Blog

The dynamics of a country's housing market are often viewed as a reflection of its economic health. As the UK grapples with an evolving economic landscape, a close analysis of key economic indicators becomes crucial in gauging the present and future state of the housing market. These indicators offer invaluable insights into the direction of interest rates, inflation, wage growth, employment trends, and broader economic stability. In this context, the UK's housing market stands at a pivotal juncture, shaped by a series of factors that warrant meticulous attention.

Interest Rate Climbs Amidst Inflationary Pressure

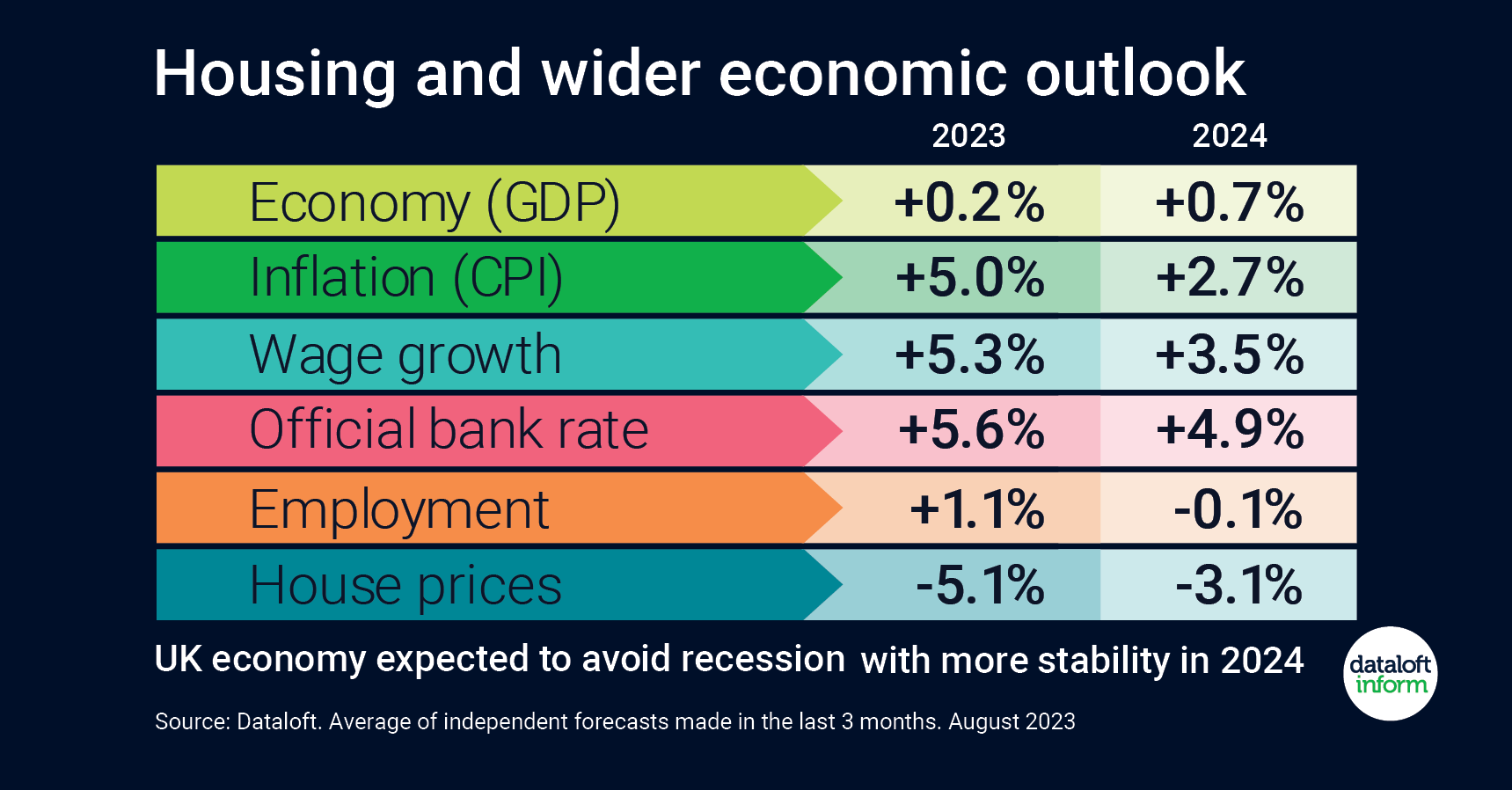

With a sequence of 14 consecutive interest rate hikes, the Bank Base rate in the UK has ascended to 5.25% by August. These deliberate rate increases have been instrumental in combating inflation, a persistent concern in recent times. The latest projections from economic experts suggest that the trajectory of interest rates is poised to peak before the close of the year. This upward journey in interest rates has demonstrated its efficacy in reining in inflationary pressures, underlining the central bank's commitment to maintaining economic stability.

Inflation and Wage Growth's Intricate Dance

Amidst this backdrop of interest rate adjustments, the UK's inflation trajectory warrants careful observation. While the target inflation rate stands at 2%, current projections anticipate that inflation will persistently exceed this benchmark. This phenomenon underscores the multifaceted interplay between inflation and wage growth. The latter remains robust, supporting consumer spending and reinforcing the broader economic fabric. As long as wage growth remains elevated and employment figures continue their upward trend, the delicate balance between these factors will significantly influence the housing market's course.

Anticipating Stability and Policy Shifts

As the calendar inches closer to 2024, a sense of stability emerges in the economic outlook. Despite the preceding uncertainties, projections now point towards the UK economy steering clear of a recession. This promising shift bodes well for various sectors, including the housing market. However, on a national scale, expectations point towards a potential decline in house prices. The impending electoral horizon introduces an intriguing variable, as the anticipation of an election tends to galvanize policy shifts. Particularly noteworthy are the projected policy incentives aimed at first-time homebuyers. These incentives could potentially inject new dynamics into the housing market, reshaping demand and supply dynamics.

Sourcing Insights: #Dataloft and Independent Forecasts

The insights discussed here draw heavily from reputable sources, particularly #Dataloft. These insights are distilled from an average of independent forecasts made within the past three months, capturing the zeitgeist of economic sentiment as of August 2023. The reliance on such data-driven insights underscores the importance of staying current with trends and projections to make informed decisions in a dynamic economic environment.

Navigating the Path Forward

In an era marked by economic turbulence and uncertainty, the UK's housing market reflects the intricate dance between economic indicators and policy shifts. The relentless rise in interest rates has successfully tamed inflation, while the delicate interplay between wage growth and employment trends drives consumer spending. As 2024 beckons, a panorama of relative stability emerges, accompanied by a potential correction in house prices. The imminent election introduces a fresh layer of complexity, promising policy incentives that could potentially reshape the housing market's trajectory.

In essence, monitoring the economic indicators is akin to gazing into a crystal ball for the housing market's future. As investors, policymakers, and individuals seeking shelter navigate these dynamic waters, a keen eye on these indicators will be essential in making informed decisions amidst the ebb and flow of the UK's economic landscape.

- Details

- Hits: 423

In the wake of the global pandemic, our lives have undergone significant transformations, reshaping the way we work, socialize, and find solace. One of the most profound changes has been a newfound appreciation for gardens and private outdoor spaces. Whether as sanctuaries for relaxation or extensions of our living spaces, gardens have experienced a surge in demand since the pandemic began. Contrary to the popular belief that new build homes come with tiny gardens, evidence indicates that homebuilders have taken heed of this trend and have been increasingly expanding the size of gardens. This article delves into the growing significance of gardens and outdoor spaces, highlighting how they have become a vital component of modern living.

The Growing Importance of Gardens

As people spent more time at home during the pandemic, they turned to their gardens as an escape from the confines of indoor living. The healing power of nature, fresh air, and sunlight became apparent as we sought solace in our outdoor spaces. Gardens offered a respite from the stress and uncertainty of the outside world, providing an opportunity for relaxation, exercise, and mental rejuvenation.

Furthermore, with the advent of remote work and the desire for flexible working environments, gardens became a haven for creativity and productivity. Many individuals transformed their gardens into home offices or creative spaces, blurring the boundaries between indoor and outdoor living. Garden offices provided a tranquil setting for work, free from distractions and offering a healthier work-life balance.

The Rise of Larger Gardens in New Build Homes

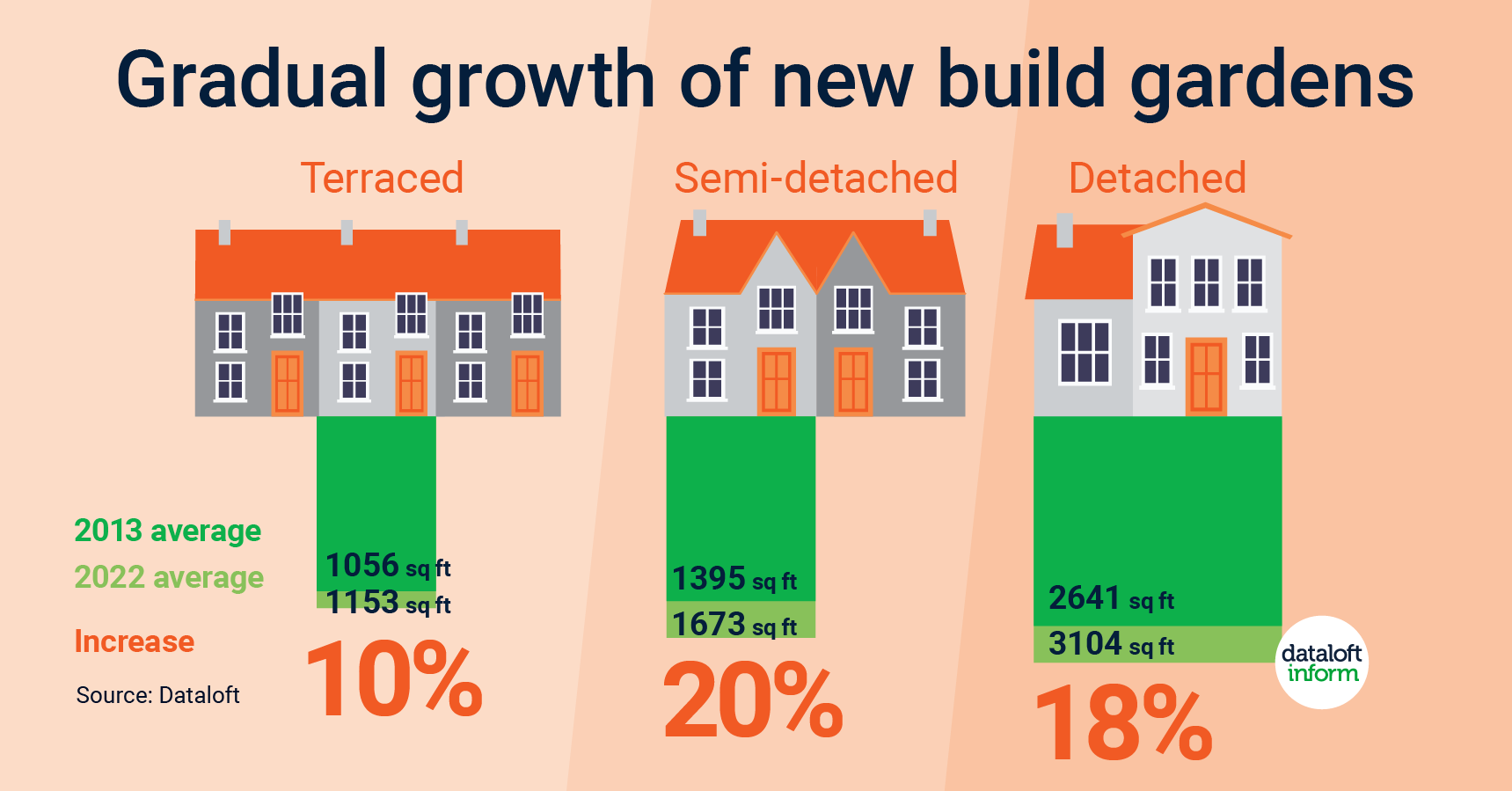

Traditionally, new build homes were associated with small gardens due to space constraints and the need to accommodate higher housing densities. However, the demand for larger outdoor spaces has led to a shift in this trend. Since 2020, homebuilders have acknowledged the changing needs of homeowners and have been gradually expanding the size of gardens in new build properties.

According to recent data from #Dataloft 2023, gardens of new build detached homes are now 18% larger compared to ten years ago. Semi-detached homes have seen a 20% increase in garden size, while terraced houses boast gardens that are 10% larger. This change reflects a conscious effort by developers to align their offerings with the shifting preferences of potential buyers.

Embracing Garden Rooms and Outdoor Living

As the demand for private outdoor spaces has soared, so too has the interest in garden rooms and outdoor entertaining areas. People are now looking to optimize their gardens for both relaxation and social gatherings, seeking to extend their living spaces beyond the confines of their homes.

The number of Google searches for 'garden rooms' has risen by an impressive 27% since 2019, indicating a growing desire to create dedicated spaces for various activities in the garden. These garden rooms can serve as home offices, art studios, yoga spaces, or even just a cozy retreat to read and unwind.

Moreover, the surge in Google searches for 'house for sale garden' by 47% highlights the increasing preference for properties that offer ample outdoor space. Homebuyers are actively seeking homes with larger gardens to cater to their evolving lifestyles and enjoy the many benefits that come with private outdoor areas.

The pandemic has brought about a profound transformation in the way we perceive and utilize our homes and outdoor spaces. Gardens and private outdoor areas have emerged as essential components of modern living, providing refuge, relaxation, and an extension of our homes. Homebuilders have been quick to respond to the changing zeitgeist, expanding the size of gardens in new build properties to cater to the growing demand.

As we continue to embrace the value of nature and the importance of spending time outdoors, gardens will remain a focal point in our residential preferences. The increased interest in garden rooms and outdoor living spaces indicates a desire to integrate nature seamlessly into our everyday lives.

In this post-pandemic era, the importance of gardens as personal sanctuaries and versatile extensions of our homes cannot be understated. As society evolves, so too will the way we interact with our living spaces, making gardens an integral part of the contemporary living experience.

- Details

- Hits: 495

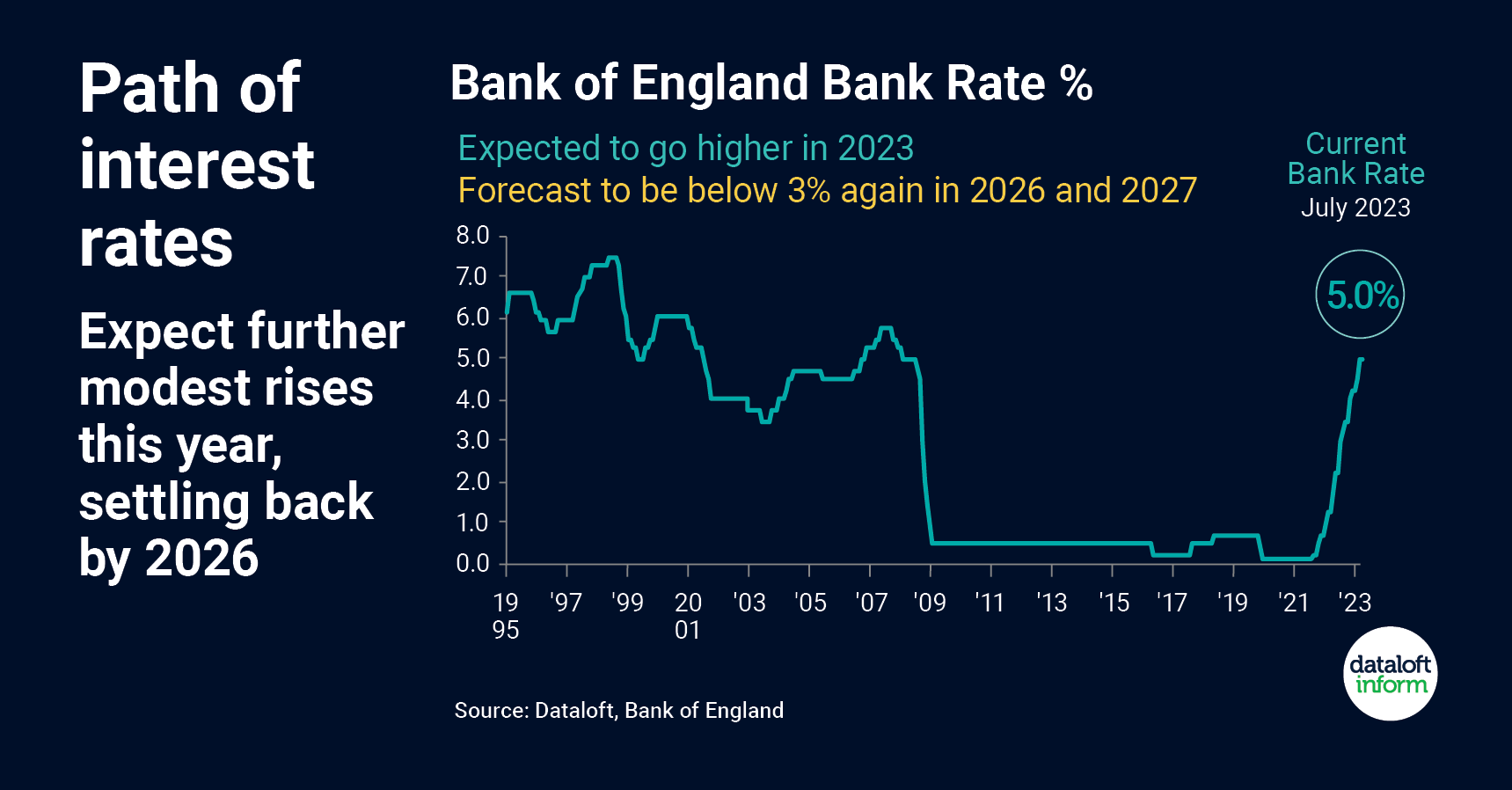

In recent times, borrowers have been grappling with the uncertainty surrounding the rapid increase in interest rates. As of now, the Bank Rate stands at 5%, leaving many wondering where this upward trajectory will end. Experts predict further interest rate hikes in the short term, with an average consensus forecast of 5.6% by the end of this year. However, there is some hope for the long term, as projections indicate a potential decline below 3% again in 2026 and 2027. The steepness of this increase has been likened to the sharp drop observed during the Global Financial Crisis, but promising inflation data from June could offer some glimmers of hope. In this blog post, we'll delve into the current state of interest rates, the potential future scenarios, and how borrowers can navigate this uncertain financial landscape.

The Current Interest Rate Landscape

With the Bank Rate at 5%, borrowers have been grappling with higher borrowing costs across various financial products. Mortgages, personal loans, and credit card rates have all been affected, making it difficult for many to manage their debts. As interest rates rise, it becomes more challenging for borrowers to service their loans and manage their monthly repayments effectively.

Short-Term Projections

Unfortunately, the near future doesn't promise much relief for borrowers. Economists and financial experts predict that interest rates are likely to rise further in the short term. The consensus forecast of an average 5.6% by the end of this year could put added strain on borrowers, leading to reduced spending power and potentially slower economic growth.

Long-Term Outlook

Despite the gloomy short-term projections, the long-term outlook offers a glimmer of hope. Forecasts suggest that the Bank Rate may eventually come down, potentially falling below 3% again by 2026 and 2027. This decline could bring some relief to borrowers burdened by high-interest rates. However, it is essential to remember that these projections are subject to change, depending on various economic factors and policy decisions.

Comparison to the Global Financial Crisis

The sharp increase in interest rates has drawn comparisons to the Global Financial Crisis, a period of economic turmoil that began in 2008. During that crisis, interest rates saw a drastic drop as central banks implemented measures to stimulate the economy. Now, the steepness of the current interest rate rise is reminiscent of that decline, but the context is different. Rather than stimulating a faltering economy, these rate hikes are an attempt to counteract inflation and manage the potential risk of overheating economies.

Inflation Data and its Impact

In June, there was tentative evidence of improving inflation data, which could play a vital role in shaping the long-term interest rate outlook. As inflation is a key determinant of interest rate decisions, any signs of inflation moderating could potentially alleviate the need for more aggressive rate increases in the future. However, inflation is a complex phenomenon influenced by numerous factors, and policymakers will closely monitor its trajectory before making significant interest rate decisions.

Navigating the Uncertainty

For borrowers, the current interest rate environment demands careful financial planning and risk management. Here are some tips to help navigate this uncertain landscape:

Refinancing: Consider refinancing existing loans to take advantage of lower rates or to lock in more favourable terms.

Budgeting: Create a comprehensive budget to track income and expenses. Ensure that you have enough room in your budget to accommodate potential interest rate increases.

Fixed vs. Variable Rates: Understand the pros and cons of fixed-rate and variable-rate loans, and choose the one that best suits your financial situation and risk tolerance.

Emergency Fund: Build or bolster your emergency fund to cushion any financial shocks that may arise from fluctuating interest rates or unexpected events.

Seek Professional Advice: Consult with financial advisors or experts who can provide personalized guidance based on your specific financial circumstances.

The recent rapid rise in interest rates has left borrowers on edge, wondering about the future trajectory of rates and how it will impact their financial well-being. While short-term forecasts predict further increases, the long-term outlook shows some potential for relief. In the meantime, borrowers must exercise caution, plan prudently, and consider professional advice to navigate this uncertain interest rate landscape effectively. Staying informed about economic indicators like inflation data will be crucial in understanding the potential direction of interest rates. Remember, financial prudence and a well-thought-out strategy will be key to weathering these challenging times.

- Details

- Hits: 493

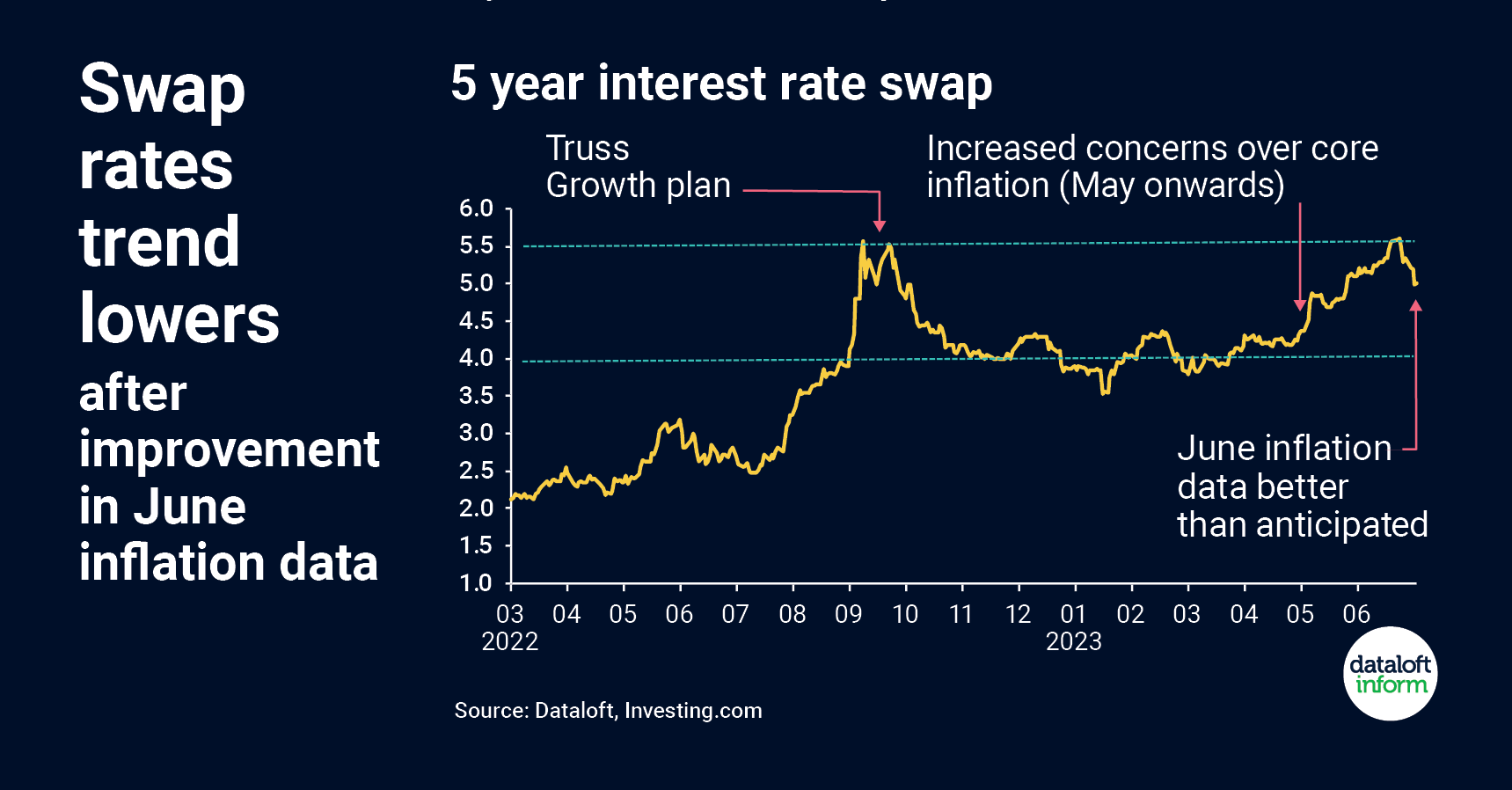

Swap rates are essential tools for predicting changes in mortgage costs, serving as indicators of borrowing costs for lenders. Throughout the first half of the year, the 5-year swap rates had stabilized around 4%. However, starting in May, these rates showed an upward trend, peaking at 5.5%, largely due to mounting concerns over core inflation. Fortunately, recent data released on July 19th brought some relief, as June's inflation figures came in better than expected. This positive news on inflation subsequently translated into lower interest rates on 5-year swaps, falling back below 5%. While data volatility remains a possibility in the coming months, this initial shift in swap rates suggests that inflation may be starting to ease.

Understanding Swap Rates and their Significance

Swap rates are critical indicators of market sentiment and economic outlook. They represent the fixed interest rates at which financial institutions exchange future cash flows with each other. Specifically, the 5-year swap rate reflects the cost of borrowing for lenders over a five-year period. As a result, these rates offer valuable insights into potential changes in mortgage costs.

Trends in 5-Year Swap Rates

For the first half of the year, the 5-year swap rates remained relatively steady at approximately 4%. This stability provided some comfort to market participants, giving the impression that borrowing costs for lenders would remain manageable.

However, starting from May, the market witnessed a gradual increase in the 5-year swap rates. Climbing as high as 5.5%, this surge was primarily fuelled by concerns surrounding core inflation. As inflation rates appeared to be rising, investors and lenders became cautious, pushing the swap rates higher in response to the perceived increased risk.

Inflation Concerns and Their Impact on Swap Rates

Inflation, as measured by both headline and core inflation figures, has a significant influence on swap rates. Headline inflation includes all consumer goods and services, while core inflation excludes volatile elements like food and energy prices. High inflation can erode purchasing power and lead to a decrease in the value of money, prompting lenders to adjust their interest rates to account for the risk.

On July 19th, the release of inflation data provided some relief to the growing concern over rising inflation rates. The June inflation figures showed a headline inflation rate of 7.3% and a core inflation rate of 6.4%. The figures were better than expected, leading market participants to believe that inflation might be under control, albeit still at elevated levels.

Impact of Inflation News on Swap Rates

The positive inflation news had a direct impact on the 5-year swap rates, causing them to dip back below 5%. This decrease in the swap rates implied that lenders perceived a reduced risk of inflation getting out of hand, prompting a slight easing in borrowing costs.

Future Outlook and Data Volatility

While the recent dip in 5-year swap rates is encouraging, it is essential to approach the data with caution. Economic data, including inflation figures, can be subject to volatility and revisions over the next few months. Various factors, such as supply chain disruptions, geopolitical tensions, or changes in central bank policies, can still influence inflationary pressures.

Swap rates serve as valuable tools to gauge potential changes in mortgage costs, reflecting the cost of borrowing for lenders. The 5-year swap rates experienced a period of stability before trending upward due to concerns over core inflation. However, the release of better-than-expected inflation data provided some relief, leading to a slight easing in 5-year swap rates. While this initial shift indicates that inflation may be starting to come down, it is crucial to remain vigilant as data volatility remains a possibility in the coming months. Investors and market participants should continue to closely monitor economic indicators to better assess the future trajectory of swap rates and its implications for mortgage costs. (Source: #Dataloft, Investing.com)

- Details

- Hits: 514

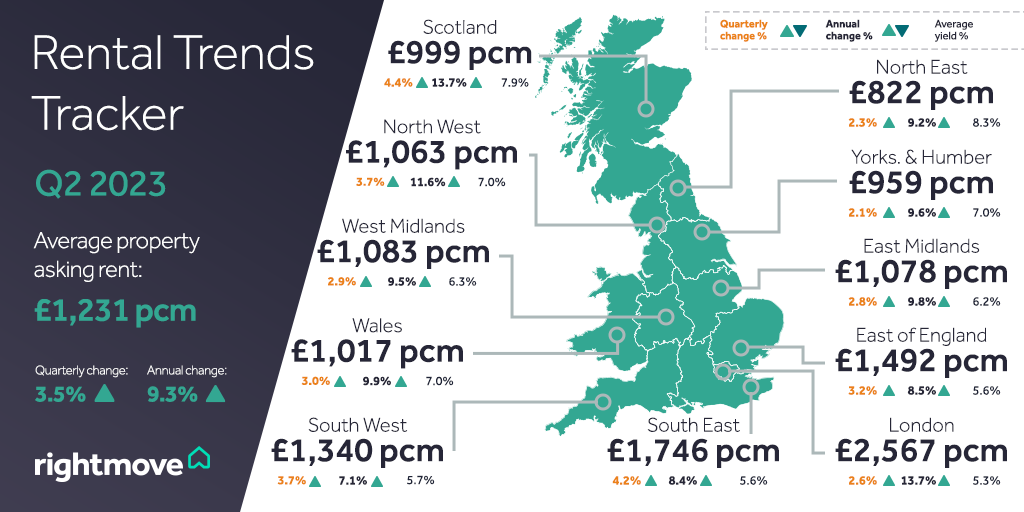

As the world emerges from the shadows of the pandemic, the housing market has been experiencing a remarkable transformation. Across the United Kingdom, national average asking rents outside of London have surged to an unprecedented level, reaching £1,231 per calendar month (pcm). This astonishing figure is over £300 (33%) higher than pre-pandemic levels in 2019, indicating a strong recovery and increasing demand for rental properties. This article delves into the factors behind this surge, the changing dynamics of the rental market, and the challenges faced by landlords in the midst of these developments.

Record-Breaking Average Asking Rents

The rental market has witnessed an impressive upswing, with average asking rents for new tenants experiencing remarkable growth. This surge is evident in both London and other regions of the country. In the capital, average asking rents have hit an all-time high of £2,567 pcm. This record-breaking figure reflects the increased demand for rental properties in the bustling city despite the challenging economic conditions posed by the pandemic.

Pace of Rent Growth and Current Trends

Although the annual pace of rent growth has slowed slightly, it remains near double-digits, showcasing the resilience and stability of the rental market. Interestingly, despite the uncertainties and fluctuations experienced throughout the pandemic, homes are now being let at an astonishing speed. The current time to find a tenant stands at just 17 days, the quickest since the previous November. This is a remarkable feat, considering the slight easing in the gap between demand and supply.

Tenant Demand and Available Properties

Tenant demand has demonstrated notable growth, increasing by 3% compared to the previous year. However, this positive trend is met with an equally significant increase in available properties to rent, up by 7%. This delicate balance between demand and supply is one of the contributing factors to the rental market's sustained growth and competitiveness. It allows for a wider range of options for tenants while ensuring properties are filled swiftly, keeping vacancy rates at bay.

Challenges Faced by Landlords

Despite the overall optimism in the rental market, landlords face a unique set of challenges. The prevailing government sentiment towards the industry is a significant concern for 48% of landlords, as changes in regulations and policies can impact the profitability and stability of their investments. Rising taxation is another worry, with 41% expressing concern about the financial implications it may have on their rental business. Additionally, increasing compliance requirements, which are becoming more stringent, are a worry for 33% of landlords.

Market Response: Selling vs. Retaining Properties

As a response to the current market landscape, some landlords have chosen to sell their rental properties. This trend is partly influenced by market challenges, but it is also a strategic decision in light of the increased property values. According to recent data, 16% of properties for sale were previously on the rental market, a noticeable increase from 13% recorded in January 2019. On the other hand, a significant majority (57%) of landlords are opting to keep good tenants in their properties for longer than 24 months, establishing stable and long-term rental relationships.

The rental market's astonishing recovery post-pandemic has resulted in a new record for average asking rents, reaching heights 33% higher than the pre-pandemic era. While the annual pace of rent growth is showing slight deceleration, the overall momentum remains strong, with homes letting at impressive speed. Despite the challenges faced by landlords, many remain committed to providing quality rental housing and maintaining stable tenancy relationships. The rental market's resilience and growth highlight its importance in the broader housing sector, providing a reliable and flexible option for both landlords and tenants alike.

Source: Rightmove.co.uk

- Details

- Hits: 480