As the world emerges from the shadows of the pandemic, the housing market has been experiencing a remarkable transformation. Across the United Kingdom, national average asking rents outside of London have surged to an unprecedented level, reaching £1,231 per calendar month (pcm). This astonishing figure is over £300 (33%) higher than pre-pandemic levels in 2019, indicating a strong recovery and increasing demand for rental properties. This article delves into the factors behind this surge, the changing dynamics of the rental market, and the challenges faced by landlords in the midst of these developments.

Record-Breaking Average Asking Rents

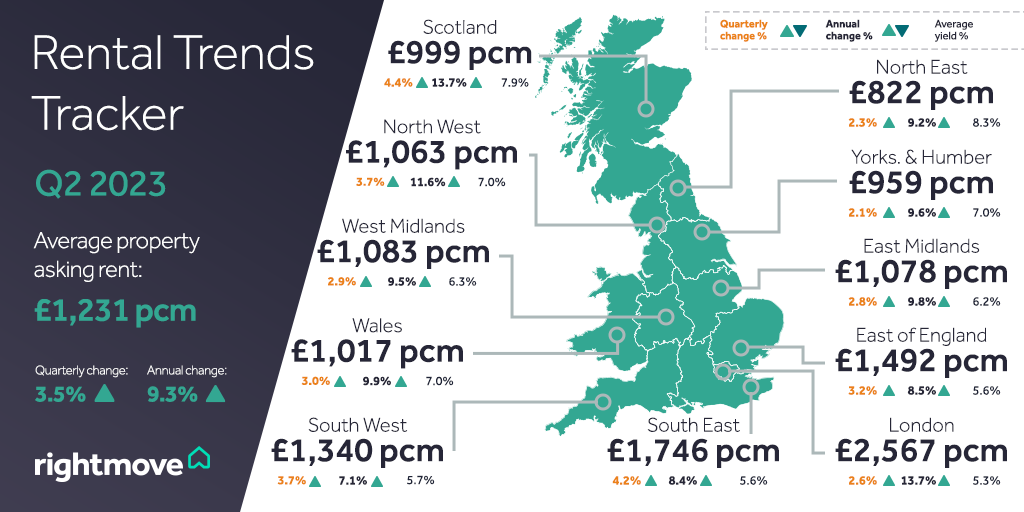

The rental market has witnessed an impressive upswing, with average asking rents for new tenants experiencing remarkable growth. This surge is evident in both London and other regions of the country. In the capital, average asking rents have hit an all-time high of £2,567 pcm. This record-breaking figure reflects the increased demand for rental properties in the bustling city despite the challenging economic conditions posed by the pandemic.

Pace of Rent Growth and Current Trends

Although the annual pace of rent growth has slowed slightly, it remains near double-digits, showcasing the resilience and stability of the rental market. Interestingly, despite the uncertainties and fluctuations experienced throughout the pandemic, homes are now being let at an astonishing speed. The current time to find a tenant stands at just 17 days, the quickest since the previous November. This is a remarkable feat, considering the slight easing in the gap between demand and supply.

Tenant Demand and Available Properties

Tenant demand has demonstrated notable growth, increasing by 3% compared to the previous year. However, this positive trend is met with an equally significant increase in available properties to rent, up by 7%. This delicate balance between demand and supply is one of the contributing factors to the rental market's sustained growth and competitiveness. It allows for a wider range of options for tenants while ensuring properties are filled swiftly, keeping vacancy rates at bay.

Challenges Faced by Landlords

Despite the overall optimism in the rental market, landlords face a unique set of challenges. The prevailing government sentiment towards the industry is a significant concern for 48% of landlords, as changes in regulations and policies can impact the profitability and stability of their investments. Rising taxation is another worry, with 41% expressing concern about the financial implications it may have on their rental business. Additionally, increasing compliance requirements, which are becoming more stringent, are a worry for 33% of landlords.

Market Response: Selling vs. Retaining Properties

As a response to the current market landscape, some landlords have chosen to sell their rental properties. This trend is partly influenced by market challenges, but it is also a strategic decision in light of the increased property values. According to recent data, 16% of properties for sale were previously on the rental market, a noticeable increase from 13% recorded in January 2019. On the other hand, a significant majority (57%) of landlords are opting to keep good tenants in their properties for longer than 24 months, establishing stable and long-term rental relationships.

The rental market's astonishing recovery post-pandemic has resulted in a new record for average asking rents, reaching heights 33% higher than the pre-pandemic era. While the annual pace of rent growth is showing slight deceleration, the overall momentum remains strong, with homes letting at impressive speed. Despite the challenges faced by landlords, many remain committed to providing quality rental housing and maintaining stable tenancy relationships. The rental market's resilience and growth highlight its importance in the broader housing sector, providing a reliable and flexible option for both landlords and tenants alike.

Source: Rightmove.co.uk