Blog

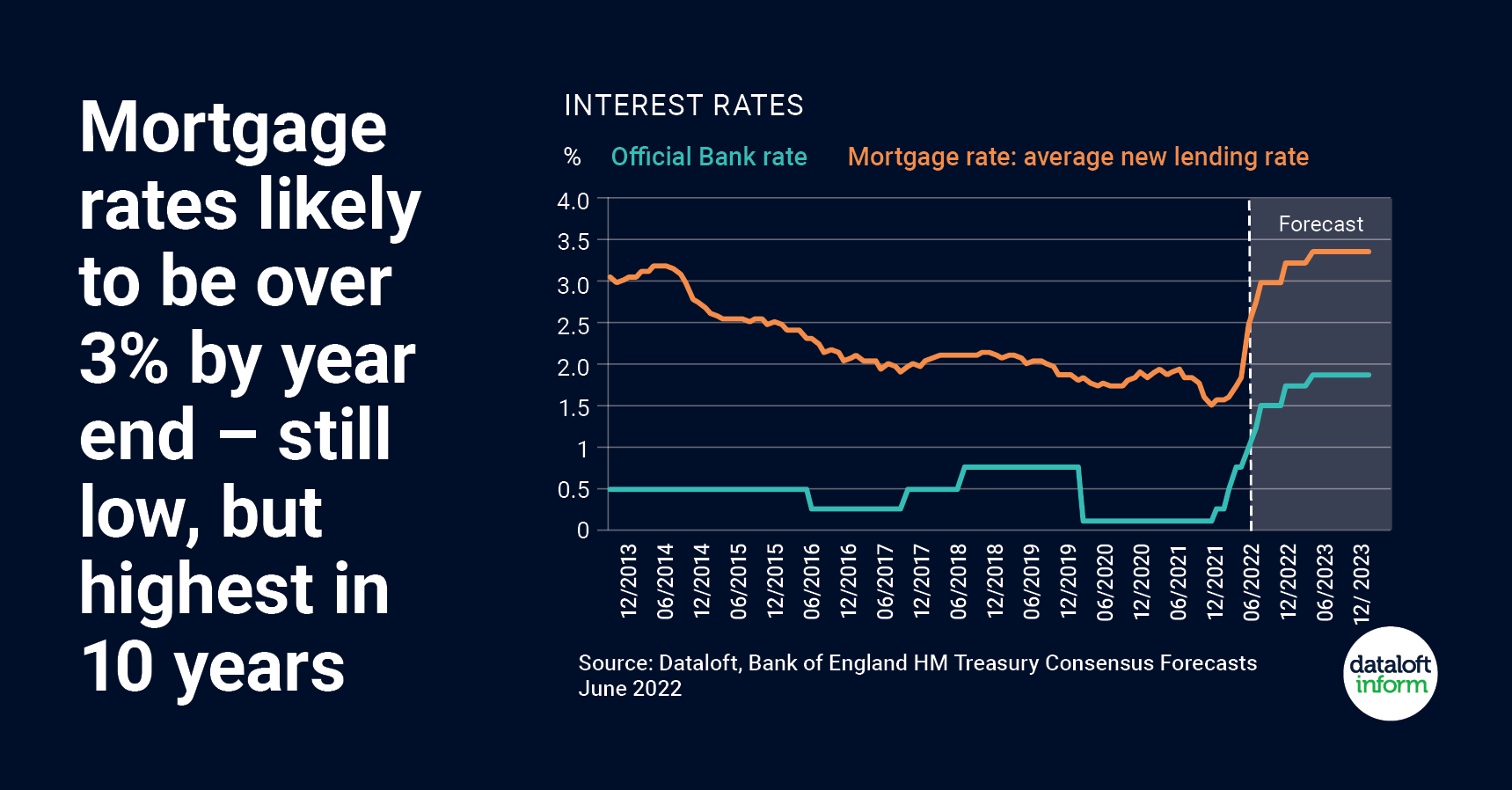

- With inflation running high, the Bank of England increased its base rate to 1.25% in June, with another 0.5 percentage point rise forecast before the end of 2022 and potential for a further 0.25 percentage point rise in 2023.

- The typical margin between mortgage rates and the bank rate (1.5 percentage points over the last year) suggests the average new lending mortgage rates will be over 3% by the end of 2022.

- The vast majority of new mortgage borrowers are on fixed rates (representing 92% of new loans over the last 5 years) offering protection from rising payments, at least until the fixed term expires.

- House prices are largely driven by what people can borrow and at what cost, so with rising rates this does start to drive affordability the wrong way.

- Source: Dataloft, Bank of England HM Treasury Consensus Forecasts June 2022

- Details

- Hits: 799

The government has outlined significant changes to the Private Rented Market in the fairer Private Rented Sector white paper. The measures will form part of the Renters Reform Bill announced in the queen’s speech.

The headliner is the end of the Section 21 so called ‘no-fault’ evictions, although I don’t like the name ‘no fault’ eviction as the section 21 (6a) is a legal notice a landlord needs to serve to regain possession of their property. An eviction can only be done with a court order – just another use of catastrophising language to grab headlines.

No more fixed terms all tenancies to be moved to a Single system of periodic tenancies which will only require 2 months’ notice from tenants at any point and a landlord will only be able to end the tenancy if the landlord has a valid reason, which will be defined by law i.e. a need to sell, move in, rent arrears or anti-social behaviour.

It will be illegal for landlords or agents to have a blanket ban on allowing pets or renting to families with children, or those on benefits.

The decent homes standard will be extended to the private sector for the first time, with councils set to have stronger powers to tackle rogue landlords.

A new property portal one-stop-shop (landlord register?) will be introduced to help landlords comply with and understand their responsibilities, while a new Property Ombudsman will be created to handle disputes between renters and landlord.

This is only a white paper and will most likely change prior to being passed into law, landlords and agents who operate within the law, should not fear the renting changes proposed by the Government

Source: Dataloft, DLUHC. Link: https://www.gov.uk/government/publications/a-fairer-private-rented-sector

- Details

- Hits: 832

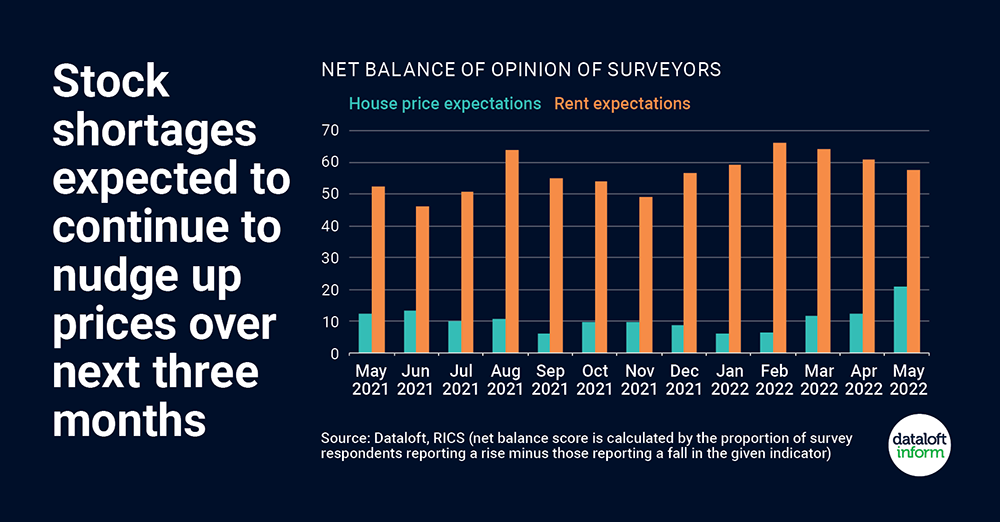

Many of our customers know that we like to take an analytical approach to the property market and we also know that everyone loves a good market prediction! So here is a short one for the next 3 months based on the latest RICS sentiment survey of chartered surveyors. Property and rental prices are expected to continue to climb over the next three months. Interestingly to see surveyors are more optimistic about the short-term outlook for rents, with +58 expecting rental values to increase over the next few months, compared to +21 for house prices.

Both the sales and lettings market are blighted by stock shortages and the rental market specifically is suffering from falling landlord instructions at a time when demand from renters is increasing, this could possibly be due to lack of stock in the sales market. I still believe that now is a great time to buy an investment property due to the ever-increasing demand and lack of new properties coming on to the rental market. If you need any advice on buy to let, please call the office and ask for Ben.

The 12-month outlook is starting to ease slightly for house prices but remains positive. The rate of growth in rents is expected to overtake that of house prices over the next 5 years due to the continued shortage of rental properties.

Source: Dataloft, RICS (net balance score is calculated by the proportion of survey respondents reporting a rise minus those report a fall in the given indicator)

- Details

- Hits: 740

Tenants are looking to stay longer according to a recent survey carried out by Rightmove consisting of 1300 landlords.

As a landlord the main goal is to have long staying tenants that pay their rent and look after the property and according to this survey tenants are staying longer, did you know that the average length of tenancy is now at 2 years?

This is the findings from a recent landlord survey by Rightmove and the survey has indicated a change in renter behaviour against a backdrop of record rents and rising household bills. Over the last year 20% of landlords reported a rise in their average length of tenancy, with the most common average tenancy period being over 2 years (63%). We have seen this as an increasing trend over the last few years at Taylor Robinson with many tenants looking to stay longer, it is very rare we will get a tenant ask for 6 months.

Many landlords have recognised the challenges of rising household bills for renters, with the majority (63%) choosing not to put up rents. This is despite there being triple the number of enquiries than available properties.

Analysis of 20,000 build to rent listings revealed that the feature which has seen the largest increase in renter demand is to have all bills included at + 36%, it will be interesting to see if this is something that becomes more common across the board.

Source: Dataloft, Rightmove (survey of 1,300 landlords)

- Details

- Hits: 1814

- Although many organisations use app-based technology, the human touch remains an important feature of the estate agency sector.

- Over 70% of sellers, irrespective of age or previous sales experience, prefer using the phone when dealing with an agent for offers or agreeing a sale.

- Phone is the preferred communication for much of the sales process. The only exception is when signing contracts, where an equal split prefer email (38%) or meeting face-to-face (38%).

- One in 10 sellers prefer a WhatsApp or text message from their agent when booking viewings. A third prefer email to inform them of sales progression.

- Source: Dataloft, Property Academy Home Moving Trends Survey, 2021

- Details

- Hits: 713