Blog

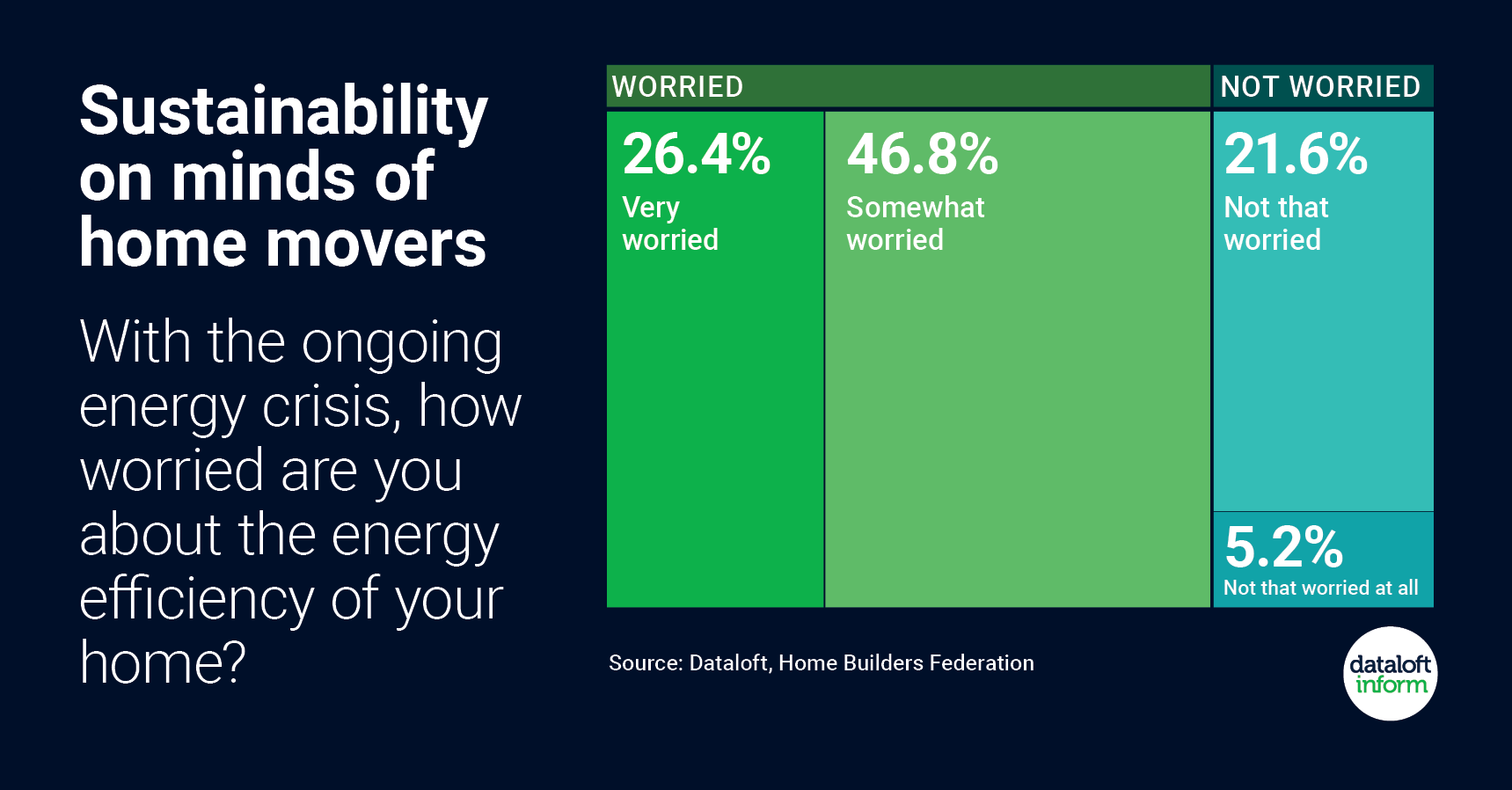

- Almost three-quarters of people are worried about the energy efficiency of their homes given the ongoing energy crisis, according to a recent survey by the Home Builders Federation (HBF).

- The highest levels of concern are among females (81%), those aged 35-44 (86%) and those living in the social rented (82%) and private rented sectors (80%).

- 1 in 4 of those who are worried about their homes being energy efficient say that when they buy their next property, its energy efficiency will be crucial.

- The most important sustainable home features considered to be: insulation (51%), double/triple glazed windows (50%), energy efficient appliances (39%) and a heat pump/ modern condensing boiler (21%).

- Source: Dataloft, Home Builders Federation

- Details

- Hits: 780

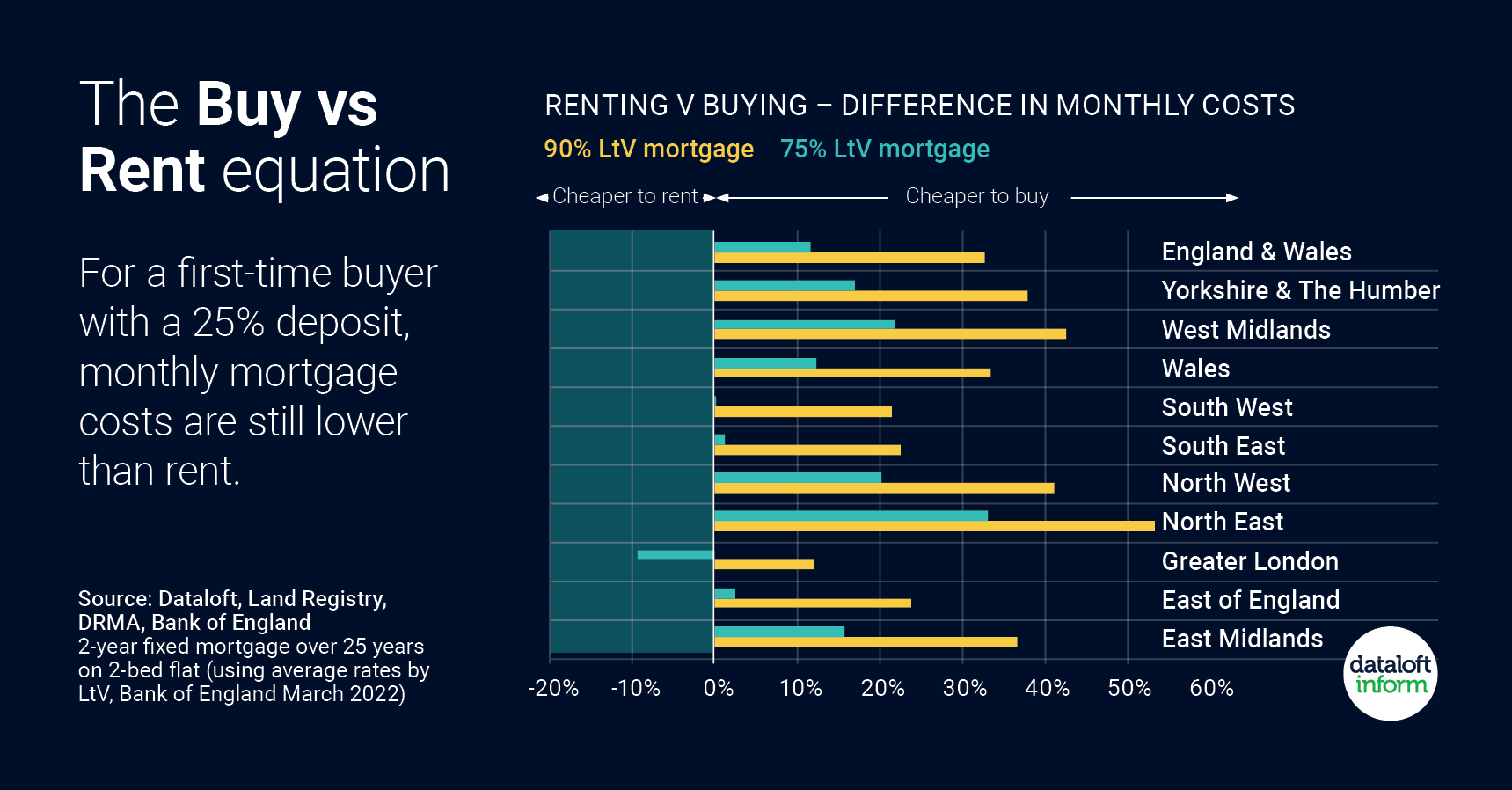

- For a buyer with a 25% deposit, the monthly mortgage payment in all areas remains lower than the equivalent monthly rent for a 2-bed flat (2-year fixed rate mortgage, over 25 years).

- However, for those with a 10% deposit (90% LtV), increased mortgage rates in March mean that in London, the monthly rent would be 9% less than mortgage payments, and there is virtually no difference in the South West, South East and East.

- For first-time buyers, getting together a deposit is still the most significant barrier to home ownership. Maintenance costs and giving up flexibility are other considerations.

- As interest rates continue to rise, the monthly cost gap is likely to narrow further in all regions and this may see more 'would-be' first-time buyers evaluating their housing options.

- Source: Dataloft, Land Registry, DRMA, Bank of England

- Details

- Hits: 750

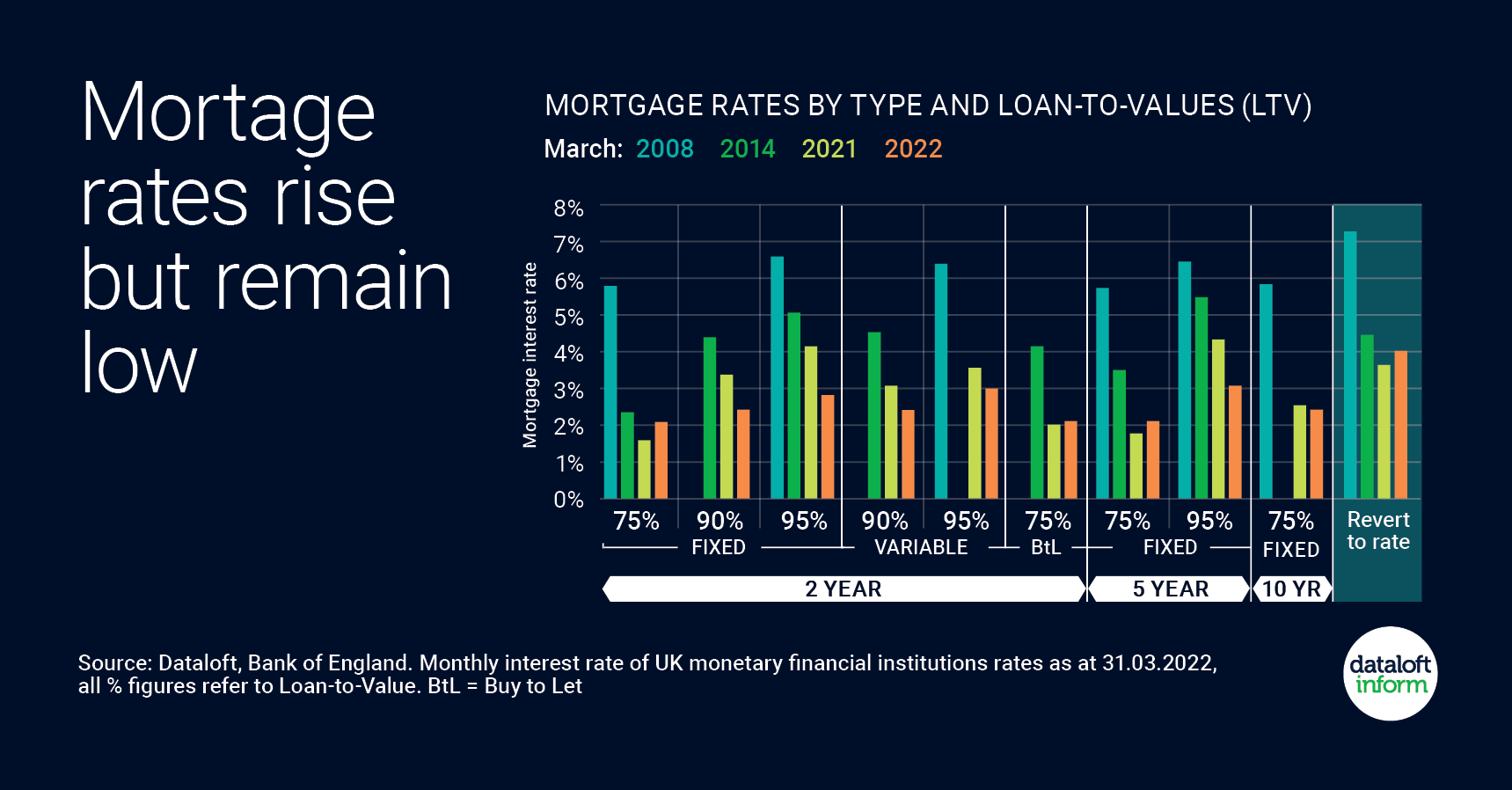

- Since the start of 2022 interest rates have risen by 0.5%, however for those looking to purchase a home many mortgage rates remain attractive.

- It is estimated over 1 in 4 households are on mortgage deals affected by changing interest rates (UK Finance), but the average 2 year variable rate published by the Bank of England is actually lower than a year ago.

- At 3.99% the revert-to-rate is 0.37% higher year-on-year. For those with a 25% deposit the current 10-year fixed rate is just 0.33% above the 2-year fixed rate.

- Back in 2008 when the base rate was last 0.75% and in 2014 when affordability tests were introduced, rates were far higher. The next meeting of the Banks Monetary Policy Committee is on Thursday 5th May.

- Source: Dataloft, Bank of England, For general information only. Specialist advice on investments must always be sought.

- Details

- Hits: 776

- More than one in four private rental households could be headed by a person over the age of 55 by 2035 according to a new report by the Social Market Foundation.

- A greater proportion of current renters in this age group consider an unfurnished property and the length of tenancy priorities than those aged 18–34 and 35–54.

- In terms of the neighbourhood they choose, proximity to local shops and closeness to family and friends are top considerations, with access to healthcare a key consideration for the future.

- Research has found that renters aged 55+ are less likely to pay a premium for additional facilities within their property compared to younger generations (Dataloft, Property Academy 2021).

- Details

- Hits: 758

- In his Spring Statement on 23 March 2022, the Chancellor announced the scrapping of VAT on materials and installation of energy efficiency equipment for homes.

- Energy efficiency is becoming more important to buyers as a result of escalating bills and concerns about fuel security.

- Homes sold with an EPC rating of A or B in 2021 achieved a 6% premium over properties with an EPC D rating, on a £ per square foot basis.

- A substantial shift in buyer behaviour might require more significant financial implications. The Energy Efficiency Infrastructure Group are lobbying for a reduction in SDLT for energy efficient properties.

- Source: Dataloft/UK Government

- Details

- Hits: 914