The Bank of England's decision to maintain the bank rate at 5.25% in their November 2023 meeting has significant implications for the UK's residential property market. Interest rates, particularly through their influence on mortgage affordability, play a pivotal role in shaping the outlook for the housing market. In this article, we will delve into the recent decision by the Bank of England, the consensus forecasts for interest rates, and how these factors may impact the real estate landscape.

The Bank of England's November Decision

In its latest policy meeting, the Bank of England chose to keep the bank rate steady at 5.25%. This decision, while not surprising to many, reflects the central bank's cautious approach to monetary policy. It comes as the Bank strives to strike a balance between controlling inflation and ensuring the economy's stability.

Impact of Interest Rates on the Residential Market

Interest rates have a profound influence on the residential property market. When the bank rate is increased, borrowing becomes more expensive, making it challenging for potential homebuyers to secure affordable mortgages. Conversely, when rates are lowered, borrowing costs decrease, which can stimulate demand in the housing market.

Consensus Forecasts for Interest Rates

HM Treasury has compiled consensus forecasts, suggesting that interest rates may be at their peak. According to these forecasts, the bank rate is expected to end 2023 at 5.3%. However, the outlook is more optimistic for 2024, with a forecasted drop to 4.7% by the end of the year. These projections offer some relief to potential homebuyers, as the anticipation of lower rates may make homeownership more attainable in the near future.

Swap Rates and Mortgage Costs

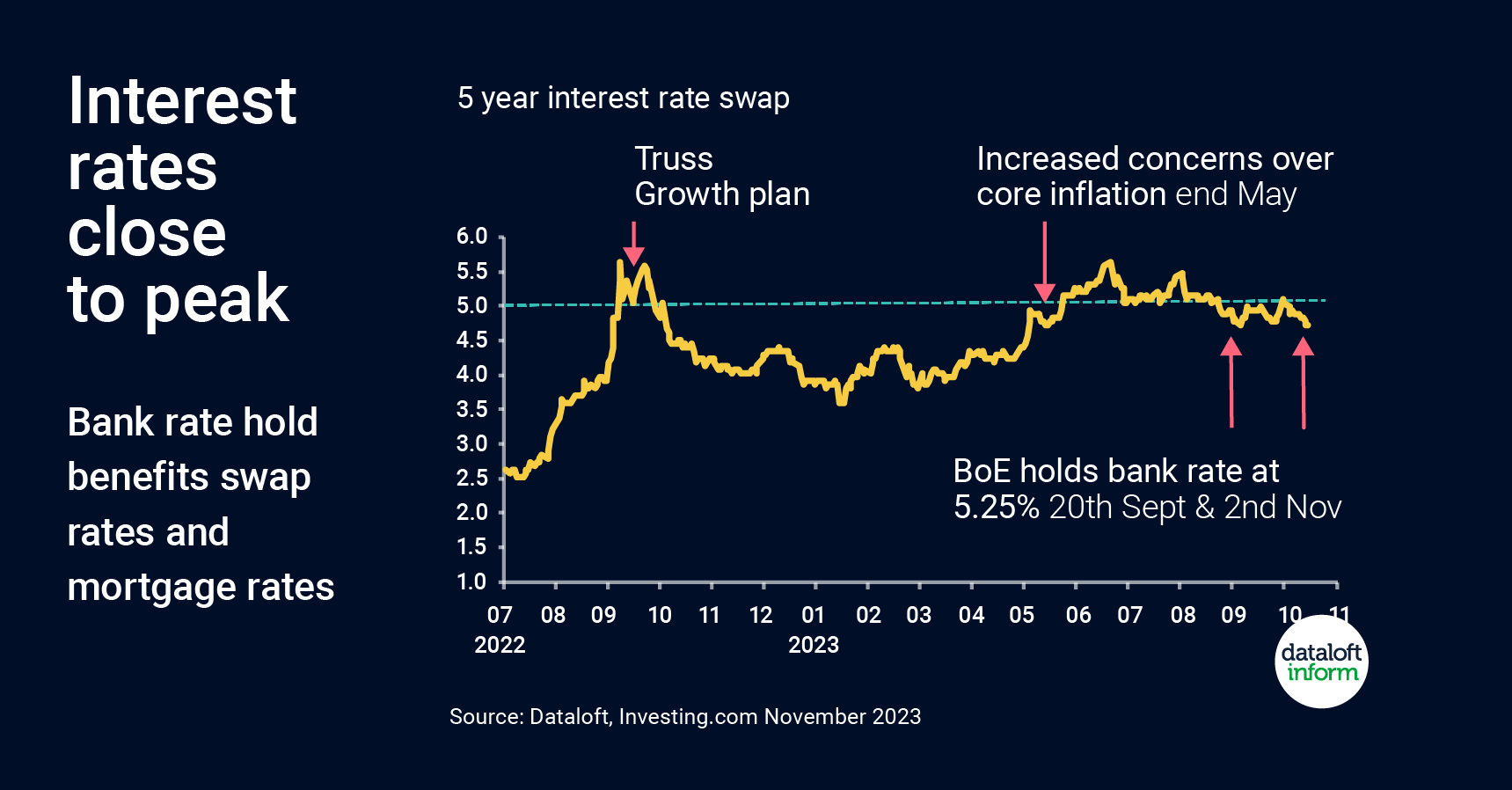

Swap rates are crucial indicators of changes in mortgage costs. They reflect the cost of borrowing for lenders, providing insight into the trends in interest rates. The Bank of England's decision to maintain the bank rate had a positive impact on 5-year swap rates, which are now at their lowest level since May. This suggests that borrowing costs may become more favourable for mortgage seekers, which can boost the residential property market.

Market Adjustment to Higher Interest Rates

The market is still adapting to the consequences of higher interest rates, and mortgage approvals remain relatively low. However, as consensus forecasts indicate that interest rates may be nearing their peak, we can expect to see an improvement in market sentiment starting from Spring 2024. This could lead to a more robust residential property market as the cost of borrowing becomes more manageable.

In conclusion, the Bank of England's decision to maintain the bank rate at 5.25% in November 2023 has important implications for the UK's residential property market. While higher interest rates have caused some adjustment in the market, the consensus forecasts suggest that rates may soon start to decrease, offering hope to potential homebuyers. With swap rates also reflecting a positive trend, the housing market is poised for improved sentiment and activity in the coming months. It's essential for buyers and sellers alike to stay informed about interest rate developments as they can significantly influence the dynamics of the residential property market.