Blog

- The property market is busy, with the start of 2022 seeing no slowdown in sales activity.

- Nearly 107,000 sales were recorded in January. Except for 2021, this is the strongest start to a year since 2007 and up 10% on the January average (2012–2021).

- Demand continues to outpace supply, sustaining pressure on prices. Rightmove report the biggest monthly jump in the asking price of newly- listed property since 1994.

- n a sign of more balance returning in future months, home valuation requests were up 27% in January year-on-year, and up 50% compared to 2020 (Rightmove).

- Source: Dataloft, HMRC (10 year January average 2011–2021)

- Details

- Hits: 805

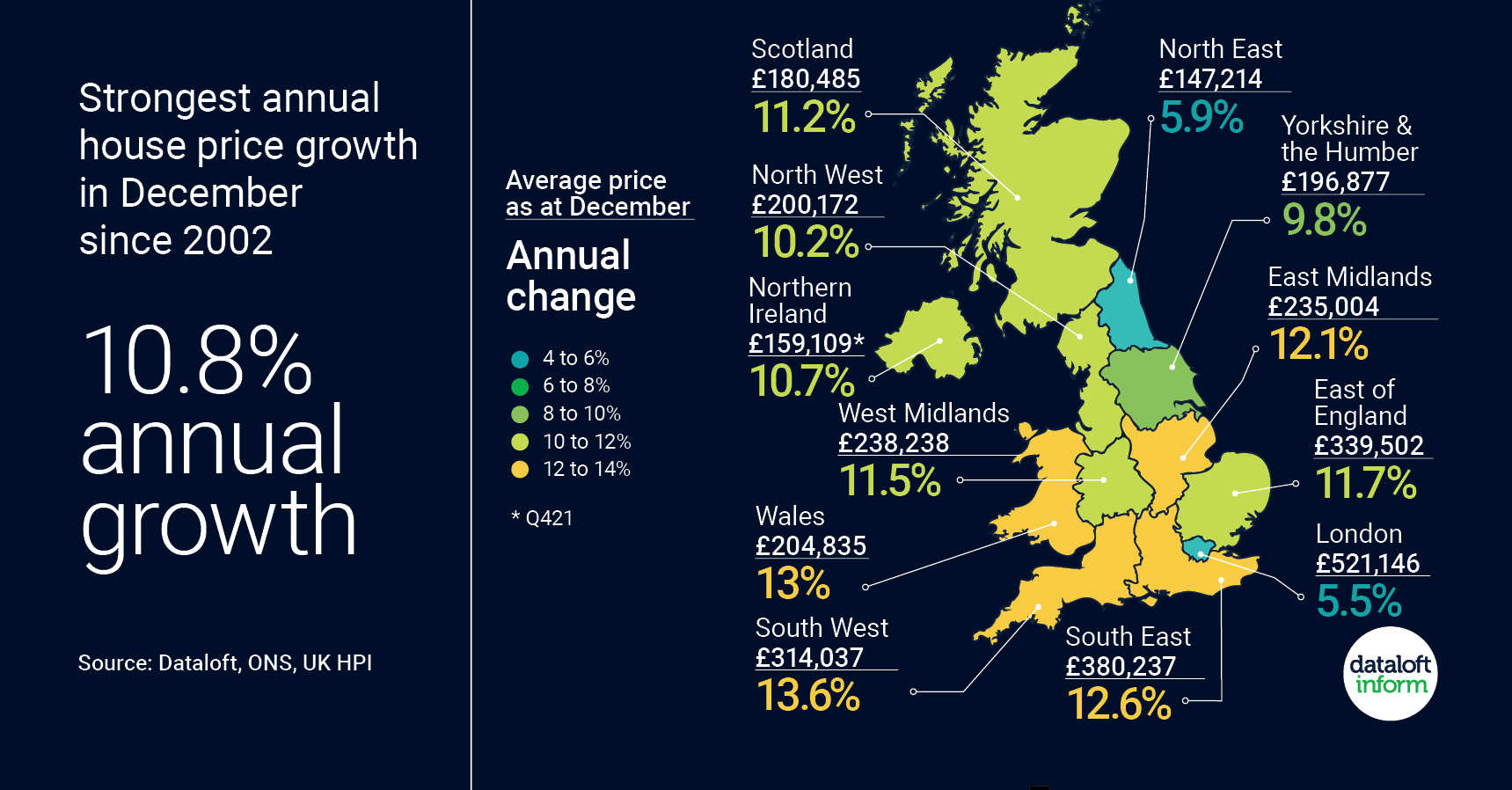

- The UK recorded average house price growth of 10.8% in 2021. This is the strongest annual growth at the year end since 2002.

- The average price of a UK home now stands at £274,712, marking another record high. House prices increased by £23,407 over the course of 2021.

- Annual increases in house prices were seen in all regions of the UK. The South West experienced the biggest increase (13.6%), followed by Wales (13%).

- Detached (15.3%) and semi-detached (11.1%) homes recorded above annual growth in a market continuing to be driven by equity and a desire for more space.

- Source: Dataloft, ONS, UK HPI

- Details

- Hits: 847

- A net balance in demand of +64% was reported by survey participants for renter demand. This is the strongest result since 1999.

- In the sales market, participants recorded a net balance of +16% for new buyer enquiries, up from +9% in December. This is the strongest figure since May 2021.

- Conversely, supply of properties (new instructions) remains constrained in both the lettings and sales markets and will continue to put pressure on prices. Source: Dataloft, RICS (net balance of survey participants).

- The RICS net balance score is calculated by the proportion of survey respondents reporting a rise minus those reporting a fall in the given indicator.

- Details

- Hits: 793

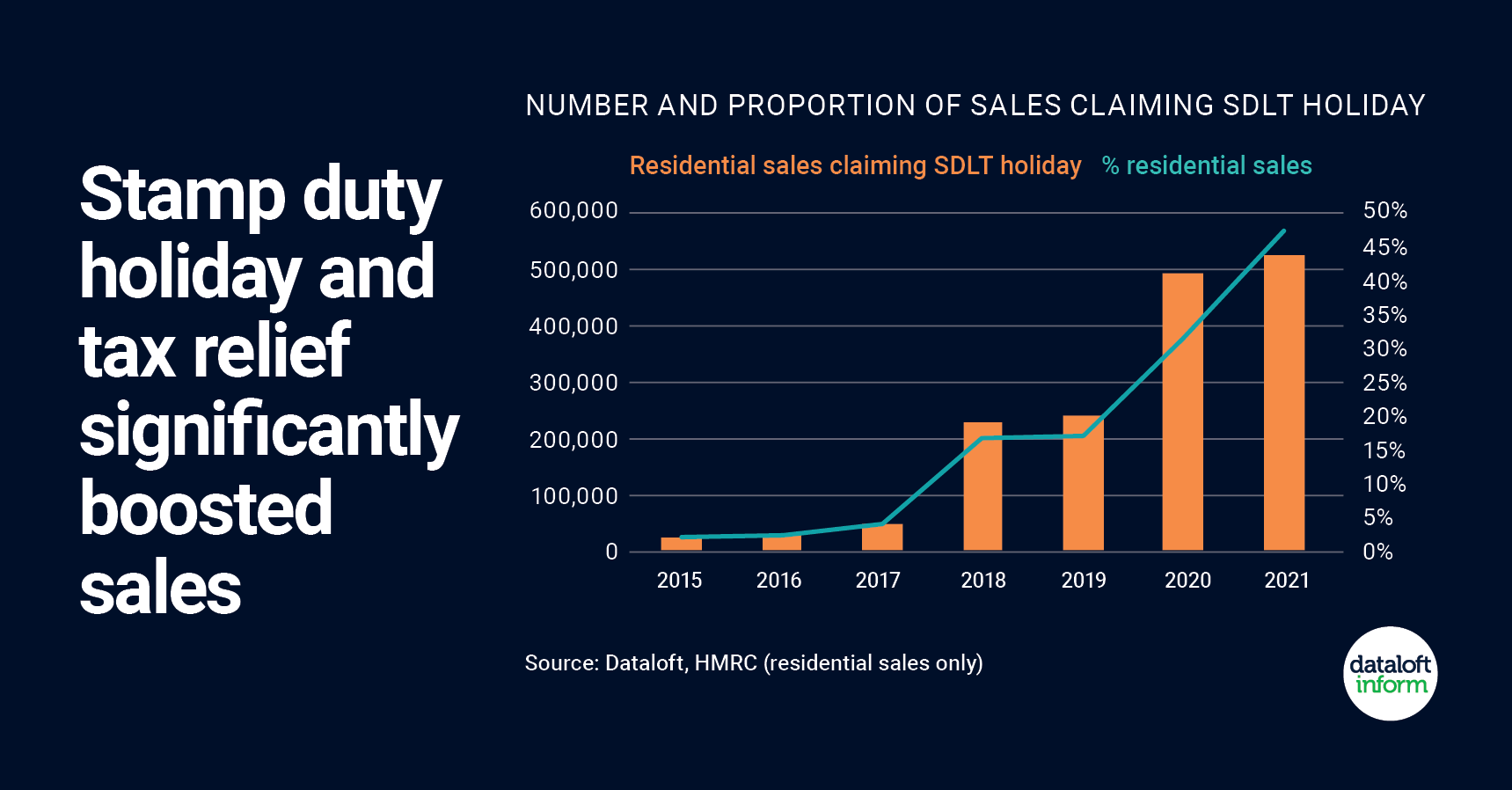

- 44% of home buyers in England were eligible for a Stamp Duty Land Tax (SDLT) holiday (or claimed relief) in 2021, totalling 566,700 sales.

- Those qualifying in the 5 years preceding 2020 averaged just 6%. This highlights the impact this incentive has had on stimulating the housing market.

- The SDLT holidays have contributed to sales volumes increasing by 43% in 2021, following six years of falls.

- It is estimated over 60% of purchasers in Wales benefitted from a reduction in stamp duty taxation during the first six months of 2021 (Stats Wales).

- Source: Dataloft, HMRC (residential sales only)

- Details

- Hits: 855

- The Federation of Master Builders' latest State of Trade Survey reports that 74% of builders have raised prices for their work in Q4 2021.

- At a time when they are reporting a 19% increase in workloads, 95% of builders are also seeing a rise in the cost of materials.

- Labour shortages are also making it hard with 43% struggling to hire carpenters and 41% finding it difficult to find bricklayers.

- Increased cost for home improvements, labour shortages and material price rises, may prompt homeowners to consider moving over improving.

- Source: Dataloft, Federation of Master Builders

- Details

- Hits: 791