Blog

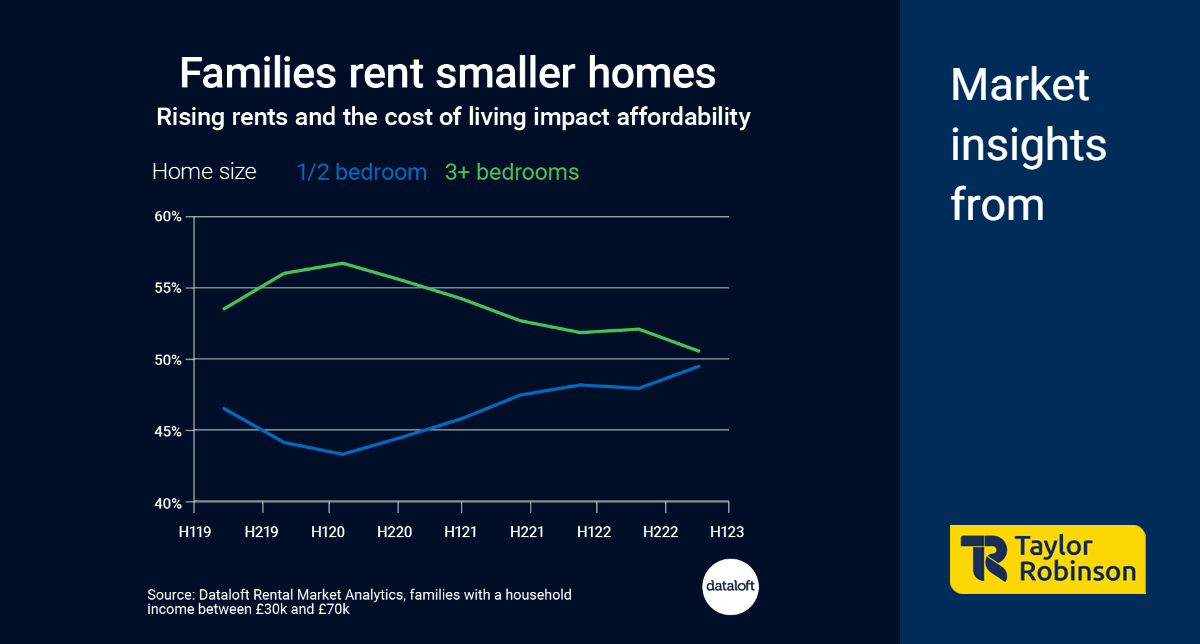

With the rise in the cost of living, an increasing number of renters are facing tough decisions when it comes to selecting their homes. The correlation between rising rents and shifting housing preferences has become a significant trend, with families in particular feeling the impact. According to #Dataloft Rental Market analytics, in the year leading up to June 2023, nearly half of families with a household income ranging from £30,000 to £70,000 opted for smaller homes, a notable increase from 43% in the first half of 2020.

Choosing Smaller Homes:

The data reveals a significant shift in housing choices among families, highlighting the economic pressures they face. Families are now more likely to select homes with just 1 or 2 bedrooms, showcasing the compromises renters are willing to make in response to escalating rents. This trend reflects the challenging trade-offs many renters are navigating to secure affordable housing amid financial constraints.

Relocating for Affordability:

For a considerable number of renters, the compromise doesn't end with downsizing; it extends to choosing a lower-cost location. The data indicates that, in the year leading up to June 2023, renters over the age of 30 were more inclined to move to areas with lower rents rather than opting for higher rent locations. This suggests a growing trend of prioritizing financial prudence over other considerations when deciding on a place to live.

The Call for Increased Rental Housing Supply:

One potential solution to address the challenges posed by rising rents and shifting housing preferences is the delivery of new rental homes at scale. As the data underscores the growing demand for smaller, more affordable housing options, the need for an increased supply of such homes becomes evident. It is hoped that this issue will find its way to the forefront of the political agenda in 2024, signalling a commitment to tackling the housing affordability crisis.

The intersection of rising rents and the cost of living has prompted renters, especially families with moderate incomes, to reassess their housing choices. The data from #Dataloft Rental Market Analytics underscores the shift towards smaller homes and lower-cost locations, highlighting the ongoing challenges faced by renters in the current economic climate. As we look ahead, addressing the housing affordability crisis will require concerted efforts, including policy changes and a substantial increase in the supply of affordable rental homes. The hope is that policymakers will prioritize this issue in the coming years to ensure a more sustainable and equitable housing landscape for all.

- Details

- Hits: 278

The timeless tale of the Three Wise Men following a guiding star to present gifts of gold, frankincense, and myrrh to the newborn king has captured imaginations for centuries. However, as we navigate the complexities of modern finance, one might wonder if a different choice of gift, such as a home, could have been a more astute financial move. In this article, we explore the current economic landscape and compare the potential financial outcomes of the Three Wise Men's gifts with the state of today's property market and precious metal markets.

The Changing Landscape:

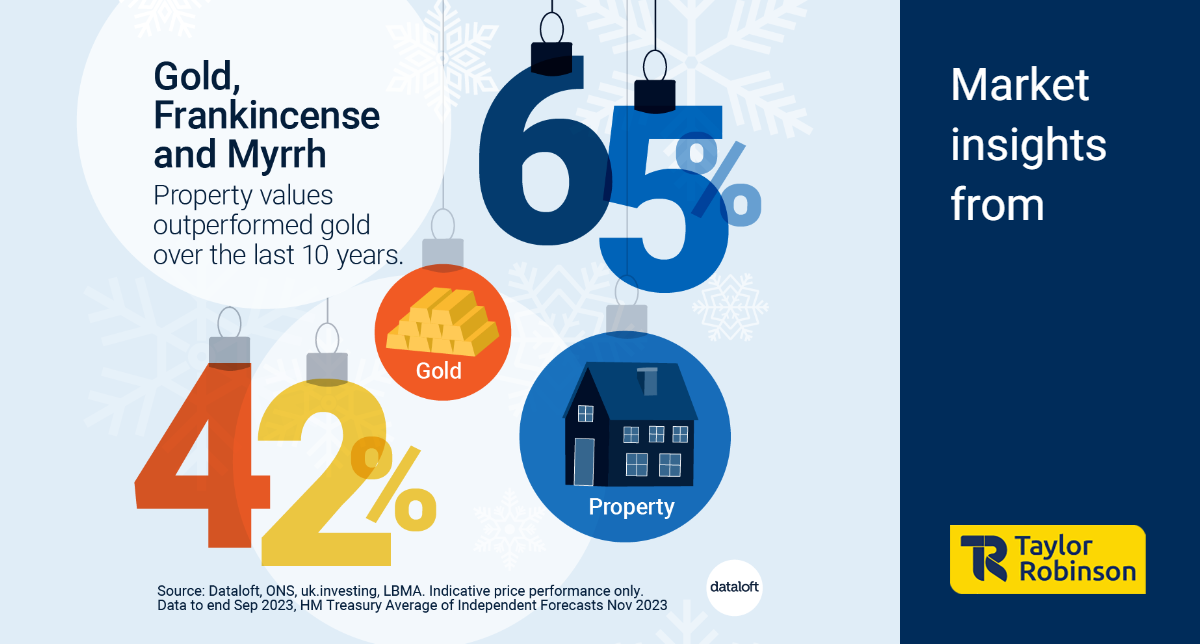

Over the past decade, the average price of a home has seen a remarkable 65% increase, soaring from £176,097 to £291,385. This surge in value outpaces the 42% rise in the value of gold during the same period. The robust performance of the housing market reflects the dynamic nature of property investments, making homes an attractive option for those seeking long-term financial gains.

Comparing Investments:

Gold, traditionally considered a stable investment, has experienced a commendable rise in value. However, property market's consistent growth demonstrates the potential for substantial returns over time. As of September 2023, the forecast for home prices indicates a price moderation in 2024, followed by a cumulative growth of 5.8% between 2025 and 2027, according to sources such as #Dataloft, ONS, uk.investing, LBMA, and HM Treasury Average of Independent Forecasts Nov 2023.

The Home Advantage:

While gold has historically been a symbol of wealth, homes offer a unique advantage in terms of utility and enduring value. A property not only serves as a place of shelter but also provides the potential for rental income or resale profit. Additionally, the property market's adaptability to economic trends and shifts ensures that property investments can weather various financial climates.

Looking Ahead:

The forecasted price moderation in 2024 may create opportunities for prospective homebuyers to enter the market, capitalizing on potentially lower prices. Moreover, the cumulative growth predicted between 2025 and 2027 suggests that property market remains a promising avenue for those considering long-term investments.

As we reflect on the gifts of the Three Wise Men, it's intriguing to contemplate how the financial landscape has evolved. While gold has its allure, the substantial and consistent growth of the housing market over the past decade indicates that a gift of a home might have been a wiser financial move in the long run. As we navigate the future, the enduring value and versatility of real estate continue to make it a compelling investment option.

- Details

- Hits: 245

As the festive season approaches, a recent survey conducted by #Dataloft Poll of Subscribers in November 2023, in collaboration with Rightmove, unveils interesting insights into the preferences of prospective homebuyers during the Christmas season. The findings suggest that a significant 61% of respondents are saying "Ho-Ho-No!" to refurbishments or fixer-uppers, expressing a strong desire to move into their new homes hassle-free as they countdown to Christmas.

Fixer-Uppers: A Merry 8% Cheaper:

Surprisingly, over a quarter of survey participants revealed that homes in need of refurbishment are the most sought after. These properties come with an attractive bonus – they are, on average, 8% cheaper than the typical properties available for sale in the market. This budget-friendly option has sparked interest among a considerable portion of the homebuying population, providing an opportunity to save money while investing in a property that holds potential.

Newly-Refurbished Homes: A Frosty Premium of 19%:

On the flip side, the survey also shed light on a different trend among homebuyers. Approximately 39% of respondents expressed a preference for newly-refurbished homes. However, this choice comes at a frosty premium, with buyers willing to pay an average of 19% more for the convenience of moving into a property that requires little to no additional work. This premium translates to nearly £70,000, showcasing the value placed on a turnkey solution.

The Christmas Rush and Housing Market Dynamics:

The survey results reflect the unique dynamics of the housing market during the holiday season. The Christmas rush seems to influence buyer preferences, with a substantial portion opting for the ease and convenience of a ready-to-move-in property. The desire to avoid the stress of refurbishments and settle into a new home in time for the festive season appears to be a driving factor.

Implications for Sellers and Market Trends:

For sellers, understanding these preferences can be crucial in positioning their properties effectively in the market. Highlighting the benefits of a hassle-free move-in or the potential for customization in fixer-uppers could be key marketing strategies.

Moreover, these findings indicate a diverse landscape in the housing market, where different segments of buyers have distinct preferences. Property professionals and developers may need to adapt their strategies to cater to these varied demands, ensuring a well-balanced inventory that appeals to a wide range of potential buyers.

As we navigate the Christmas season, the housing market experiences a fascinating interplay between the desire for a hassle-free move-in and the attraction of more affordable fixer-upper options. The data from the #Dataloft Poll of Subscribers, in collaboration with Rightmove, provides valuable insights into the complex decision-making processes of homebuyers during this festive time, shedding light on the nuanced dynamics of the property market.

- Details

- Hits: 310

As we celebrate the one-year milestone of navigating the intricacies of the property landscape, it is imperative to delve into the latest developments shaping the rental market. Our expertise in deciphering market trends has brought forth a nuanced understanding of the demand-supply imbalance, rental fluctuations, and the ever-evolving dynamics that define the sector.

Demand-Supply Imbalance:

In the realm of rental properties, the persistent demand-supply imbalance remains a focal point of discussion. According to recent data from a Dataloft Poll of Subscribers (October 2023), a staggering 17% of agents reported instances where renters consistently offered amounts exceeding the asking rent. Additionally, 44% acknowledged that such instances occurred intermittently, painting a picture of an intense competition among tenants vying for desirable properties.

Market Metrics:

As we scrutinize the broader metrics, the average UK rent stands at £1,279, reflecting an annual increase of 8.9%. However, a closer examination reveals a subtle monthly decline of 0.3%. This dip hints at a seasonal cooling in demand post a bustling summer period, indicating a cyclical trend in rental activity.

Regional Variances:

The intricate tapestry of the UK rental market is further complicated by regional variances. While rents experienced a marginal decrease across the board, noteworthy increases were observed in the East of England, Midlands, South West, and Wales. These regional outliers challenge conventional expectations, emphasizing the localized nature of rental market dynamics.

Winter Lull, Yet Persistent Competition:

Traditionally, demand in the rental market tends to wane during the winter months. However, the current landscape defies this norm, with competition remaining robust despite the seasonal dip. This resilience in tenant demand underscores the critical need for property owners and agents to stay attuned to shifting market dynamics and adjust strategies accordingly.

In conclusion, our comprehensive analysis of the UK rental market, drawing insights from reputable sources such as the Dataloft Poll of Subscribers (October 2023) and HomeLet (November 2023), unveils a complex tapestry of demand-supply imbalances, regional nuances, and seasonal variations. As experts in the field, we remain committed to unravelling these intricacies, offering invaluable insights to stakeholders navigating the ever-evolving landscape of the rental market.

- Details

- Hits: 290

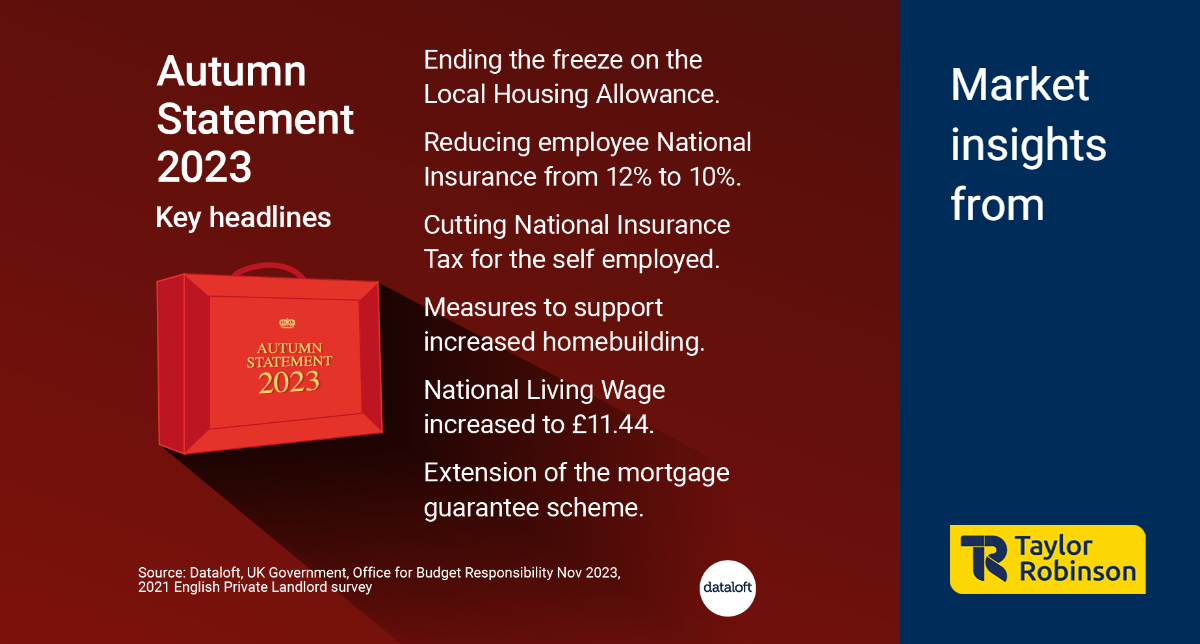

In the recent Autumn Statement, the Chancellor unveiled a series of measures aimed at addressing various facets of the UK economy, with a particular focus on the property market. From bolstering support for low-income renters to implementing changes in National Insurance rates and making significant investments in housing initiatives, the government has outlined a comprehensive strategy with potential implications for both tenants and property owners.

Support for Low-Income Renters

A key highlight of the Autumn Statement is the government's commitment to supporting low-income renters by raising the Local Housing Allowance to cover the lower 30% of rents. This move is anticipated to provide financial relief to 1.6 million households, with an average support of £800. This injection of funds is expected to alleviate the burden on vulnerable tenants, offering them increased financial stability in the face of rising living costs.

National Insurance Cuts and Their Impact on Landlords

The reduction in employee National Insurance rates from 12% to 10% is a significant development that will have a tangible impact on the average earner, translating to an annual saving of £450. Simultaneously, self-employed individuals, including landlords with five or more properties, are set to benefit from similar reductions in National Insurance contributions. This move is poised to positively influence the financial landscape for a substantial portion of the property-owning demographic, potentially stimulating further investment in the housing market.

Government Commitment to Housing Development

Recognizing the need for increased housing supply, the government has committed to relaxing planning rules and injecting £110 million into schemes aimed at supporting the construction of 40,000 new homes. This strategic investment signals a concerted effort to address the ongoing housing shortage, with the potential to invigorate the property market by creating more opportunities for buyers and renters alike.

OBR Predictions for House Price Growth and Mortgage Rates

The Office for Budget Responsibility (OBR) has revised its predictions for UK house price growth and mortgage rates. According to their projections, house prices are expected to experience a 4.7% decline in 2024, following a modest 0.9% increase in the current year. These adjustments reflect the complex interplay of various economic factors and underscore the importance of carefully monitoring the evolving landscape of the property market.

The Autumn Statement of 2023 introduces a range of measures designed to impact the property market from multiple angles. From providing support to low-income renters and implementing National Insurance cuts to fostering housing development and revising house price growth predictions, the government's approach reflects a nuanced understanding of the challenges and opportunities within the property sector. As stakeholders navigate these changes, a dynamic and adaptable approach will be essential to capitalize on the evolving landscape of the UK property market.

- Details

- Hits: 290