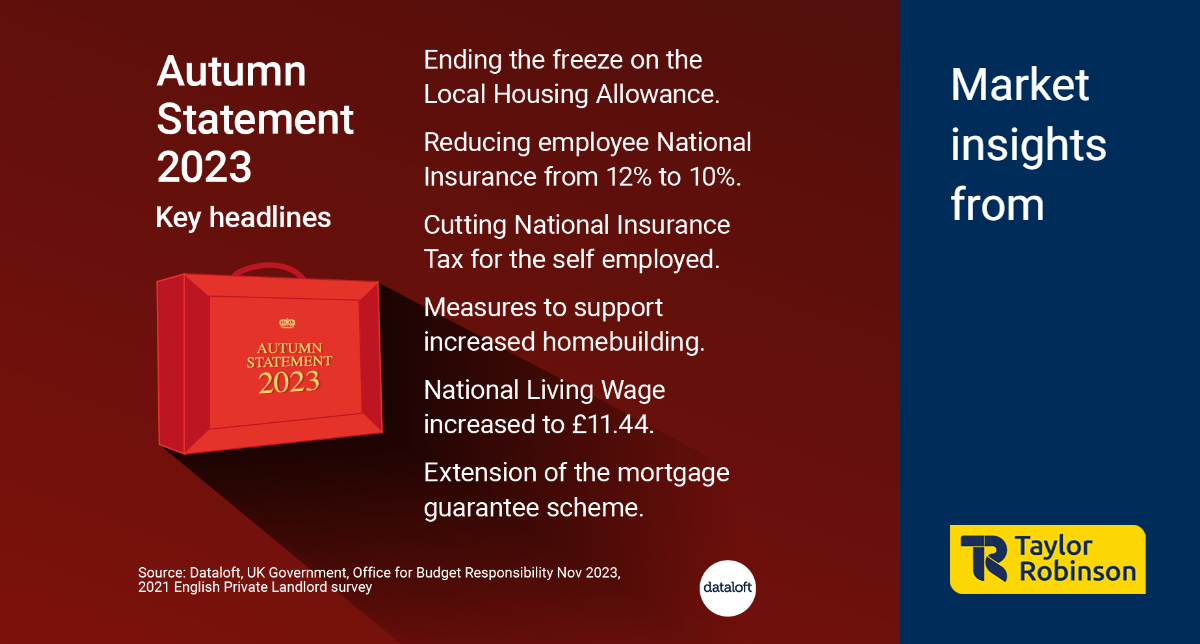

In the recent Autumn Statement, the Chancellor unveiled a series of measures aimed at addressing various facets of the UK economy, with a particular focus on the property market. From bolstering support for low-income renters to implementing changes in National Insurance rates and making significant investments in housing initiatives, the government has outlined a comprehensive strategy with potential implications for both tenants and property owners.

Support for Low-Income Renters

A key highlight of the Autumn Statement is the government's commitment to supporting low-income renters by raising the Local Housing Allowance to cover the lower 30% of rents. This move is anticipated to provide financial relief to 1.6 million households, with an average support of £800. This injection of funds is expected to alleviate the burden on vulnerable tenants, offering them increased financial stability in the face of rising living costs.

National Insurance Cuts and Their Impact on Landlords

The reduction in employee National Insurance rates from 12% to 10% is a significant development that will have a tangible impact on the average earner, translating to an annual saving of £450. Simultaneously, self-employed individuals, including landlords with five or more properties, are set to benefit from similar reductions in National Insurance contributions. This move is poised to positively influence the financial landscape for a substantial portion of the property-owning demographic, potentially stimulating further investment in the housing market.

Government Commitment to Housing Development

Recognizing the need for increased housing supply, the government has committed to relaxing planning rules and injecting £110 million into schemes aimed at supporting the construction of 40,000 new homes. This strategic investment signals a concerted effort to address the ongoing housing shortage, with the potential to invigorate the property market by creating more opportunities for buyers and renters alike.

OBR Predictions for House Price Growth and Mortgage Rates

The Office for Budget Responsibility (OBR) has revised its predictions for UK house price growth and mortgage rates. According to their projections, house prices are expected to experience a 4.7% decline in 2024, following a modest 0.9% increase in the current year. These adjustments reflect the complex interplay of various economic factors and underscore the importance of carefully monitoring the evolving landscape of the property market.

The Autumn Statement of 2023 introduces a range of measures designed to impact the property market from multiple angles. From providing support to low-income renters and implementing National Insurance cuts to fostering housing development and revising house price growth predictions, the government's approach reflects a nuanced understanding of the challenges and opportunities within the property sector. As stakeholders navigate these changes, a dynamic and adaptable approach will be essential to capitalize on the evolving landscape of the UK property market.