Blog

A question I keep getting asked is, why is it so difficult to find a rental property at the moment?

The UK rental market has seen a significant rise in demand for rental properties in recent years and we are seeing this massively in Crawley. However, there is a severe shortage of rental properties available, which has resulted in high rental costs and difficulties for renters in finding suitable accommodation. In this article, we will explore the reasons behind the scarcity of rental properties available to let in the UK.

1. High Demand for Rental Properties

One of the main reasons for the shortage of rental properties is the high demand for them. A growing population, urbanization, and the increasing number of people living alone or in smaller households have all contributed to this. The demand for rental properties has also been fuelled by the difficulties that first-time buyers face in getting onto the property ladder due to rising property prices and stricter mortgage lending criteria.

2. Lack of Incentives for Landlords

Another factor that has contributed to the scarcity of rental properties in the UK is the lack of incentives for landlords to invest in the rental market. For instance, there has been a reduction in tax relief for buy-to-let landlords, which has made it less attractive to invest in rental properties. This has led to a decrease in the number of new landlords entering the market, resulting in a shortage of rental properties.

3. Restrictions on Property Development

Restrictions on property development have also contributed to the shortage of rental properties in the UK. Planning permission processes can be lengthy and costly, and there are often restrictions on building in certain areas. This has made it difficult for developers to build new rental properties in areas where there is high demand, resulting in a scarcity of rental properties.

4. Short-Term Lets and Airbnb

The rise of short-term lets and Airbnb has also impacted the availability of rental properties. Landlords may find it more profitable to rent out their properties on a short-term basis rather than to long-term tenants. This has led to a decrease in the number of rental properties available for long-term lets.

5. COVID-19 Pandemic

Finally, the COVID-19 pandemic has also contributed to the scarcity of rental properties. The pandemic has caused many landlords to exit the rental market, either due to financial difficulties or because they have decided to sell their properties. Additionally, the pandemic has made it difficult for tenants to move house, resulting in fewer properties becoming available for rent.

In conclusion, the shortage of rental properties available to let in the UK is caused by a combination of factors, including high demand, lack of incentives for landlords, restrictions on property development, short-term lets, and the COVID-19 pandemic. Addressing these issues will be key to increasing the supply of rental properties and ensuring that renters can find affordable and suitable accommodation.

If you have a rental property you are thinking about letting call Ben on 01293 552 388

- Details

- Hits: 1050

- At £14bn the value of unspent paper £20 and £50 notes equates to the equivalent of over 50,000 average priced homes.

- After the 30th September 2022 paper £20 and £50 notes will no longer be legal tender in the UK. At the last count the Bank of England estimated there were over 460 million unspent paper notes, over £6bn unspent in £20s and £8bn in £50s.

- Each month around 28% of all sales in England and Wales are cash purchases. In 2021, cash sales account for more than 1 in 3 property purchases in the South West and less than 1 in five in London.

- The average price of a property purchased with cash is, on average, 8%-9% less than the average price of a property purchased with a mortgage.

- Source: Dataloft, Nationwide, UKHPI, Bank of England

- Details

- Hits: 1149

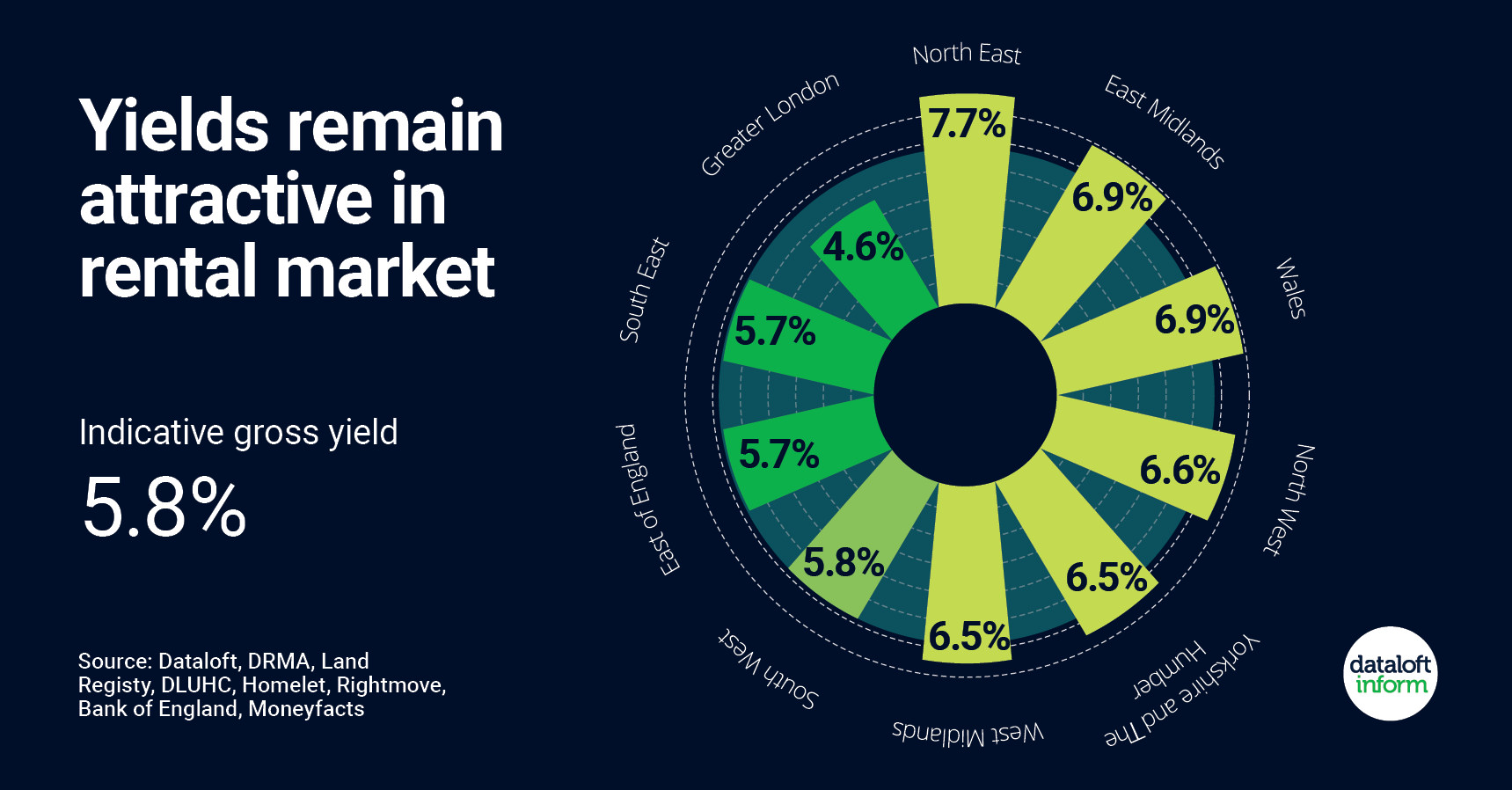

- Indicative gross yields remain attractive in the rental market. Based on an analysis of apartments sold and rented over the past 12 months the indicative gross yield is 5.8%. This is up from 5.1% 3 years ago.

- Indicative gross yields have risen across all regions of England and Wales compared to three years ago.

- A survey of over 1,000 landlords by Dataloft with Homelet found that the majority (73%) of landlords were planning for their portfolios to stay the same over the next year, 1 in 10 looking to expand.

- Nearly half see their portfolio as their long-term pension, a further 25% consider property the best place to invest, and 17% hope to increase their monthly income.

- At present the Bank of England base rate is 1.25%, the average interest rate on a 1-year fixed rate ISA in the region of 2.5%. Rightmove predict rental values will rise by 8% over the course of 2022, rental price growth set to outpace sales growth.

- Source: Dataloft, DRMA, Land Registy, DLUHC, Homelet, Rightmove, Bank of England, Moneyfacts

- Details

- Hits: 1227

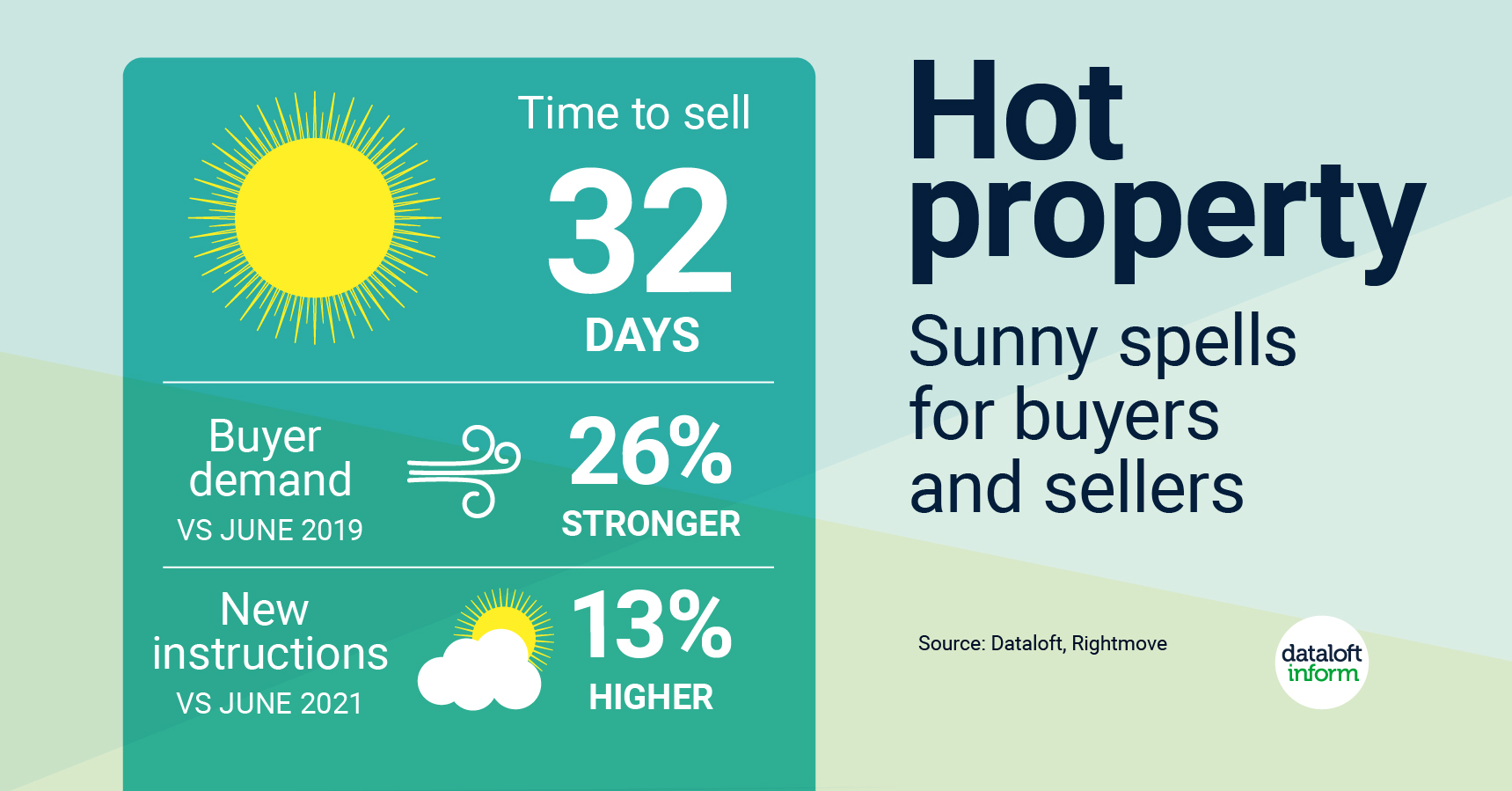

- The UK has dealt with historic temperatures this week, and although the scorching heat of the housing market is showing some signs of moderating as month-on-month price rises soften, it remains sunny for those looking to buy and sell.

- Rightmove report that buyer demand, while down year on year, is 26% stronger than in pre-pandemic June 2019, with the volume of new sellers to the market up 13% compared to this time last year. At 47, average stock levels per agent have improved since the start of the year.

- With the volume of new instructions still failing to keep track with demand, properties continue to sell (SSTC) in just 32 days. This is 6 days faster than a year ago, and over three weeks quicker than the pre-pandemic June average.

- The cost of living crisis is likely to dampen the market over the second half of 2022, but a net balance of agents still anticipate price growth over the next 12 months (RICS).

- Source: Dataloft, DLUHC, Land Registry

- Details

- Hits: 1181

While we wait for the 2021 census housing data we look to the newly published 2020/21 English housing Survey data to help us understand the changing relationship we have with our homes since the last census.

Since 2011/12, owner occupiers have seen a drop in their length of tenure, from an average 17.1 years in their accommodation to 16 years in the new 2020/21 survey results, in contrast, private renters have increased their tenure length, increasing from and average of 3.8 years in 2011/12 to 4.2 years in 2020/21, I expect this to continue in Crawley especially as 39% of the population are families who want stability.

This slight swing to longer private tenancies also come amidst of a new cost of living crisis where the English Housing Survey reports 52% of private renters feel that they are unlikely to be able to buy a home. In 2011/12 this figure was 41%.

Demand for rental property is incredibly high at the moment in Crawley with hundreds of tenants looking for their next rental property, it has never been such a good time to consider investing in property.

For more information or for free, impartial advice, get in touch with me on 01293 307 323 or drop me an email – This email address is being protected from spambots. You need JavaScript enabled to view it.

Source Dataloft, DLUHC English Housing Survey 2021/22 and 2011/12

- Details

- Hits: 2161