When it comes to tracking property prices in the UK, there are several organisations that publish data on average property prices and annual price growth. However, the figures can differ quite significantly, which can cause confusion for those looking to buy or sell a property. In this article, we'll take a closer look at why these variations occur and what they mean for the property market.

One of the most well-known organisations that tracks property prices is Rightmove. Their average prices tend to be the highest, but this is because their index is based on the asking prices of newly listed properties, rather than on sales prices. This means that the figures are not necessarily reflective of what properties are actually selling for. Rightmove records around 100,000 new listings each month, so their data is based on a large sample size.

In comparison, the Office for National Statistics (ONS) UK House Price Index (HPI) uses final sales prices, including for cash and mortgage sales, recorded by the Land Registry. This means that their data is based on actual sales prices and is therefore considered to be more accurate than Rightmove's data. The ONS HPI includes around 80,000-100,000 sales per month.

Other organisations that track property prices include Halifax and Nationwide. Both of these organisations use their own mortgage applications at the approval stage to gather data on property prices. This means that their data is also based on actual sales prices, but is limited to the properties that have been sold to those who have applied for a mortgage with them. Nationwide tends to have the lowest average price quoted, while Halifax's figures tend to be slightly higher.

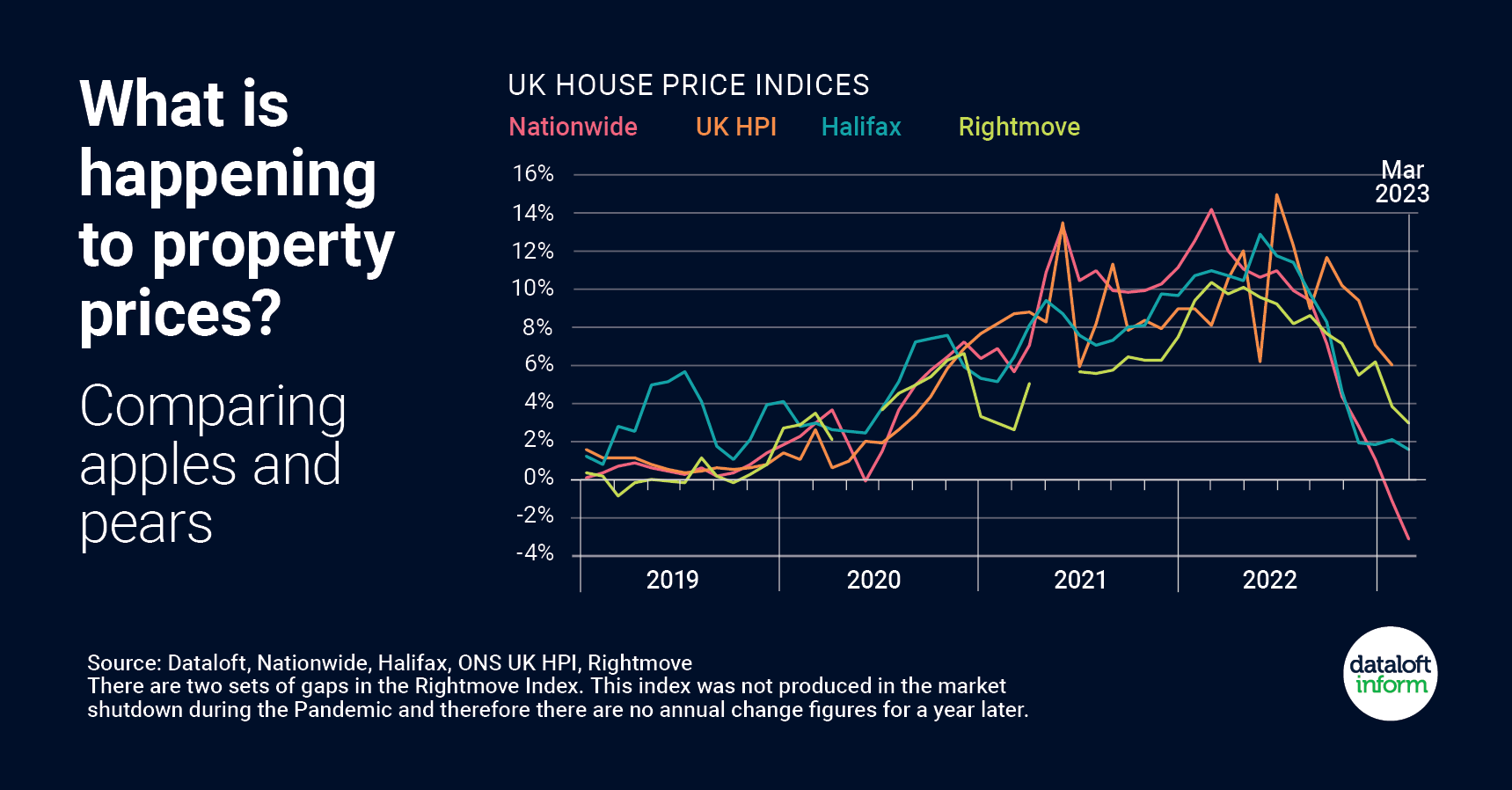

The variations in the source of the data, as well as the statistical calculations that make up each index, explain the differences in the figures published by these organisations. Comparing the indexes against each other is like comparing apples with pears, and it's important to bear this in mind when looking at the data.

However, despite the variations in methodologies, the overall trend direction noted by each organisation is usually similar. This means that the property market is generally moving in the same direction, regardless of which organisation's data you look at. It's this overall trend that's important when considering what's happening in the current market.

In conclusion, while there are several organisations that track property prices in the UK, their data can differ significantly due to variations in the source of the data and the statistical calculations used. However, by looking at the overall trend direction noted by each organisation, we can get a good sense of what's happening in the property market. Whether you're looking to buy or sell a property, it's always a good idea to do your own research and consider the data from multiple sources to get a more accurate picture of the market.

If you would like to know the value of your property call us today on 01293552388