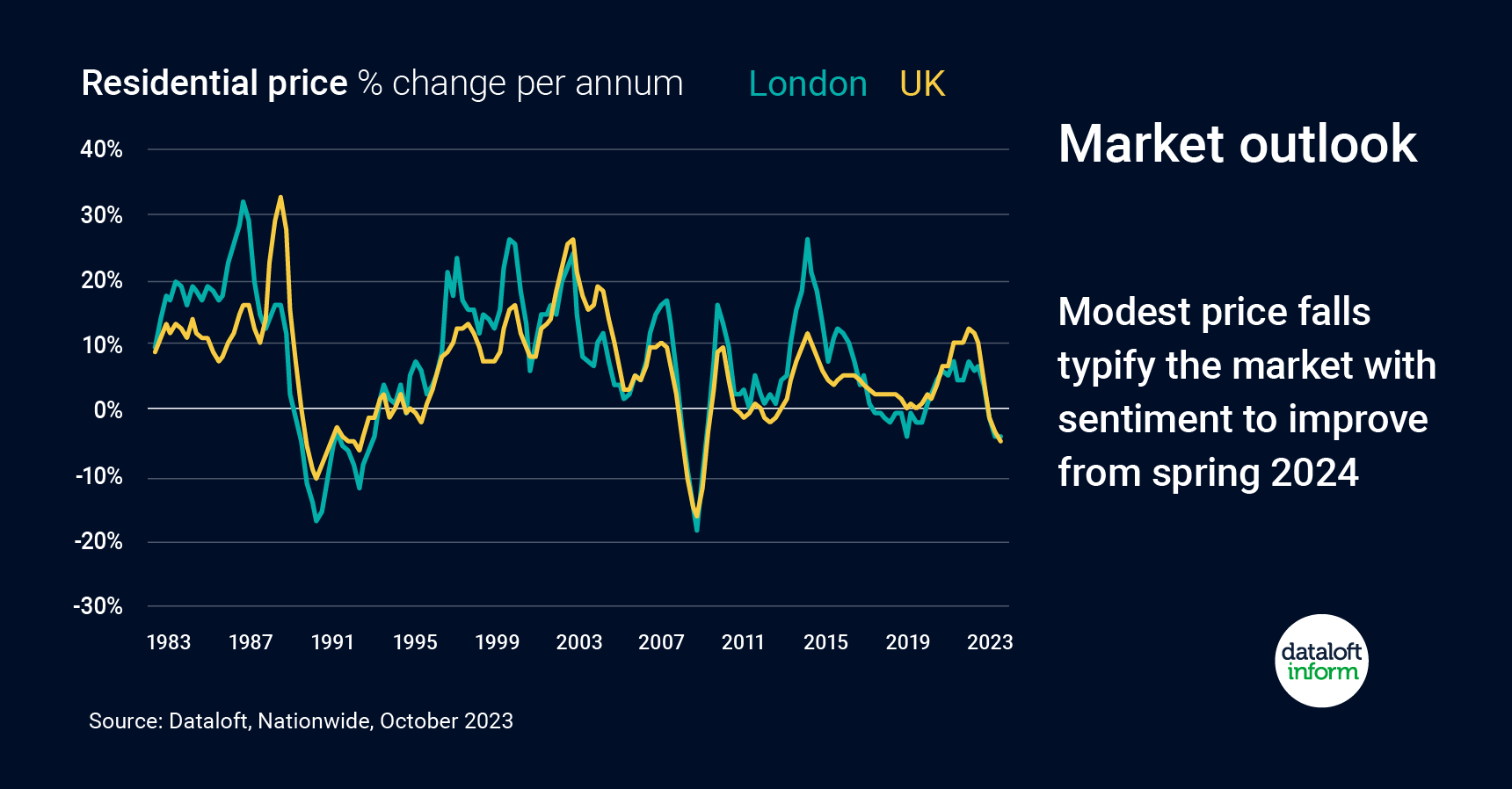

The property market in the United Kingdom has been a rollercoaster ride over the past year, primarily due to fluctuations in interest rates and their impact on housing prices and sentiment. As we delve into the remainder of 2023 and look forward to spring 2024, there are signs of potential improvement, but uncertainty looms over the market's future stability. In this article, we will explore the current state of the UK property market, expectations for interest rates, and how these factors may influence the market's trajectory.

Interest Rates and Sentiment

Interest rates have been a central point of concern for the UK property market. The prevailing sentiment is that interest rates are currently at, or near, their peak. This has been a source of unease for potential homebuyers and investors, as higher interest rates typically lead to increased borrowing costs and can dampen enthusiasm for property investments.

However, the prospect of interest rates stabilizing or even decreasing in the near future should be seen as a positive development. As interest rates become more predictable, it is likely to improve sentiment in the market. Potential buyers and investors may feel more confident about making decisions, which can stimulate activity in the market.

Sales Volumes and Price Volatility

For the remainder of 2023, we can anticipate continued low sales volumes and some degree of price volatility. The uncertainty surrounding interest rates, coupled with ongoing economic factors, may lead to a cautious approach from buyers and sellers. Price fluctuations can create opportunities for those with the financial flexibility to capitalize on market fluctuations.

Spring 2024: A Turning Point?

Spring 2024 is being closely watched as a potential turning point in the UK property market. If interest rates indeed stabilize and sentiment improves, this season could mark an upturn in the market. However, this projection is not without its caveats.

Risks Looming

One of the key risks to consider is the possibility of another 25 basis point (bp) rise in the Bank Rate. Such an increase is widely anticipated by experts, but it remains a concern for the fragile shoots of improved sentiment. Any further escalation in interest rates beyond this point could negatively impact the market's stability.

Another risk factor is the potential reversal of the downward trend in inflation. Inflationary pressures can erode the purchasing power of consumers and affect their ability to buy homes. A resurgence in inflation could further complicate the property landscape.

A Look Back: Q3 2022 to Present

To gain a better perspective on the current state of the market, let's take a brief look back. The shock of rapid changes to interest rates in Q3 2022 triggered sharp quarterly price falls over the winter, impacting Q4 2022 and Q1 2023. However, since then, the market has exhibited signs of stabilization. Remarkably, prices today are higher than they were at the end of Q1 2023.

What does it all mean?

The UK property market is in a state of flux, with interest rates and sentiment playing a crucial role in its dynamics. While we anticipate continued challenges in the form of low sales volumes and price volatility for the remainder of 2023, the possibility of an upturn in spring 2024 is a glimmer of hope. However, it is essential to tread cautiously, as risks associated with further interest rate hikes and inflation remain on the horizon. As always, staying informed and seeking expert advice is key for those navigating this evolving market landscape.