Blog

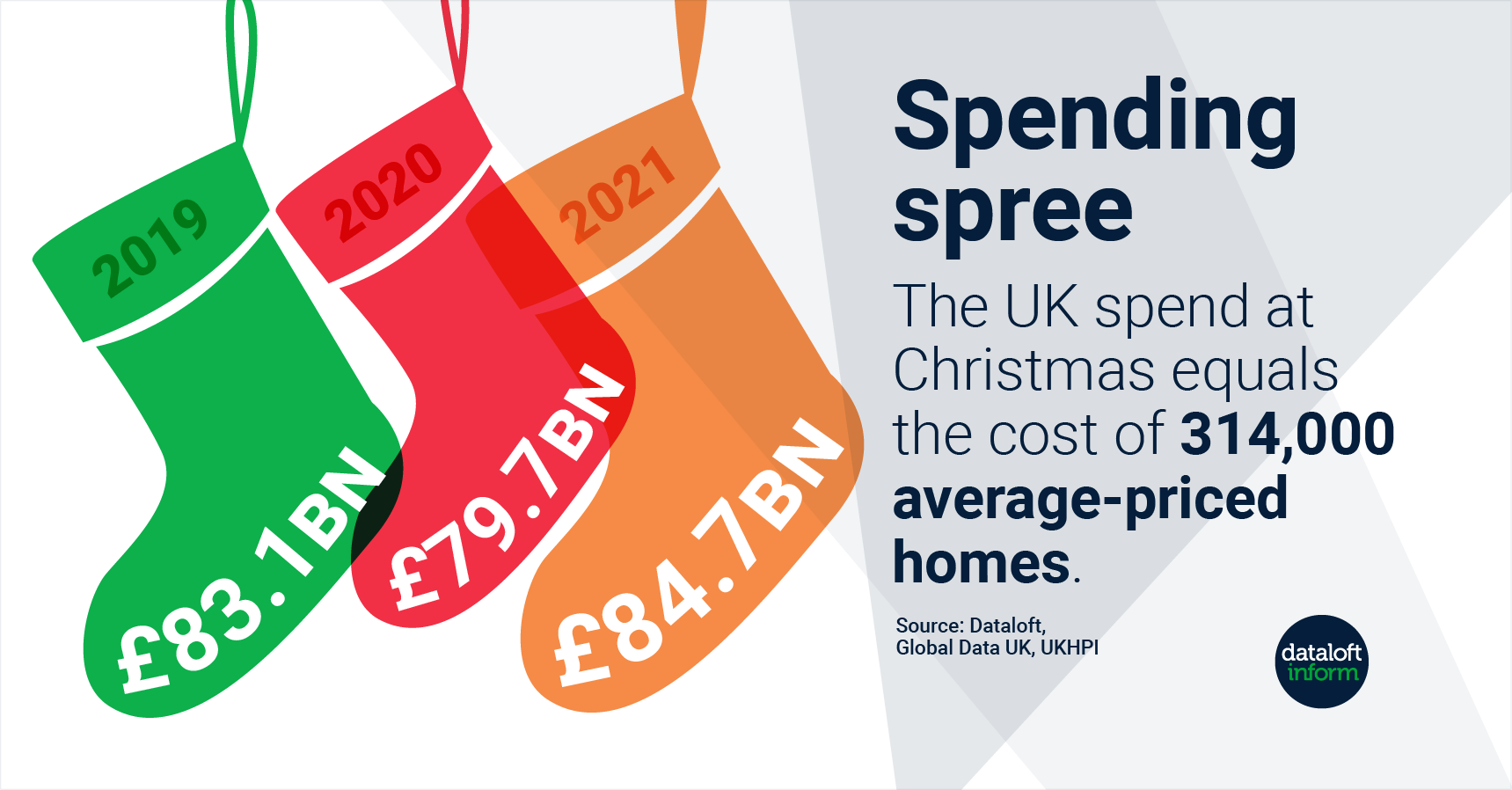

- Shoppers across the UK are forecast to spend a staggering £84.7 billion on Christmas 2021, the equivalent to nearly 314,000 average-priced homes. Spending is set to rise above pre-pandemic levels.

- £32.26 billion (38%) of spending is set to be online, the value of Christmas online spending up 45% on 2019. Source: Dataloft, Global Data UK, UKHPI

- Details

- Hits: 887

- The past 18 months have been tough for UK high streets due to Covid-19 restrictions in early 2020 which triggered a hollowing-out of city centres.

- Footfall and spend analysis from the Centre or Cities/Locomizer suggests that UK cities have begun to recover (despite increased online shopping) but at varying degrees.

- Small/medium sized cities and large towns have recovered the most. Large cities have recovered the least and continue to struggle due to upward trend in remote working.

- Thriving places are those with a catchment of high disposable incomes, large number of workers commuting in (even if flexibly) and have shifted businesses located in them. Source: Dataloft, Centre for Cities, Locomizer

- Details

- Hits: 878

- Many people move more often than they expect to. This is a key finding of the 2021 Home Moving Trends Survey, conducted by the Property Academy and analysed by Dataloft.

- While just 13% of home movers expect to move within the next 5 years, the reality is that 28% are likely to.

- Equally, while a significant proportion (36%) anticipate their new property will be their 'forever' home, the reality is that just 1 in 4 will stay for over 20 years.

- The survey, answered by over 14,000 home movers nationwide, found that the pandemic could be considered a trigger for more than 40% of recent home moves.

- Source: Dataloft, Property Academy, 2021

- Details

- Hits: 1013

- The rate of house price growth is due to slow in 2022, but remain positive, ranging from 2% (London) to 4.3% (North West).

- Growth will be highest in northern and Midlands regions, where affordability is less constrained, and slowest in London where it is more stretched.

- A shortage of homes on the market and high levels of equity will be key drivers for house price growth in 2022.

- Cost of living rises and the expectation that mortgage rates and taxes will increase in 2022 are likely to impact affordability, thus limiting house price growth.

- Source: Dataloft, Zoopla, Savills

- Details

- Hits: 862

- Research commissioned by the Creative Land Trust illustrates an outperformance of residential values in areas with a cluster of creative industries.

- Creative industries include all types of artists, screen printing, film making, music, performing arts and rehearsal space.

- Case studies across London and the Thames Estuary were used but the findings will apply in any location.

- The results are hard evidence that successful placemaking by developers translates into increased demand and ultimately economic value. Source: Dataloft, Ramidus Consulting, Hawkins\Brown, Creative Land Trust, Creative Estuary & Get Living, based on comparison of prices within a 10-year window in London

- Details

- Hits: 926