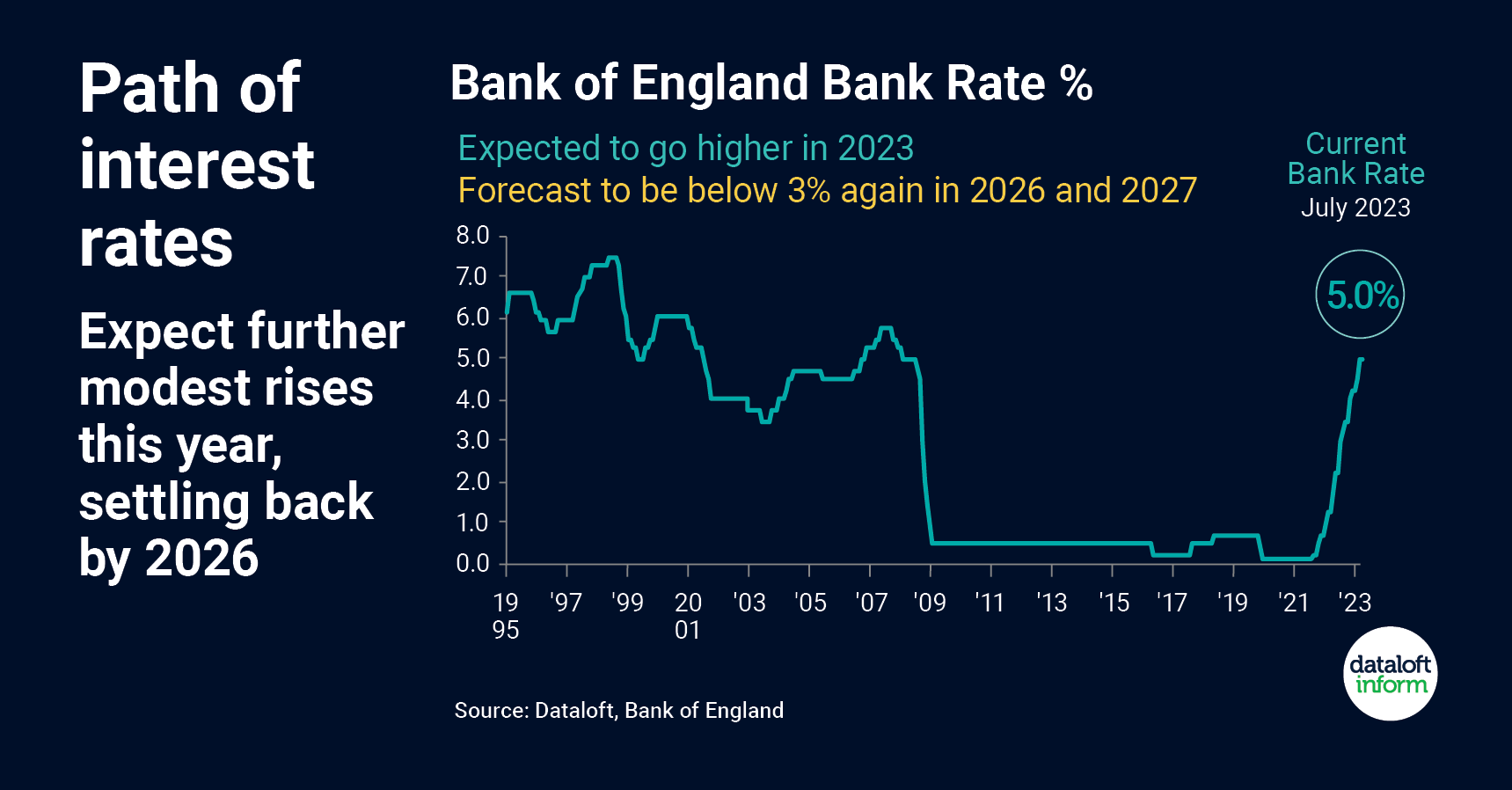

In recent times, borrowers have been grappling with the uncertainty surrounding the rapid increase in interest rates. As of now, the Bank Rate stands at 5%, leaving many wondering where this upward trajectory will end. Experts predict further interest rate hikes in the short term, with an average consensus forecast of 5.6% by the end of this year. However, there is some hope for the long term, as projections indicate a potential decline below 3% again in 2026 and 2027. The steepness of this increase has been likened to the sharp drop observed during the Global Financial Crisis, but promising inflation data from June could offer some glimmers of hope. In this blog post, we'll delve into the current state of interest rates, the potential future scenarios, and how borrowers can navigate this uncertain financial landscape.

The Current Interest Rate Landscape

With the Bank Rate at 5%, borrowers have been grappling with higher borrowing costs across various financial products. Mortgages, personal loans, and credit card rates have all been affected, making it difficult for many to manage their debts. As interest rates rise, it becomes more challenging for borrowers to service their loans and manage their monthly repayments effectively.

Short-Term Projections

Unfortunately, the near future doesn't promise much relief for borrowers. Economists and financial experts predict that interest rates are likely to rise further in the short term. The consensus forecast of an average 5.6% by the end of this year could put added strain on borrowers, leading to reduced spending power and potentially slower economic growth.

Long-Term Outlook

Despite the gloomy short-term projections, the long-term outlook offers a glimmer of hope. Forecasts suggest that the Bank Rate may eventually come down, potentially falling below 3% again by 2026 and 2027. This decline could bring some relief to borrowers burdened by high-interest rates. However, it is essential to remember that these projections are subject to change, depending on various economic factors and policy decisions.

Comparison to the Global Financial Crisis

The sharp increase in interest rates has drawn comparisons to the Global Financial Crisis, a period of economic turmoil that began in 2008. During that crisis, interest rates saw a drastic drop as central banks implemented measures to stimulate the economy. Now, the steepness of the current interest rate rise is reminiscent of that decline, but the context is different. Rather than stimulating a faltering economy, these rate hikes are an attempt to counteract inflation and manage the potential risk of overheating economies.

Inflation Data and its Impact

In June, there was tentative evidence of improving inflation data, which could play a vital role in shaping the long-term interest rate outlook. As inflation is a key determinant of interest rate decisions, any signs of inflation moderating could potentially alleviate the need for more aggressive rate increases in the future. However, inflation is a complex phenomenon influenced by numerous factors, and policymakers will closely monitor its trajectory before making significant interest rate decisions.

Navigating the Uncertainty

For borrowers, the current interest rate environment demands careful financial planning and risk management. Here are some tips to help navigate this uncertain landscape:

Refinancing: Consider refinancing existing loans to take advantage of lower rates or to lock in more favourable terms.

Budgeting: Create a comprehensive budget to track income and expenses. Ensure that you have enough room in your budget to accommodate potential interest rate increases.

Fixed vs. Variable Rates: Understand the pros and cons of fixed-rate and variable-rate loans, and choose the one that best suits your financial situation and risk tolerance.

Emergency Fund: Build or bolster your emergency fund to cushion any financial shocks that may arise from fluctuating interest rates or unexpected events.

Seek Professional Advice: Consult with financial advisors or experts who can provide personalized guidance based on your specific financial circumstances.

The recent rapid rise in interest rates has left borrowers on edge, wondering about the future trajectory of rates and how it will impact their financial well-being. While short-term forecasts predict further increases, the long-term outlook shows some potential for relief. In the meantime, borrowers must exercise caution, plan prudently, and consider professional advice to navigate this uncertain interest rate landscape effectively. Staying informed about economic indicators like inflation data will be crucial in understanding the potential direction of interest rates. Remember, financial prudence and a well-thought-out strategy will be key to weathering these challenging times.