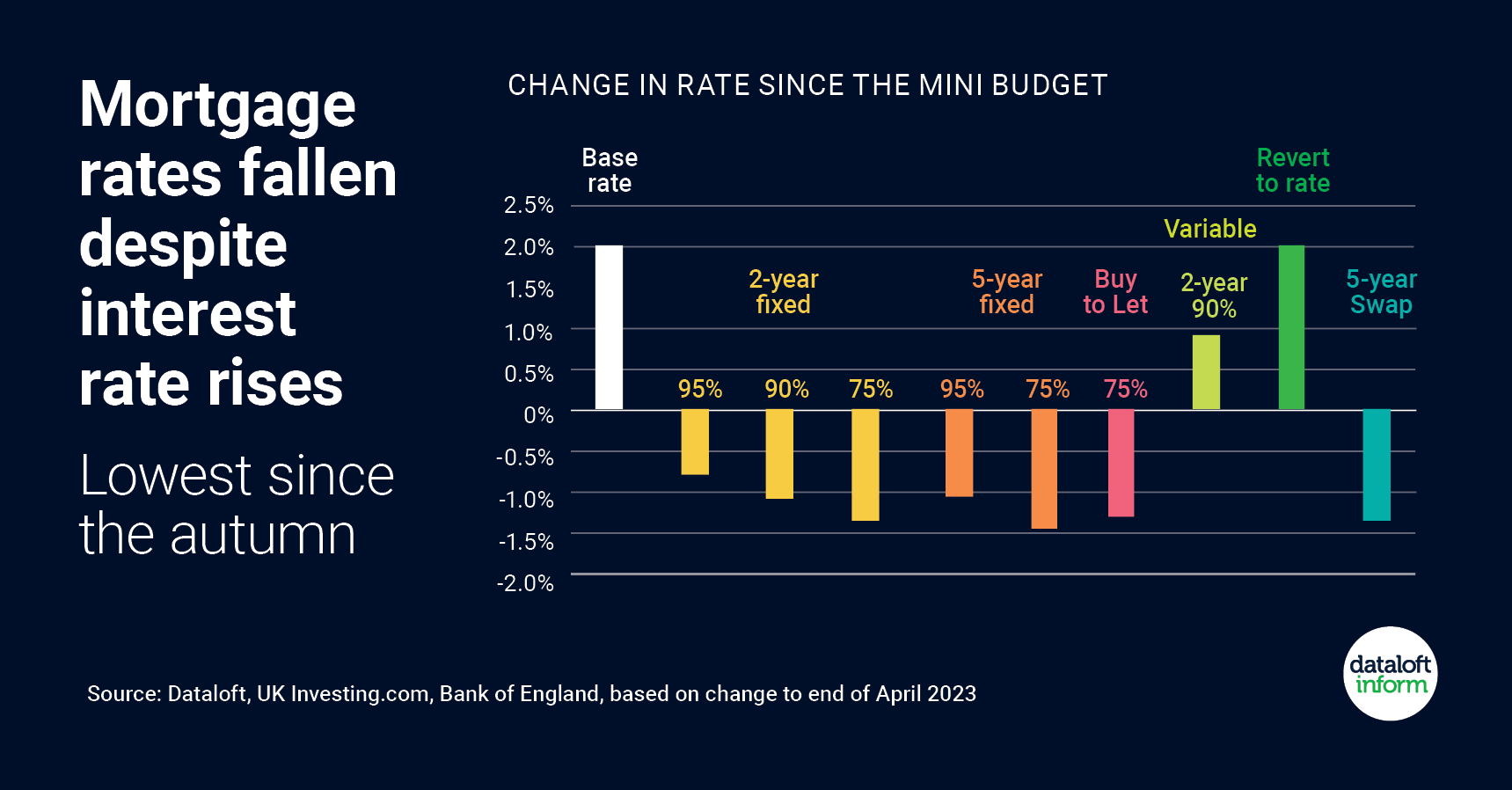

In recent times, the mortgage interest rate market has been subject to some fluctuations. Analysis of this market indicates that while the base rate of interest has risen, mortgage rates for those seeking to purchase have fallen back from their autumn peak.

This trend can be observed in the falling average fixed rate mortgage rates, which have returned to their lowest point since the Autumn season prior to the announcement by the Bank of England to raise the base rate to 4.5%. This drop in mortgage rates is good news for prospective homebuyers, as it provides them with more favourable borrowing conditions.

Another factor that is contributing to the increased affordability of mortgages is the wider product choice available across the Loan-to-Value (LTV) spectrum. In recent months, product choice has increased, providing more options for prospective purchasers. Lower LTV ratios have benefitted the most from rate declines, meaning that those with a larger deposit are seeing the greatest reductions in their mortgage rates.

It is important to note that while the base rate rise will have an impact on those with tracker or variable rate mortgages, the majority of mortgage loans agreed continue to be on a fixed term basis. This means that the majority of mortgage holders will not be directly impacted by the base rate rise.

Overall, these trends in the mortgage interest rate market are positive news for those looking to buy a home in the near future. With lower mortgage rates and a wider range of product choices available, prospective homebuyers have more opportunities to secure a favourable mortgage. However, it is always important to keep an eye on the market and consult with a professional advisor before making any significant financial decisions.