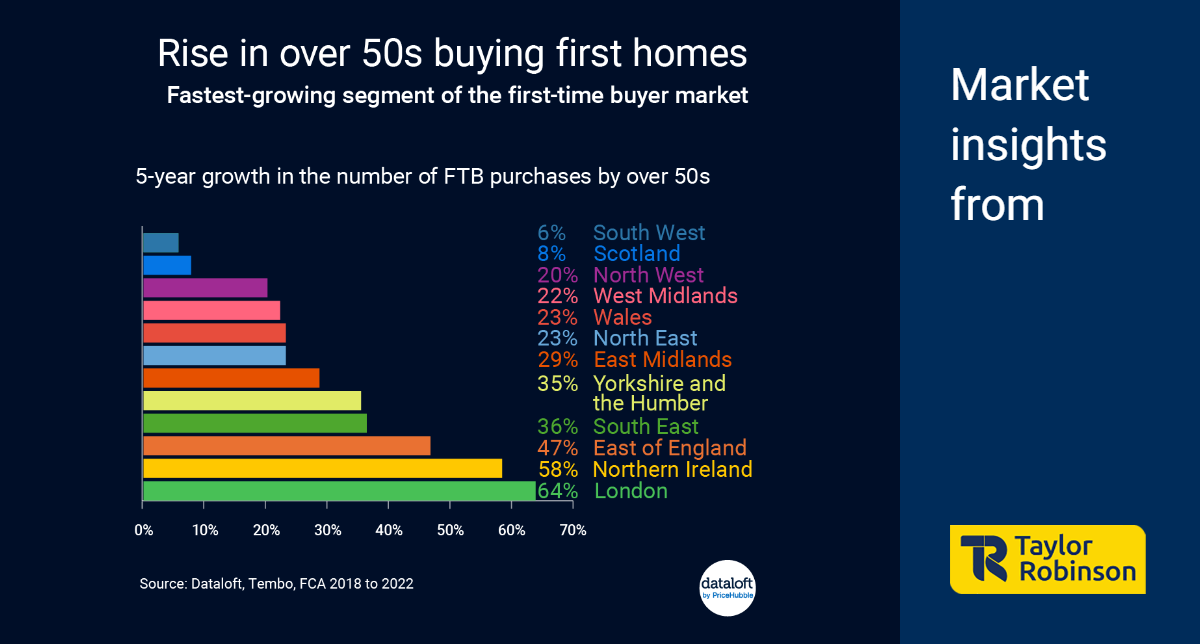

In a striking departure from conventional patterns, there has been a notable surge in individuals aged 50 and above stepping into the realm of first-time homebuyers. Recent data compiled by mortgage specialist Tembo in conjunction with property data company Dataloft reveals a staggering 30% increase in the number of over-50s purchasing their inaugural homes across the UK over the past five years. This contrasts starkly with a 7% decline in younger first-time buyers over the same period.

The trend is particularly pronounced in urban hubs like London, where the figure has soared by an impressive 64%. Moreover, regions such as the South East (36%), the East of England (47%), and even Northern Ireland (58%) have witnessed substantial upticks in this demographic's foray into homeownership.

This burgeoning phenomenon among the over-50 cohort is multi-faceted, reflecting several societal shifts and individual circumstances. Firstly, the prolongation of life expectancy coupled with improved health conditions has rendered individuals more financially stable and empowered to pursue homeownership later in life. Additionally, changing societal norms have seen many delaying major life milestones such as starting a family, thereby deferring the need for homeownership until later stages.

Moreover, the diminishing allure of the buy-to-let market, attributed to regulatory changes and economic uncertainties, has redirected investment intentions towards primary residence acquisition among this demographic. The confluence of these factors has culminated in a notable demographic shift within the property landscape.

The ramifications of this trend extend beyond mere statistical observations, significantly influencing the dynamics of the housing market. Foremost among these is the anticipated surge in demand for smaller, more affordable housing units tailored to the needs and preferences of older first-time buyers. Consequently, this demographic's entry into the market necessitates a re-evaluation of mortgage products and lending practices to accommodate the unique financial profiles and retirement considerations of older borrowers.

In essence, the surge in over-50s embarking on their maiden homeownership journey signals a profound evolution in demographic trends and lifestyle choices. As this demographic continues to assert its presence in the housing market, its impact is poised to reverberate through the property landscape, shaping housing policies, market dynamics, and consumer preferences in the years to come. This paradigm shift underscores the imperative for stakeholders to adapt and innovate in response to the evolving needs of an increasingly diverse and dynamic demographic profile of homebuyers.