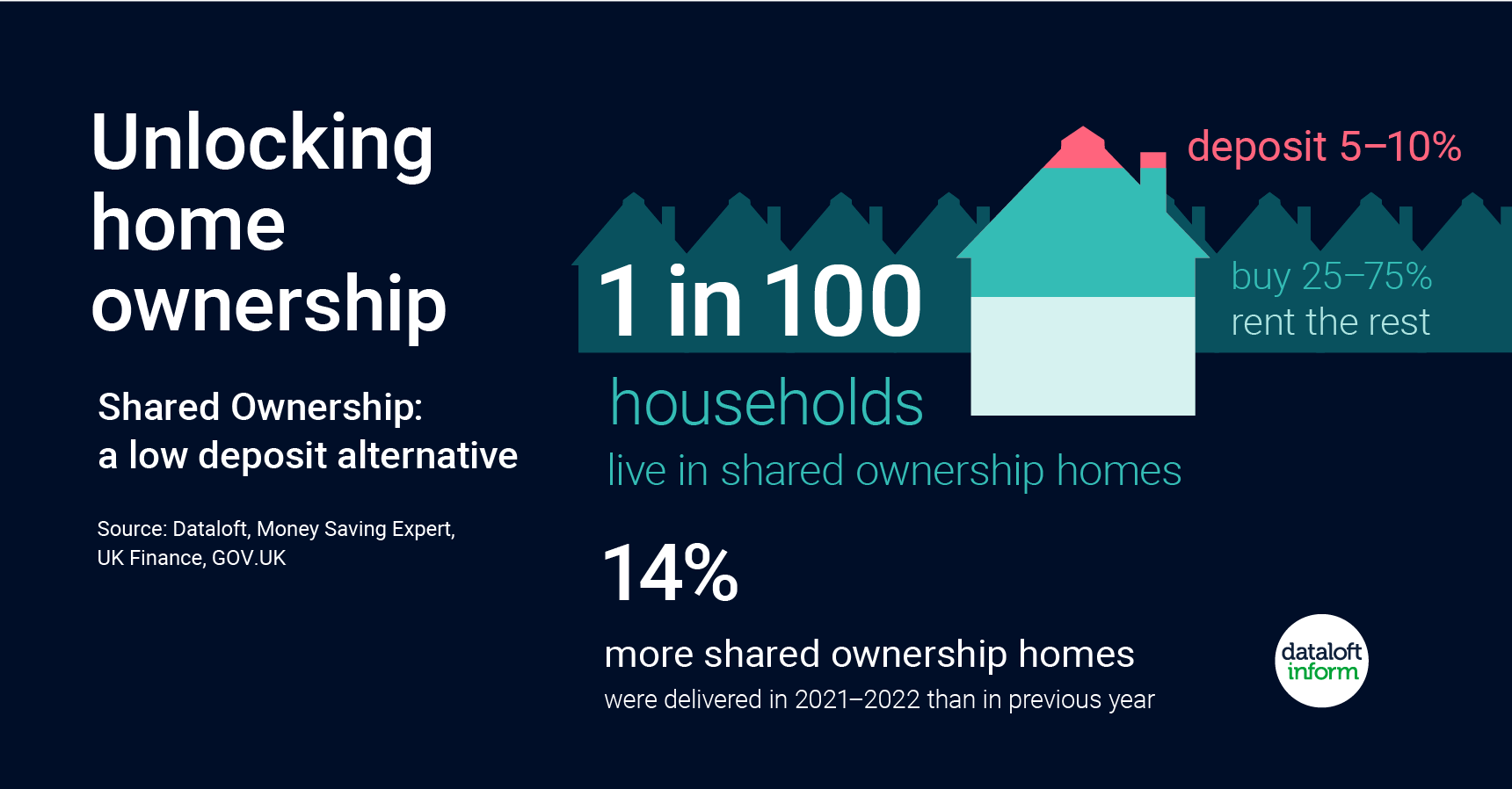

As the curtains draw on the Help to Buy scheme, the landscape of homeownership in the United Kingdom has undergone a noticeable shift. The need for a low-deposit solution to facilitate the dream of owning a home has gained prominence. With approximately 1 in every 100 households in the country residing in shared ownership homes, the concept has emerged as a promising avenue for those seeking to step onto the property ladder with limited upfront costs.

Shared ownership, a novel approach to homeownership, presents an attractive alternative for individuals and families who find themselves grappling with the challenge of gathering a substantial down payment. The scheme's mechanics are simple yet innovative: prospective buyers are offered the opportunity to purchase a share of their chosen property, typically ranging from 25% to 75%, while concurrently paying rent on the remaining portion. Over time, purchasers have the flexibility to gradually acquire additional shares until they eventually gain complete ownership of their home.

A defining feature that sets shared ownership apart from conventional routes is the remarkably reduced deposit requirement. In contrast to the staggering average deposit of 24% typically demanded from UK first-time buyers, shared ownership demands a more manageable deposit, often ranging between 5% and 10% of the share being acquired. This significant reduction in upfront financial burden makes shared ownership a palpable and financially viable option for individuals yearning to attain the status of a homeowner.

It is important to underscore that shared ownership is not an exclusive privilege reserved solely for first-time buyers. The eligibility criteria encompass a broader spectrum, extending the opportunity to those with a household income of £80,000 per annum or less (or £90,000 or less in London), who are unable to afford a residence that aligns with their needs and aspirations. This inclusivity, anchored in financial prudence, underscores the government's commitment to democratizing the experience of homeownership and making it accessible to a wider segment of the population.

Sources of data and expertise, including #Dataloft, Money Saving Expert, UK Finance, and GOV.UK, corroborate the viability and advantages of shared ownership. These reputable sources bolster the notion that shared ownership is not merely a stopgap measure but a bona fide pathway toward establishing a stable and fulfilling homeownership journey.

In conclusion, as the Help to Buy scheme concludes its chapter, shared ownership emerges as a beacon of hope for those seeking a low-deposit route to homeownership. Its dynamic structure, which enables incremental ownership acquisition while reducing the burden of a substantial deposit, positions shared ownership as an accessible and practical solution. By extending eligibility beyond first-time buyers and embracing a wider income bracket, the UK government underscores its commitment to empowering individuals to embrace the joys and responsibilities of homeownership. In the tapestry of UK housing, shared ownership is undoubtedly a thread woven with affordability, flexibility, and opportunity.