Blog

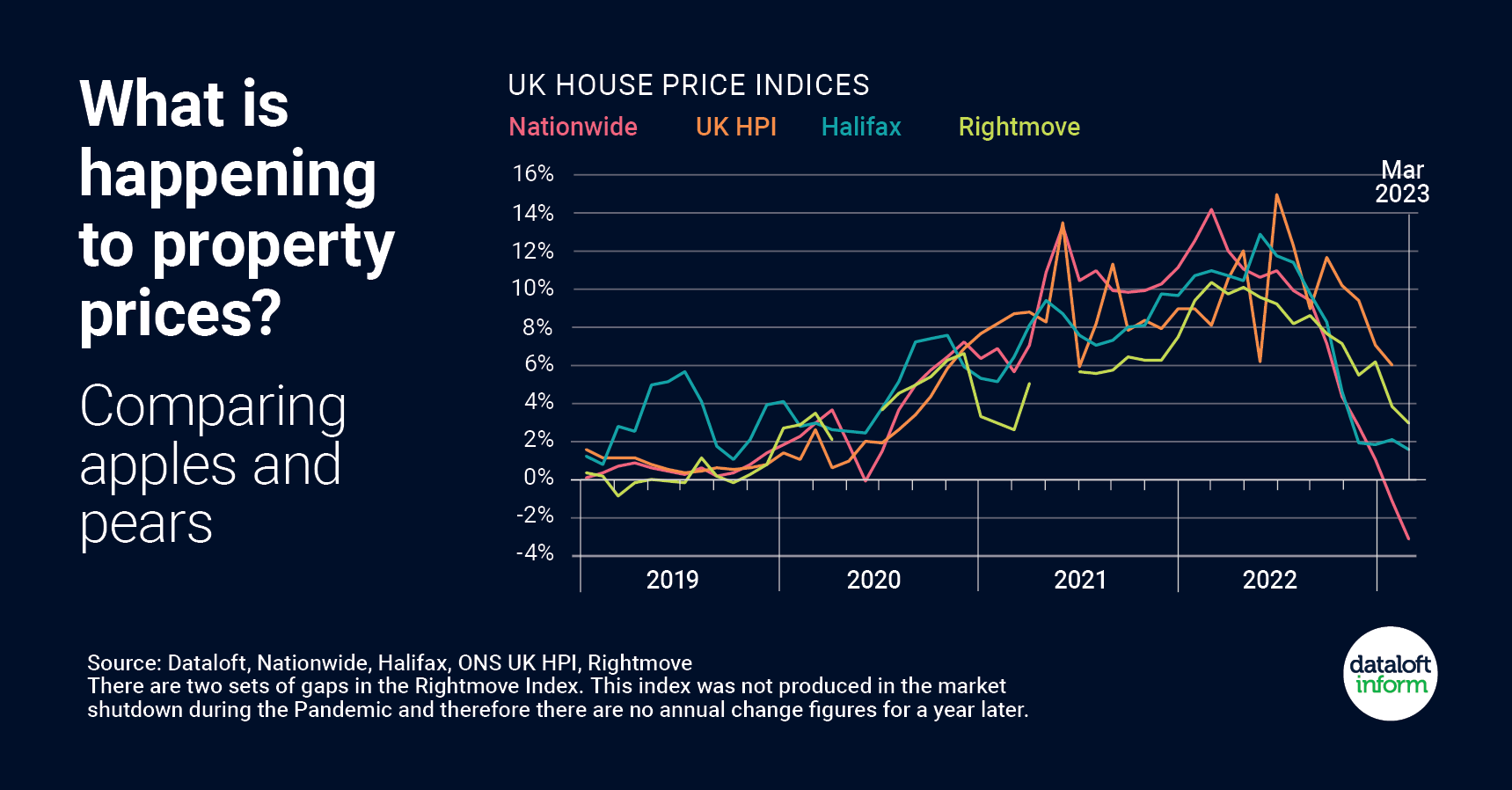

When it comes to tracking property prices in the UK, there are several organisations that publish data on average property prices and annual price growth. However, the figures can differ quite significantly, which can cause confusion for those looking to buy or sell a property. In this article, we'll take a closer look at why these variations occur and what they mean for the property market.

One of the most well-known organisations that tracks property prices is Rightmove. Their average prices tend to be the highest, but this is because their index is based on the asking prices of newly listed properties, rather than on sales prices. This means that the figures are not necessarily reflective of what properties are actually selling for. Rightmove records around 100,000 new listings each month, so their data is based on a large sample size.

In comparison, the Office for National Statistics (ONS) UK House Price Index (HPI) uses final sales prices, including for cash and mortgage sales, recorded by the Land Registry. This means that their data is based on actual sales prices and is therefore considered to be more accurate than Rightmove's data. The ONS HPI includes around 80,000-100,000 sales per month.

Other organisations that track property prices include Halifax and Nationwide. Both of these organisations use their own mortgage applications at the approval stage to gather data on property prices. This means that their data is also based on actual sales prices, but is limited to the properties that have been sold to those who have applied for a mortgage with them. Nationwide tends to have the lowest average price quoted, while Halifax's figures tend to be slightly higher.

The variations in the source of the data, as well as the statistical calculations that make up each index, explain the differences in the figures published by these organisations. Comparing the indexes against each other is like comparing apples with pears, and it's important to bear this in mind when looking at the data.

However, despite the variations in methodologies, the overall trend direction noted by each organisation is usually similar. This means that the property market is generally moving in the same direction, regardless of which organisation's data you look at. It's this overall trend that's important when considering what's happening in the current market.

In conclusion, while there are several organisations that track property prices in the UK, their data can differ significantly due to variations in the source of the data and the statistical calculations used. However, by looking at the overall trend direction noted by each organisation, we can get a good sense of what's happening in the property market. Whether you're looking to buy or sell a property, it's always a good idea to do your own research and consider the data from multiple sources to get a more accurate picture of the market.

If you would like to know the value of your property call us today on 01293552388

- Details

- Hits: 474

Rightmove is a popular property website that provides good information about properties available for sale or rent. The website allows users to search for properties based on location, price range, number of bedrooms, and other criteria, some of that data is what this article is going to look at, specifically the market activity for RH10 which has always been a popular location in Crawley. This article will provide an overview of the investment activity in RH10, based on the data provided by Rightmove for the period between 1st March and 31st March.

RH10 Property Prices

According to Rightmove's data, the average property prices in RH10 for houses with different numbers of bedrooms are as follows:

- 1 bedroom: £220,540

- 2 bedroom: £389,149

- 3 bedroom: £484,038

- 4 bedroom: £578,330

- 5 bedroom: £735,781

According to Rightmove's data, the average property prices in RH10 for flats with different numbers of bedrooms are as follows:

- 1 bedroom: £193,433

- 2 bedroom: £241,028

- 3 bedroom: £320,000

Compared to the neighbouring RH11 area, the prices in RH10 are higher for most property sizes.

RH10 Rental Prices

The average rental prices in RH10 for houses and flats with different numbers of bedrooms are as follows:

- House:

- 1 bedroom: £915

- 2 bedroom: £1,368

- 3 bedroom: £1,642

- 4 bedroom: £2,033

- Flat:

- 1 bedroom: £1,111

- 2 bedroom: £1,353

The data shows that the rental prices in RH10 are higher than in RH11, which has an average of £320,000 for a 3-bedroom house. This suggests that the demand for rental properties in RH10 is higher than in RH11, which could be due to the proximity of the Gatwick airport or the town's good transportation links.

RH10 Investment Potential

RH10's high property prices and rental yields make it an attractive investment option for property investors, which we have seen constantly throughout the years at Taylor Robinson.

Conclusion

RH10 is a high-demand area for both buying and renting properties. The area's proximity to Gatwick airport and good transport links makes it attractive for people who work in the travel, hospitality industries and for many commuters due to the good links to London via Three Bridges Station. The high rental yields and property prices make it an attractive investment option for property investors.

If you are thinking about buying a property to let out or have one currently available, please call Ben on 01293552388.

- Details

- Hits: 387

Being a landlord in the UK comes with significant legal responsibilities. From ensuring the property is safe and habitable to protecting tenant deposits, there are many legal requirements that landlords must comply with. Here are a few of the key legal responsibilities of being a landlord in the UK:

- Providing a safe and habitable property: Landlords have a legal obligation to provide their tenants with a safe and habitable property. This includes ensuring that the property meets all health and safety requirements (Fitness for Human Habitation Act 2018), Landlords must also ensure that the property is free from hazards, such as mould or dampness, and that it meets the minimum standards for amenities and utilities.

- Conducting annual gas safety checks: Landlords are required by law to have an annual gas safety check carried out by a Gas Safe registered engineer. This ensures that all gas appliances, fittings, and flues in the property are safe and in good working order.

- To serve the tenant(s) with a copy of the latest How to Rent Guide (last updated 24th March 2023), a booklet issued by the government detailing a checklist for tenants when renting, is one of the very first actions you must take before renting out a house in England.

- Protecting tenant deposits: Landlords must protect any deposits paid by their tenants in a government-approved deposit protection scheme within a certain timeframe. This is a legal requirement, and failure to comply can result in legal action and fines and the inability to legally remove a tenant.

- Carrying out repairs and maintenance: Landlords are responsible for carrying out repairs and maintenance to their properties, and for ensuring that any issues are addressed in a timely manner. This includes fixing any structural problems, repairing appliances, and maintaining the exterior of the property.

- Providing tenants with an Energy Performance Certificate (EPC): Landlords are required by law to provide their tenants with an EPC when they move into the property. This certificate rates the energy efficiency of the property and provides recommendations for improving its efficiency.

- Provide the tenants with a valid Electrical Safety Certificate (EICR): Landlords are required by law to provide their tenants with an EICR when they move into the property.

- Conducting right to rent checks: Landlords are required to conduct right to rent checks on all tenants to ensure that they have the legal right to rent property in the UK. This involves checking tenants' immigration status and verifying their identity.

- Complying with fire safety regulations: Landlords are responsible for complying with fire safety regulations, including providing smoke alarms on every floor of the property, ensure a carbon monoxide alarm is equipped in any room used as living accommodation which contains a fixed combustion appliance (excluding gas cookers) along with any solid fuel burning appliances (including open fire places) and ensuring that any furnishings and materials used in the property are fire-safe.

In addition to these legal responsibilities, landlords must also comply with various other regulations and requirements, such as providing tenants with a copy of the tenancy agreement and protecting their privacy rights. Failure to comply with these legal obligations can result in legal action, fines, and damage to the landlord's reputation.

Overall, being a landlord in the UK requires a thorough understanding of the legal responsibilities and requirements involved. By fulfilling these obligations, landlords can provide their tenants with a safe and secure place to live while protecting their own interests and investment, which is why using a trusted letting agent like Taylor Robinson to let and manage your property is vital.

If you have a property to let or are concerned that you may not be fully compliant on your current let please call Ben on 01293552388.

- Details

- Hits: 496

The UK property market has seen some interesting changes in recent years, with fluctuations in supply and demand. However, recent data suggests that the market is returning to normal, with properties selling faster than ever before.

According to a report by Rightmove, the average time taken to sell a property (from listing to sold subject to contract) is just 55 days, nearly two weeks faster than the last so-called 'normal' market of 2019, which saw properties take an average of 67 days to sell. This is great news for sellers, who can expect to see their properties sell quickly and efficiently.

Furthermore, the number of sales agreed in March 2023 is just 1% lower than in March 2019, indicating that the market is recovering well. Buyer demand is also up, with an 8% increase compared to 2019. This suggests that buyers are still eager to enter the property market.

Interestingly, smaller properties of two bedrooms or less are proving the most sought after at present. Sales agreed in this sector are up 4%, and demand is 11% higher than in 2019. This could be due to a number of factors, including a rise in remote working, which has led to more people seeking out smaller, more affordable properties that offer a better work-life balance.

In terms of location, properties are currently selling more quickly than the national average in the North East, West Midlands, Yorkshire and the Humber, and the South West, according to data from Dataloft and Rightmove. This suggests that these regions are experiencing a surge in demand and could be great places for sellers to target.

Overall, the data suggests that the UK property market is returning to a more normal state. With properties selling faster than ever before and buyer demand remaining strong, it's a great time for sellers to list their properties and for buyers to enter the market. However, as always, it's important to do your research and work with a trusted estate agent like Taylor Robinson who have been open in Crawley since 1991 to ensure that you get the best possible outcome for your individual circumstances.

- Details

- Hits: 481

Over 60% of properties placed on the rental market in the UK are being rented out within a week of being listed, according to a recent poll of subscribers conducted by Dataloft. The poll also revealed that one in six properties is being let out within three days, which highlights the increasing demand for rental properties in the UK and this is something we are very much seeing in Crawley.

Over 60% of properties placed on the rental market in the UK are being rented out within a week of being listed, according to a recent poll of subscribers conducted by Dataloft. The poll also revealed that one in six properties is being let out within three days, which highlights the increasing demand for rental properties in the UK and this is something we are very much seeing in Crawley.

Moreover, the poll indicated that less than 3% of properties are currently on the market for more than two weeks. This indicates that the rental market is highly competitive, with properties being rented out almost immediately after being listed.

The survey also highlighted the preferred ways renters wish to be contacted by agents if there is a new property on the market that meets their requirements. The poll revealed that email is the preferred mode of contact for 65% of renters, followed by phone at 22%, and WhatsApp at 12%. These preferences reflect the increasing use of digital communication in the real estate industry.

The anticipated rental price growth is also a significant trend highlighted by the poll, as it is expected to outpace sales price growth in the UK market over the next five years. This indicates that the rental market is expected to remain strong in the coming years.

The data suggests that the current demand for rental properties in the UK is high, and the market is competitive. As such, renters looking for properties need to be vigilant and quick to act when suitable properties become available. Likewise, landlords must ensure that they are keeping up with the latest trends and using digital communication channels to reach potential renters quickly.

In conclusion, the Dataloft poll provides valuable insights into the current state of the UK rental market, which puts Taylor Robinson in a better position to assist you with the letting of your investment property. With the demand for rental properties remaining high, if you have a property you are looking to let out, please call Ben on 01293 552 388.

- Details

- Hits: 539