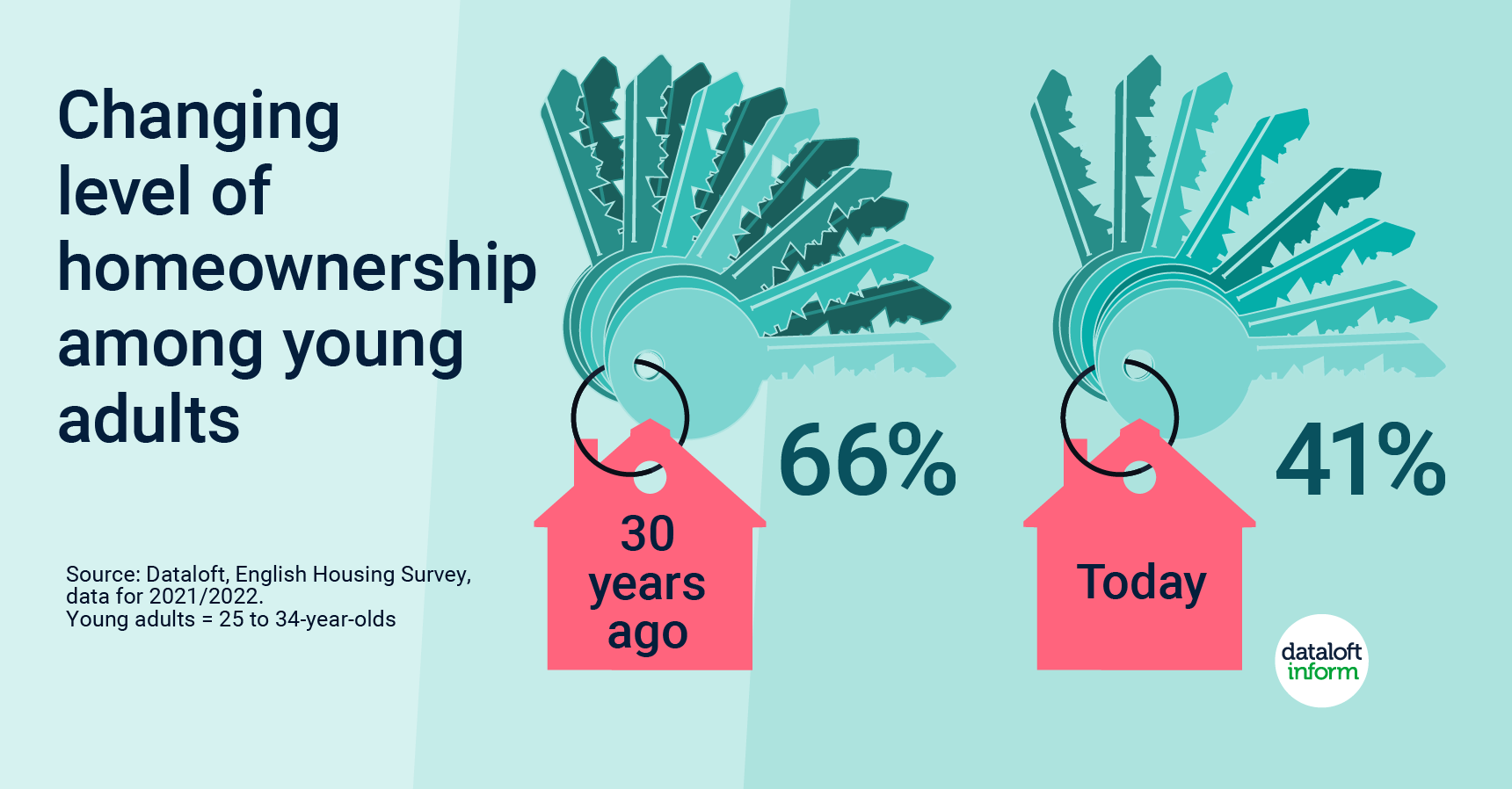

The homeownership landscape in the United Kingdom is undergoing a significant transformation, particularly for young adults. A recent report reveals that well under half of today's young adults, aged 25 to 34, own their own homes, with only 41% having achieved this milestone. This represents a stark contrast to the situation 30 years ago when two-thirds of individuals in the same age group had already become homeowners. In this article, we will explore the reasons behind this shift and how it is influencing the Crawley property market.

The Decline in Young Adult Homeownership

The decline in young adult homeownership has been a gradual process, but its impact has been profound. Looking back three decades, a staggering 66% of 25 to 34-year-olds had successfully purchased their own homes. However, a sharp decline in owner occupation occurred between 1991 and 2011/2012, leading to a significant increase in the size of the private rented sector.

Several factors contribute to this decline in homeownership among young adults. Skyrocketing property prices, stagnant wage growth, and the increased difficulty of obtaining mortgage financing are all prominent reasons. Additionally, the younger generation faces more significant financial burdens, including student loan debt and the rising cost of living, which further hinder their ability to save for a down payment on a home.

The Impact on the Crawley Property Market

The changing landscape of homeownership has not only influenced individual aspirations but also the broader property market in areas like Crawley. As fewer young adults are able to enter the property market, there is an increased demand for rental properties. This demand has driven up rental prices in Crawley and other similar regions, making it more challenging for young people to save for a future home purchase.

Furthermore, the lack of first-time buyers in the market can affect the stability and growth of the property market in Crawley. A strong property market often relies on a healthy mix of first-time buyers and repeat buyers, but the current situation skews towards the latter due to the difficulties young adults face when trying to buy their first homes. This could potentially lead to stagnation or slower growth in property values in the long run.

Political Implications

With a general election on the horizon, it is expected that political parties will actively seek the support of young adults by addressing the housing crisis. Policies aimed at making it easier for first-time buyers to step onto the housing ladder are likely to be at the forefront of election promises.

These policies may include initiatives to increase affordable housing supply, offer financial incentives for first-time buyers, and reform the renting sector to provide even more security for tenants. While these measures may not immediately reverse the decline in young adult homeownership, they could pave the way for a more sustainable and balanced property market in the future.

The decline in homeownership among young adults, both nationally and in areas like Crawley, is a pressing issue that has significant implications for individuals and the property market alike. Skyrocketing property prices, stagnant wages, and financial pressures have contributed to this trend. To address this challenge and boost young adult homeownership, it is expected that political parties will introduce housing-related policies in the upcoming general election. The future of the Crawley property market, like many others, will depend on the success of these measures in making homeownership more accessible to the younger generation.