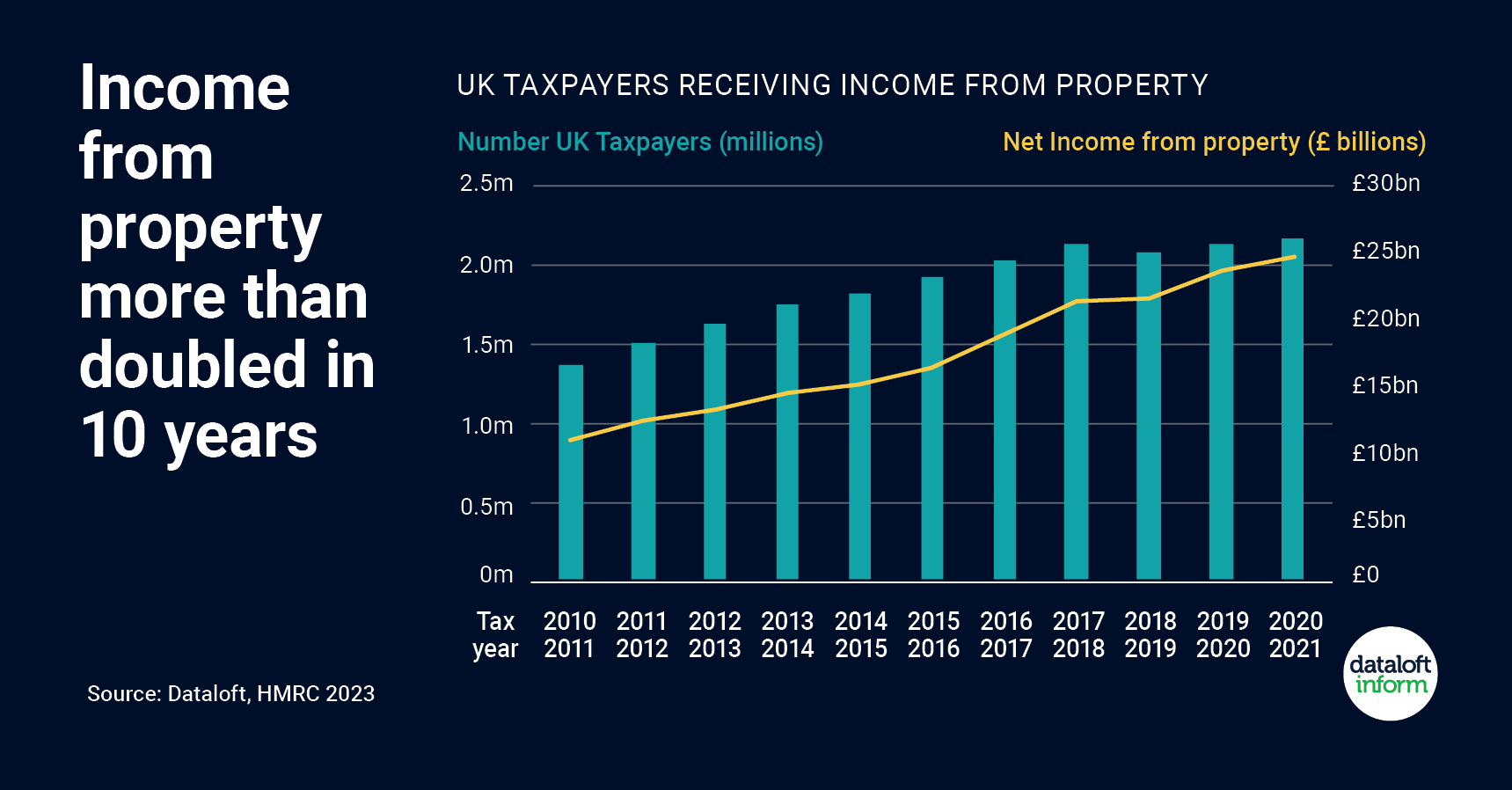

Property is still a good investment despite all the doom and gloom. The latest data released by HMRC (Her Majesty's Revenue and Customs) reveals that over 2.1 million UK taxpayers received income from property in the tax year 2020/21. These taxpayers received a total net income of £24.5 billion (net), which is up by 5% compared to the previous year. This is despite the effects of the landlords' interest restriction, which was phased in since 2017/18.

On average, each taxpayer received a net income of £11,400 from their property. This figure is a result of deducting allowable expenses from their gross rental income. Allowable expenses include letting agent fees, repairs, and maintenance costs, among others.

Moreover, 50% of individuals received between £20,000 and £50,000 in total gross income, while one in eleven received £100,000 or more. These high-earning individuals accounted for over 19% of the total net income received.

Interestingly, the number of UK taxpayers receiving an income from property has risen by close to a quarter of a million in the past 5 years. This suggests that investing in property is still an attractive option for many individuals, despite the various tax changes and increased regulations in recent years.

These findings were sourced from a report by Dataloft, which used HMRC data for the tax year 2020/21. The report provides valuable insights into the UK's property market and the income generated by landlords and property investors.

The report highlights that the income generated from property can provide a reliable source of income, which is especially important in today's economic climate. However, it is crucial to ensure that landlords and property investors are aware of their tax obligations and comply with the relevant regulations.

In conclusion, the latest data released by HMRC indicates that income from property remains a significant source of income for over 2.1 million UK taxpayers. The rise in the number of individuals receiving an income from property suggests that it is still an attractive investment option. However, it is important to remain informed about the tax changes and regulations in the property market to ensure compliance with the law.

If you would like to discuss property investment, please call Ben on 01293552388