In the world of residential property sales, market trends and activity are often closely linked to mortgage approvals. These approvals serve as a pivotal leading indicator, offering insight into the health and direction of the housing market. As we delve into the dynamics of the housing market in 2023, it's evident that mortgage approvals play a crucial role in predicting future trends. In this article, we'll explore why mortgage approvals are an essential indicator and analyse their recent patterns to understand what they suggest for the coming months.

Mortgage Approvals as Leading Indicators

Mortgage approvals can be seen as the proverbial canary in the coal mine for the residential property market. They typically lead trends in property sales activity by approximately three months. This means that changes in mortgage approvals today can give us a sneak peek into the future health of the housing market. Understanding this lag effect is crucial for market analysts, policymakers, and potential homebuyers and sellers.

The Current Landscape

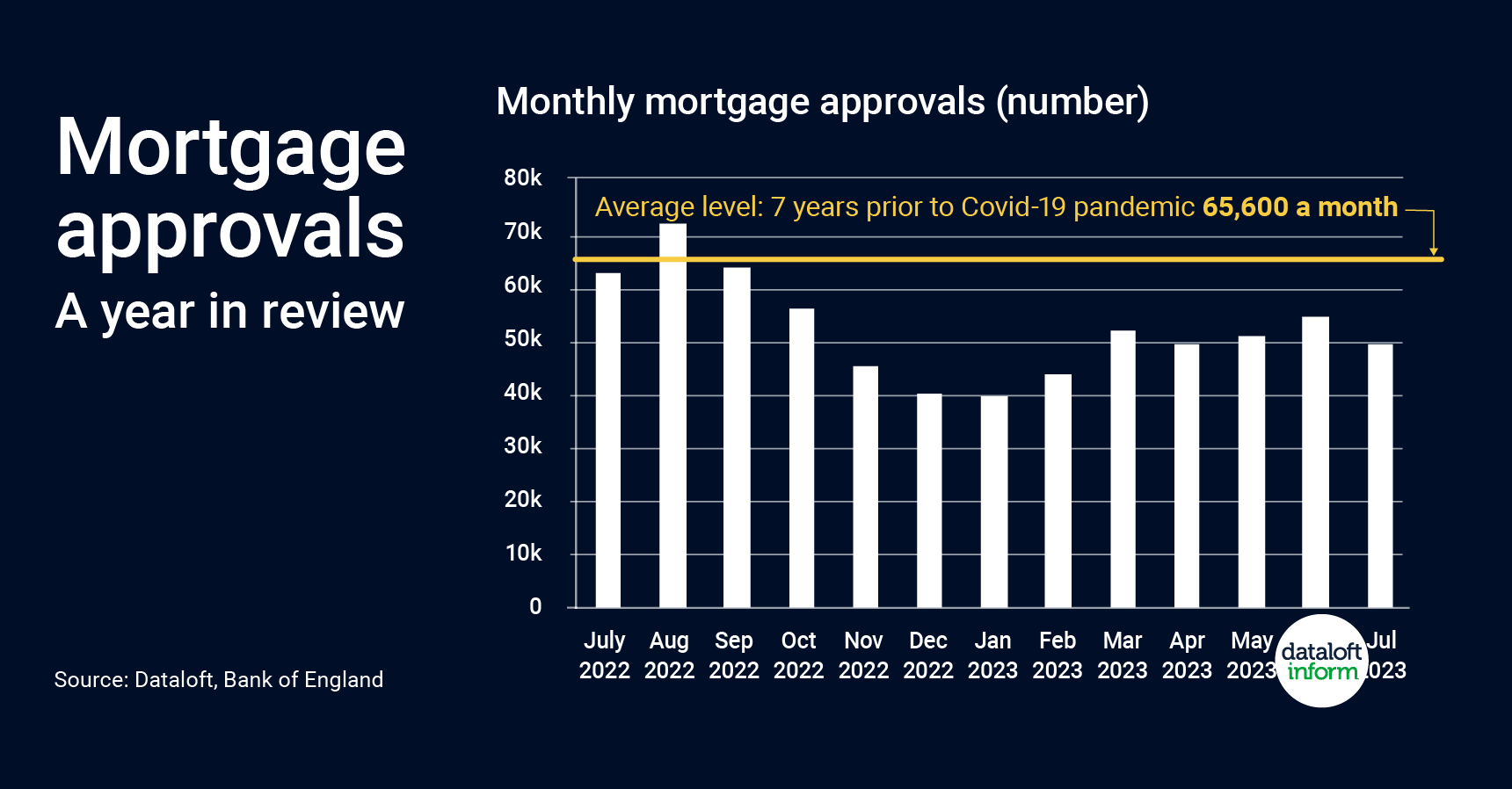

As of the beginning of 2023, we've observed an uptick in the number of mortgage approvals. However, it's important to note that these approvals still remain below the usual levels we saw in the years leading up to the Covid-19 pandemic. In the year ending July 2023, monthly mortgage approvals averaged 51,600, representing a 21% decline from the levels recorded in the seven years preceding the pandemic. This shortfall, while not alarming, raises questions about the resilience and future prospects of the housing market.

Economic Factors at Play

To understand the factors influencing the mortgage approval landscape, we must consider broader economic conditions. Inflationary pressures have been a significant concern for many sectors of the economy, including the property market. However, recent inflation data has provided some relief and optimism. Projections also suggest that interest rates are expected to peak in the current year and start a gradual decline in 2024. These developments are pivotal for prospective homebuyers, as lower interest rates can make mortgages more affordable, potentially leading to increased market activity.

The Turnaround Point

Mortgage approvals reached their lowest point in December 2022 and January 2023. This dip was influenced by a combination of seasonal factors and heightened uncertainty surrounding inflation and interest rates. Seasonally, the holiday season often witnesses a slowdown in the property market, as people are preoccupied with festivities rather than property transactions. Moreover, the spectre of rising inflation and interest rates led to cautious behaviour among both buyers and lenders.

Looking Ahead

Given the close relationship between mortgage approvals and residential sales activity, these indicators are vital for anticipating market movements. As we monitor the trajectory of mortgage approvals in the coming months, we can expect them to serve as a leading indicator for any potential shifts in the housing market.

The recent uptick in approvals, coupled with optimistic inflation and interest rate projections, suggests that the market may be poised for an uptick in activity. However, it's essential to remain vigilant and continue tracking these indicators to make informed decisions regarding property investments, whether you're buying, selling, or investing.

In the ever-evolving world of the housing market, mortgage approvals stand as a valuable compass, guiding us towards future market trends. While they have recently shown signs of improvement, we should bear in mind that they are still recovering from the shocks of the pandemic and economic uncertainties. As inflationary pressures abate and interest rates begin to recede, mortgage approvals are likely to provide the first glimpse of a potential resurgence in market activity. So, keep a close eye on these approvals if you want to stay ahead in the property game.