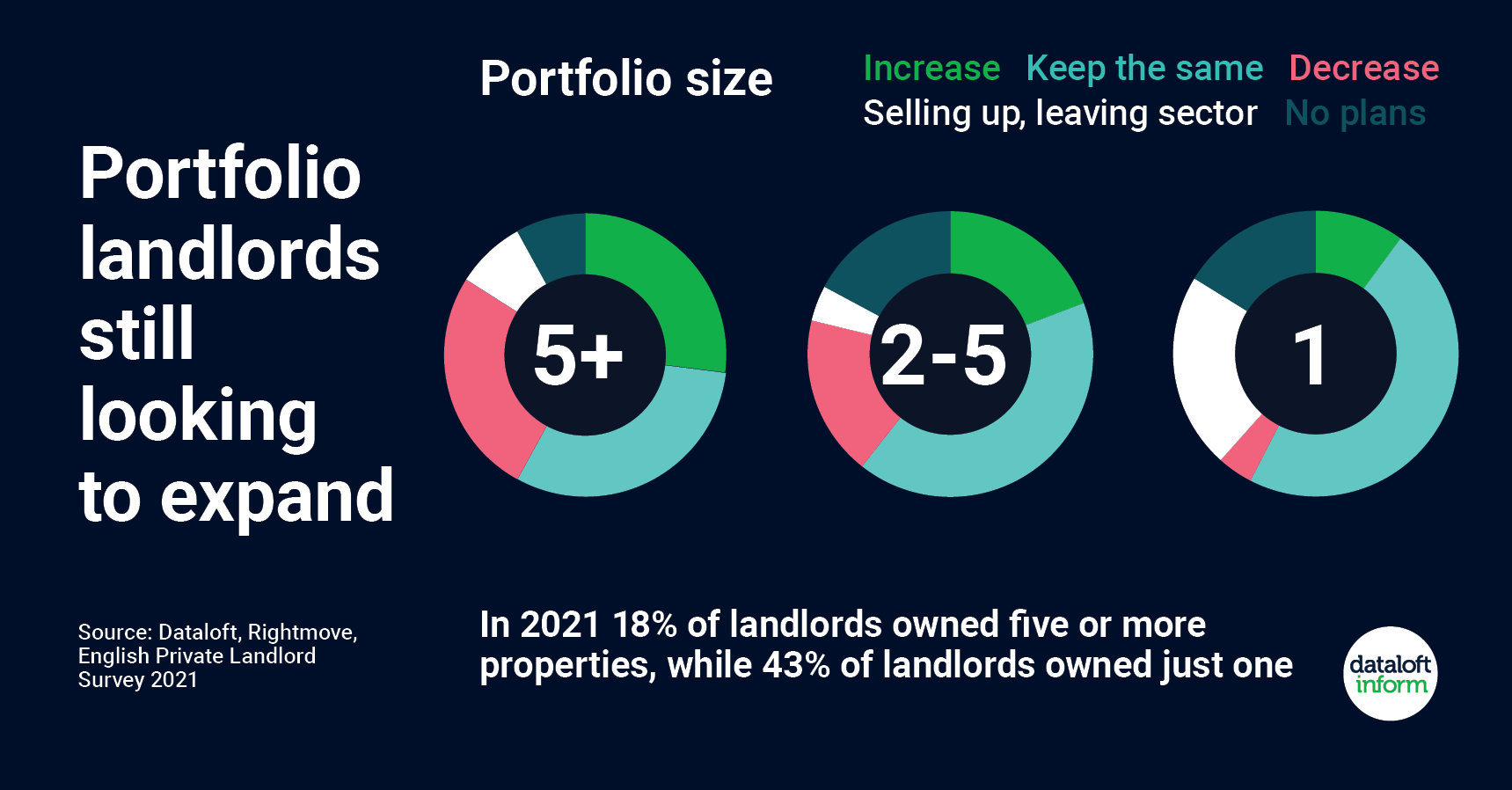

The property market in Crawley, West Sussex, is set to experience a positive boost as more than a quarter of landlords who own five or more properties have expressed their intentions to expand their portfolios in the coming year. Additionally, one in five landlords with 2–5 properties are also planning to increase their holdings. This surge in portfolio expansion reflects a promising outlook for the local market. Moreover, over half of landlords aim to maintain or grow the number of properties they own, signifying a stable and confident environment for property investment. This article explores the potential benefits of this trend for the Crawley market.

Growth in Portfolio Expansion:

According to a report by Rightmove, more than 25% of landlords who currently own five or more properties are actively planning to expand their portfolios in the near future. This figure suggests a positive sentiment among established landlords in the Crawley area. Furthermore, the report indicates that one in five landlords with 2–5 properties are also seeking to grow their portfolios, highlighting a diverse range of investors aiming to capitalize on the market's potential.

Stability and Consistency:

The English Private Landlord Survey 2021, published in 2022, revealed that 48% of all tenancies were attributed to landlords who owned five or more properties, despite constituting only 18% of all landlords. This data underscores the stability and reliability that these experienced landlords bring to the market. By actively maintaining or expanding their portfolios, they contribute to a consistent supply of rental properties in England and the Crawley area. This stability benefits both tenants and the local market, ensuring a reliable and diverse range of housing options.

Positive Financing Conditions:

A Property Academy survey, which encompassed close to 6,000 landlords, uncovered a positive financial outlook for landlords. Over three-quarters of the respondents reported owing less than half the value of their portfolio on their buy-to-let mortgages. This low loan-to-value ratio indicates that landlords in the area are less impacted by market volatility and economic fluctuations. Such favourable financing conditions provide landlords with a sense of security and encourage further investment, stimulating the local market.

Economic Impact:

The increased portfolio expansion by landlords in Crawley is poised to have a positive impact on the local economy. As more properties are acquired or developed, it creates opportunities for construction, renovation, and property management businesses, generating employment and contributing to economic growth. Additionally, a vibrant rental market attracts tenants and professionals to the area, leading to increased spending in local businesses and enhancing the overall economic vitality of Crawley.

Improved Housing Supply:

The expansion of landlord portfolios will directly address the growing demand for rental properties in Crawley. With a greater number of available properties, tenants benefit from increased choices and improved affordability. As the market expands, landlords can cater to a wider range of housing needs, from single professionals to families, thereby contributing to a diverse and inclusive community.

The increasing number of landlords planning to expand their portfolios in Crawley, West Sussex, presents an optimistic outlook for the local market. This trend not only ensures stability and reliability but also stimulates economic growth and improves housing supply. The positive financing conditions and the diverse range of investors actively participating in the market further reinforce the promising future of Crawley's real estate sector. As portfolio expansion continues, the area is likely to witness continued growth and prosperity in the coming years.