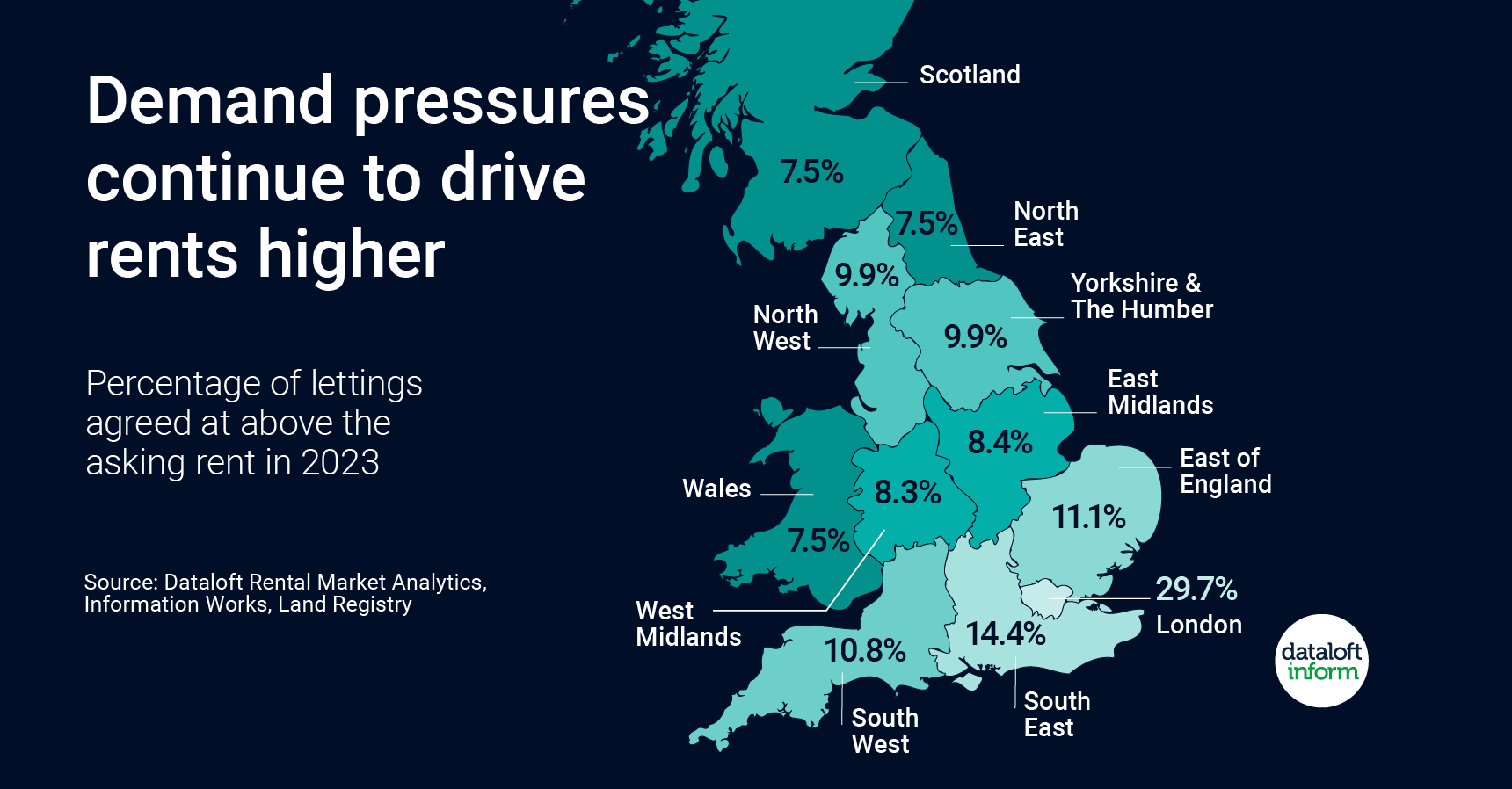

In 2023, the UK rental market has experienced a significant shift in dynamics, with almost one in six rental transactions being agreed at rental rates above the asking price. This is a stark contrast to 2019, where less than one in 15 rental agreements exceeded the listed rent. New analysis conducted by Dataloft has shed light on this phenomenon, revealing that similar pressures are being felt across the country. The most dramatic effects have been observed in London, where a staggering 30% of rentals were agreed upon at rates higher than the asking price. This article explores the factors driving this trend and the effects it has had on the Crawley rental market.

Rising Demand Outpaces Supply

One of the primary drivers behind the surge in rents is the persistently high demand for rental properties that has consistently outpaced supply since the onset of the COVID-19 pandemic. As remote work and flexible working arrangements became the norm, individuals and families have sought more spacious and comfortable living conditions. Consequently, the demand for rental properties, especially in areas with good access to amenities and transportation, has soared.

Effect on Rent Prices

This increase in demand has not only led to more competitive rental markets but has also driven up rental prices. Since 2019, average monthly rents in the UK have witnessed a staggering 41% increase, significantly outpacing the growth in house prices, which only grew by 25% over the same period. While this has had a broad impact on the rental market throughout the UK, the effect has been particularly pronounced in London and its surrounding areas.

London's Rental Market

In the capital city, London, the effect of this surge is most noticeable, with a staggering 30% of rentals being agreed upon at rates exceeding the asking price. The extreme competitiveness of London's rental market is primarily due to the city's allure, job opportunities, and diverse culture. Renters in London are not only willing but also often compelled to pay higher rents to secure the accommodation they desire. This situation has created a challenging environment for tenants, particularly in terms of affordability.

Regional Impact

Although London has experienced the most significant impact, other regions in the UK have also felt the ripple effect of the soaring rental prices. The wider South East, including areas near London, saw 14% of new rentals agreed upon at rates above the asking price. Furthermore, more than 10% of rental transactions in four other UK regions - the East of England, North West, South West, and Yorkshire & Humber - also surpassed the asking rent. These statistics indicate a nationwide trend driven by the fundamental imbalance between rental demand and supply.

Crawley's Rental Market

Crawley, has not been immune to these shifts in the rental market. While it may not experience the same extremes as London, the pressure on renters and the increase in rental prices have undoubtedly affected the town's rental market. As demand for rental properties in Crawley continues to grow, renters may find themselves facing higher monthly rental costs and increased competition for desirable accommodations.

The UK's rental market in 2023 is experiencing a historic shift, with more rental transactions being agreed upon at rates above the asking rent than ever before. This trend can be attributed to a surge in demand for rental properties that has consistently outpaced supply since the pandemic. As a result, rental prices have seen substantial increases, particularly in London and its surrounding areas, but the effects have been felt across the nation. In Crawley, like many other parts of the UK, renters are encountering increased competition and rising rental prices. It remains to be seen whether these trends will continue, but for now, they underscore the challenges facing renters in the current housing market.