Blog

If you're thinking of buying a rental property in the Crawley, one of the first decisions you'll need to make is whether to buy it in your own name or in a company name. Each option has its own advantages and disadvantages, so it's important to consider your circumstances and goals before making a decision.

Buying in your own name:

One of the main advantages of buying a rental property in your own name is simplicity. You'll own the property personally, so there are no complex legal structures or additional paperwork to worry about. This can make the buying process quicker and easier, and can also make it easier to get a mortgage.

Another advantage of buying in your own name is flexibility. You'll be able to choose how to manage the property and how to allocate any rental income or capital gains. You'll also be able to sell the property whenever you choose, without having to worry about company structures or tax implications.

However, there are also some downsides to buying a rental property in your own name. One of the main disadvantages is the potential tax implications. If you own the property personally, you'll be liable for income tax on any rental income you receive, as well as capital gains tax if you sell the property at a profit. This can be a significant amount of tax, depending on your circumstances and the value of the property.

Buying in a company name:

Another option when buying a rental property in Crawley is to buy it in a company name. This can offer several advantages, including reduced tax liabilities and increased protection.

One of the main advantages of buying in a company name is that the company will be liable for any tax on rental income or capital gains, rather than you personally. This can result in a lower overall tax liability, especially if you're a higher rate taxpayer.

Another advantage of buying in a company name is increased protection. If the property is owned by a company, your personal assets will be protected if the company is sued or becomes insolvent. This can provide peace of mind for landlords who are worried about potential liabilities.

However, buying a rental property in a company name also has some disadvantages. One of the main drawbacks is the increased complexity of the buying process. You'll need to set up a company, which can involve legal and administrative costs, and you'll need to comply with additional regulations and reporting requirements.

In addition, buying in a company name can make it more difficult to get a mortgage. Lenders may view company structures as riskier than personal ownership, and may require higher deposits or charge higher interest rates.

In conclusion, there are pros and cons to buying a rental property in your own name versus in a company name. Buying in your own name can be simpler and more flexible, but can result in higher tax liabilities. Buying in a company name can offer reduced tax liabilities and increased protection, but can be more complex and may make it more difficult to get a mortgage. It's important to carefully consider your circumstances and goals before making a decision.

If your are thinking of buying a buy to let and want some free impartial advice, call Ben on 01293552388

- Details

- Hits: 423

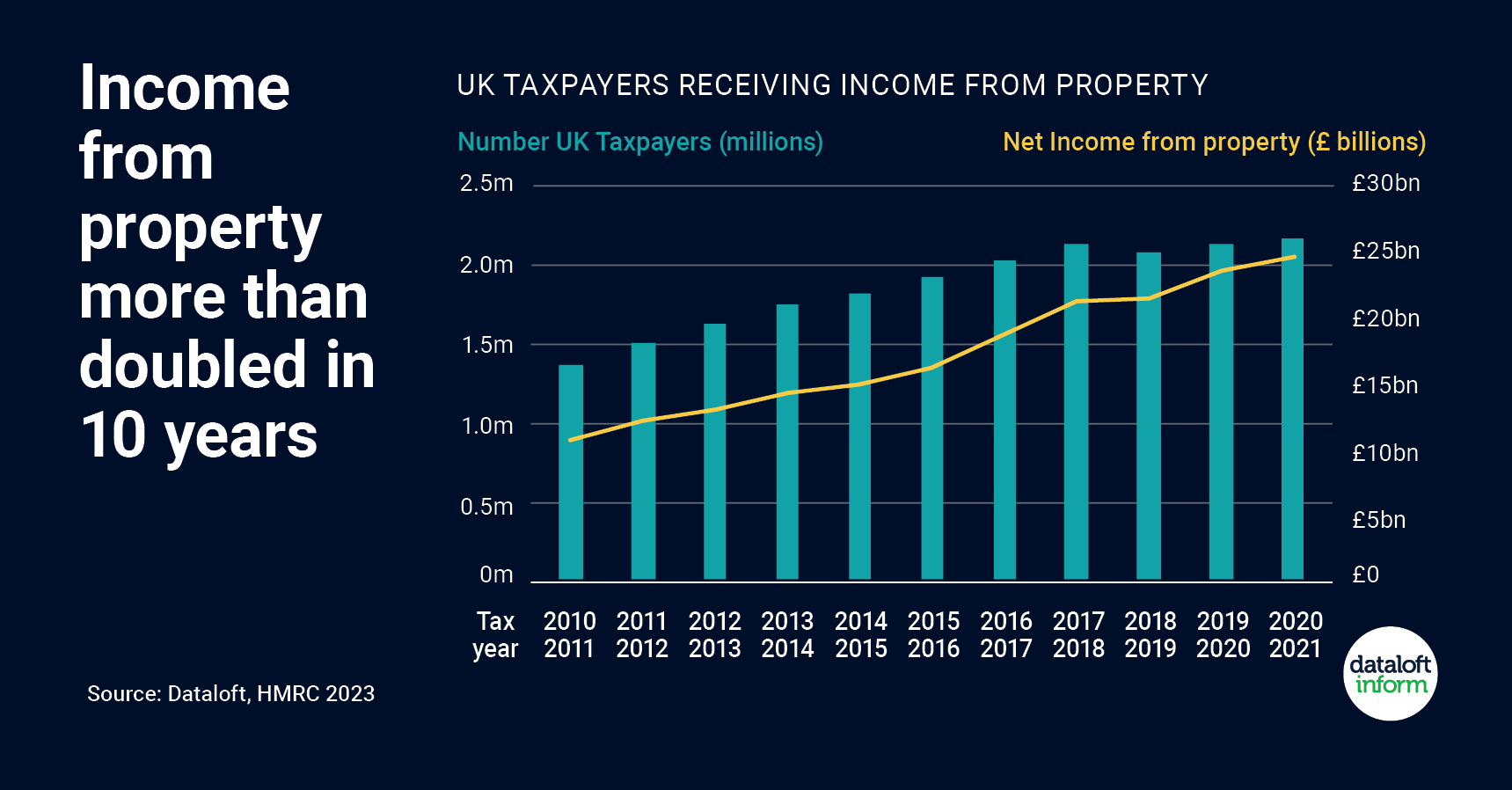

Property is still a good investment despite all the doom and gloom. The latest data released by HMRC (Her Majesty's Revenue and Customs) reveals that over 2.1 million UK taxpayers received income from property in the tax year 2020/21. These taxpayers received a total net income of £24.5 billion (net), which is up by 5% compared to the previous year. This is despite the effects of the landlords' interest restriction, which was phased in since 2017/18.

On average, each taxpayer received a net income of £11,400 from their property. This figure is a result of deducting allowable expenses from their gross rental income. Allowable expenses include letting agent fees, repairs, and maintenance costs, among others.

Moreover, 50% of individuals received between £20,000 and £50,000 in total gross income, while one in eleven received £100,000 or more. These high-earning individuals accounted for over 19% of the total net income received.

Interestingly, the number of UK taxpayers receiving an income from property has risen by close to a quarter of a million in the past 5 years. This suggests that investing in property is still an attractive option for many individuals, despite the various tax changes and increased regulations in recent years.

These findings were sourced from a report by Dataloft, which used HMRC data for the tax year 2020/21. The report provides valuable insights into the UK's property market and the income generated by landlords and property investors.

The report highlights that the income generated from property can provide a reliable source of income, which is especially important in today's economic climate. However, it is crucial to ensure that landlords and property investors are aware of their tax obligations and comply with the relevant regulations.

In conclusion, the latest data released by HMRC indicates that income from property remains a significant source of income for over 2.1 million UK taxpayers. The rise in the number of individuals receiving an income from property suggests that it is still an attractive investment option. However, it is important to remain informed about the tax changes and regulations in the property market to ensure compliance with the law.

If you would like to discuss property investment, please call Ben on 01293552388

- Details

- Hits: 420

Crawley is primarily made up of 2 key postcodes, RH10 and RH11 which both offer great investment opportunities for property buyers and investors. However, understanding the property market activity in these areas is crucial before making any investment decisions. In this article, we will compare the property market activity in RH10 and RH11 based on the data provided by Rightmove for the period between 1st March and 31st March 2023, in previous posts we have broken these down individually.

Property Prices

According to Rightmove's data, the average property prices in RH10 for houses with different numbers of bedrooms are as follows:

1 bedroom: £220,540

2 bedroom: £389,149

3 bedroom: £484,038

4 bedroom: £578,330

5 bedroom: £735,781

Meanwhile, in RH11, the average property prices for the same period are:

1 bedroom: £228,841

2 bedroom: £360,441

3 bedroom: £385,889

4 bedroom: £480,112

5 bedroom: £656,006

Compared to RH11, RH10 has higher property prices for most property sizes, particularly for houses with 3 bedrooms or more. However, both areas offer similar prices for 1 and 2-bedroom properties.

Rental Prices

The average rental prices in RH10 for houses and flats with different numbers of bedrooms are as follows:

House:

1 bedroom: £915

2 bedroom: £1,368

3 bedroom: £1,642

4 bedroom: £2,033

Flat:

1 bedroom: £1,111

2 bedroom: £1,353

On the other hand, in RH11, the average rental prices for the same period are:

House:

1 bedroom: £841

2 bedroom: £1,308

3 bedroom: £1,642

4 bedroom: £1,916

Flat:

1 bedroom: £982

2 bedroom: £1,295

3 bedroom: £1,400

The data shows that rental prices in RH10 are generally higher than in RH11, particularly for flats with 2 bedrooms or more. This indicates that the demand for rental properties in RH10 is higher than in RH11. Its interesting to note that 3 bedroom houses have the same average price for both areas, this is because of the incredible demand for 3 bedroom houses in Crawley we are seeing, families are the most common form of households in Crawley making up 41.6% of all households

Property Supply

In short there isn’t enough rental properties to go round! In RH10, 64 new flats and 25 new houses were added to Rightmove for lettings, while 116 new houses and 42 new flats were added for sale. Meanwhile, in RH11, 18 new flats and 25 new houses were added for lettings, and 89 new houses and 21 new flats were added for sale. Again, it goes to show how little properties there are currently available to rent with only a combined 132 properties made available during the month. To show a comparable we have around 300 new applicants a month register looking for a property for rent. The data suggests that the sales market is more active in RH11, with more houses being put up for sale than flats. Meanwhile, in RH10, there is a more balanced supply of houses and flats, although there are more houses available for sale then flats.

Yield

The rental yield for both arears is 4.97% based on data from March 2023, however it would appear that RH10 offers greater capital growth.

Conclusion

Both RH10 and RH11 offer great investment opportunities for property buyers and investors, if you would to discuss tenant demand and trends for your potential investment property call Ben on 01293552338.

- Details

- Hits: 488

Following on from our look at the Rightmove.co.uk information on RH10 we are now reviewing their property information for RH11 for the same period. RH11 is a desirable investment area for property investors. Located in the Crawley area, RH11 has seen a steady growth in the property market in recent years. In this article, we will look at the latest market activity in the area based on the data from March 2023.

Property Prices in RH11

According to Rightmove, the average house prices in RH11 for properties added to the website between 1st March and 31st March 2023 were as follows:

1 bedroom - £228,841

2 bedroom - £360,441

3 bedroom - £385,889

4 bedroom - £480,112

5 bedroom - £656,006

The average flat prices in RH11 for the same period were:

1 bedroom - £180,373

2 bedroom - £230,888

3 bedroom - £275,256

It's worth noting that these prices are averages and can vary depending on the location, condition, and size of the property.

Property Rents in RH11

For rental properties in RH11 added to Rightmove between 1st March and 31st March 2023, the average rents were:

1 bedroom - £841

2 bedroom - £1,308

3 bedroom - £1,642

4 bedroom - £1,916

For flats, the average rents were:

1 bedroom - £982

2 bedroom - £1,295

3 bedroom - £1,400

The rental yields in RH11, based on the above data, were 4.97%. This yield represents the average return on investment a landlord can expect to receive from rental income, expressed as a percentage of the property value. This yield is relatively healthy and is likely to attract investors seeking to invest in the area.

Property Supply in RH11

During March 2023, 43 new properties were added to Rightmove for lettings in RH11, comprising of 18 flats and 25 houses. In addition, 110 new properties were added for sale, comprising of 21 flats and 89 houses. The above data shows that the rental market in RH11 is relatively stable, with a reasonable supply of properties available for lettings however this is still considerably lower than previous months. The sales market is also active, with a higher number of houses being put up for sale compared to flats.

Conclusion

RH11 remains a popular investment area for property investors, with a steady growth in the market. The data from March 2023 shows that property prices, rental yields, and supply in the area are all relatively healthy, making it an attractive location for property investors seeking to expand their portfolio. However, as with any investment, it is important to conduct thorough research and seek professional advice before making any investment decisions.

If you have seen a property you think would make a good investment and want some impartial advice, Call Ben on 01293552388

- Details

- Hits: 472

Charles III, King of the United Kingdom and the Commonwealth Realms, is set to be crowned in a grand ceremony at Westminster Abbey on Saturday, 6th May. This will be the 40th coronation to be held at the Abbey since the Norman Conquest in 1066, and it promises to be a momentous occasion that will be remembered for years to come.

The coronation of a new monarch is always a significant event, and this one is no exception. It marks the beginning of a new era for the United Kingdom, as Charles III prepares to take on the responsibilities of the monarchy. The ceremony itself is steeped in tradition, with many aspects of it dating back centuries. It is a powerful symbol of continuity and stability, which is especially important in a time of rapid change.

The coronation also has a significant impact on the property market, with sales of properties on streets with coronation-related names surging in the lead-up to the event. In the past two years alone, there have been over 8,800 property sales on such streets, with nearly 100 sales involving properties with the address 'King Charles'. Interestingly, properties with 'King' in the street name achieved an average sales price of just over £500,000, compared to 'King Charles' at £360,000 and 'Coronation' at £226,000.

The coronation is also an opportunity for neighbourhoods across the country to come together and celebrate. The Coronation Big Lunch and Big Help Out events are being promoted as a way for communities to get involved and show their support for the new king. According to surveys conducted by Property Academy Home Moving Trends, more than 80% of home movers rate pleasant neighbours as important when choosing a property to buy, while 3 in every 4 value a sense of community. These events provide an excellent opportunity for communities to come together and create a sense of belonging.

The coronation of Charles III as King of the United Kingdom and the Commonwealth Realms is a historic event that will be watched by millions of people around the world. It marks the beginning of a new era for the monarchy, and it has a significant impact on the property market and communities across the country. The ceremony itself is steeped in tradition and symbolism, and it is a reminder of the continuity and stability that the monarchy represents.

- Details

- Hits: 499