESTAS, commented, "When we initiated this, we aimed to create property awards that were truly impartial, with winners selected exclusively based on customer service ratings from actual transactions. Two million reviews and two decades later, ESTAS is now the go-to customer review platform for property professionals and the most prestigious accolade an agent, conveyancer, mortgage broker, or supplier can achieve in the property industry."

Dan Salmons, CEO at headline partner Coadjute, added, "On behalf of the Coadjute team, warm congratulations to all this year's ESTAS winners. We were thrilled to witness such remarkable achievements recognized across the industry. It has been a genuine pleasure to support The ESTAS this year."

Lawrence Taylor, Director of Taylor Robinson, expressed his excitement, saying, "We are absolutely thrilled to be acknowledged in this year's ESTAS. It holds immense significance for us because we recognize that it's our customers who have appraised our performance. We take our commitment to customer service very earnestly, knowing that clients have a choice. We have always taken great pride in delivering on our promise of a personalized service, and this accolade underscores our commitment to that pledge especially as this is the third year we have won."

- Details

- Hits: 311

The Bank of England's decision to maintain the bank rate at 5.25% in their November 2023 meeting has significant implications for the UK's residential property market. Interest rates, particularly through their influence on mortgage affordability, play a pivotal role in shaping the outlook for the housing market. In this article, we will delve into the recent decision by the Bank of England, the consensus forecasts for interest rates, and how these factors may impact the real estate landscape.

The Bank of England's November Decision

In its latest policy meeting, the Bank of England chose to keep the bank rate steady at 5.25%. This decision, while not surprising to many, reflects the central bank's cautious approach to monetary policy. It comes as the Bank strives to strike a balance between controlling inflation and ensuring the economy's stability.

Impact of Interest Rates on the Residential Market

Interest rates have a profound influence on the residential property market. When the bank rate is increased, borrowing becomes more expensive, making it challenging for potential homebuyers to secure affordable mortgages. Conversely, when rates are lowered, borrowing costs decrease, which can stimulate demand in the housing market.

Consensus Forecasts for Interest Rates

HM Treasury has compiled consensus forecasts, suggesting that interest rates may be at their peak. According to these forecasts, the bank rate is expected to end 2023 at 5.3%. However, the outlook is more optimistic for 2024, with a forecasted drop to 4.7% by the end of the year. These projections offer some relief to potential homebuyers, as the anticipation of lower rates may make homeownership more attainable in the near future.

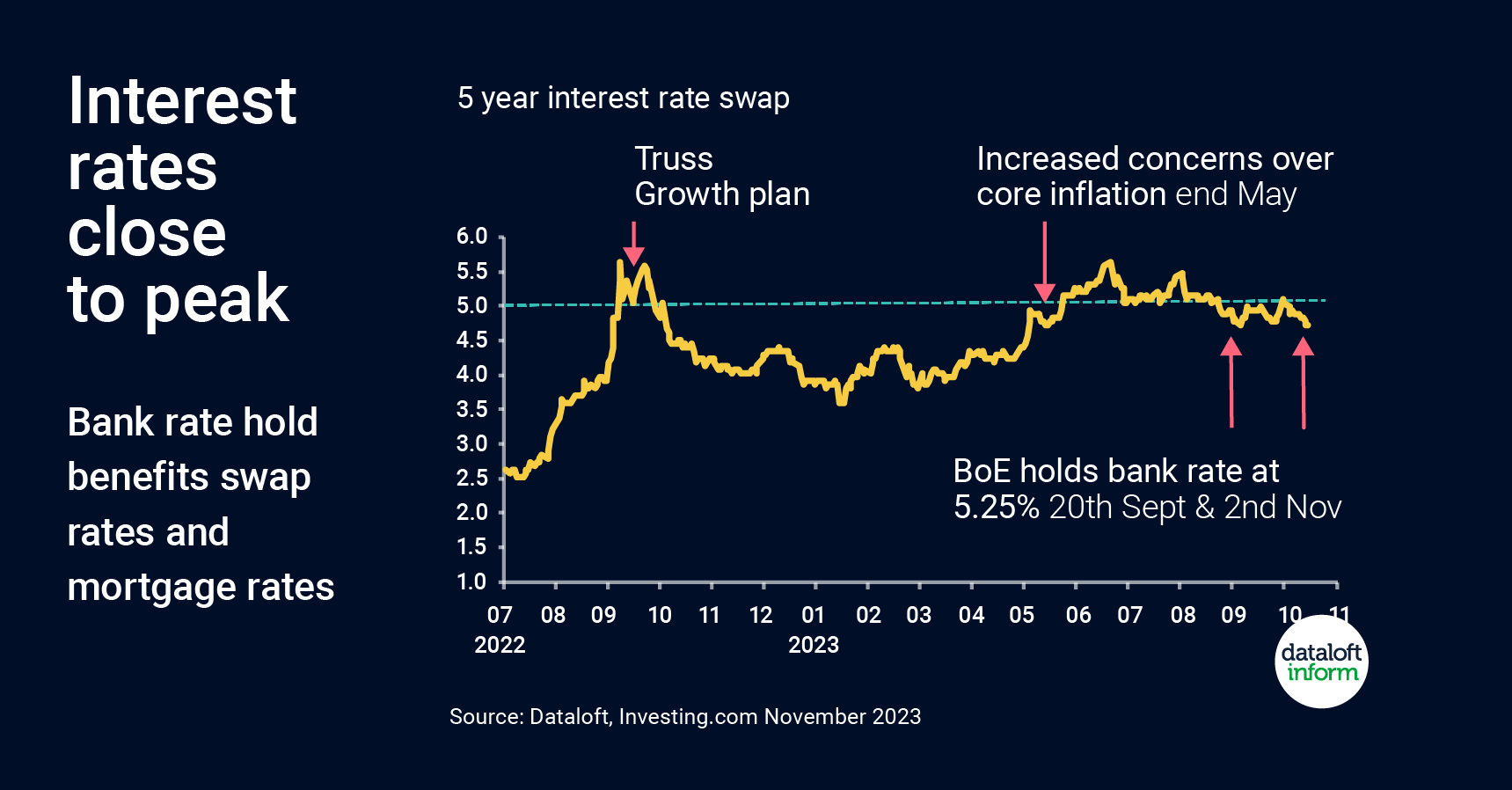

Swap Rates and Mortgage Costs

Swap rates are crucial indicators of changes in mortgage costs. They reflect the cost of borrowing for lenders, providing insight into the trends in interest rates. The Bank of England's decision to maintain the bank rate had a positive impact on 5-year swap rates, which are now at their lowest level since May. This suggests that borrowing costs may become more favourable for mortgage seekers, which can boost the residential property market.

Market Adjustment to Higher Interest Rates

The market is still adapting to the consequences of higher interest rates, and mortgage approvals remain relatively low. However, as consensus forecasts indicate that interest rates may be nearing their peak, we can expect to see an improvement in market sentiment starting from Spring 2024. This could lead to a more robust residential property market as the cost of borrowing becomes more manageable.

In conclusion, the Bank of England's decision to maintain the bank rate at 5.25% in November 2023 has important implications for the UK's residential property market. While higher interest rates have caused some adjustment in the market, the consensus forecasts suggest that rates may soon start to decrease, offering hope to potential homebuyers. With swap rates also reflecting a positive trend, the housing market is poised for improved sentiment and activity in the coming months. It's essential for buyers and sellers alike to stay informed about interest rate developments as they can significantly influence the dynamics of the residential property market.

- Details

- Hits: 309

As the chilling winds of October sweep through the British Isles, the spirit of Halloween descends upon the land, and with it comes a ghoulish extravaganza that promises to send shivers down the spines of both young and old. Halloween has evolved into big business in the United Kingdom, and its chilling embrace shows no sign of letting up. It is estimated that Britons will unleash a monstrous spending spree, with projections soaring to a staggering £1 billion, a mind-boggling figure that might just be more shocking than any ghostly apparition.

This macabre celebration of the supernatural has gripped the hearts of the British populace, with more than 56% of the population donning their favourite costumes and joining in the eerie festivities. The younger generation, Gen Z, is expected to lead the charge into the heart of darkness, with a spine-tingling 87% of them gearing up to part with their hard-earned pounds. A chilling £46 each is the sum they've chosen to unleash upon the spectral market, making it abundantly clear that Halloween isn't just for children anymore.

But what's truly blood-curdling is that some places in the UK are spookier than others, and buyers seem to be drawn to them like moths to a flame, undaunted by their eerie names. Streets and lanes with the most terrifying monikers have been sending property prices skyrocketing into the abyss. Roads, such as 'Axe Lane', have seen an average price of £795,000 this year, followed closely by the haunting 'Bloodgate Hill' at £668,000, and the eerie 'Bones Lane' with a bone-chilling £638,000.

It seems that the UK's obsession with all things eerie and uncanny knows no bounds. Even the presence of restless spirits and ghostly apparitions hasn't been enough to drive away brave souls seeking their very own haunted haven. Pluckley, often lauded as the most haunted village in all of England, stands as a testament to the undying allure of the supernatural. Over the past decade, this ghostly hamlet has witnessed a haunting transformation in its property market. The average house prices in this spectral settlement have not merely inched upward; they have doubled, as if bewitched by the very spirits that call it home.

In a world where economic realities constantly shift and change, Halloween remains a steady and profitable beacon, casting its eerie glow over the UK property market. As we stand on the precipice of the unknown, one thing is for certain – the love for all things spooky, and the fascination with the uncanny, will continue to bewitch the British population, ensuring that Halloween's spectral reign over the real estate market persists for years to come. Who knows what haunted treasures the future may reveal, as the UK delves deeper into the mysteries of the supernatural while property prices continue to rise like the undead? Source: #Dataloft, Land Registry (12 months to October 2023), Finder.

Happy Halloween!!!!!!!

- Details

- Hits: 329

Restaurants are more than just places to enjoy a delicious meal; they are the lifeblood of our communities. The restaurant industry's growth, even in the face of economic challenges, exemplifies their importance. Local restaurants foster a sense of belonging, enhance well-being, and drive economic growth in their areas. Moreover, they serve as magnets for homebuyers, breathing new life into neighbourhoods that were once overlooked. In this article, we'll explore the significant impact of restaurants on our communities, using data and insights from 2022 to shed light on their influence, with a particular focus on Crawley's remarkable restaurant scene.

The Restaurant Resurgence

In the face of mounting cost-of-living pressures, it's remarkable to witness the continued growth of the restaurant industry. As of 2022, the United Kingdom boasted over 150,000 restaurants, marking an impressive 8% increase since 2019. This expansion isn't confined to one specific region; cities such as London, Manchester, Edinburgh, Glasgow, and Liverpool experienced particularly strong growth in their restaurant sectors. The resilience of this industry in the face of economic challenges is a testament to the enduring appeal and importance of restaurants within our communities.

Building a Sense of Community

One of the most striking findings is that a majority of people recognize the pivotal role that local restaurants play in fostering a sense of community. A survey conducted for OpenTable revealed that 64% of respondents believe that local restaurants are essential for building and maintaining that communal bond. This sentiment underlines the fact that restaurants are not merely places to eat, but spaces where people come together, share stories, and build connections. They often serve as hubs for community events, meetings, and celebrations, reinforcing their significance in the social fabric of a locality.

Enhancing Well-being

The impact of local restaurants extends beyond the communal aspect; it also significantly contributes to individual well-being. According to the same research, nearly a third of respondents reported that local restaurants, pubs, and cafes added value to their overall well-being. This effect is likely attributed to the way restaurants provide a space for relaxation, enjoyment, and escape from daily pressures. Dining out can be a therapeutic experience, offering a break from cooking at home and an opportunity to savour diverse culinary creations.

Economic Growth and Homebuyer Attraction

Aside from the social and personal benefits, local restaurants are potent drivers of economic growth and can have a substantial influence on the property market. A vibrant restaurant scene can be a significant draw for prospective homebuyers. Areas with a wide array of dining options are often perceived as more attractive, not only for the residents but also for businesses and investors. This increased interest can stimulate economic activity and create a cycle of development that benefits the entire community.

Crawley's Restaurant Scene Shines

Crawley, a town with a unique charm, is home to a thriving restaurant scene that stands out as a shining example of how local restaurants can flourish even in challenging economic times. The town's restaurant industry has experienced steady growth, reflecting the town's resilience and the unwavering support of its residents. This growth is a testament to the enduring appeal and importance of restaurants within Crawley's community, making it a standout destination for culinary experiences.

Building a Sense of Belonging in Crawley

In Crawley, local restaurants do more than just serve delicious meals; they foster a deep sense of belonging within the community. Residents and visitors alike are drawn to these culinary havens, which provide a space for people to come together, share stories, and build lasting connections. Crawley's restaurant scene often serves as a hub for community events, meetings, and celebrations, underlining its significance in the social fabric of the town.

Enhancing Well-being in Crawley

Beyond the sense of community, Crawley's restaurants make a significant contribution to individual well-being. They offer a retreat from the daily grind, a place to relax and savour diverse culinary creations. Dining out in Crawley is a therapeutic experience, offering respite from home cooking and an opportunity to enjoy the talents of local chefs. Residents in Crawley find solace and rejuvenation in the welcoming ambiance of their local eateries.

Economic Growth and Homebuyer Attraction in Crawley

Crawley's restaurants are not just enriching the community but also driving economic growth and piquing the interest of prospective homebuyers. A town with a vibrant restaurant scene is often perceived as more attractive, not only for residents but also for businesses and investors. This increased interest can stimulate economic activity and development, creating a thriving environment that benefits the entire community.

An Impressive Statistic

Crawley's commitment to its restaurant culture is exemplified by the fact that it boasts 3638 residents per restaurant, significantly higher than the regional average of 2074. This statistic highlights Crawley's dedication to providing an abundance of dining options, making it a standout location in the region.

Crawley's restaurants are more than places to eat; they are the lifeblood of our community, showcasing its uniqueness and charm. The continued growth of Crawley's restaurant industry, its power to foster a sense of belonging, enhance well-being, and drive economic growth, demonstrates the town's extraordinary appeal. As magnets for homebuyers, Crawley's restaurants make it an even more desirable place to live. In an ever-changing world, one thing remains clear: Crawley's restaurants will continue to be the heartbeat of our community, uniting people and enriching the spirit of our neighbourhoods. They have put Crawley firmly in the spotlight as a destination that values and celebrates its local restaurant scene.

- Details

- Hits: 477