Blog

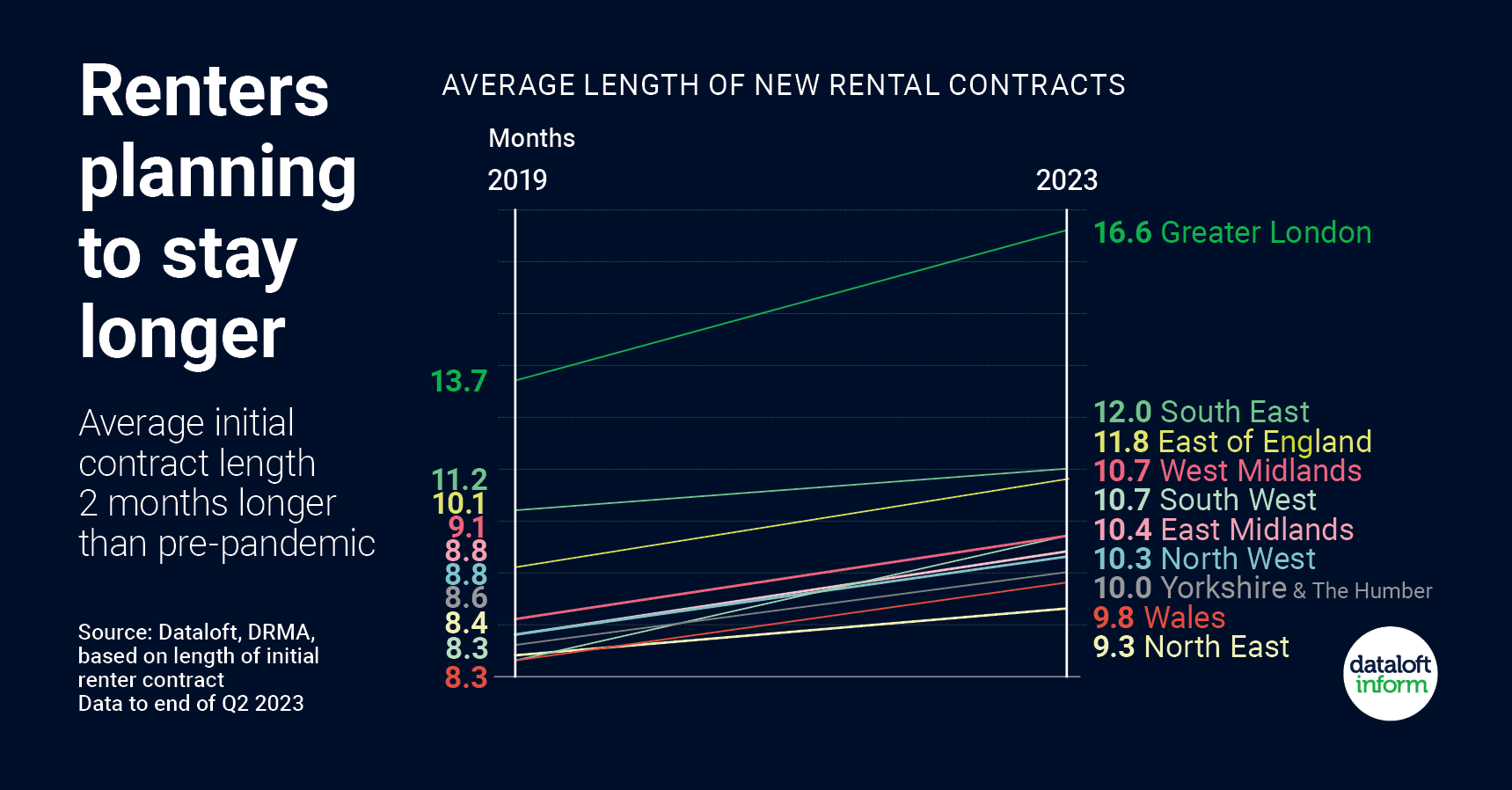

The rental market in Crawley, like many other regions across the UK, has witnessed a notable trend in recent years: tenants are opting for longer rental terms, seeking stability amidst low housing stock and rising rents. At Taylor Robinson we have observed this shift firsthand. Our analysis of the rental market data for the second quarter of 2023 reveals that the average initial rental contract term in England has increased to 12.7 months, up from 10.5 months during the same period in 2019. This article explores the factors contributing to this trend and highlights how it reflects the broader challenges in the housing market.

The Appeal of Longer Rental Terms:

In the face of limited housing stock and escalating rents, tenants are adopting a more cautious approach when it comes to securing a rental property. By opting for longer rental terms, they seek to avoid the uncertainties associated with frequent moves and the prospect of searching for a new property in a competitive market. Longer tenancies provide tenants with a sense of stability and allow them to establish a greater sense of community within their neighbourhoods.

Crawley's Rental Market Landscape:

While the extended rental term trend is evident nationwide, it is particularly pronounced in London, where tenants face intense competition for available properties. However, even in Crawley, a thriving town in West Sussex, we have witnessed a significant increase in the average initial rental contract term. This indicates that renters in Crawley are also prioritizing stability and continuity.

Factors Influencing Longer Rental Terms:

Limited housing stock: The scarcity of available properties in Crawley has created a highly competitive rental market. With fewer options to choose from, tenants are inclined to secure longer rental contracts to ensure they have a place to call home for an extended period.

Rising rents: The continuous rise in rental prices has made it challenging for tenants to find affordable options. Longer rental terms offer tenants a degree of protection against potential rent increases during their contracted period, allowing them to better plan their finances.

The Renters (Reform) Bill and Open-Ended Tenancies:

In the midst of this evolving rental landscape, the proposed Renters (Reform) Bill stands as a significant development. One of the key proposals in the bill is the introduction of open-ended tenancies, which would replace fixed-term Assured Shorthold Tenancies (ASTs). This change would grant tenants greater flexibility by eliminating the need for contract renewals.

The shift towards longer rental terms in Crawley, as observed by Taylor Robinson Lettings, is indicative of a broader trend in the UK's rental market. Tenants are seeking stability and security amidst the challenges of limited housing stock and rising rents. By opting for longer initial rental contracts, tenants aim to secure a sense of continuity and avoid the uncertainties of frequent moves. The proposed Renters (Reform) Bill, with its focus on open-ended tenancies, further reflects the evolving needs and expectations of renters. As the rental market continues to evolve, property management agencies and landlords will need to adapt their strategies to cater to the changing demands of tenants in pursuit of a stable and secure rental experience.

- Details

- Hits: 500

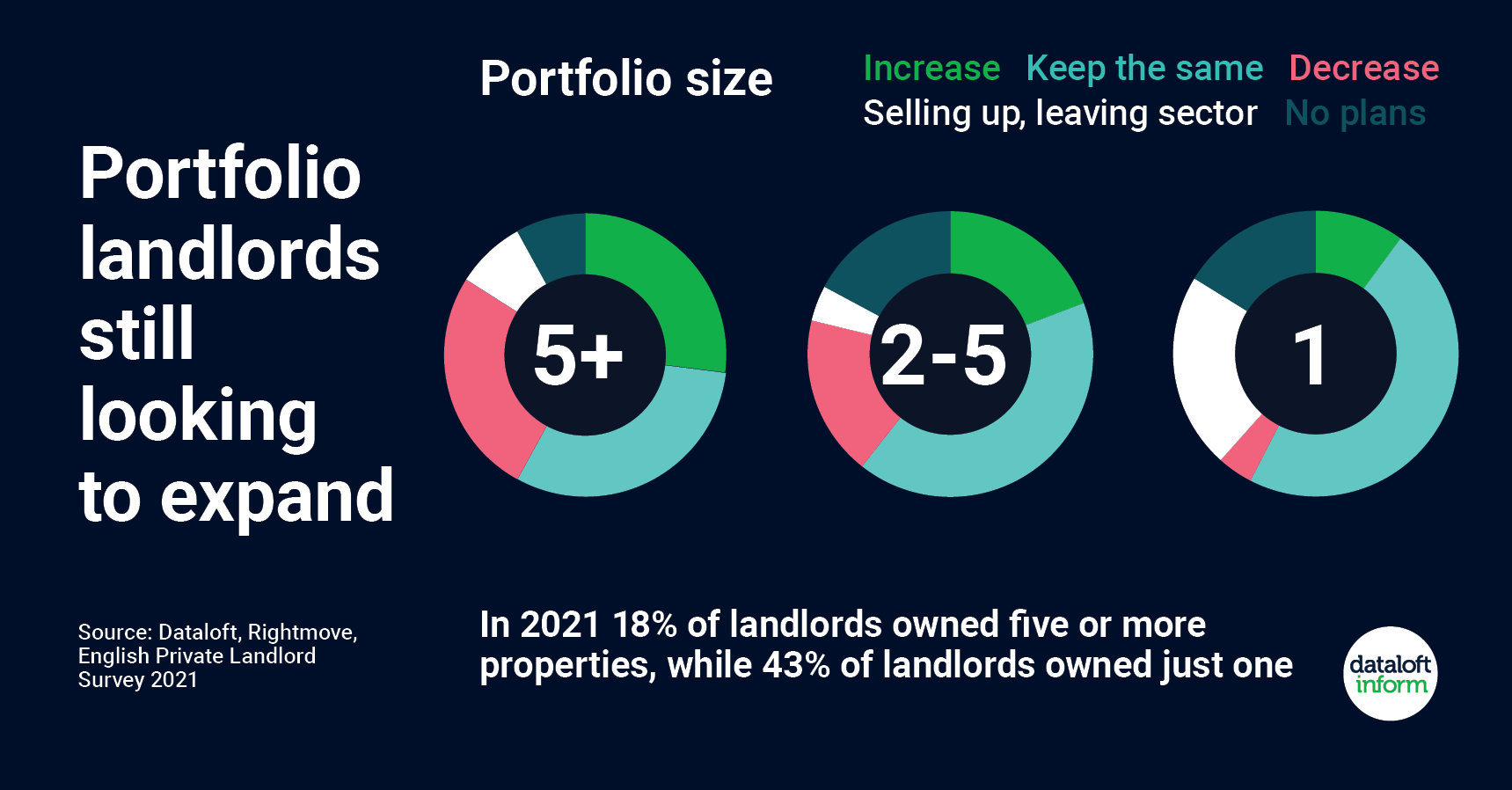

The property market in Crawley, West Sussex, is set to experience a positive boost as more than a quarter of landlords who own five or more properties have expressed their intentions to expand their portfolios in the coming year. Additionally, one in five landlords with 2–5 properties are also planning to increase their holdings. This surge in portfolio expansion reflects a promising outlook for the local market. Moreover, over half of landlords aim to maintain or grow the number of properties they own, signifying a stable and confident environment for property investment. This article explores the potential benefits of this trend for the Crawley market.

Growth in Portfolio Expansion:

According to a report by Rightmove, more than 25% of landlords who currently own five or more properties are actively planning to expand their portfolios in the near future. This figure suggests a positive sentiment among established landlords in the Crawley area. Furthermore, the report indicates that one in five landlords with 2–5 properties are also seeking to grow their portfolios, highlighting a diverse range of investors aiming to capitalize on the market's potential.

Stability and Consistency:

The English Private Landlord Survey 2021, published in 2022, revealed that 48% of all tenancies were attributed to landlords who owned five or more properties, despite constituting only 18% of all landlords. This data underscores the stability and reliability that these experienced landlords bring to the market. By actively maintaining or expanding their portfolios, they contribute to a consistent supply of rental properties in England and the Crawley area. This stability benefits both tenants and the local market, ensuring a reliable and diverse range of housing options.

Positive Financing Conditions:

A Property Academy survey, which encompassed close to 6,000 landlords, uncovered a positive financial outlook for landlords. Over three-quarters of the respondents reported owing less than half the value of their portfolio on their buy-to-let mortgages. This low loan-to-value ratio indicates that landlords in the area are less impacted by market volatility and economic fluctuations. Such favourable financing conditions provide landlords with a sense of security and encourage further investment, stimulating the local market.

Economic Impact:

The increased portfolio expansion by landlords in Crawley is poised to have a positive impact on the local economy. As more properties are acquired or developed, it creates opportunities for construction, renovation, and property management businesses, generating employment and contributing to economic growth. Additionally, a vibrant rental market attracts tenants and professionals to the area, leading to increased spending in local businesses and enhancing the overall economic vitality of Crawley.

Improved Housing Supply:

The expansion of landlord portfolios will directly address the growing demand for rental properties in Crawley. With a greater number of available properties, tenants benefit from increased choices and improved affordability. As the market expands, landlords can cater to a wider range of housing needs, from single professionals to families, thereby contributing to a diverse and inclusive community.

The increasing number of landlords planning to expand their portfolios in Crawley, West Sussex, presents an optimistic outlook for the local market. This trend not only ensures stability and reliability but also stimulates economic growth and improves housing supply. The positive financing conditions and the diverse range of investors actively participating in the market further reinforce the promising future of Crawley's real estate sector. As portfolio expansion continues, the area is likely to witness continued growth and prosperity in the coming years.

- Details

- Hits: 420

The prestigious Wimbledon Championship, the oldest tennis tournament in the world, is currently in full swing. As the world's top tennis players compete for glory on the grass courts of the All England Club, fans and spectators are indulging in the quintessential Wimbledon experience. With around 800 players, 679 matches, and over half a million spectators expected to attend, this year's championship promises to be a grand spectacle that captivates fans around the globe. The tournament, which commenced on June 26th, is set to conclude on Sunday, July 16th.

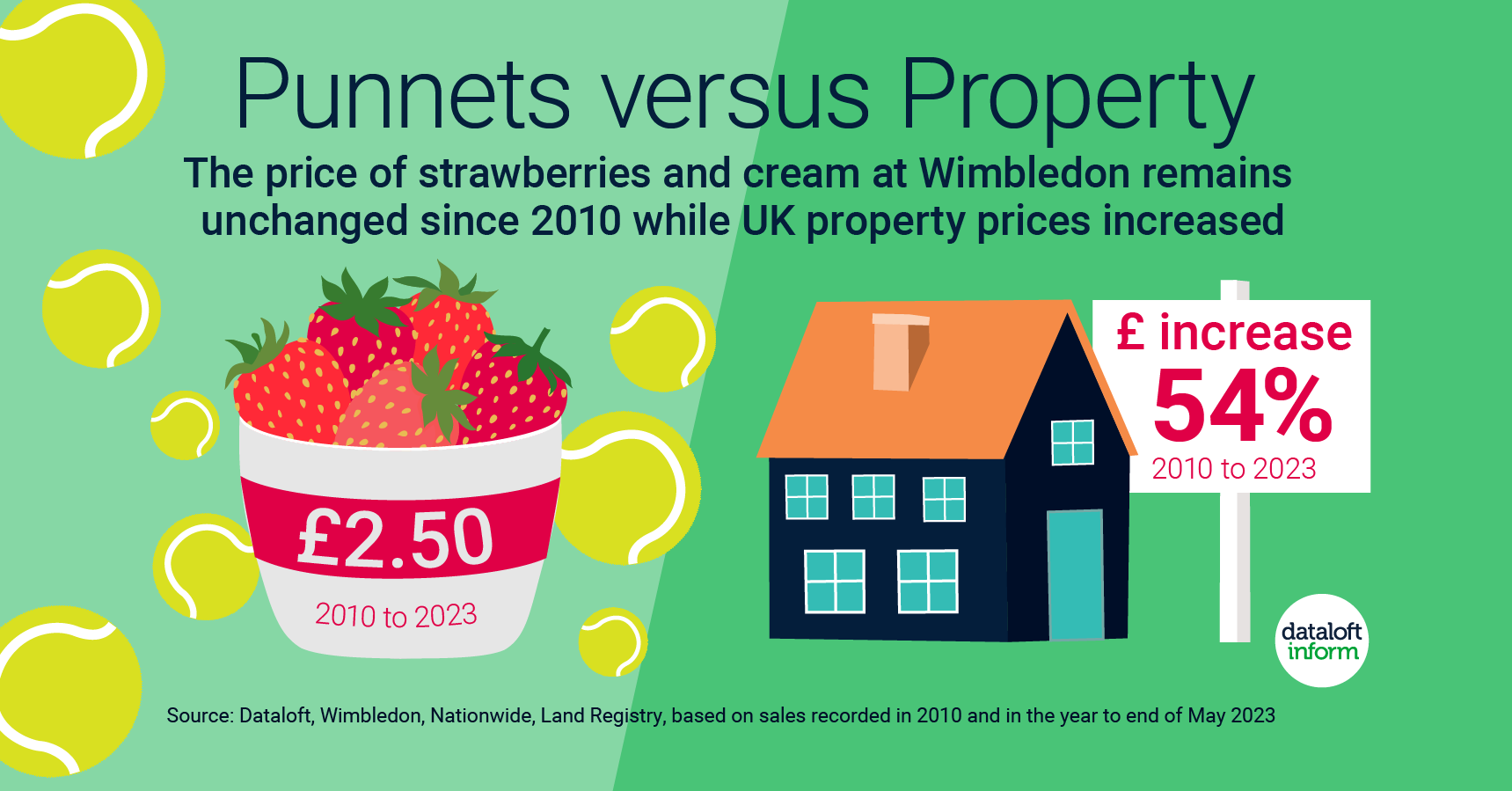

While tennis enthusiasts eagerly follow the thrilling matches, another traditional aspect of Wimbledon that has garnered attention is the consumption of strawberries and cream. Every year, spectators at the Championships collectively spend approximately £500,000 on this classic British treat. Close to 200,000 portions of strawberries and cream are sold during the tournament, priced at £2.50 per portion.

One interesting aspect of this delightful tradition is the fact that the price of a portion of strawberries and cream has remained unchanged since 2010. In a world where inflation has affected numerous goods and services, Wimbledon has managed to maintain the same price for this iconic dish over more than a decade. While it may seem like a small detail, it highlights the commitment to tradition that permeates the championship.

In contrast to the stable price of strawberries and cream, the average price of a property in the UK has experienced a significant increase during the same period. Since 2010, property prices have surged by a staggering 54%, in Crawley this has been a massive 67.7%. Back in 2010, the average price of a property in the UK stood at just over £171,000. At that time, only one in every 20 properties sold for over £500,000.

However, in the past year, the landscape of the property market has transformed dramatically. More than one in every six properties sold has now exceeded the £500,000 mark. This statistic, drawn from Dataloft, Wimbledon, Nationwide, and Land Registry data based on sales recorded in 2010 and the year leading up to the end of May 2023, reveals the substantial inflation that has taken hold in the property market.

The contrasting trajectories of the price of strawberries and cream at Wimbledon and property prices in the UK underscore the broader economic changes that have transpired over the past decade. While some sectors have witnessed significant inflation, others have managed to maintain stable prices, preserving cherished traditions and experiences.

As fans continue to flock to the All England Club to witness thrilling tennis matches and savour the iconic combination of strawberries and cream, they can appreciate the consistency and nostalgia associated with this culinary delight. Amidst a changing world, where prices fluctuate and economic dynamics evolve, the Wimbledon Championship remains a steadfast institution, offering a blend of tradition and sporting excellence that has captivated audiences for over a century.

- Details

- Hits: 485

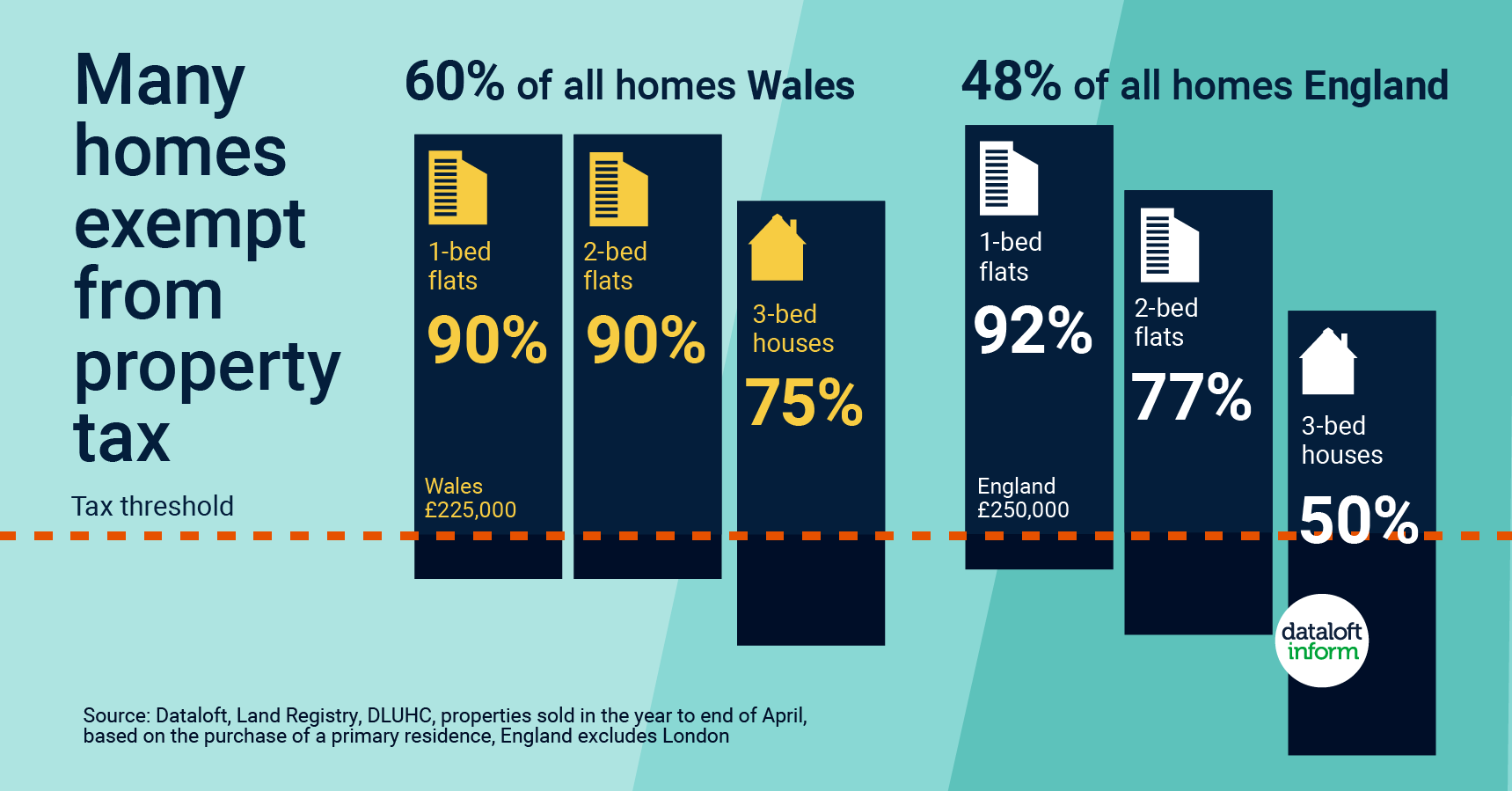

In the past year, a significant portion of home purchases across Wales and England (excluding London) have been exempt from property taxation. This exemption has had a notable impact on the local housing market in Crawley and neighbouring areas. With a considerable number of homes falling below the thresholds for property taxation, buyers, particularly first-time buyers and those seeking smaller properties, have been able to enter the market more easily. This article will delve into the effects of property tax exemptions on the local Crawley market and explore the implications for different property types.

Tax Exemptions Fuel Market Activity:

According to recent data from Dataloft, the Land Registry, DLUHC, and property sales from the year ending in April, more than 60% of homes in Wales and approximately 48% of homes in England (excluding London) purchased by home movers have been exempt from property taxation. These figures highlight a significant trend that has shaped the real estate landscape.

Affordability and Accessibility for Home Movers:

In Wales, over 90% of all 1-bed and 2-bed apartments sold fell below the £225,000 threshold for Land Transaction Tax. Similarly, in England, the proportions of apartments sold below the £250,000 threshold for Stamp Duty Land Tax were 92% and 77% for 1-bed and 2-bed apartments, respectively. This indicates that a vast majority of apartment buyers, including first-time buyers and downsizers, have benefited from these tax exemptions.

Moreover, a significant number of 3-bed houses in both Wales and England were sold below the price thresholds for taxation. Nearly three out of four 3-bed houses in Wales and over half in England were priced below these thresholds. This has made 3-bed houses more affordable for families and buyers seeking larger properties.

Boost for First-Time Buyers:

In England (excluding London), the threshold for first-time buyers stands at £425,000, which is even higher than the thresholds for other property types. The data reveals that 80% of all homes sold in the past year were below this threshold. Notably, 96% of all apartments and 80% of all terraced homes fell beneath this limit. This exemption has been instrumental in enabling first-time buyers to make their way onto the property ladder, especially in Crawley and its surrounding areas.

Impact on the Local Crawley Market:

The property tax exemptions have had a positive effect on the local housing market in Crawley. With a higher percentage of affordable homes available, demand has surged, leading to increased market activity. The increased affordability has attracted a diverse range of buyers, including first-time buyers, downsizers, and families, with more people coming into the area from London.

The surge in demand had also created a favourable environment for property sellers. Those looking to sell their homes are likely to find a larger pool of potential buyers, resulting in quicker sales and, in some cases, increased property prices. The tax exemptions have effectively facilitated transactions and stimulated the housing market in Crawley.

The significant number of homes exempt from property taxation across Wales and England (excluding London) has had a notable impact on the local housing market in Crawley. The affordability and accessibility of properties, particularly for first-time buyers and those seeking smaller homes, have driven increased market activity. The tax exemptions have not only empowered buyers but have also presented opportunities for property sellers. As the housing market in Crawley continues to be positive, these property tax exemptions play a crucial role in shaping its growth and development.

- Details

- Hits: 462

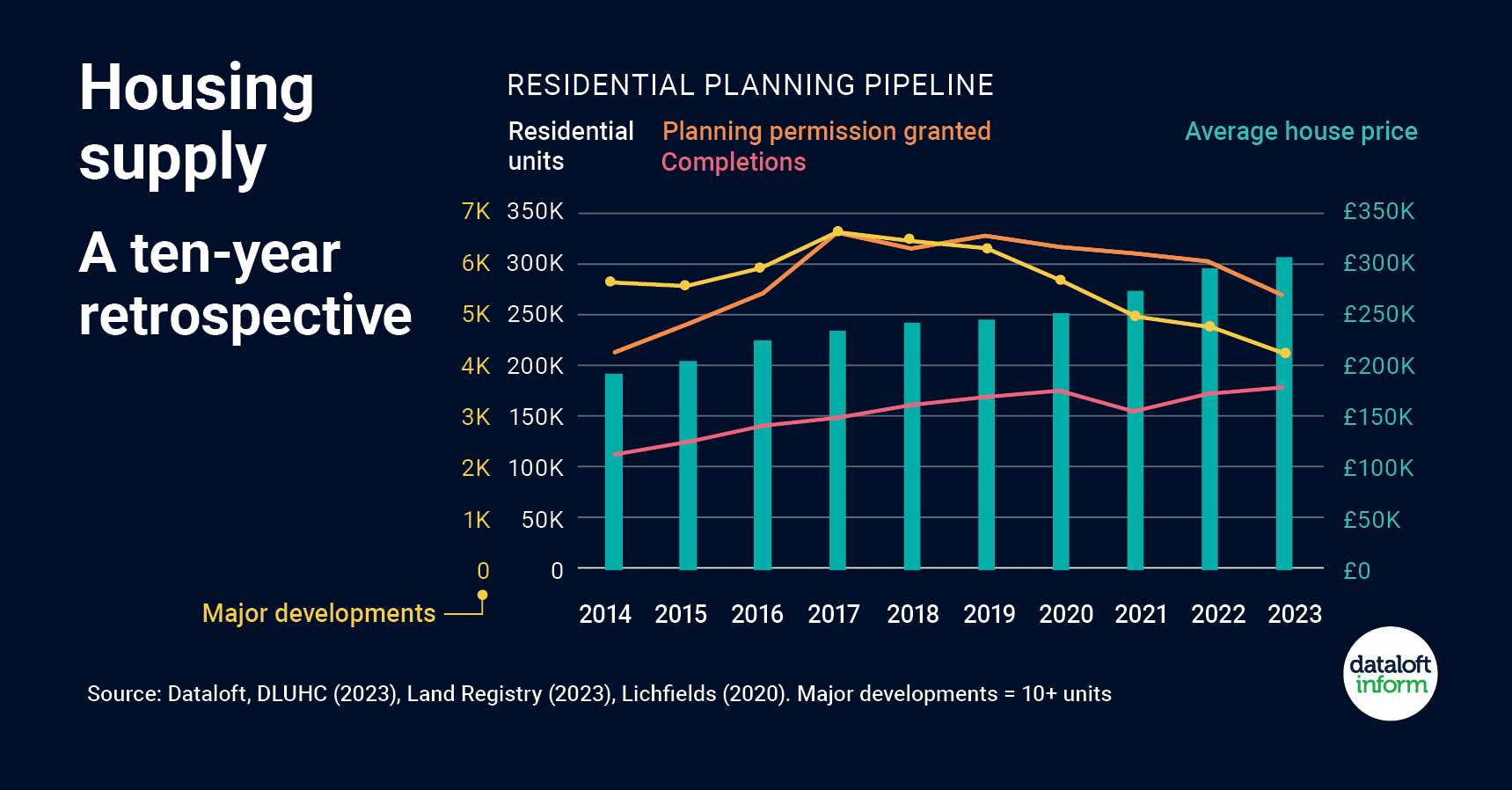

Recently-released statistics on planning applications have revealed a worrying trend of declining major residential approvals across the country. Since reaching its peak at 6,617 in 2017, the number of major residential approvals has steadily decreased, with the latest figures showing only 4,221 approvals, marking the lowest point in a decade. This downward trajectory raises concerns about the future of housing development in the region.

Crawley, is not immune to the effects of this decline. As major residential approvals continue to dwindle nationwide, the impact on local communities like Crawley becomes increasingly evident. With fewer major housing projects receiving approval, the potential for new homes and increased housing supply in the area diminishes.

Despite these concerns, there is a glimmer of hope in the form of increased housing completions. The number of newly completed homes in the past 12 months has reached a 10-year high, with over 177,000 homes finished during this period. This indicates that Crawley and the surrounding regions are still benefiting from the previous peak in residential approvals that occurred between 2017 and 2019. The completion of these homes helps to alleviate some of the immediate pressure on the housing market.

However, it's important to note that the full impact of declining major residential approvals may not be felt immediately. Research conducted by Lichfields in 2020 suggests that developments consisting of over 500 homes can take an average of three years to begin completions, while projects with 200 or more homes may take as long as 8.4 years. Therefore, the repercussions of the current decline in approvals are likely to extend into the foreseeable future.

Interestingly, despite the fluctuations in residential planning pipeline, average house prices in Crawley and its surroundings have continued to rise steadily over the past decade. This suggests that, for the time being, the local housing market remains unaffected by the dwindling number of major residential approvals. It's worth noting that this trend may not persist in the long run, as a sustained decline in housing supply could potentially impact prices.

While the recent statistics on planning approvals reveal a concerning trend of declining major residential approvals, Crawley and the wider West Sussex area continue to experience growth in the housing sector. The completion of a record number of homes in the past year is a positive indicator of ongoing development. However, the potential long-term implications of the current decline in approvals should not be ignored, as they could significantly impact housing supply and potentially affect housing prices in the future. Continued monitoring of the situation and proactive measures to address the decline in major residential approvals will be crucial to ensure the sustainable growth of the housing market in Crawley and its surrounding regions.

- Details

- Hits: 436