In the past year, a significant portion of home purchases across Wales and England (excluding London) have been exempt from property taxation. This exemption has had a notable impact on the local housing market in Crawley and neighbouring areas. With a considerable number of homes falling below the thresholds for property taxation, buyers, particularly first-time buyers and those seeking smaller properties, have been able to enter the market more easily. This article will delve into the effects of property tax exemptions on the local Crawley market and explore the implications for different property types.

Tax Exemptions Fuel Market Activity:

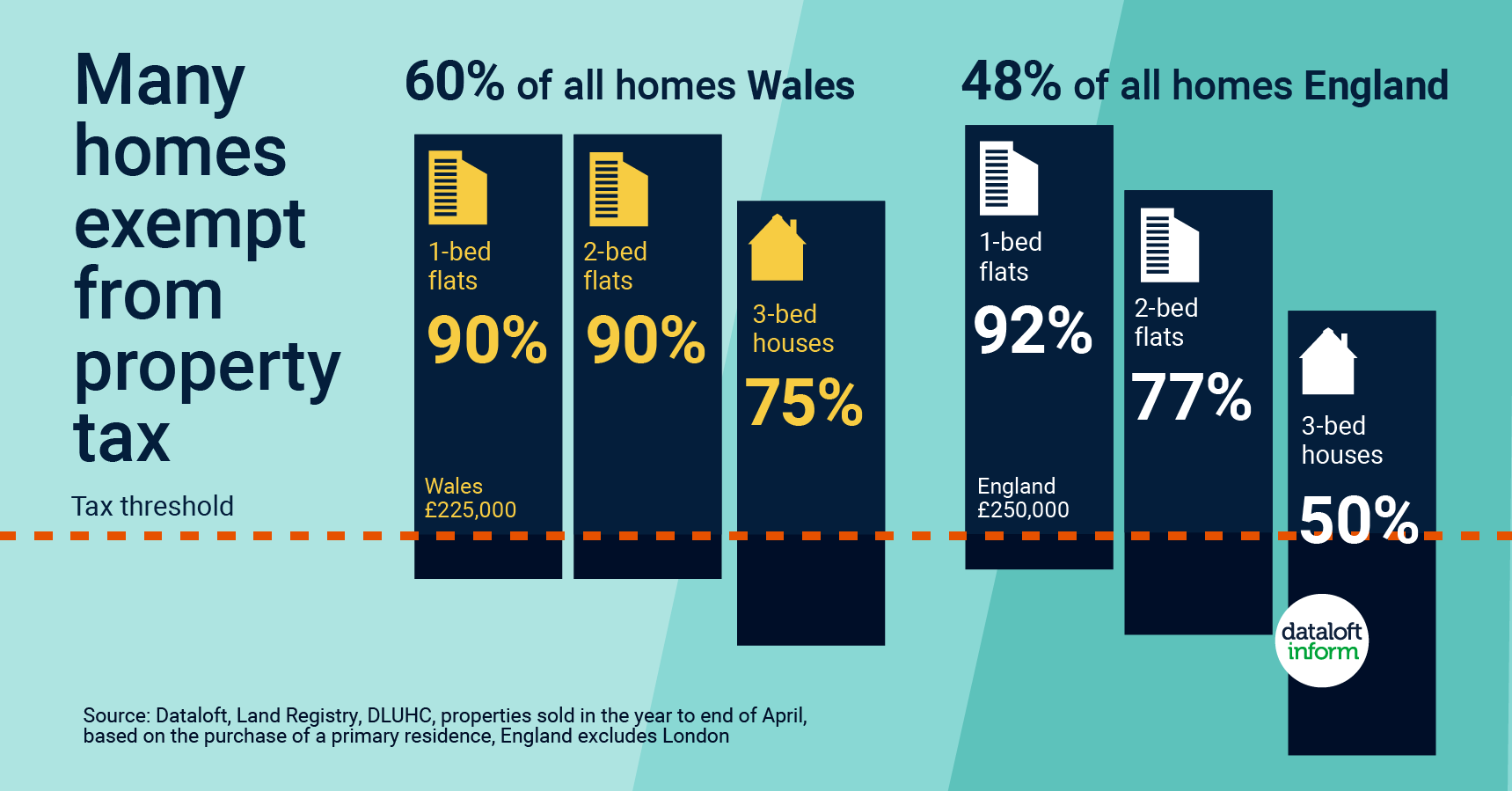

According to recent data from Dataloft, the Land Registry, DLUHC, and property sales from the year ending in April, more than 60% of homes in Wales and approximately 48% of homes in England (excluding London) purchased by home movers have been exempt from property taxation. These figures highlight a significant trend that has shaped the real estate landscape.

Affordability and Accessibility for Home Movers:

In Wales, over 90% of all 1-bed and 2-bed apartments sold fell below the £225,000 threshold for Land Transaction Tax. Similarly, in England, the proportions of apartments sold below the £250,000 threshold for Stamp Duty Land Tax were 92% and 77% for 1-bed and 2-bed apartments, respectively. This indicates that a vast majority of apartment buyers, including first-time buyers and downsizers, have benefited from these tax exemptions.

Moreover, a significant number of 3-bed houses in both Wales and England were sold below the price thresholds for taxation. Nearly three out of four 3-bed houses in Wales and over half in England were priced below these thresholds. This has made 3-bed houses more affordable for families and buyers seeking larger properties.

Boost for First-Time Buyers:

In England (excluding London), the threshold for first-time buyers stands at £425,000, which is even higher than the thresholds for other property types. The data reveals that 80% of all homes sold in the past year were below this threshold. Notably, 96% of all apartments and 80% of all terraced homes fell beneath this limit. This exemption has been instrumental in enabling first-time buyers to make their way onto the property ladder, especially in Crawley and its surrounding areas.

Impact on the Local Crawley Market:

The property tax exemptions have had a positive effect on the local housing market in Crawley. With a higher percentage of affordable homes available, demand has surged, leading to increased market activity. The increased affordability has attracted a diverse range of buyers, including first-time buyers, downsizers, and families, with more people coming into the area from London.

The surge in demand had also created a favourable environment for property sellers. Those looking to sell their homes are likely to find a larger pool of potential buyers, resulting in quicker sales and, in some cases, increased property prices. The tax exemptions have effectively facilitated transactions and stimulated the housing market in Crawley.

The significant number of homes exempt from property taxation across Wales and England (excluding London) has had a notable impact on the local housing market in Crawley. The affordability and accessibility of properties, particularly for first-time buyers and those seeking smaller homes, have driven increased market activity. The tax exemptions have not only empowered buyers but have also presented opportunities for property sellers. As the housing market in Crawley continues to be positive, these property tax exemptions play a crucial role in shaping its growth and development.