The dynamics of a country's housing market are often viewed as a reflection of its economic health. As the UK grapples with an evolving economic landscape, a close analysis of key economic indicators becomes crucial in gauging the present and future state of the housing market. These indicators offer invaluable insights into the direction of interest rates, inflation, wage growth, employment trends, and broader economic stability. In this context, the UK's housing market stands at a pivotal juncture, shaped by a series of factors that warrant meticulous attention.

Interest Rate Climbs Amidst Inflationary Pressure

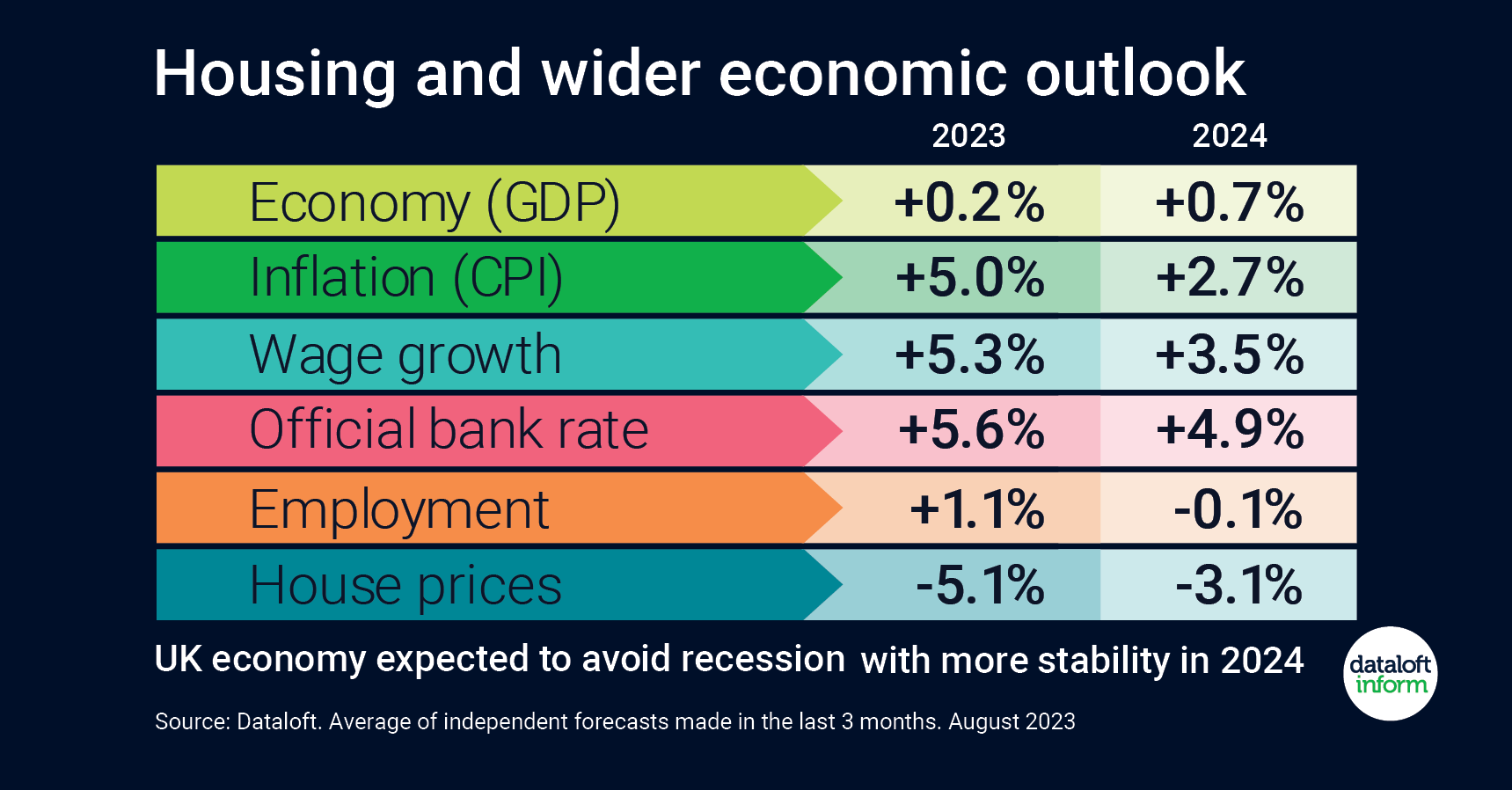

With a sequence of 14 consecutive interest rate hikes, the Bank Base rate in the UK has ascended to 5.25% by August. These deliberate rate increases have been instrumental in combating inflation, a persistent concern in recent times. The latest projections from economic experts suggest that the trajectory of interest rates is poised to peak before the close of the year. This upward journey in interest rates has demonstrated its efficacy in reining in inflationary pressures, underlining the central bank's commitment to maintaining economic stability.

Inflation and Wage Growth's Intricate Dance

Amidst this backdrop of interest rate adjustments, the UK's inflation trajectory warrants careful observation. While the target inflation rate stands at 2%, current projections anticipate that inflation will persistently exceed this benchmark. This phenomenon underscores the multifaceted interplay between inflation and wage growth. The latter remains robust, supporting consumer spending and reinforcing the broader economic fabric. As long as wage growth remains elevated and employment figures continue their upward trend, the delicate balance between these factors will significantly influence the housing market's course.

Anticipating Stability and Policy Shifts

As the calendar inches closer to 2024, a sense of stability emerges in the economic outlook. Despite the preceding uncertainties, projections now point towards the UK economy steering clear of a recession. This promising shift bodes well for various sectors, including the housing market. However, on a national scale, expectations point towards a potential decline in house prices. The impending electoral horizon introduces an intriguing variable, as the anticipation of an election tends to galvanize policy shifts. Particularly noteworthy are the projected policy incentives aimed at first-time homebuyers. These incentives could potentially inject new dynamics into the housing market, reshaping demand and supply dynamics.

Sourcing Insights: #Dataloft and Independent Forecasts

The insights discussed here draw heavily from reputable sources, particularly #Dataloft. These insights are distilled from an average of independent forecasts made within the past three months, capturing the zeitgeist of economic sentiment as of August 2023. The reliance on such data-driven insights underscores the importance of staying current with trends and projections to make informed decisions in a dynamic economic environment.

Navigating the Path Forward

In an era marked by economic turbulence and uncertainty, the UK's housing market reflects the intricate dance between economic indicators and policy shifts. The relentless rise in interest rates has successfully tamed inflation, while the delicate interplay between wage growth and employment trends drives consumer spending. As 2024 beckons, a panorama of relative stability emerges, accompanied by a potential correction in house prices. The imminent election introduces a fresh layer of complexity, promising policy incentives that could potentially reshape the housing market's trajectory.

In essence, monitoring the economic indicators is akin to gazing into a crystal ball for the housing market's future. As investors, policymakers, and individuals seeking shelter navigate these dynamic waters, a keen eye on these indicators will be essential in making informed decisions amidst the ebb and flow of the UK's economic landscape.