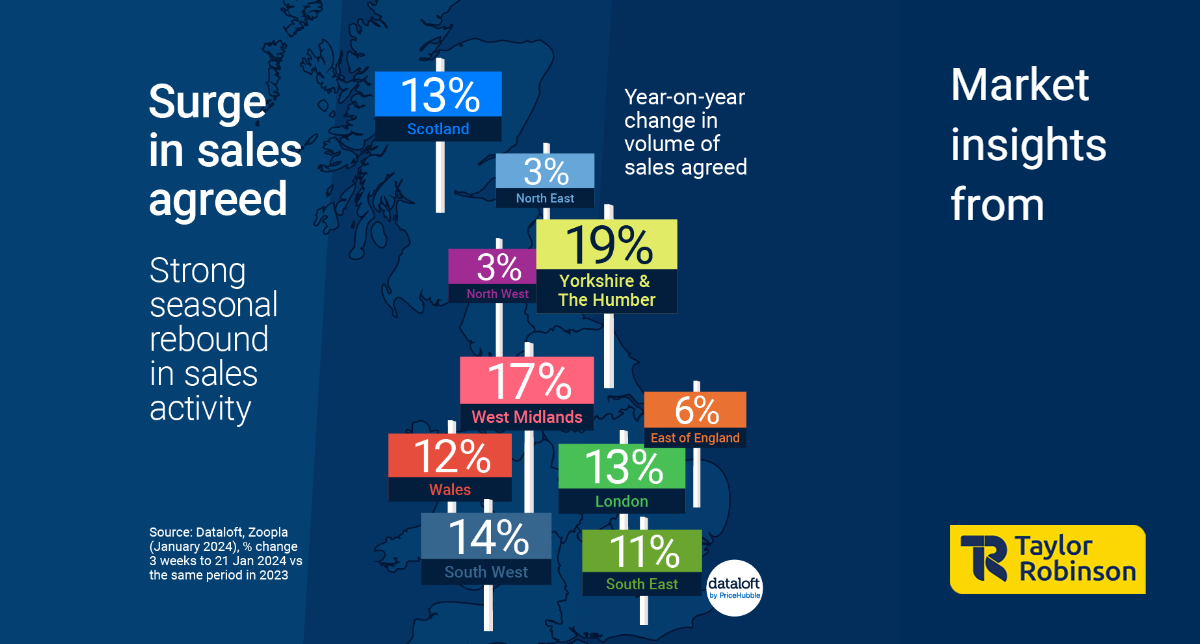

In a promising start to the new year, we at Taylor Robinson, operating from our Crawley office, are witnessing a robust surge in new sales agreements. This significant uptick serves as a crucial indicator of market confidence and activity, reflecting a positive trend in the property sector. According to data obtained from Dataloft and Zoopla for January 2024, new sales agreed have risen by an impressive 13% in the first three weeks, when compared to the same period last year.

National Trends:

The positive momentum in sales activity extends across all regions and countries, with notable spikes in key areas. Yorkshire and The Humber lead the charge with a remarkable 19% increase in new sales agreements, closely followed by the West Midlands, where activity has surged by 17%. These statistics paint a promising picture of a nationwide resurgence in the property market.

Factors Contributing to the Surge:

Several factors contribute to this surge in sales activity. First and foremost, the availability of the best mortgage rates below 4% is a compelling driver, making property ownership more attractive for potential buyers. Additionally, consumer confidence has reached its highest point since January 2022, providing further impetus to the market.

However, it's crucial to acknowledge that this rebound is occurring from a relatively low base, underscoring the challenges the property sector has faced in recent times. The gradual recovery is encouraging, but the market is still navigating its way back to pre-pandemic levels.

Buyer Price Sensitivity:

Despite the overall positive trend, buyers remain particularly price-sensitive. One noteworthy observation is that one in five sellers are willing to accept offers that are more than 10% below the asking price to secure a sale. This trend indicates that while the market is active, buyers are still exercising caution and seeking favourable deals.

In conclusion, the property market is showing signs of resilience and recovery, as evidenced by the increased volume of new sales agreements reported by Taylor Robinson Estate Agents. With mortgage rates at historically low levels and consumer confidence on the rise, the property sector is poised for a positive trajectory in 2024. However, it is essential to remain mindful of the market's sensitivity to pricing, as demonstrated by sellers accepting offers below the asking price. The data sourced from Dataloft, Zoopla (January 2024), and the GfK Consumer Confidence Tracker collectively paint a picture of a market on the mend, cautiously optimistic about the future.