The dream of owning a home is a significant milestone for many individuals and families. In the United Kingdom, the number of households achieving this milestone is substantial, with over 5.5 million households currently living in their first-time buyer homes. This figure represents more than 35% of all owner occupiers in the country. The dynamics of the first-time buyer market offer intriguing insights into the preferences and expectations of new homeowners. In this article, we will delve into the statistics and explore how these trends impact the local property market in Crawley, West Sussex.

Demographic Breakdown

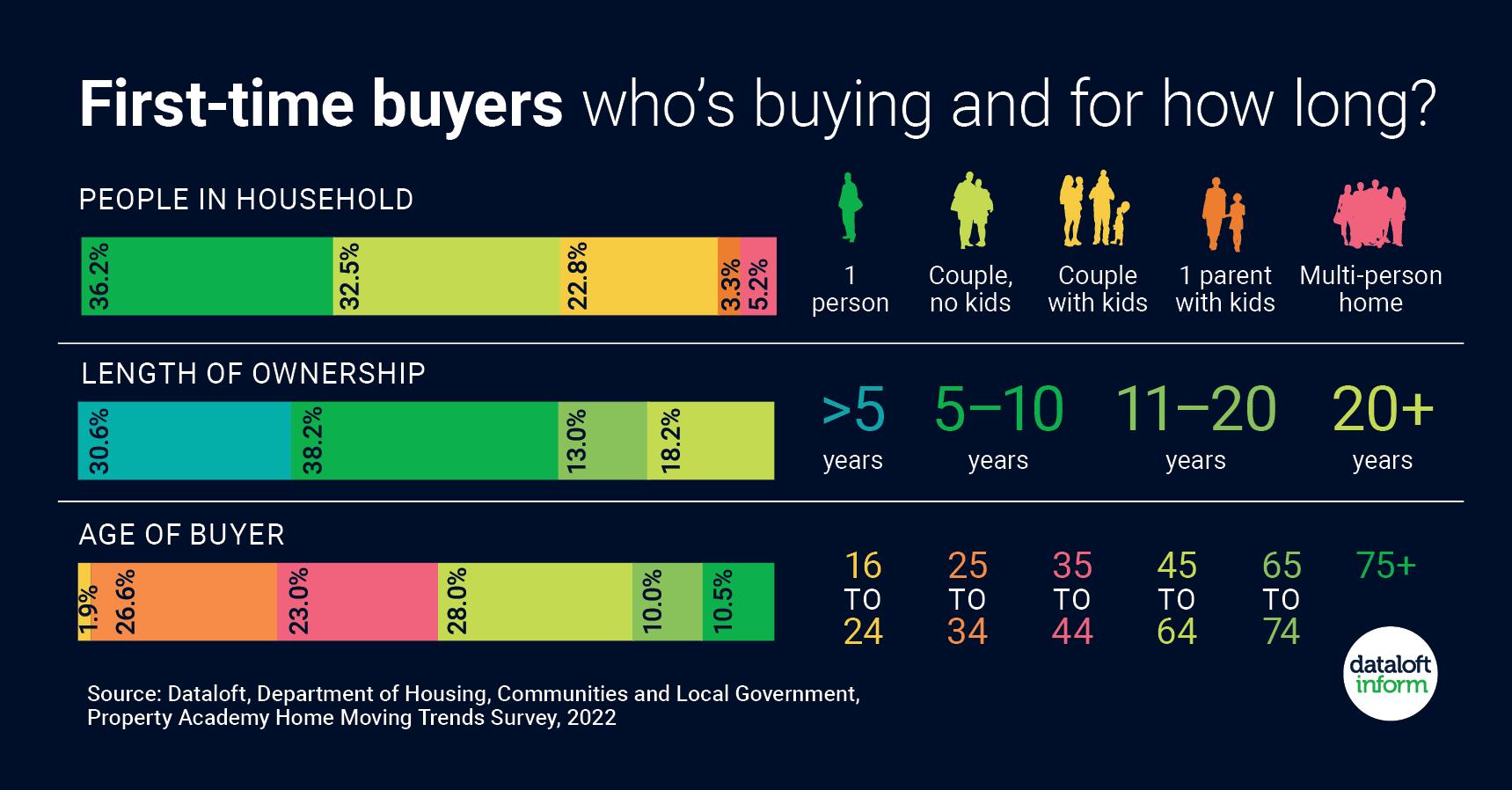

Within the first-time buyer segment, there is an interesting mix of household types. Approximately 36% of first-time buyer households consist of single individuals. It is worth noting whether they were single at the time of purchase or became single after is unclear from the data. Conversely, over 60% of first-time buyers are couples, with or without dependent children, making their initial foray into homeownership together. Furthermore, one in five individuals who reside in their first home bought it at the age of 65 or older, highlighting the diverse age range of first-time buyers.

Property Duration Expectations

An essential aspect of homeownership is the length of time individuals or families expect to stay in their first home. Two-thirds of first-time buyers anticipate residing in their property for less than a decade. However, a notable 18% plan to live in their homes for 20 years or more. This percentage increases to 33% for first-time buyers aged 45 and above, indicating a higher inclination towards long-term ownership among this age group. These varying expectations have implications for property market dynamics and the demand for housing in the years to come.

Annual First-Time Buyer Figures

Each year, more than 350,000 first-time buyers successfully step onto the property ladder in the UK. This figure is a testament to the enduring appeal of homeownership and the robustness of the housing market. The average age of first-time buyers has risen to 34, reflecting the challenges young people face in saving for a deposit and accessing affordable housing. According to a report by Halifax, first-time buyers accounted for 52% of all home purchase loans in 2022, further underlining their significance in driving activity within the housing market.

Impact on the Local Crawley Property Market

While the aforementioned statistics provide a broad overview of the national first-time buyer market, it is important to consider how these trends impact the local property market in Crawley, West Sussex. As an emerging town located within commuting distance of London and benefiting from excellent transport links, Crawley has seen increased interest from first-time buyers seeking affordable homeownership options.

The influx of first-time buyers into the Crawley property market has contributed to rising demand for entry-level properties. This heightened demand, combined with limited supply, has led to an upward pressure on property prices, making it increasingly competitive for prospective buyers. As a result, local sellers have experienced favourable conditions, witnessing faster property sales and potential increases in property values.

However, affordability concerns persist among first-time buyers, particularly those with limited financial resources. The average age of first-time buyers being 34 indicates that young professionals and families are actively seeking homeownership opportunities in Crawley. To address the needs of this segment, it is crucial for local authorities and developers to focus on providing a range of affordable housing options, including shared ownership schemes and initiatives that facilitate access to homeownership.

The first-time buyer market in the UK continues to be a significant driving force in the property sector. With millions of households already settled in their first homes and a steady influx of new buyers each year, understanding the preferences, demographics, and duration expectations of this segment is essential. The local property market in Crawley, West Sussex, has also felt the impact of these trends, experiencing increased demand and rising prices. However, addressing affordability concerns and expanding housing options will be vital to ensuring sustainable homeownership opportunities for aspiring buyers in the region.