Blog

A recent poll conducted by Dataloft, a leading provider of property market insights, shed light on the shifting dynamics of the buyer market when a rental property is put up for sale. The survey, which gathered responses from property professionals, aimed to identify the most likely buyers in such scenarios. The results reveal a significant impact on the Crawley rental market, as properties increasingly transition from the private rented sector to alternative ownership categories. This article will explore the implications of this trend and its consequences for both tenants and property investors.

The Survey Results:

According to the Dataloft poll, the breakdown of likely buyers when a rental property is put up for sale is as follows:

First-time buyers: 48.1%

Downsizers: 3.9%

Investors: 28.6%

General home movers: 19.5%

The Rise of First-Time Buyers:

The dominance of first-time buyers in the poll's results suggests a growing interest in homeownership among this demographic. As housing prices continue to rise, more individuals are recognizing the long-term benefits of investing in property rather than remaining in the rental market. This shift is particularly noticeable in Crawley, where a thriving job market and excellent transport links make it an attractive location for young professionals looking to settle down. The increased presence of first-time buyers could lead to a reduction in the number of available rental properties, thereby tightening the supply and potentially driving up rental prices.

Impact on Downsizers:

Downsizers, typically individuals or couples looking to downsize their living arrangements as they approach retirement, constituted a relatively small portion of likely buyers according to the survey. While this segment is less likely to affect the rental market directly, it does indicate a shift in preferences towards more manageable, low-maintenance properties. This trend could potentially lead to an increase in the availability of smaller, more affordable homes in the Crawley area, benefiting both downsizers and first-time buyers seeking entry-level properties.

Investors and General Home movers:

Investors, comprising 28.6% of likely buyers in the survey, play a pivotal role in the Crawley rental market. As rental properties transition to alternative ownership, investors have the opportunity to expand their portfolios. However, as more properties leave the private rented sector, it may become more challenging for investors to find suitable properties that meet their criteria. This increased competition among investors could drive up prices for remaining rental properties, potentially impacting tenants in the form of higher rents.

General home movers, representing 19.5% of likely buyers, encompass a broad category that includes individuals and families looking to upsize or change their living arrangements for various reasons. The presence of general home movers suggests that some properties may be sold to existing residents within the Crawley area, leading to minimal disruption in the rental market.

The findings of the Dataloft poll indicate a significant transformation in the buyer demographics when rental properties are put up for sale. With first-time buyers emerging as the most likely purchasers, the Crawley rental market may experience a decrease in available properties. This reduced supply is one of the main reasons for the drive-up of rental prices, presenting challenges for tenants. Moreover, the presence of investors and general home movers signifies an evolving landscape that may impact the availability and affordability of rental properties.

As the property market continues to evolve, local authorities, investors, and tenants, should closely monitor these trends to ensure the rental market remains balanced and meets the needs of all participants. Measures such as increasing the supply of affordable housing and encouraging responsible property investment could help mitigate the effects of properties leaving the private rented sector, fostering a healthy and sustainable rental market in Crawley.

- Details

- Hits: 381

Gardens are an integral part of British life, contributing to the charm and character of residential properties across Great Britain. In fact, it is estimated that 97% of houses in the country have a garden. However, in recent years, the significance of garden size has grown, as homeowners increasingly seek to maximize their outdoor spaces for various purposes. One such trend is the rise of garden offices, providing a dedicated area for individuals to work from home.

The concept of expanding living spaces into the garden has gained popularity, as people recognize the benefits of having a separate and tranquil area to focus on their professional responsibilities. Garden offices offer a harmonious blend of nature and work, allowing individuals to escape the confines of indoor spaces while maintaining productivity and concentration. This innovative approach has proven to be a valuable solution, especially in the wake of the COVID-19 pandemic, which has significantly increased the number of people working remotely.

Interestingly, the size of a garden varies across different regions of Great Britain, leading to noticeable disparities. According to available data, the South East takes the lead in terms of average garden size, boasting an impressive 422 square meters. In contrast, Londoners contend with the smallest average garden size, measuring just 201 square meters. These regional differences are likely influenced by various factors, such as urbanization, population density, and the availability of land for housing development.

Moreover, recent research conducted by #Dataloft, in collaboration with the Office for National Statistics (ONS), Ordnance Survey, and Savills, has shed light on the economic implications of garden size. The study revealed a significant 39% price difference per square foot between homes with the largest gardens and those with the smallest ones. This finding underscores the value and desirability of spacious outdoor areas in today's housing market. It is clear that a larger garden can significantly enhance the appeal and market value of a property.

These trends and findings are not limited to a broader national scale but can also be observed in specific areas, such as Crawley. In Crawley, it has become increasingly common for tenants to express a preference for properties with gardens or outdoor spaces. The majority of tenants now seek residences that offer the opportunity to enjoy the benefits of nature and open-air living. This growing demand reflects the evolving priorities of individuals and the recognition of the positive impact that gardens can have on overall well-being and quality of life.

As the importance of gardens continues to rise, both in terms of their functionality and their financial implications, homeowners and property developers are paying closer attention to outdoor spaces. Whether it is the creation of garden offices, the expansion of existing gardens, or the inclusion of outdoor amenities, such as seating areas and green spaces, the integration of nature into residential properties has become a key consideration. The ability to provide a garden or outdoor space that meets the demands of tenants and homeowners is increasingly seen as a valuable asset in the housing market.

In conclusion, gardens have long been a cherished aspect of British life, and their significance has only grown in recent years. The desire for larger outdoor spaces, exemplified by the popularity of garden offices, demonstrates how gardens have evolved beyond mere aesthetics. The regional variations in garden sizes and the substantial price difference associated with different garden sizes highlight the economic impact of outdoor spaces. Moreover, the trend observed in Crawley, where tenants increasingly prioritize gardens and outdoor areas, reinforces the growing demand for nature-infused living spaces. As gardens become increasingly sought-after amenities, homeowners and property developers must recognize their value and adapt to the changing preferences of individuals seeking a connection with the outdoors.

- Details

- Hits: 383

From the 1st to the 7th of June, the United Kingdom observes National Volunteers' Week, a time to honour the selfless individuals who dedicate their time and energy to supporting various causes. Volunteering not only benefits society at large but also has a significant impact on individuals' mental health and well-being. In England and Wales, more than half of the population aged 16 and above have volunteered within the past year, with one in three individuals volunteering at least once per month. This article explores the motivations behind volunteering, its positive effects on mental health, and its relevance to the preferences of tenants in Crawley, West Sussex.

Motivations for Volunteering:

Volunteering is driven by various factors, including the desire to improve the lives of others, socializing and making new friends, and supporting the local community. Many individuals find fulfilment in knowing that their efforts contribute to positive change, making volunteering an avenue to address societal issues and improve the lives of those in need. Beyond the impact on the recipients of volunteering services, volunteers often find a sense of purpose and personal satisfaction in their efforts.

Positive Effects on Mental Health and Well-being:

Engaging in volunteer work has been associated with improved mental health and well-being. Research indicates that volunteering can reduce stress, combat depression, and increase overall life satisfaction. It provides individuals with a sense of belonging and purpose, fosters social connections, and boosts self-esteem. Through volunteering, people expand their social networks, form meaningful relationships, and develop a stronger support system, all of which contribute to enhanced mental and emotional well-being.

The Importance of Community for Home Renters:

When it comes to choosing a place to live, a sense of community and neighbourliness are vital considerations for both home buyers and renters. According to surveys conducted by Dataloft, HMRC, StatsWales, Census 2021, Property Academy Home Moving Trends, and Renter Survey 2022, approximately 75% of home buyers prioritize a sense of community when searching for a home. For renters, two-thirds consider the local community to be an important factor when selecting a rental property. Additionally, more than one in five renters express a desire to receive information about the local community.

Implications for Tenants in Crawley, West Sussex:

The influence of community and volunteering on the preferences of tenants in Crawley, West Sussex, is likely to be significant. Crawley is a vibrant town known for its strong sense of community and numerous volunteer organizations. Potential tenants may prioritize areas that offer opportunities for volunteering, community engagement, and social interactions. Neighbourhoods with active community centres, local initiatives, and volunteer-run organizations may be particularly appealing.

In Crawley, tenants seeking a rental home may value areas that foster a sense of belonging and provide opportunities for community involvement. They may be attracted to neighbourhoods with regular community events, volunteering opportunities, and local amenities that encourage social connections. The availability of resources and information about the local community may also play a crucial role in their decision-making process.

National Volunteers' Week sheds light on the transformative power of volunteering and the importance of community in people's lives. Engaging in volunteer work not only helps improve the lives of others but also enhances mental health and well-being. For tenants in Crawley, West Sussex, the sense of community and the availability of volunteering opportunities may greatly influence their choice of a rental home. Recognizing the significance of community-building initiatives can help property developers and landlords cater to the preferences and needs of prospective tenants, ultimately creating thriving and welcoming neighbourhoods

- Details

- Hits: 387

The dream of owning a home is a significant milestone for many individuals and families. In the United Kingdom, the number of households achieving this milestone is substantial, with over 5.5 million households currently living in their first-time buyer homes. This figure represents more than 35% of all owner occupiers in the country. The dynamics of the first-time buyer market offer intriguing insights into the preferences and expectations of new homeowners. In this article, we will delve into the statistics and explore how these trends impact the local property market in Crawley, West Sussex.

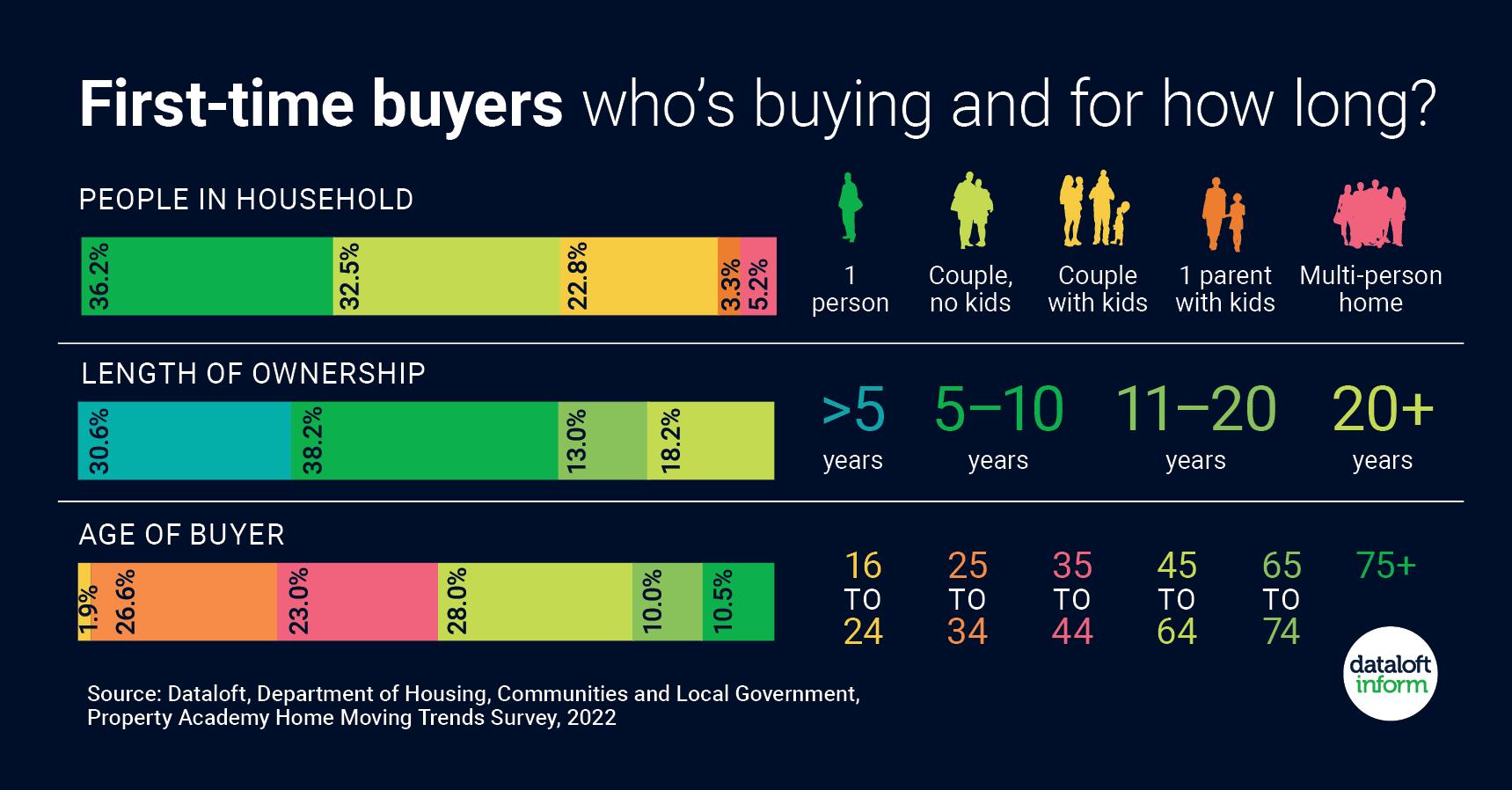

Demographic Breakdown

Within the first-time buyer segment, there is an interesting mix of household types. Approximately 36% of first-time buyer households consist of single individuals. It is worth noting whether they were single at the time of purchase or became single after is unclear from the data. Conversely, over 60% of first-time buyers are couples, with or without dependent children, making their initial foray into homeownership together. Furthermore, one in five individuals who reside in their first home bought it at the age of 65 or older, highlighting the diverse age range of first-time buyers.

Property Duration Expectations

An essential aspect of homeownership is the length of time individuals or families expect to stay in their first home. Two-thirds of first-time buyers anticipate residing in their property for less than a decade. However, a notable 18% plan to live in their homes for 20 years or more. This percentage increases to 33% for first-time buyers aged 45 and above, indicating a higher inclination towards long-term ownership among this age group. These varying expectations have implications for property market dynamics and the demand for housing in the years to come.

Annual First-Time Buyer Figures

Each year, more than 350,000 first-time buyers successfully step onto the property ladder in the UK. This figure is a testament to the enduring appeal of homeownership and the robustness of the housing market. The average age of first-time buyers has risen to 34, reflecting the challenges young people face in saving for a deposit and accessing affordable housing. According to a report by Halifax, first-time buyers accounted for 52% of all home purchase loans in 2022, further underlining their significance in driving activity within the housing market.

Impact on the Local Crawley Property Market

While the aforementioned statistics provide a broad overview of the national first-time buyer market, it is important to consider how these trends impact the local property market in Crawley, West Sussex. As an emerging town located within commuting distance of London and benefiting from excellent transport links, Crawley has seen increased interest from first-time buyers seeking affordable homeownership options.

The influx of first-time buyers into the Crawley property market has contributed to rising demand for entry-level properties. This heightened demand, combined with limited supply, has led to an upward pressure on property prices, making it increasingly competitive for prospective buyers. As a result, local sellers have experienced favourable conditions, witnessing faster property sales and potential increases in property values.

However, affordability concerns persist among first-time buyers, particularly those with limited financial resources. The average age of first-time buyers being 34 indicates that young professionals and families are actively seeking homeownership opportunities in Crawley. To address the needs of this segment, it is crucial for local authorities and developers to focus on providing a range of affordable housing options, including shared ownership schemes and initiatives that facilitate access to homeownership.

The first-time buyer market in the UK continues to be a significant driving force in the property sector. With millions of households already settled in their first homes and a steady influx of new buyers each year, understanding the preferences, demographics, and duration expectations of this segment is essential. The local property market in Crawley, West Sussex, has also felt the impact of these trends, experiencing increased demand and rising prices. However, addressing affordability concerns and expanding housing options will be vital to ensuring sustainable homeownership opportunities for aspiring buyers in the region.

- Details

- Hits: 465

The UK rental market has become a frequent topic of discussion, with media outlets highlighting the surge in demand for property, impending changes to regulations, and landlords choosing to sell their properties. Among the many concerns surrounding the rental market, rising rents have sparked significant controversy. While tenants understandably find it worrisome, it is essential to delve deeper and explore the factors contributing to this trend. Contrary to popular belief, landlords are not solely responsible for the escalation of rent prices. In this brief article, we will examine three key reasons behind the increasing rents and shed light on the challenges faced by landlords.

Mortgage Rates

As with residential mortgages, interest rates influence the cost of buy-to-let mortgages. Landlords face the same economic fluctuations as residential property owners, often resulting in increased monthly mortgage payments. Although some may perceive rental properties as a lucrative venture, the reality is that landlords must ensure their rental income covers mortgage expenses while leaving room for profit. Consequently, when mortgage payments rise, landlords may adjust rents to offset their increased costs and maintain a sustainable business model.

Changes to Tax Rules

In recent years, the UK government has implemented several tax law amendments that directly affect landlords. These changes impact the allowable deductions for expenses and the overall amount of tax landlords are required to pay. As a result, numerous landlords have chosen to sell their rental properties, while others have found it necessary to raise rents to meet their financial obligations. Although complex and intricate, these alterations to the tax system have had significant repercussions, contributing to the upward trajectory of rent prices.

Increased Costs of Repairs and Maintenance

Maintaining rental properties is an ongoing responsibility for landlords, and rising costs in repairs and maintenance can influence the rental prices they set. Several factors contribute to these increased expenses:

- a) General Cost Escalation: The price of labour, materials, fixtures, and furnishings has experienced a noticeable uptick, impacting landlords' ability to cover these expenses solely through rental income.

- b) Service Charges and Ground Rents: In the case of purpose-built flats, landlords often incur service charges or ground rents payable to the freeholder. Many of these charges have risen due to escalating energy costs. As communal heating and lighting become more expensive, landlords may need to adjust rents to compensate.

- c) Enhanced Energy Efficiency Standards: In the coming years, all rental properties must meet higher energy efficiency standards, potentially necessitating major renovations. Such substantial works can exert additional financial pressure on landlords, which may be reflected in increased rental prices.

Understanding the reasons behind rising rents is crucial to appreciate the challenges faced by landlords in the Crawley rental market. Factors such as mortgage rates, changes to tax rules, and increased costs of repairs and maintenance significantly influence the rental prices landlords set. It is essential to recognize that landlords, like any business owners, must navigate a complex financial landscape and ensure their operations remain viable. By considering these factors, tenants and policymakers can gain a more nuanced understanding of the rental market's dynamics and work towards finding balanced and equitable solutions.

If you are a landlord seeking to rent out a property or a tenant in search of a new home, our lettings team is ready to assist you. Contact Ben on 01293 552 388 to avail our services and expertise.

- Details

- Hits: 411