Blog

Roses are red, violets are blue, and in the UK's property market, a perfect home awaits you. Valentine's Day, traditionally celebrated as a day of love and affection, also sees many couples embarking on the journey of finding their dream home. In 2023, over 1,300 homebuyers sealed the deal on Valentine's Day, creating their own love story amidst the backdrop of the property market.

According to data sourced from Dataloft and the Land Registry for 2023, Valentine's Day transactions in the UK's property market showcased intriguing insights. The average sold price for homes on this romantic day stood at £364,655, marking a 4% increase compared to the rest of the year. This surge in pricing underlines the sentimentality and significance attached to purchasing a home on Valentine's Day.

In matters of the heart, the UK's property market offers a diverse array of options, catering to every preference and budget. From lavish estates to cosy retreats, there's something for every heart's desire. Last Valentine's Day exemplified this diversity, with a staggering £5,546,750 difference between the most and least expensive purchases.

Topping the list as the most extravagant purchase was a luxurious flat located in Gloucester Square, Westminster, fetching a price tag of £5,580,000. This opulent residence epitomized grandeur and sophistication, serving as a testament to the heights of luxury within the UK's property landscape.

However, amidst the allure of high-end properties, love also found a place in more budget-friendly abodes. In Hartlepool, a charming terrace stole hearts with its modest price of £33,250. This humble yet cosy dwelling demonstrated that love knows no bounds, transcending monetary considerations to find solace in the warmth of a home.

The juxtaposition of these diverse transactions highlights the dynamic nature of the UK's property market, where romance intertwines with financial pragmatism. Whether it's a lavish indulgence or a modest haven, Valentine's Day serves as a poignant reminder that home is where the heart is.

As couples across the UK exchange vows and keys on this special day, the property market continues to evolve, offering endless possibilities for those embarking on the journey of love and homeownership. With each transaction, a new chapter unfolds in the ongoing saga of romance and property in the UK.

In conclusion, as roses bloom and violets flourish, so too does the allure of finding the perfect home in the UK's property market. Whether you're dreaming of a lavish sanctuary or a cosy retreat, Valentine's Day beckons with promises of love and opportunity in the realm of property. And if your heart is set on finding your dream home in Crawley, look no further – simply call our office on 01293 552 388 to start your journey towards homeownership and a love-filled future.

- Details

- Hits: 248

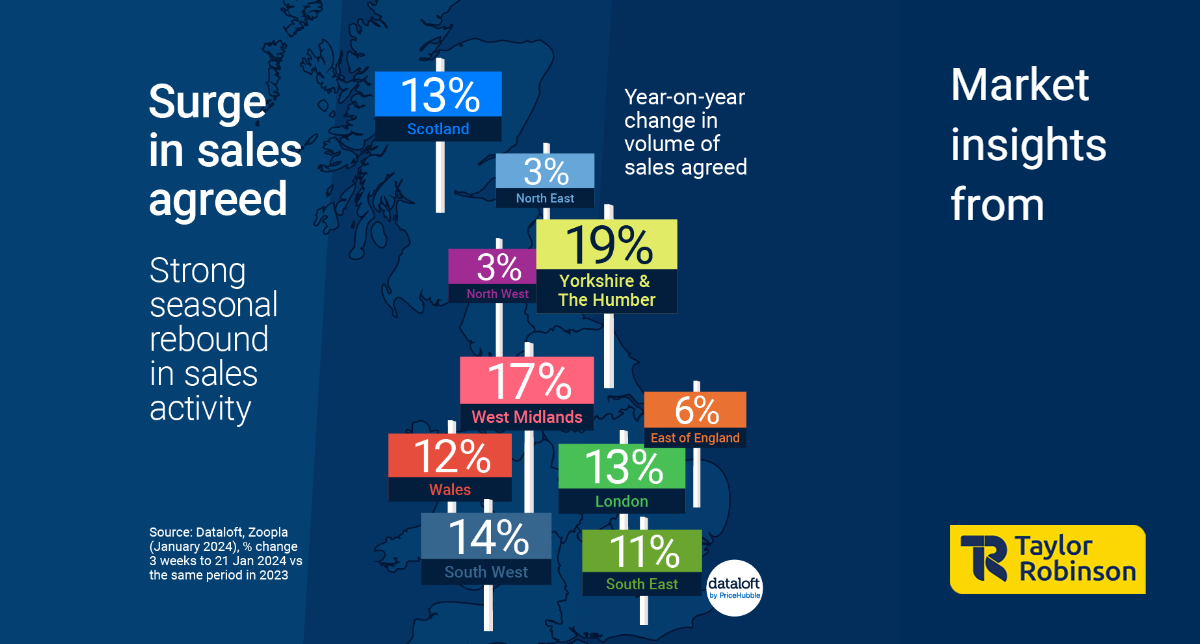

In a promising start to the new year, we at Taylor Robinson, operating from our Crawley office, are witnessing a robust surge in new sales agreements. This significant uptick serves as a crucial indicator of market confidence and activity, reflecting a positive trend in the property sector. According to data obtained from Dataloft and Zoopla for January 2024, new sales agreed have risen by an impressive 13% in the first three weeks, when compared to the same period last year.

National Trends:

The positive momentum in sales activity extends across all regions and countries, with notable spikes in key areas. Yorkshire and The Humber lead the charge with a remarkable 19% increase in new sales agreements, closely followed by the West Midlands, where activity has surged by 17%. These statistics paint a promising picture of a nationwide resurgence in the property market.

Factors Contributing to the Surge:

Several factors contribute to this surge in sales activity. First and foremost, the availability of the best mortgage rates below 4% is a compelling driver, making property ownership more attractive for potential buyers. Additionally, consumer confidence has reached its highest point since January 2022, providing further impetus to the market.

However, it's crucial to acknowledge that this rebound is occurring from a relatively low base, underscoring the challenges the property sector has faced in recent times. The gradual recovery is encouraging, but the market is still navigating its way back to pre-pandemic levels.

Buyer Price Sensitivity:

Despite the overall positive trend, buyers remain particularly price-sensitive. One noteworthy observation is that one in five sellers are willing to accept offers that are more than 10% below the asking price to secure a sale. This trend indicates that while the market is active, buyers are still exercising caution and seeking favourable deals.

In conclusion, the property market is showing signs of resilience and recovery, as evidenced by the increased volume of new sales agreements reported by Taylor Robinson Estate Agents. With mortgage rates at historically low levels and consumer confidence on the rise, the property sector is poised for a positive trajectory in 2024. However, it is essential to remain mindful of the market's sensitivity to pricing, as demonstrated by sellers accepting offers below the asking price. The data sourced from Dataloft, Zoopla (January 2024), and the GfK Consumer Confidence Tracker collectively paint a picture of a market on the mend, cautiously optimistic about the future.

- Details

- Hits: 253

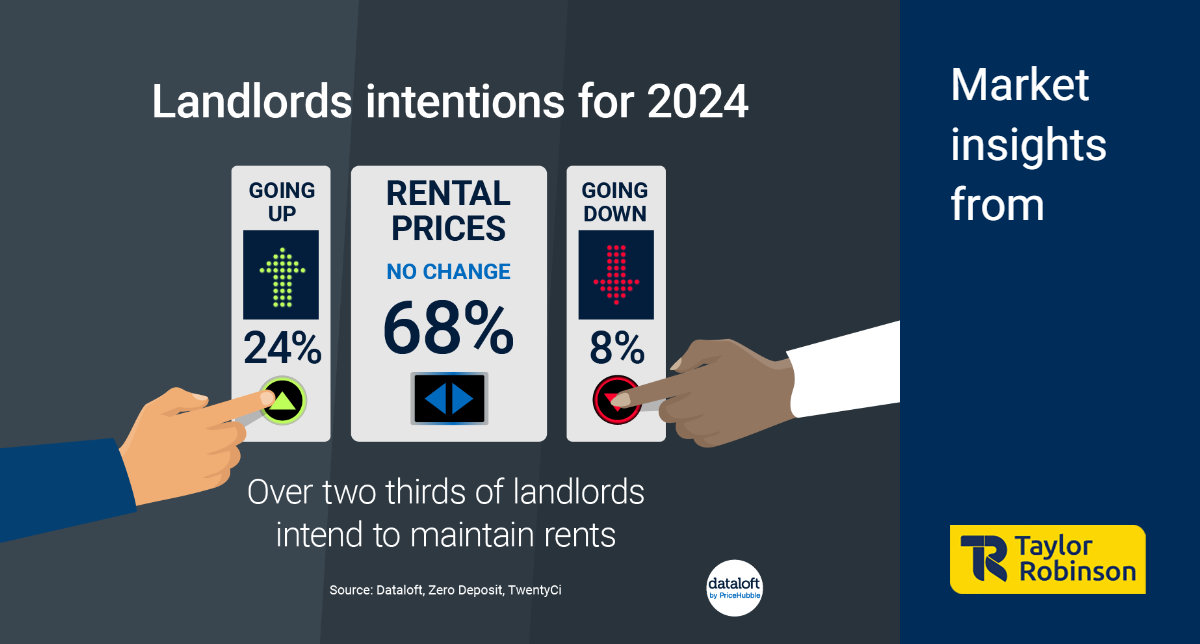

In the ever-evolving landscape of property, landlords play a crucial role in providing housing solutions to tenants. As we step into 2024, a glimpse into the plans and challenges faced by landlords sheds light on the dynamics of the rental market. According to recent data from #Dataloft, Zero Deposit, and TwentyCi, only 24% of landlords intend to increase rents this year, while 68% plan to maintain current levels, and 8% are considering a rent reduction.

Rising Rents:

Over the past few years, the rental market has experienced a notable surge in prices. Since the fourth quarter of 2022, rents have increased by an average of £135 per month. The escalation becomes even more apparent when compared to the same quarter in 2019, with an astonishing rise of £450 per month. This upward trend places additional financial strain on tenants, creating a ripple effect throughout the rental ecosystem.

Prioritizing Tenant Relationships:

In the face of escalating rents, landlords are recognizing the importance of fostering strong relationships with their tenants. Finding and retaining high-quality renters has become a top priority for property owners. This emphasis on relationship-building may explain why the majority of landlords, constituting 68%, are opting to maintain existing rent levels rather than pushing for further increases.

Challenges on the Horizon:

Looking ahead, landlords anticipate encountering several challenges in 2024. The primary concerns include the costs associated with maintaining, repairing, and running properties. As landlords strive to provide comfortable living spaces, the financial burdens of property upkeep become significant. Legislative changes also feature prominently as a challenge, underscoring the need for landlords to stay abreast of evolving regulations to navigate the rental landscape effectively.

Encouraging a Dialogue:

For landlords seeking expertise and guidance in navigating these challenges, it's essential to connect with industry professionals. As an expert in the field, I invite landlords to reach out for personalized insights and strategies tailored to their unique situations. With a deep understanding of the current rental market dynamics, I am well-equipped to assist landlords in optimizing their rental properties and addressing the challenges that lie ahead.

The rental market in 2024 presents a mix of challenges and opportunities for landlords. While rent increases are not the primary focus for the majority, maintaining positive tenant relationships and staying abreast of evolving regulations are crucial elements of success. As landlords navigate this complex landscape, seeking expert advice becomes paramount. Don't hesitate to call me, Ben on 01293 552 388 or email This email address is being protected from spambots. You need JavaScript enabled to view it., to discuss how we can work together to ensure your success in the ever-dynamic world of residential lettings.

- Details

- Hits: 287

As we step into the new year, the property market is exhibiting signs of positivity, setting the stage for a robust and dynamic year ahead. Key indicators reveal a significant uptick in the market, reflecting both buyer and seller confidence. The property landscape is experiencing a notable surge, with promising statistics that hint at a flourishing market in 2024.

Positive Shift in Asking Prices:

One of the standout trends in the property market is the remarkable increase in the average new seller asking price. January 2024 has witnessed a substantial rise of 1.3%, marking the most significant price surge for this month since 2020. What's even more impressive is that this surge is more than double the 20-year average of +0.6%. This spike in asking prices suggests a growing confidence among sellers, a trend that bodes well for the overall health of the property market.

Impact of Falling Mortgage Rates:

The decline in mortgage rates is playing a pivotal role in boosting buyer confidence. As mortgage rates continue to fall, prospective homebuyers find themselves in a favourable position, making homeownership more accessible. This positive trend is contributing to an improvement in buyer demand, with 42% of agents reporting that buyer demand is higher than it was a year ago. The correlation between falling mortgage rates and increased buyer activity paints a promising picture for the property market's trajectory in the coming months.

Rise in Property Listings:

A notable indicator of sellers' growing confidence is the increase in the number of properties entering the market. In the first week of the year, property listings surged by an impressive 15% compared to the same period last year. This surge in inventory suggests that sellers are increasingly optimistic about the market conditions and are eager to capitalize on the demand. The rise in property listings is a positive sign for both buyers and sellers, fostering a more balanced and dynamic property landscape.

Essential Role of Accurate Pricing:

Amidst these encouraging trends, it's essential for those navigating the property market to maintain accurate and realistic pricing strategies. The success of transactions hinges on understanding the local market dynamics and pricing properties accordingly. Sellers looking to make a move in 2024 should pay close attention to accurate and realistic pricing, ensuring a smooth and successful selling process.

As we kick off the new year, the Crawley property market is experiencing a wave of positivity, marked by a substantial increase in asking prices, improved buyer demand, and a surge in property listings. The combination of falling mortgage rates and a brighter economic outlook sets the stage for a dynamic and flourishing Crawley market in 2024. It remains crucial for both buyers and sellers to stay attuned to these trends and make informed decisions as they navigate the evolving landscape of the property market. Source: Dataloft Poll of Subscribers, Rightmove (January 2024).

- Details

- Hits: 323

In the ever-evolving landscape of the mortgage market, the winds of change are blowing as big lenders engage in fierce competition, leading to a significant drop in interest rates. This phenomenon is not only a response to market dynamics but is also accompanied by an increased product choice, offering more options to consumers. Recent developments indicate a potential shift in economic trends, influencing both mortgage rates and the overall stability of the market.

Interest Rate Slashing:

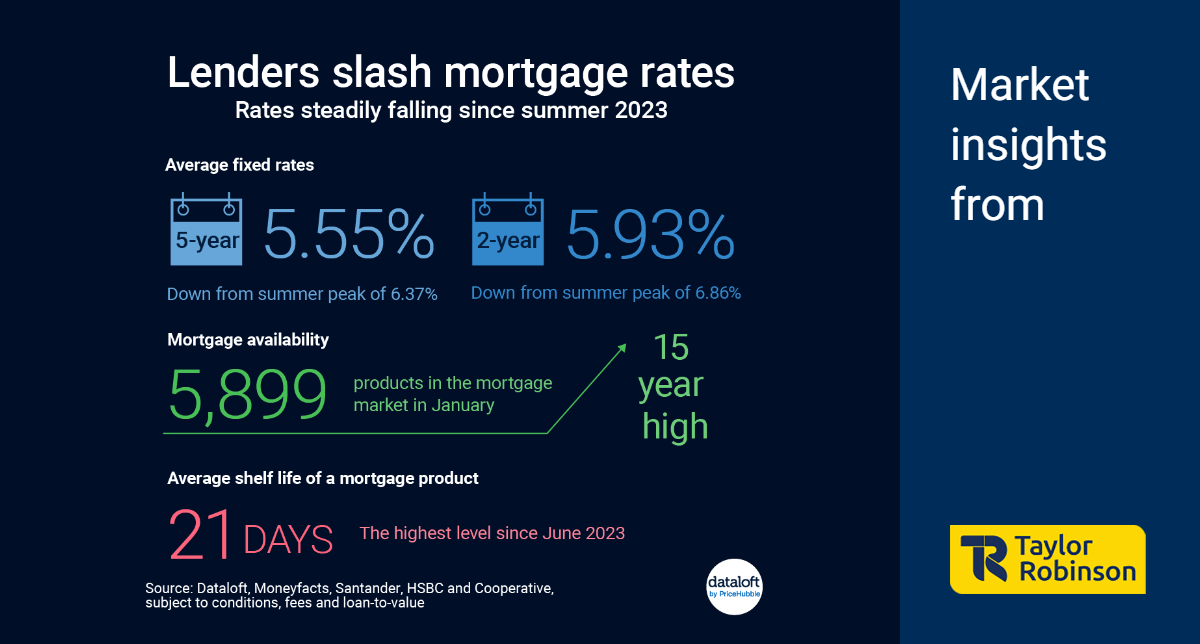

Many prominent mortgage lenders are currently engaged in a relentless battle to attract borrowers by slashing interest rates. The average five-year fixed-rate has plummeted to 5.55%, a notable decrease from its peak at 6.37% in August. Similarly, the two-year fixed-rate has seen a reduction from 6.86% in July to 5.93%. Notably, Santander and HSBC have recently joined the sub-4% club for a five-year fixed-rate, while Barclays has introduced two-year deals tantalizingly close to the 4% threshold. These developments signal a borrower-friendly environment with historically low mortgage rates.

Expanding Product Options:

The competition among mortgage lenders has led to a surge in product choices, reaching 5,899 options. This marks the sixth consecutive month of product choice growth, reaching a 15-year high. The average shelf life of a mortgage product has also extended to 21 days, the longest since June, indicating increased stability in the market. This expansion in product options provides consumers with a diverse range of choices, catering to different financial needs and preferences.

Economic Outlook and Interest Rate Cut Speculation:

The mortgage market's fluctuations are not isolated from broader economic trends. Forecasters at three leading institutions are suggesting a significant decline in the inflation rate, projecting it to halve to 2% by April. This potential drop in inflation has led to speculation that the Bank of England might consider advancing the date of its first interest rate cut. Such a move could have ripple effects on the mortgage market, influencing rates and borrower behaviour.

The current dynamics in the mortgage market, characterized by intense competition among lenders, falling interest rates, and an expanding array of product choices, reflect a dynamic and responsive industry. As economic forecasts hint at a potential shift, borrowers may find themselves in a favourable position to secure attractive mortgage deals. However, it's crucial for consumers to stay informed about market trends and be prepared for possible changes as economic conditions continue to evolve.

- Details

- Hits: 269