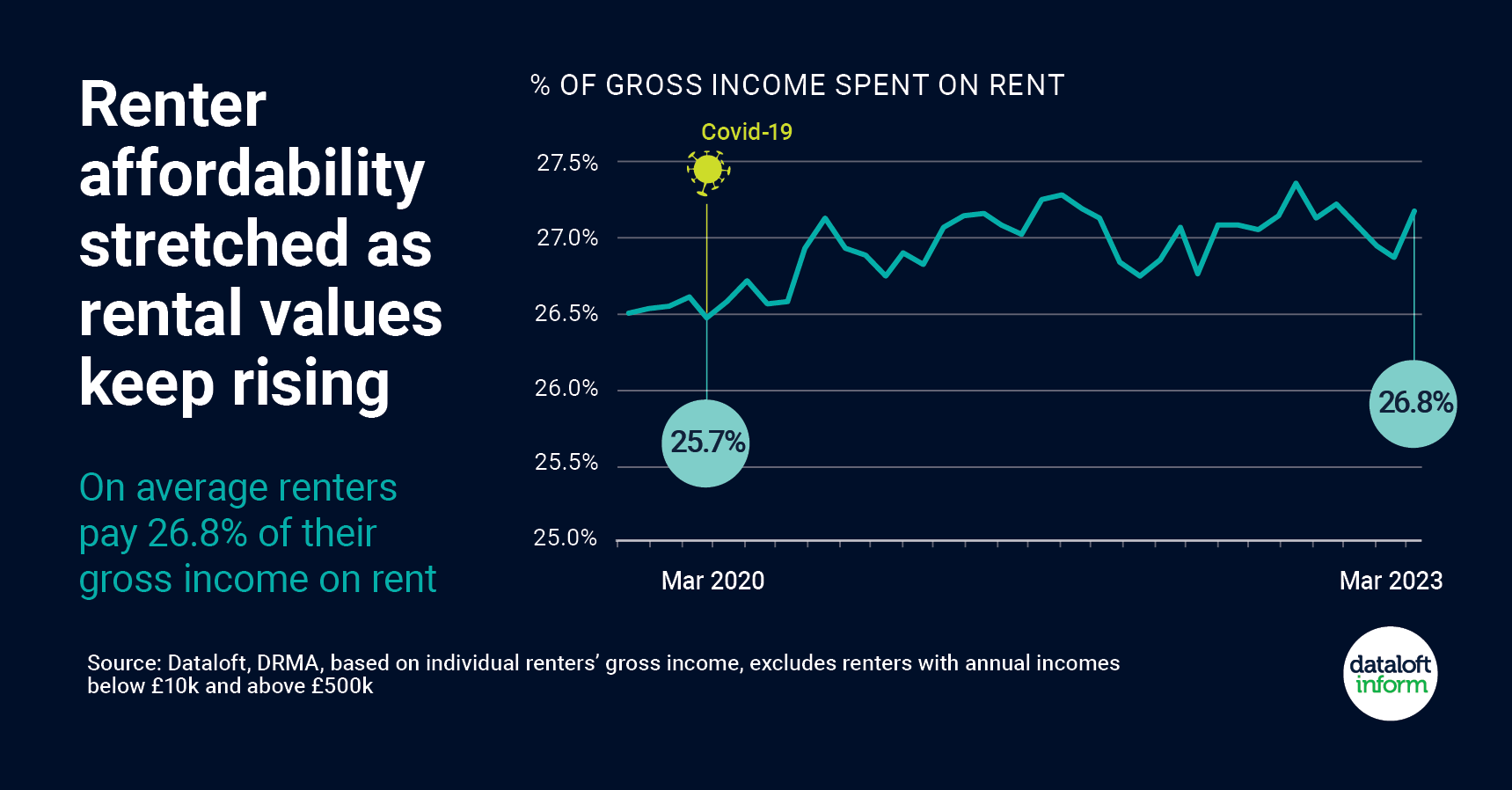

The affordability of renting is increasingly becoming a concern for many tenants, as growth in private rental prices continues to outpace wage increases. According to recent data, on average, renters now pay 26.8% of their gross income on rent, compared to 25.7% three years ago.

The annual rental growth rate in the UK was 9.8% in the year to March, Crawley itself was slightly higher than that at 10.4% for the same period based on new private tenancies. The Office for National Statistics (ONS) recorded growth of 4.9%, which includes pre-existing tenancies and new lets. This suggests that rental price growth is currently stronger than wage growth, which was at 6.6% from December to February. This puts additional pressure on household incomes, particularly as wage growth was also lower than inflation during this period.

The latest survey of agents by the Royal Institution of Chartered Surveyors (RICS) indicates that demand for rental properties is continuing to outpace available supply. This demand-supply imbalance is a key factor driving rental price growth. However, rising affordability ratios are likely to start to limit rental growth, as tenants struggle to afford further increases.

Despite this, there are some potential solutions that could ease the rental affordability crisis. The government could introduce measures to increase the supply of affordable housing, such as incentives for property developers to build more rental homes and to introduce better incentives for landlords to keep their current investments and to potentially buy more rental properties.

Another possible solution is for tenants to consider house sharing, which would help to reduce individual rental costs. Similarly, renters could also consider moving to areas with lower rental prices, although we understand this may not be practical for everyone.

In conclusion, rising rental prices are putting pressure on tenant affordability, and growth in rental prices is currently stronger than wage growth. While demand for rental properties continues to outpace supply, affordability ratios are likely to limit rental growth in the future.

If you have a rental property you are looking to let out, please call Ben on 01293 552 388.