Blog

Crawley has seen a significant increase in the average rent over the last 12 months. According to recent data, the average rent achieved for homes let in Crawley during this period was £1,185 per month, which represents a 10% increase from the previous 12-month period.

It is interesting to note that flats accounted for 52% of homes let in the past 12 months in Crawley, achieving an average rental value of £1,050 per month. On the other hand, houses achieved a higher average rent of £1,392 per month.

In terms of demographics, 23% of renters in Crawley are aged between 25 and 29. This suggests that the town may be particularly attractive to younger renters, possibly due to its proximity to London and other major cities in the South East of England such as Brighton. The average age of renters in Crawley is 35 years old, according to recent data. This indicates that the town's rental market appeals to a broad range of age groups, from young professionals to families and retirees.

In the past 12 months, there have been a significant number of renters in Crawley, suggesting that the demand for rental properties in the town remains high. This may be due to a range of factors, such as the town's location, transport links, and amenities, which make it an attractive place to live for many people.

As Crawley continues to develop and grow, it will be interesting to see how the rental market evolves to meet the changing needs and preferences of its residents, both in terms of age and lifestyle. However, the current data suggests that Crawley remains a popular and desirable location for renters, with a diverse and vibrant rental market.

Despite the increase in rent, Crawley remains an attractive location for renters looking for affordable housing options outside of London. The town is well-connected, with excellent transport links to London and other nearby cities. Additionally, Crawley offers a range of amenities and attractions, including the historic Crawley Museum, the Tilgate Nature Centre, and the K2 Leisure Centre.

Overall, the recent increase in average rent in Crawley may reflect the town's growing popularity as a residential location, particularly among young renters. As the town continues to grow and develop, it will be interesting to see how the rental market evolves and adapts to meet the changing needs and preferences of its residents.

If you have a property to let and need to find suitable tenants, call Ben on 01293552388.

- Details

- Hits: 591

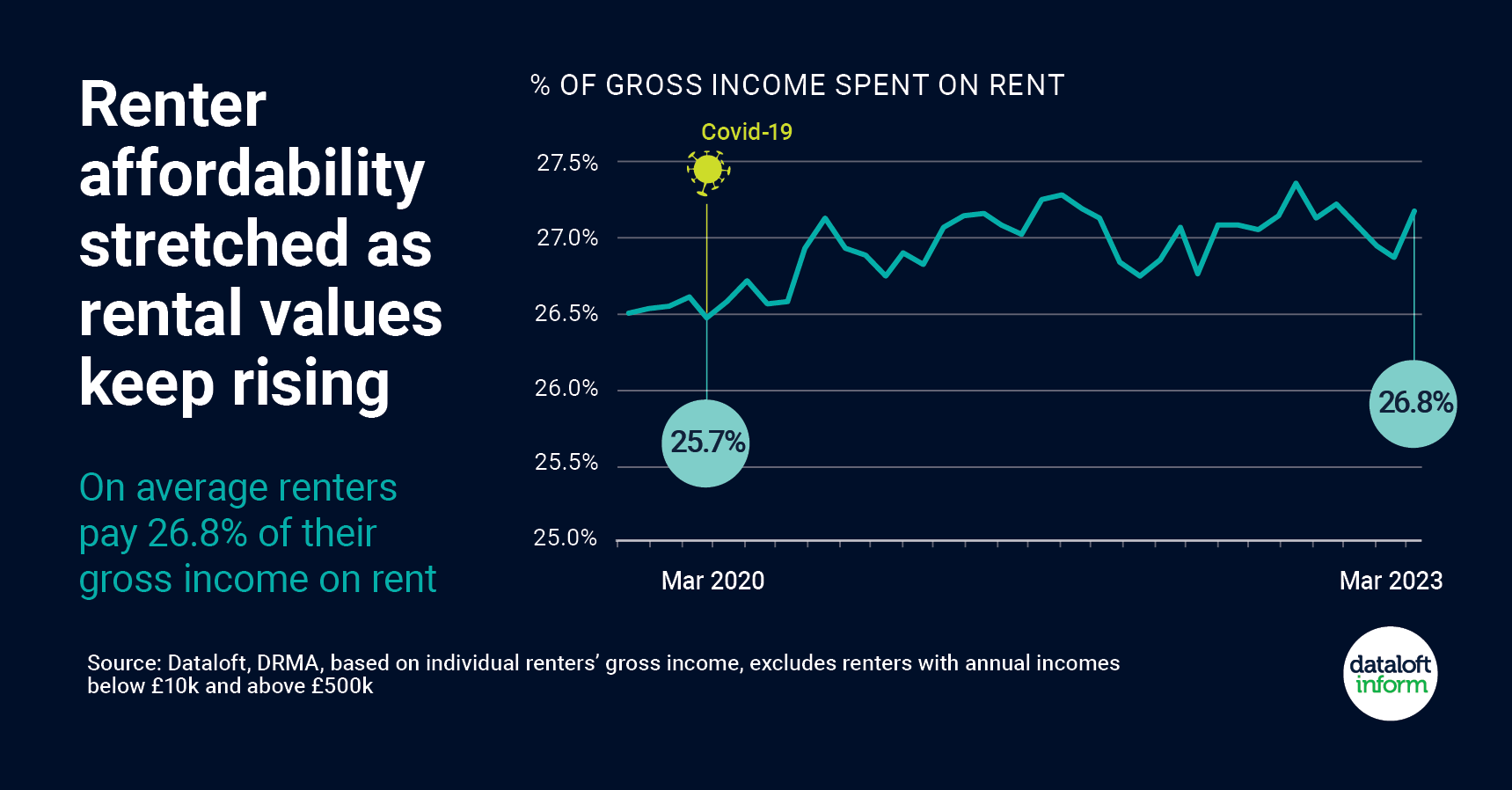

The affordability of renting is increasingly becoming a concern for many tenants, as growth in private rental prices continues to outpace wage increases. According to recent data, on average, renters now pay 26.8% of their gross income on rent, compared to 25.7% three years ago.

The annual rental growth rate in the UK was 9.8% in the year to March, Crawley itself was slightly higher than that at 10.4% for the same period based on new private tenancies. The Office for National Statistics (ONS) recorded growth of 4.9%, which includes pre-existing tenancies and new lets. This suggests that rental price growth is currently stronger than wage growth, which was at 6.6% from December to February. This puts additional pressure on household incomes, particularly as wage growth was also lower than inflation during this period.

The latest survey of agents by the Royal Institution of Chartered Surveyors (RICS) indicates that demand for rental properties is continuing to outpace available supply. This demand-supply imbalance is a key factor driving rental price growth. However, rising affordability ratios are likely to start to limit rental growth, as tenants struggle to afford further increases.

Despite this, there are some potential solutions that could ease the rental affordability crisis. The government could introduce measures to increase the supply of affordable housing, such as incentives for property developers to build more rental homes and to introduce better incentives for landlords to keep their current investments and to potentially buy more rental properties.

Another possible solution is for tenants to consider house sharing, which would help to reduce individual rental costs. Similarly, renters could also consider moving to areas with lower rental prices, although we understand this may not be practical for everyone.

In conclusion, rising rental prices are putting pressure on tenant affordability, and growth in rental prices is currently stronger than wage growth. While demand for rental properties continues to outpace supply, affordability ratios are likely to limit rental growth in the future.

If you have a rental property you are looking to let out, please call Ben on 01293 552 388.

- Details

- Hits: 492

Managing a rental property can be a time-consuming and complex task, especially for landlords who are new to the rental market or who have multiple properties to manage. That's why many landlords in the UK choose to use a letting agent to manage their properties. Here are some reasons why using a letting agent can be a smart move for landlords:

- Time-saving: One of the biggest benefits of using a letting agent is that it can save landlords a lot of time. A letting agent can handle everything from advertising the property to finding tenants, conducting viewings, and managing repairs and maintenance. This can free up landlords' time to focus on other tasks or simply enjoy their free time.

- Tenant selection: Letting agents have access to a wider pool of potential tenants than individual landlords, which means they can be more selective when choosing tenants. This can help landlords find tenants who are more reliable, have a better credit history, and are more likely to pay their rent on time.

- Legal compliance: The rental market in the UK is highly regulated, and landlords must comply with a range of laws and regulations. A letting agent can help landlords navigate this complex regulatory landscape and ensure that they are in compliance with all relevant laws.

- Rent collection: Letting agents can handle rent collection on behalf of landlords, which can be a big relief for landlords who find this aspect of property management challenging. Letting agents can also handle late payments and pursue tenants who fall behind on their rent.

- Property management: Letting agents can handle all aspects of property management, from conducting regular inspections to arranging repairs and maintenance. This can help ensure that the property is well-maintained and that any issues are addressed quickly and efficiently.

- Marketing: Letting agents have access to a range of marketing channels, including online listings, social media, and print advertising. This can help ensure that the property is seen by as many potential tenants as possible, increasing the chances of finding a suitable tenant quickly.

In conclusion, using a letting agent like Taylor Robinson to manage your rental property can be a smart move for landlords in Crawley. Letting agents can save landlords time, help with tenant selection, ensure legal compliance, handle rent collection, manage the property, and market the property effectively. By using Taylor Robinson, landlords can ensure that their properties are well-managed and that they get the best possible return on their investment.

- Details

- Hits: 405

When it comes to selling a property, choosing the right estate agent is crucial. But what factors influence a vendor's decision when selecting an agent? According to the Property Academy Home Moving Trends Survey 2022 conducted by Dataloft, professionalism and knowledge were the top reasons why prospective vendors choose their agents, regardless of their age or experience as sellers.

It's not surprising that professionalism and knowledge are critical factors for vendors when selecting an estate agent. After all, selling a property is a significant financial and emotional decision, and vendors want to work with someone who is experienced, reliable, and knowledgeable about the local property market. A professional estate agent can provide valuable insights into the market conditions, help vendors set realistic expectations, and offer guidance on how to present the property in the best possible light.

However, when it comes to the most cited reason for choosing an agent, the survey found that it was 'confidence in an agent's ability to market my property,' followed by 'liked and trusted them.' These findings indicate that vendors want an estate agent who can effectively promote their property to potential buyers and someone they feel comfortable working with. This suggests that while knowledge and professionalism are important, personal relationships and communication skills are also critical in building trust and ensuring a successful sale.

Interestingly, the survey also found that 37% of vendors include 'pleased with their valuation' in their top 5 reasons for selecting an agent. This factor was more prominent among younger and less experienced sellers, indicating that they may place more importance on the initial property valuation than their more experienced counterparts. A realistic valuation is essential, as overpricing can deter potential buyers, and underpricing can result in a lower sale price than the property's true value.

Finally, with the property market stabilising, selecting an estate agent who understands market conditions and prices accordingly is crucial for achieving sales success. As market conditions can change rapidly, estate agents must keep up to date with the latest trends and fluctuations to ensure that their clients receive accurate and timely advice.

In conclusion, selecting the right estate agent is a crucial decision for vendors when selling a property. While professionalism and knowledge are essential, personal relationships, effective communication, and a realistic valuation are equally critical in building trust and ensuring a successful sale. Ultimately, working with an experienced estate agent like Taylor Robinson who understands the local market and can price accordingly is key to achieving a successful sale in today's property market.

- Details

- Hits: 387

Buy-to-let mortgages are a type of loan that allows people to purchase properties with the intention of renting them out to tenants. In the UK, buy-to-let mortgages have become increasingly popular over the years, as property investment has become a popular way of generating income.

What is a buy-to-let mortgage?

A buy-to-let mortgage is a type of mortgage specifically designed for people who want to buy a property to rent out to tenants. The loan is secured against the property and is usually repaid through rental income generated by the property.

How do buy-to-let mortgages work?

Buy-to-let mortgages work in a similar way to standard mortgages, but there are some key differences. Firstly, the interest rates on buy-to-let mortgages tend to be higher than on standard mortgages, as they are seen as a higher risk to lenders. Additionally, the deposit required for a buy-to-let mortgage is usually higher, typically around 25% of the property's value.

The amount that can be borrowed for a buy-to-let mortgage is based on the rental income that the property is likely to generate. Lenders will typically require that the rental income covers around 125% of the mortgage repayments, to ensure that there is enough income to cover the mortgage repayments even if the property is unoccupied for a period of time.

Who can get a buy-to-let mortgage?

In order to be eligible for a buy-to-let mortgage in the UK, you will usually need to meet certain criteria. This may include having a good credit score, having a certain level of income, and having a deposit of at least 25% of the property's value.

Additionally, lenders will typically require that the property being purchased is in good condition and is located in an area with high demand for rental properties. They may also require that you have experience as a landlord, although this is not always the case.

What are the benefits of a buy-to-let mortgage?

The main benefit of a buy-to-let mortgage is that it allows people to invest in property and generate rental income. This can be a good way to build wealth over time, as the property increases in value and the rental income provides a steady stream of cash flow.

What are the risks of a buy-to-let mortgage?

Like any investment, there are risks associated with buy-to-let mortgages. One of the main risks is that the property may not generate enough rental income to cover the mortgage repayments, leaving the landlord with a shortfall to cover.

Additionally, property values can go down as well as up, so there is a risk that the property may decrease in value over time. This can make it difficult to sell the property if needed, and may result in the landlord being left with a mortgage debt that is greater than the value of the property.

Finally, being a landlord comes with its own set of responsibilities and potential headaches, such as dealing with tenant disputes, maintenance issues, and complying with regulations.

Conclusion

Buy-to-let mortgages can be a good way to invest in property and generate rental income, but they also come with risks and responsibilities. If you are considering a buy-to-let mortgage, it's important to do your research and seek advice from a qualified financial advisor to ensure that it is the right investment strategy for you.

- Details

- Hits: 413