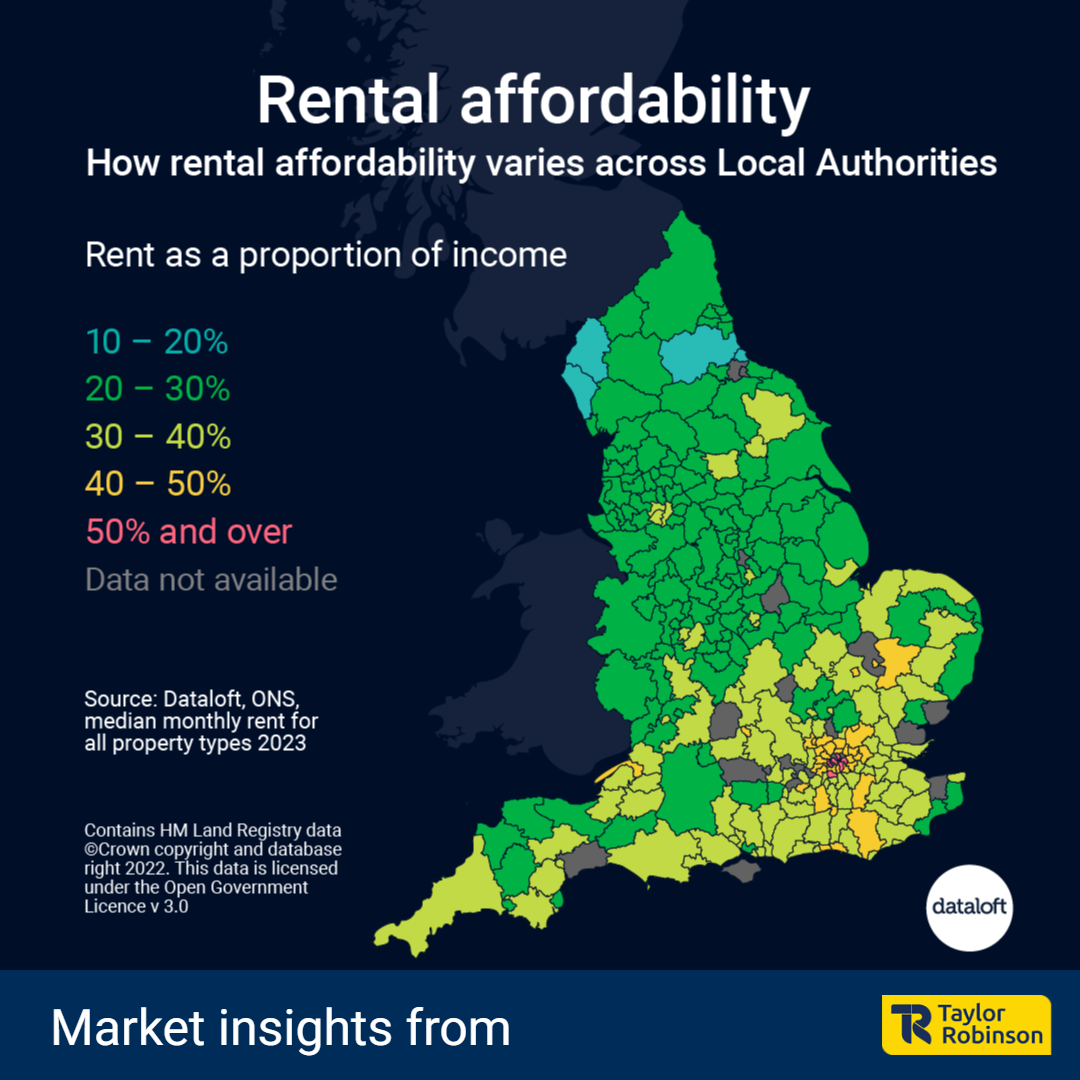

In the intricate landscape of the UK rental market, the southern regions, particularly in the vibrant and bustling South of England, present a unique set of challenges for prospective tenants. Despite the allure of higher earnings, the cost of renting a home in this region requires individuals to allocate a substantial portion of their income to cover living expenses. Understanding the concept of 'rental affordability' serves as a key metric in gauging the pressure within local rental markets, offering valuable insights into the economic dynamics of various areas.

Rental Affordability as an Indicator

Rental affordability is a crucial metric that sheds light on the delicate balance between income and housing costs in any given locality. It is calculated by examining the average rent as a proportion of the average earnings in a specific area, typically measured in Local Authorities. This metric provides a comprehensive view of the financial strain that renting imposes on individuals and families, making it an invaluable tool for assessing the health of a rental market.

The London Conundrum

Nowhere is the impact of rental affordability more pronounced than in the bustling metropolis of London. The city, synonymous with opportunity and prosperity, presents a stark reality for its residents. An average Londoner, earning what is considered an average salary for the capital, must allocate more than 40% of their earnings to cover the average rent. This startling figure underscores the immense pressure on individuals in the capital to balance housing costs with other essential expenses.

Contrastingly, in many other parts of the country, the equivalent proportion hovers between 20% and 30%. This stark contrast highlights the regional disparities in rental affordability and underscores the unique challenges faced by those navigating the rental market in the South of England.

Balancing Act: Earnings versus Expenses

One might assume that higher earnings in the South of England provide a cushion against the soaring costs of rent. Fortunately, for many individuals, the correlation between rising rents and increasing salaries helps to mitigate the financial strain. While rent has seen an upward trajectory, salaries have also experienced growth, providing a degree of relief for tenants in the face of escalating living costs.

Hidden Gems in the Home Counties

Surprisingly, within the home counties, there are pockets where the balance between income and rental costs remains favourable. Areas such as East and North Hertfordshire, Dover, and Folkestone stand out as examples where only 20–30% of incomes are allocated to rent. These locales present an intriguing alternative for those seeking affordable housing options without compromising on their overall financial well-being.

Source: #Dataloft Rental Market Analytics, Information Works, Land Registry

Navigating the rental market in the South of England demands a nuanced understanding of the intricate interplay between earnings and housing costs. As an expert in the field, it is crucial to emphasize the significance of rental affordability as a key indicator of the economic health of local rental markets. By staying informed and exploring hidden gems within the home counties, individuals can make informed decisions that align with their financial goals while securing a place to call home in this dynamic and challenging landscape.