In recent times, the residential property market in England and Wales has experienced a significant shift in transaction volumes, with just over one million residential sales recorded in the year ending July. This figure represents an 11.4% decrease compared to the previous year. While this decline might seem alarming at first glance, a closer examination reveals that it is only 7.8% below the five-year average leading up to 2019, the pre-pandemic period. This raises an important question: Does a fall in sale volumes translate into an equal fall in property prices? To answer this question, we must delve into the historical relationship between sale volumes and property prices and explore what these trends could mean for the Crawley property market.

Historical Trends: Sale Volumes vs. Property Prices

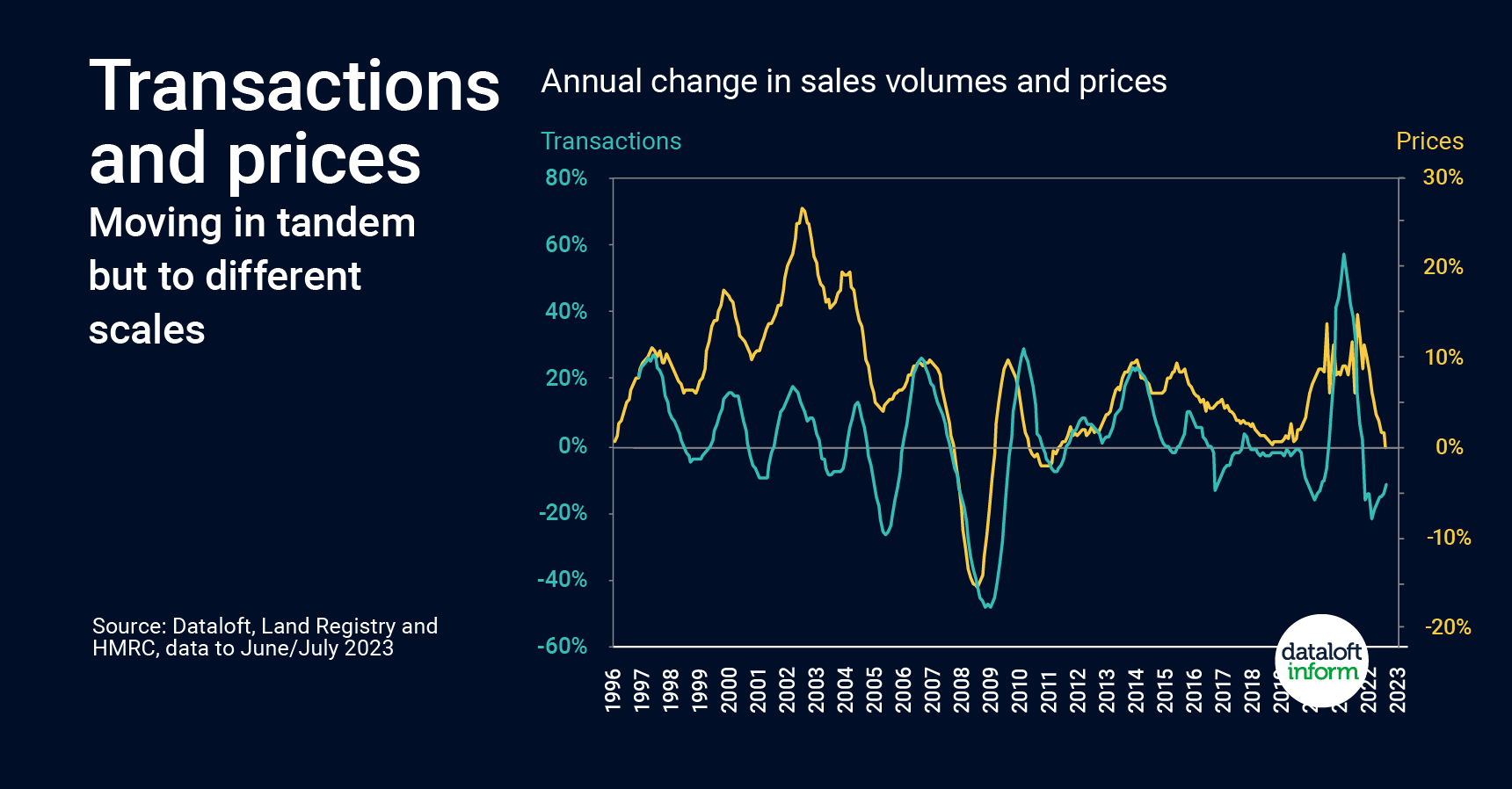

Sale volumes and property prices have historically exhibited a close relationship, moving in tandem through property market cycles. When sale volumes rise, prices tend to follow suit, and conversely, when sale volumes decline, prices often exhibit a downward trend. However, the current scenario appears to be different, with sale volumes decreasing at a more significant rate compared to property prices. To understand this phenomenon better, it's essential to consider historical data.

During the last housing market downturn, which occurred in the wake of the 2008 financial crisis, the worst annual fall in sale volumes was a staggering -47.6%, occurring in the year ending February 2009. Meanwhile, property prices experienced a significant but less severe decline, with the worst fall recorded at -15.4%, happening in the year ending March 2009. This historical data illustrates that the relationship between sale volumes and property prices is not one-to-one; rather, they move on different scales.

Implications for the Crawley Property Market

The observed discrepancy between falling sale volumes and relatively stable property prices has important implications for the Crawley property market and the broader property landscape. Here's what it means for potential buyers, sellers, and investors in Crawley:

Buyers: Lower sale volumes could present opportunities for buyers in Crawley. With fewer competing buyers in the market, there may be reduced pressure to act quickly, allowing for more thorough property evaluations and negotiations. However, buyers should remain cautious, as property prices can still be influenced by other factors such as supply and demand dynamics, local economic conditions, and government policies.

Sellers: Sellers in Crawley may face a more challenging environment due to reduced transaction volumes. It may take longer to find a suitable buyer, and pricing strategies should be carefully considered. A well-presented property with a competitive price could still attract interested buyers, even in a slower market.

Investors: Property investors in Crawley should keep an eye on both sale volumes and property prices. While falling sale volumes might indicate decreased market activity, they don't necessarily signify an immediate drop in property values. Investors should conduct thorough market research, assess rental demand, and consider long-term potential when making investment decisions.

Local Factors: It's crucial to remember that the Crawley property market can be influenced by local factors such as job opportunities, infrastructure developments, and population trends. These factors can either mitigate or exacerbate the effects of changing sale volumes on property prices.

The recent decline in residential sale volumes across England and Wales, including the Crawley area, raises questions about its impact on property prices. Historical data suggests that while sale volumes and property prices often move in tandem through market cycles, they don't follow a one-to-one relationship. As observed during the 2008 financial crisis, a significant drop in sale volumes did not result in an equivalent drop in property prices. Therefore, while a reduction in sale volumes might create a more favourable environment for buyers and potentially longer listing times for sellers in the Crawley property market, it does not necessarily guarantee a sharp decline in property values. Local factors and broader economic conditions will continue to play a significant role in shaping property market dynamics. As such, prospective buyers, sellers, and investors in Crawley should carefully monitor these factors and seek professional guidance to make informed decisions in this evolving market landscape.