As the property landscape in England and Wales continues to evolve, a significant number of owner-occupiers are opting to downsize their homes, leading to a surge in outright property ownership. This trend has far-reaching implications for the housing market, and Crawley, is one of the regions experiencing its impact. In this article, we will explore the downsizing phenomenon, its implications for homeowners, and how it affects the property market in Crawley.

The Rise of Outright Property Ownership

Recent data from the Land Registry reveals a remarkable shift in homeownership across England and Wales. With over 8.1 million owner-occupiers now owning their homes outright, this group constitutes 52% of all owner-occupied properties. Notably, this percentage rises even higher to over 90% among those aged 65 and above. The reasons behind this trend are diverse and reflect changes in lifestyle choices, financial planning, and the desire for stability and security in retirement.

Downsizing: Unlocking Housing Equity

One of the primary drivers behind the surge in outright homeownership is the downsizing trend. Homeowners are increasingly choosing to move from larger, under-occupied properties, such as 4 or more bedroom houses, to more manageable 2-bedroom apartments or smaller homes. The potential financial gain from this transition can be substantial.

According to Land Registry sales price data, downsizing from a larger property to a smaller one could release, on average, over £250,000. This amount varies depending on the region, reflecting variations in property prices. Such a financial windfall can be a game-changer for homeowners, presenting various opportunities to enhance their quality of life and financial well-being.

Impacts on the Housing Market

The growing number of downsizers has implications for the broader housing market. By freeing up larger properties, they contribute to easing some of the housing stock issues, especially the shortage of family-sized homes. This, in turn, can help address the housing supply-demand imbalance that many areas in England and Wales are facing.

Crawley and Downsizing

Crawley, a vibrant town located in West Sussex, is also experiencing the effects of the downsizing trend. As homeowners in the region embrace the idea of releasing equity by moving to smaller properties, it may lead to a reshuffling of the local housing market.

The potential influx of larger homes into the market can offer valuable opportunities for families seeking more spacious accommodation. However, it may also impact property prices in the area. With more significant supply in the higher-end property market, there might be a moderation in prices for larger homes.

On the other hand, as downsizers move into smaller properties, demand for 2-bedroom apartments and smaller homes could increase. This upsurge in demand might lead to higher prices in this segment of the market, making it an attractive option for property investors.

Financial Opportunities for Downsizers

Beyond alleviating housing stock issues, downsizing presents exciting financial prospects for homeowners. Aside from the considerable equity released, downsizers can significantly reduce their ongoing costs. Smaller properties often entail lower maintenance and utility expenses, making them more cost-effective.

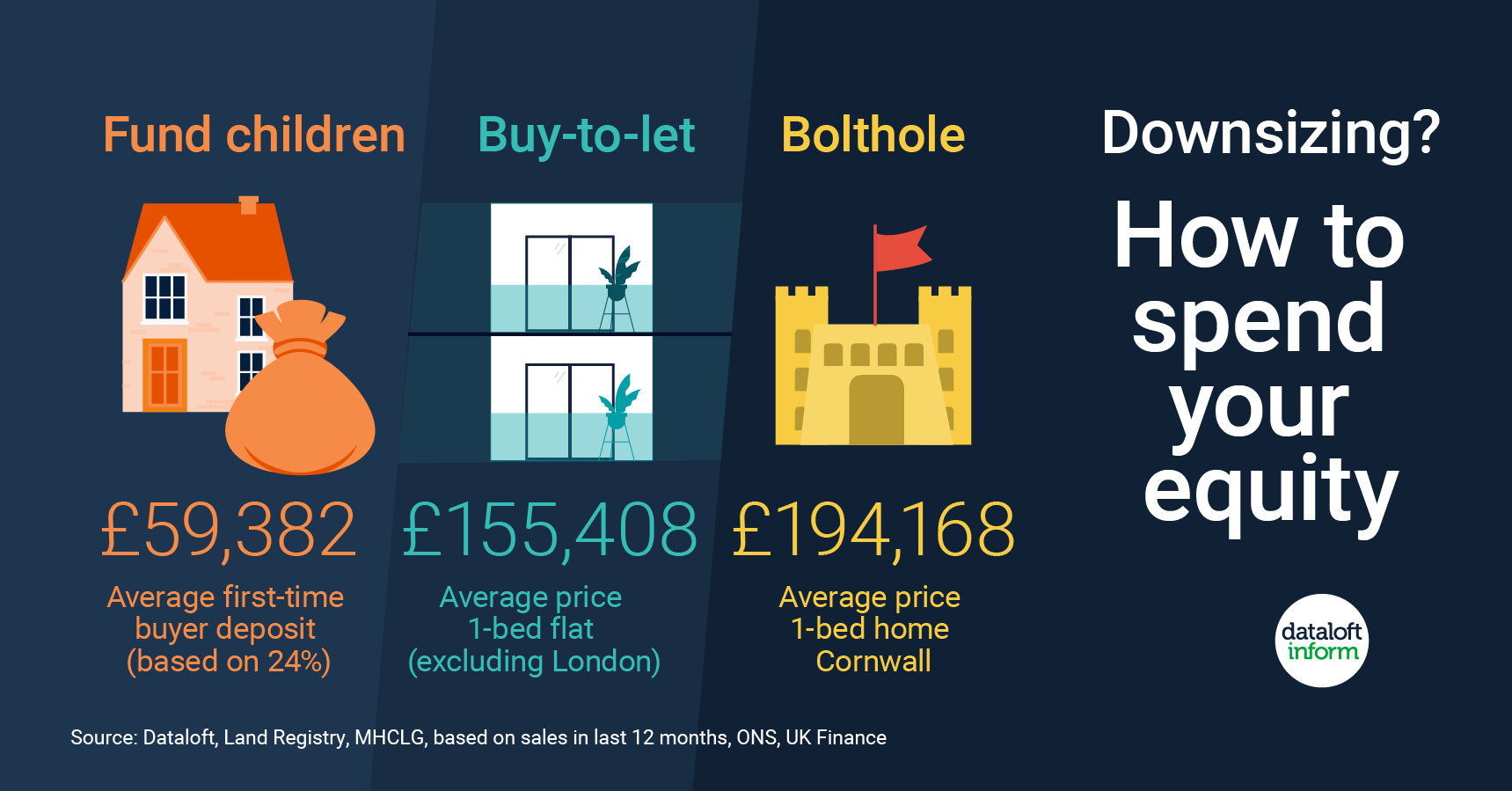

With the equity at their disposal, downsizers have numerous options to consider. Some may choose to invest in additional properties, either as a source of rental income or to provide accommodation for their children. Others may take the opportunity to fulfil lifelong dreams, such as purchasing a holiday home or embarking on a once-in-a-lifetime trip. Many may opt to bolster their retirement savings, thus securing their financial future.

The downsizing trend sweeping through England and Wales is transforming the housing market, impacting Crawley, West Sussex, and other regions alike. With a significant percentage of owner-occupiers now owning their homes outright, downsizing offers an avenue for homeowners to unlock substantial housing equity. The resulting reshuffling of the housing market provides opportunities for both buyers and investors, but also calls for prudent financial planning and advice.

As homeowners consider the possibilities that downsizing presents, it is crucial to seek independent financial advice to make informed decisions. By doing so, they can maximize the benefits of releasing equity, secure their financial future, and embrace a lifestyle that aligns with their evolving needs and aspirations.

Source: Dataloft, Land Registry, MHCLG, based on sales in last 12 months, ONS, UK Finance