Blog

Taylor Robinson, a leading player in the Crawley residential property industry, has achieved a significant milestone by securing a spot on the shortlist for The ESTAS in 2023. This prestigious recognition is a testament to their unwavering commitment to providing exceptional customer service to their clients. Having previously won awards in both 2021 and 2022, Taylor Robinson is proud to have continued their tradition of excellence.

The ESTAS is widely regarded as the largest award scheme in the UK residential property industry, honouring the best agents, conveyancers, and mortgage brokers. It is powered by an online customer review platform that allows property professionals to showcase their exceptional customer service standards. With a strict verification process in place to ensure the authenticity of reviews, this year's shortlist was determined based on an evaluation of a staggering 300,000 customer review ratings.

Taylor Robinson's achievement of the ESTAS 'Standard of Excellence' is a result of the remarkable service ratings they received from their customers through the ESTAS review platform. These ratings are collected at the conclusion of the moving experience, providing a comprehensive and accurate overview of the consistently high standard of service delivered to their valued clients. The ESTAS 'Standard of Excellence' serves as a prominent endorsement, symbolizing the exceptional service performance of every shortlisted firm in 2023.

The regional and national winners of The ESTAS Awards will be announced in October during the highly anticipated annual ESTAS ceremony held in London. This prestigious event brings together the crème de la crème of the UK's property professionals, with the awards being presented by the beloved property expert, Phil Spencer, in front of an audience of 1,200 industry leaders.

Speaking about The ESTAS Awards, Phil Spencer emphasized the authenticity of the accolades, as they are based on genuine feedback from real clients who have experienced the service first hand. These awards provide tangible evidence of the service levels provided by a firm, which is especially crucial in today's competitive market where exceptional customer service is a pivotal factor in helping home movers achieve their dreams of acquiring their ideal properties.

Simon Brown, the founder of ESTAS, highlighted the organization's mission of fostering a community of property professionals dedicated to best practices and a shared belief in the importance of exemplary service. By celebrating and acknowledging outstanding customer service, ESTAS encourages property professionals to continually raise the bar and deliver exceptional experiences to their clients.

Taylor Robinson's inclusion in The ESTAS shortlist for 2023 exemplifies their ongoing commitment to delivering exceptional service to their clients. This recognition not only showcases their achievements but also serves as a testament to their dedication to excellence within the UK residential property industry. As they eagerly await the October awards ceremony, Taylor Robinson can take pride in their continued success and look forward to potentially securing prestigious regional or national honours in front of their esteemed peers.

- Details

- Hits: 416

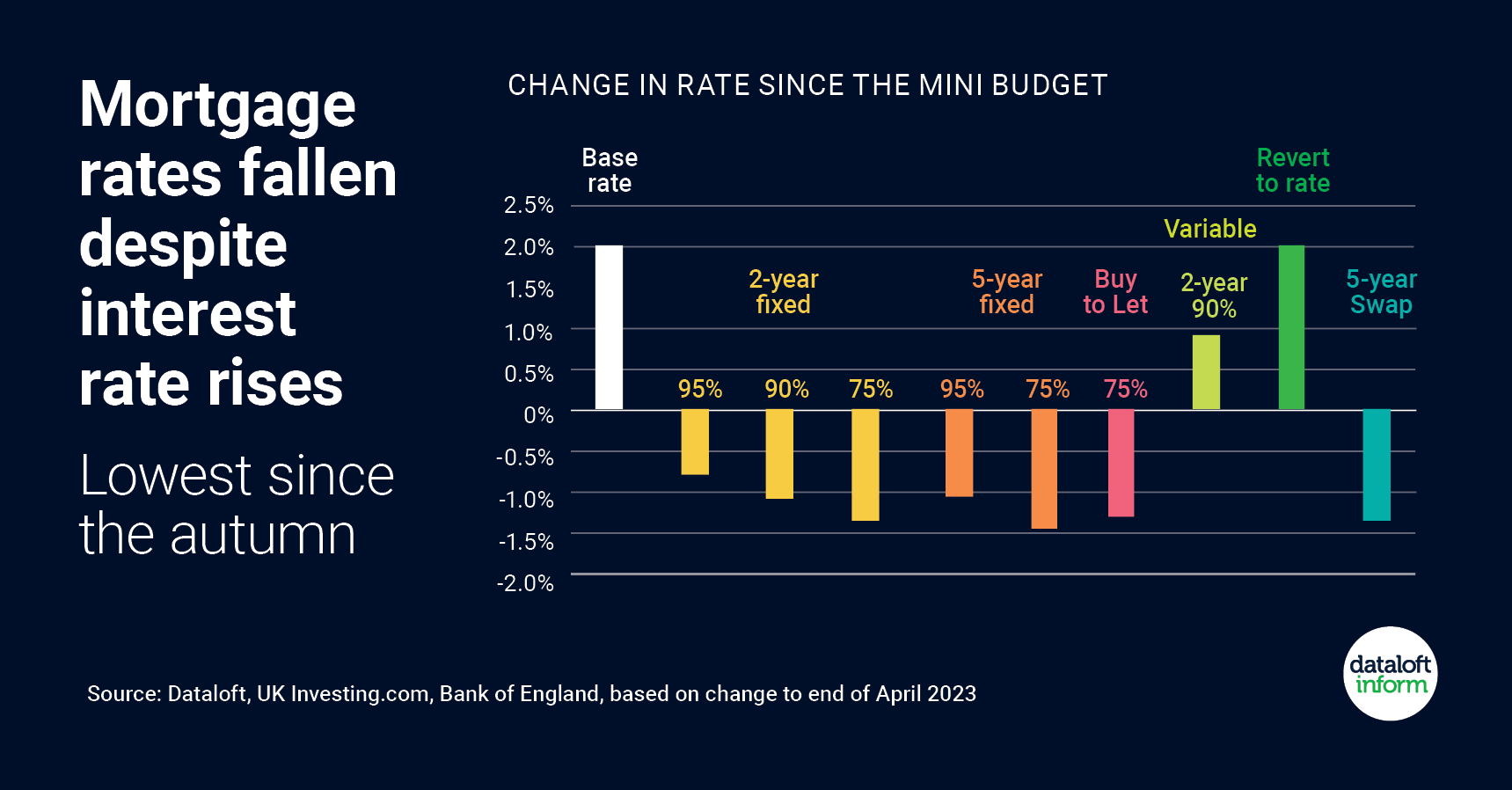

In recent times, the mortgage interest rate market has been subject to some fluctuations. Analysis of this market indicates that while the base rate of interest has risen, mortgage rates for those seeking to purchase have fallen back from their autumn peak.

This trend can be observed in the falling average fixed rate mortgage rates, which have returned to their lowest point since the Autumn season prior to the announcement by the Bank of England to raise the base rate to 4.5%. This drop in mortgage rates is good news for prospective homebuyers, as it provides them with more favourable borrowing conditions.

Another factor that is contributing to the increased affordability of mortgages is the wider product choice available across the Loan-to-Value (LTV) spectrum. In recent months, product choice has increased, providing more options for prospective purchasers. Lower LTV ratios have benefitted the most from rate declines, meaning that those with a larger deposit are seeing the greatest reductions in their mortgage rates.

It is important to note that while the base rate rise will have an impact on those with tracker or variable rate mortgages, the majority of mortgage loans agreed continue to be on a fixed term basis. This means that the majority of mortgage holders will not be directly impacted by the base rate rise.

Overall, these trends in the mortgage interest rate market are positive news for those looking to buy a home in the near future. With lower mortgage rates and a wider range of product choices available, prospective homebuyers have more opportunities to secure a favourable mortgage. However, it is always important to keep an eye on the market and consult with a professional advisor before making any significant financial decisions.

- Details

- Hits: 398

Adding Value to Your Home: Maximizing Your Investment

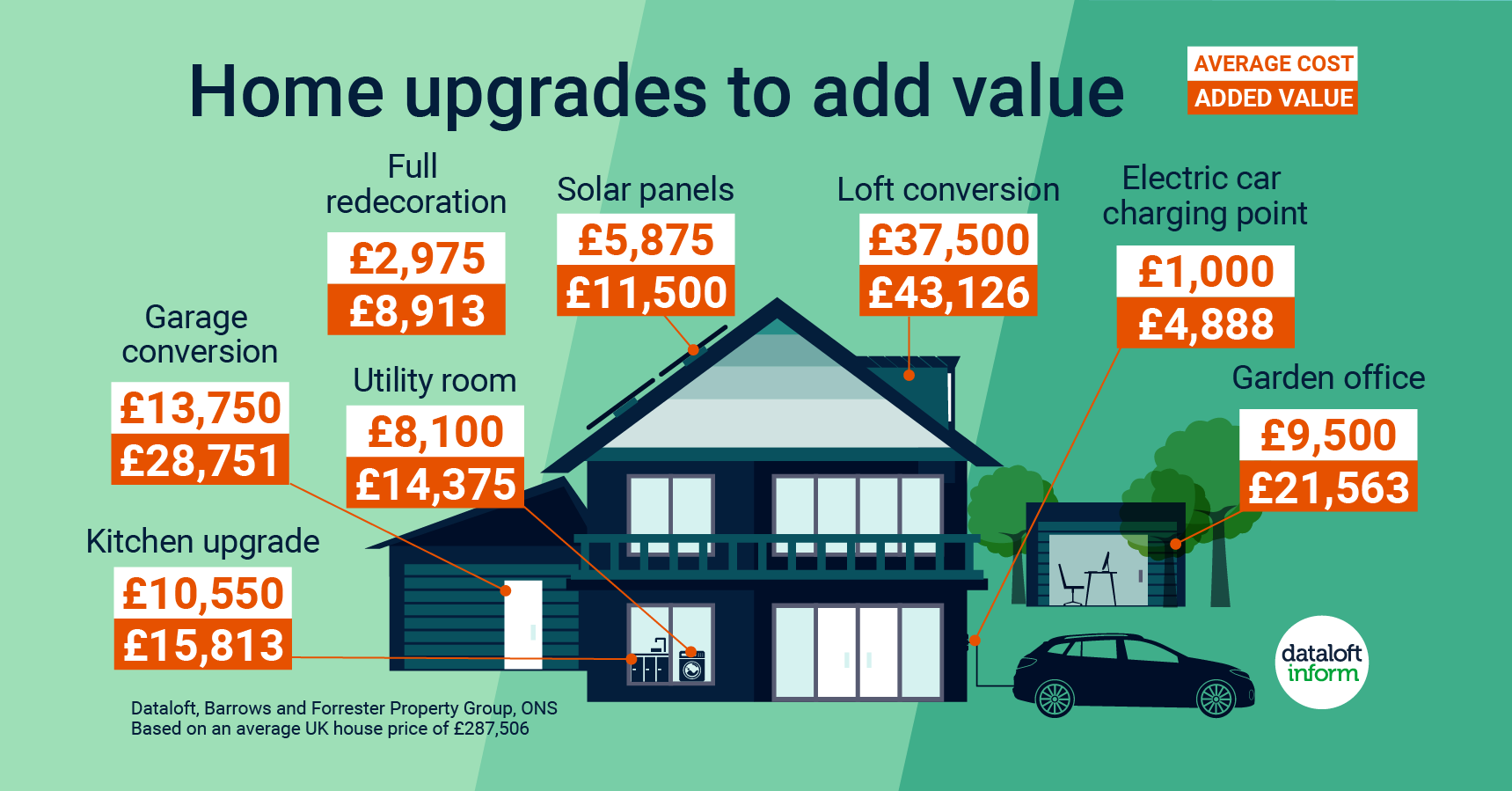

For many homeowners, their property is more than just a place to live – it's also an investment. Whether you're looking to sell in the near future or simply want to ensure that your home retains its value over time, there are a variety of ways to add value to your property. In this article, we'll explore some of the most effective ways to increase your home's value based on the latest data from Dataloft, Barrows and Forrester Property Group, and the Office for National Statistics (ONS).

Large-Scale Projects: Garage Conversions and Garden Offices

If you're looking to make a significant investment in your home, research shows that a garage conversion or garden office may be the best way to maximize your return. With 44% of people now working from home, according to the ONS, the demand for home offices and additional living space has never been higher.

Converting your garage into a usable living space can provide a significant boost to your property's value. Not only does this give you extra living space, but it can also add value by making your property more appealing to prospective buyers.

Similarly, a garden office can provide a functional and attractive workspace that can be used year-round. This is especially true in light of the pandemic, which has prompted many people to re-evaluate their working arrangements and seek out home office solutions.

Energy Efficiency Upgrades: A Smart Investment

Upgrades to energy efficiency can provide a better return on investment than traditional home renovations such as kitchen or bathroom upgrades. These types of upgrades can often be costly and may not necessarily appeal to a wide range of buyers.

By contrast, improving your home's energy efficiency is a smart investment that can pay dividends in the long run. Not only does this make your property more eco-friendly, but it can also save you money on energy bills and make your home more attractive to buyers.

Smaller Investments: Redecorating and Electric Vehicle Charge Points

If you're looking to add value to your home without making a large-scale investment, there are still plenty of options available. Redecorating your home can give it a fresh, modern look that can appeal to buyers.

Another small investment that can pay off in the long run is adding an electric vehicle (EV) charge point to your property. As more and more people switch to electric vehicles, having a dedicated EV charge point can make your home more attractive to prospective buyers.

Conclusion

Adding value to your home in Crawley is an important consideration for many homeowners. Whether you're looking to sell your property in the near future or simply want to ensure that your investment is protected, there are a variety of ways to increase your home's value.

Large-scale projects such as garage conversions and garden offices can provide a significant boost to your property's value, while energy efficiency upgrades can help you save money on bills and make your home more eco-friendly.

Smaller investments such as redecorating and adding an EV charge point can also add value to your property and help it appeal to a wider range of buyers. By considering these options and making smart investments in your home, you can ensure that your property retains its value over time.

If you are interested to know the value of your property, call us on 01293 552388

- Details

- Hits: 425

If you're thinking of buying a rental property in the Crawley, one of the first decisions you'll need to make is whether to buy it in your own name or in a company name. Each option has its own advantages and disadvantages, so it's important to consider your circumstances and goals before making a decision.

Buying in your own name:

One of the main advantages of buying a rental property in your own name is simplicity. You'll own the property personally, so there are no complex legal structures or additional paperwork to worry about. This can make the buying process quicker and easier, and can also make it easier to get a mortgage.

Another advantage of buying in your own name is flexibility. You'll be able to choose how to manage the property and how to allocate any rental income or capital gains. You'll also be able to sell the property whenever you choose, without having to worry about company structures or tax implications.

However, there are also some downsides to buying a rental property in your own name. One of the main disadvantages is the potential tax implications. If you own the property personally, you'll be liable for income tax on any rental income you receive, as well as capital gains tax if you sell the property at a profit. This can be a significant amount of tax, depending on your circumstances and the value of the property.

Buying in a company name:

Another option when buying a rental property in Crawley is to buy it in a company name. This can offer several advantages, including reduced tax liabilities and increased protection.

One of the main advantages of buying in a company name is that the company will be liable for any tax on rental income or capital gains, rather than you personally. This can result in a lower overall tax liability, especially if you're a higher rate taxpayer.

Another advantage of buying in a company name is increased protection. If the property is owned by a company, your personal assets will be protected if the company is sued or becomes insolvent. This can provide peace of mind for landlords who are worried about potential liabilities.

However, buying a rental property in a company name also has some disadvantages. One of the main drawbacks is the increased complexity of the buying process. You'll need to set up a company, which can involve legal and administrative costs, and you'll need to comply with additional regulations and reporting requirements.

In addition, buying in a company name can make it more difficult to get a mortgage. Lenders may view company structures as riskier than personal ownership, and may require higher deposits or charge higher interest rates.

In conclusion, there are pros and cons to buying a rental property in your own name versus in a company name. Buying in your own name can be simpler and more flexible, but can result in higher tax liabilities. Buying in a company name can offer reduced tax liabilities and increased protection, but can be more complex and may make it more difficult to get a mortgage. It's important to carefully consider your circumstances and goals before making a decision.

If your are thinking of buying a buy to let and want some free impartial advice, call Ben on 01293552388

- Details

- Hits: 415

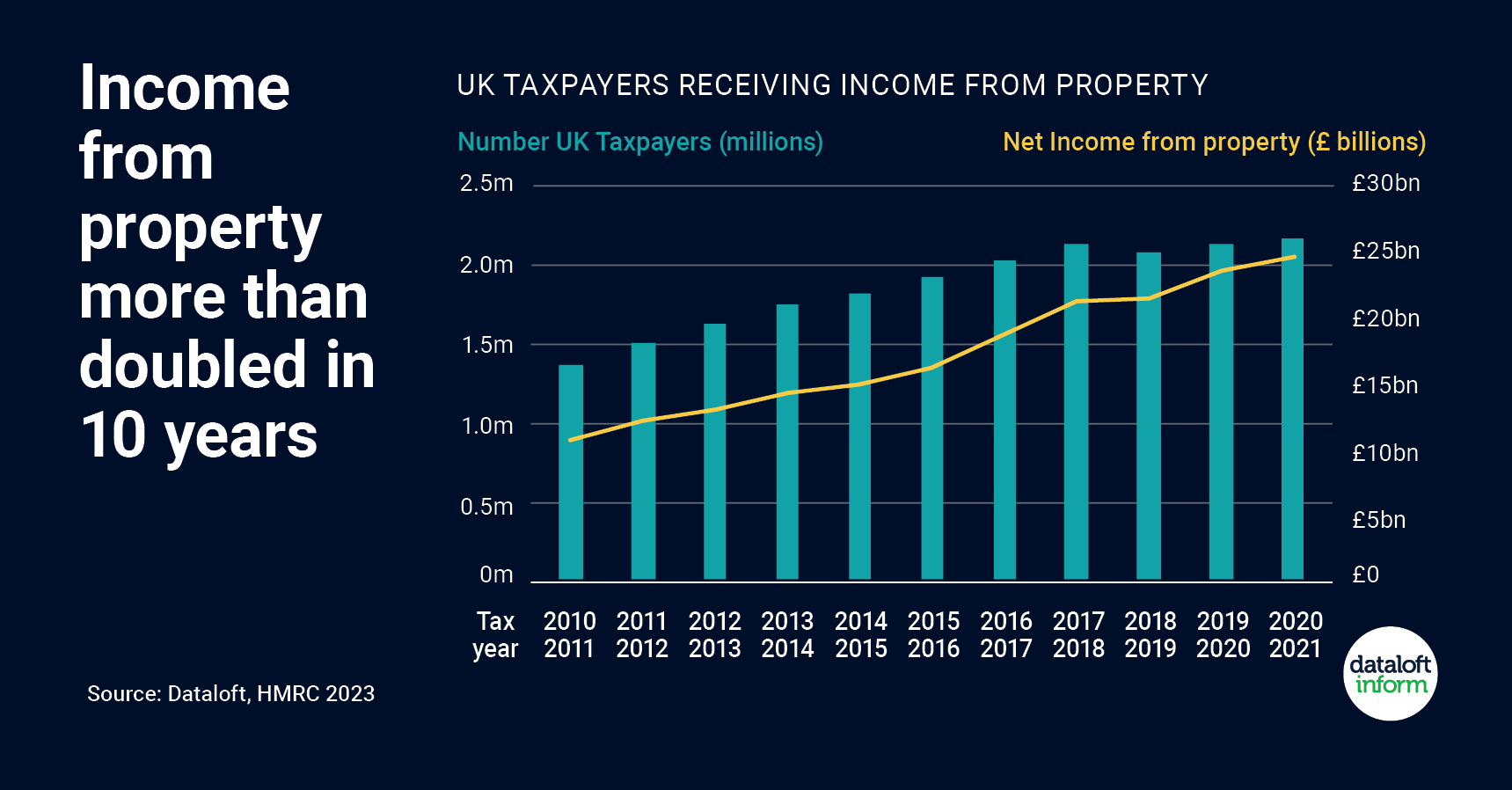

Property is still a good investment despite all the doom and gloom. The latest data released by HMRC (Her Majesty's Revenue and Customs) reveals that over 2.1 million UK taxpayers received income from property in the tax year 2020/21. These taxpayers received a total net income of £24.5 billion (net), which is up by 5% compared to the previous year. This is despite the effects of the landlords' interest restriction, which was phased in since 2017/18.

On average, each taxpayer received a net income of £11,400 from their property. This figure is a result of deducting allowable expenses from their gross rental income. Allowable expenses include letting agent fees, repairs, and maintenance costs, among others.

Moreover, 50% of individuals received between £20,000 and £50,000 in total gross income, while one in eleven received £100,000 or more. These high-earning individuals accounted for over 19% of the total net income received.

Interestingly, the number of UK taxpayers receiving an income from property has risen by close to a quarter of a million in the past 5 years. This suggests that investing in property is still an attractive option for many individuals, despite the various tax changes and increased regulations in recent years.

These findings were sourced from a report by Dataloft, which used HMRC data for the tax year 2020/21. The report provides valuable insights into the UK's property market and the income generated by landlords and property investors.

The report highlights that the income generated from property can provide a reliable source of income, which is especially important in today's economic climate. However, it is crucial to ensure that landlords and property investors are aware of their tax obligations and comply with the relevant regulations.

In conclusion, the latest data released by HMRC indicates that income from property remains a significant source of income for over 2.1 million UK taxpayers. The rise in the number of individuals receiving an income from property suggests that it is still an attractive investment option. However, it is important to remain informed about the tax changes and regulations in the property market to ensure compliance with the law.

If you would like to discuss property investment, please call Ben on 01293552388

- Details

- Hits: 416