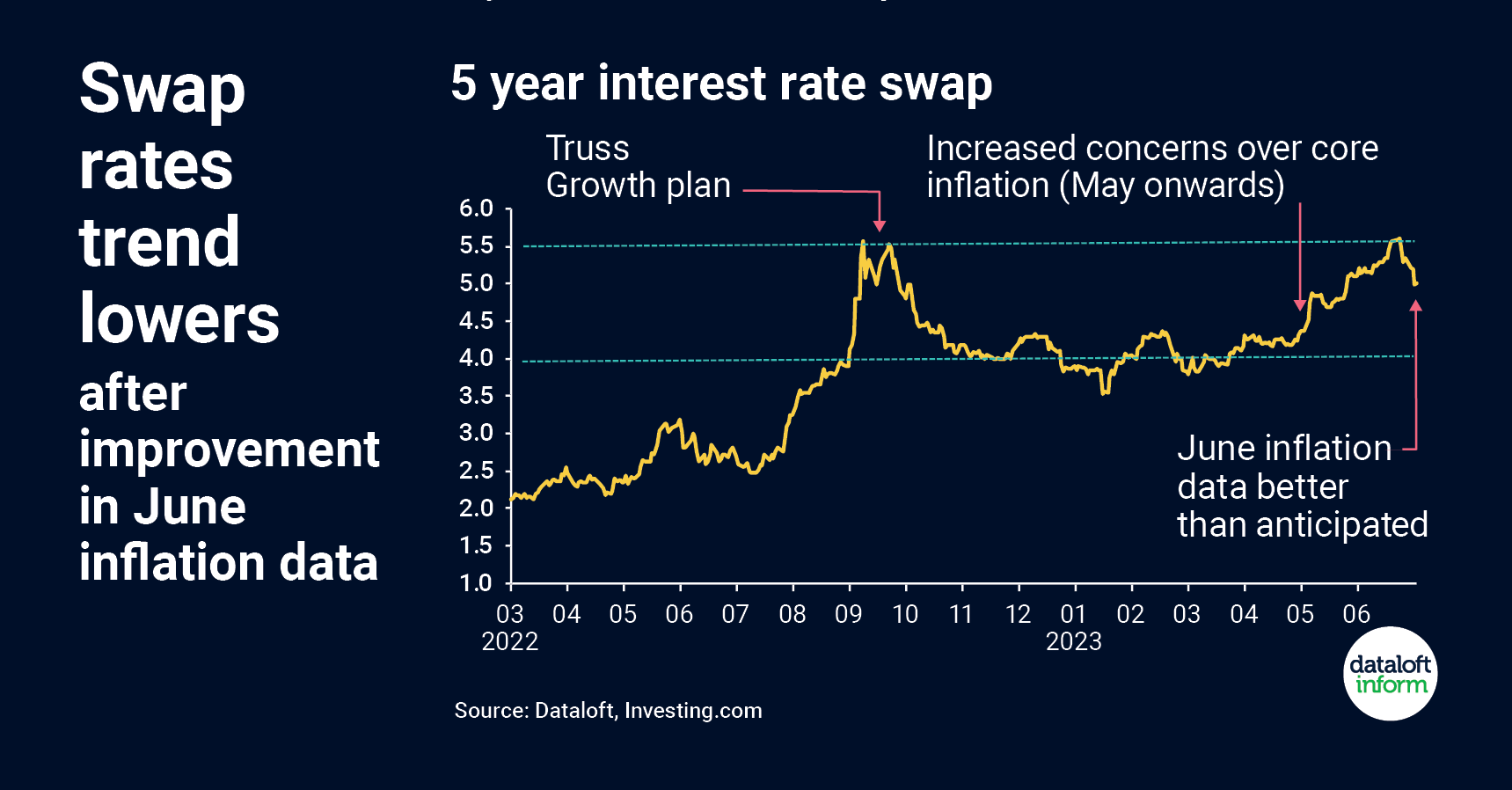

Swap rates are essential tools for predicting changes in mortgage costs, serving as indicators of borrowing costs for lenders. Throughout the first half of the year, the 5-year swap rates had stabilized around 4%. However, starting in May, these rates showed an upward trend, peaking at 5.5%, largely due to mounting concerns over core inflation. Fortunately, recent data released on July 19th brought some relief, as June's inflation figures came in better than expected. This positive news on inflation subsequently translated into lower interest rates on 5-year swaps, falling back below 5%. While data volatility remains a possibility in the coming months, this initial shift in swap rates suggests that inflation may be starting to ease.

Understanding Swap Rates and their Significance

Swap rates are critical indicators of market sentiment and economic outlook. They represent the fixed interest rates at which financial institutions exchange future cash flows with each other. Specifically, the 5-year swap rate reflects the cost of borrowing for lenders over a five-year period. As a result, these rates offer valuable insights into potential changes in mortgage costs.

Trends in 5-Year Swap Rates

For the first half of the year, the 5-year swap rates remained relatively steady at approximately 4%. This stability provided some comfort to market participants, giving the impression that borrowing costs for lenders would remain manageable.

However, starting from May, the market witnessed a gradual increase in the 5-year swap rates. Climbing as high as 5.5%, this surge was primarily fuelled by concerns surrounding core inflation. As inflation rates appeared to be rising, investors and lenders became cautious, pushing the swap rates higher in response to the perceived increased risk.

Inflation Concerns and Their Impact on Swap Rates

Inflation, as measured by both headline and core inflation figures, has a significant influence on swap rates. Headline inflation includes all consumer goods and services, while core inflation excludes volatile elements like food and energy prices. High inflation can erode purchasing power and lead to a decrease in the value of money, prompting lenders to adjust their interest rates to account for the risk.

On July 19th, the release of inflation data provided some relief to the growing concern over rising inflation rates. The June inflation figures showed a headline inflation rate of 7.3% and a core inflation rate of 6.4%. The figures were better than expected, leading market participants to believe that inflation might be under control, albeit still at elevated levels.

Impact of Inflation News on Swap Rates

The positive inflation news had a direct impact on the 5-year swap rates, causing them to dip back below 5%. This decrease in the swap rates implied that lenders perceived a reduced risk of inflation getting out of hand, prompting a slight easing in borrowing costs.

Future Outlook and Data Volatility

While the recent dip in 5-year swap rates is encouraging, it is essential to approach the data with caution. Economic data, including inflation figures, can be subject to volatility and revisions over the next few months. Various factors, such as supply chain disruptions, geopolitical tensions, or changes in central bank policies, can still influence inflationary pressures.

Swap rates serve as valuable tools to gauge potential changes in mortgage costs, reflecting the cost of borrowing for lenders. The 5-year swap rates experienced a period of stability before trending upward due to concerns over core inflation. However, the release of better-than-expected inflation data provided some relief, leading to a slight easing in 5-year swap rates. While this initial shift indicates that inflation may be starting to come down, it is crucial to remain vigilant as data volatility remains a possibility in the coming months. Investors and market participants should continue to closely monitor economic indicators to better assess the future trajectory of swap rates and its implications for mortgage costs. (Source: #Dataloft, Investing.com)