Blog

The Bank of England's decision to maintain the bank rate at 5.25% in their November 2023 meeting has significant implications for the UK's residential property market. Interest rates, particularly through their influence on mortgage affordability, play a pivotal role in shaping the outlook for the housing market. In this article, we will delve into the recent decision by the Bank of England, the consensus forecasts for interest rates, and how these factors may impact the real estate landscape.

The Bank of England's November Decision

In its latest policy meeting, the Bank of England chose to keep the bank rate steady at 5.25%. This decision, while not surprising to many, reflects the central bank's cautious approach to monetary policy. It comes as the Bank strives to strike a balance between controlling inflation and ensuring the economy's stability.

Impact of Interest Rates on the Residential Market

Interest rates have a profound influence on the residential property market. When the bank rate is increased, borrowing becomes more expensive, making it challenging for potential homebuyers to secure affordable mortgages. Conversely, when rates are lowered, borrowing costs decrease, which can stimulate demand in the housing market.

Consensus Forecasts for Interest Rates

HM Treasury has compiled consensus forecasts, suggesting that interest rates may be at their peak. According to these forecasts, the bank rate is expected to end 2023 at 5.3%. However, the outlook is more optimistic for 2024, with a forecasted drop to 4.7% by the end of the year. These projections offer some relief to potential homebuyers, as the anticipation of lower rates may make homeownership more attainable in the near future.

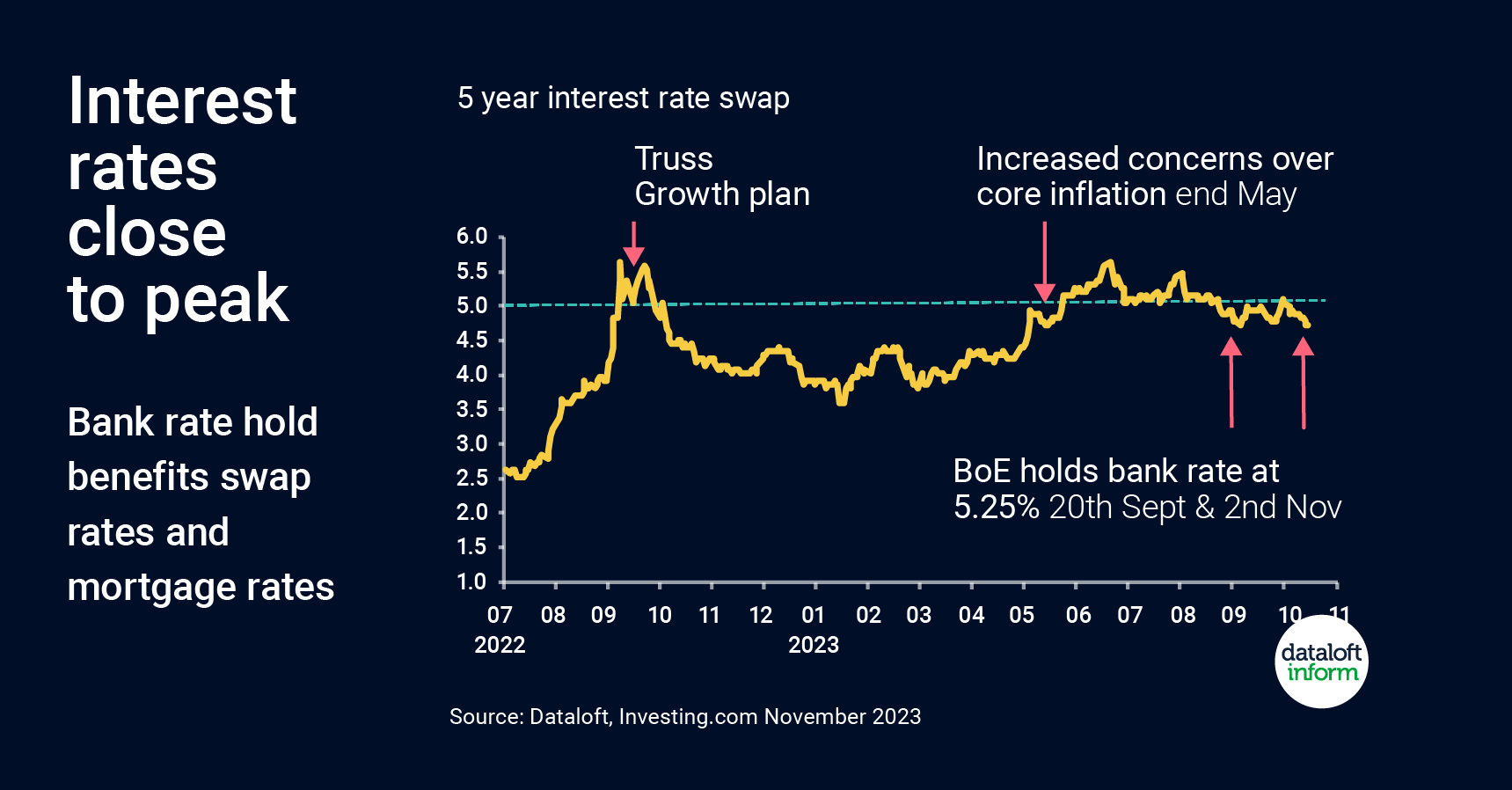

Swap Rates and Mortgage Costs

Swap rates are crucial indicators of changes in mortgage costs. They reflect the cost of borrowing for lenders, providing insight into the trends in interest rates. The Bank of England's decision to maintain the bank rate had a positive impact on 5-year swap rates, which are now at their lowest level since May. This suggests that borrowing costs may become more favourable for mortgage seekers, which can boost the residential property market.

Market Adjustment to Higher Interest Rates

The market is still adapting to the consequences of higher interest rates, and mortgage approvals remain relatively low. However, as consensus forecasts indicate that interest rates may be nearing their peak, we can expect to see an improvement in market sentiment starting from Spring 2024. This could lead to a more robust residential property market as the cost of borrowing becomes more manageable.

In conclusion, the Bank of England's decision to maintain the bank rate at 5.25% in November 2023 has important implications for the UK's residential property market. While higher interest rates have caused some adjustment in the market, the consensus forecasts suggest that rates may soon start to decrease, offering hope to potential homebuyers. With swap rates also reflecting a positive trend, the housing market is poised for improved sentiment and activity in the coming months. It's essential for buyers and sellers alike to stay informed about interest rate developments as they can significantly influence the dynamics of the residential property market.

- Details

- Hits: 328

As the chilling winds of October sweep through the British Isles, the spirit of Halloween descends upon the land, and with it comes a ghoulish extravaganza that promises to send shivers down the spines of both young and old. Halloween has evolved into big business in the United Kingdom, and its chilling embrace shows no sign of letting up. It is estimated that Britons will unleash a monstrous spending spree, with projections soaring to a staggering £1 billion, a mind-boggling figure that might just be more shocking than any ghostly apparition.

This macabre celebration of the supernatural has gripped the hearts of the British populace, with more than 56% of the population donning their favourite costumes and joining in the eerie festivities. The younger generation, Gen Z, is expected to lead the charge into the heart of darkness, with a spine-tingling 87% of them gearing up to part with their hard-earned pounds. A chilling £46 each is the sum they've chosen to unleash upon the spectral market, making it abundantly clear that Halloween isn't just for children anymore.

But what's truly blood-curdling is that some places in the UK are spookier than others, and buyers seem to be drawn to them like moths to a flame, undaunted by their eerie names. Streets and lanes with the most terrifying monikers have been sending property prices skyrocketing into the abyss. Roads, such as 'Axe Lane', have seen an average price of £795,000 this year, followed closely by the haunting 'Bloodgate Hill' at £668,000, and the eerie 'Bones Lane' with a bone-chilling £638,000.

It seems that the UK's obsession with all things eerie and uncanny knows no bounds. Even the presence of restless spirits and ghostly apparitions hasn't been enough to drive away brave souls seeking their very own haunted haven. Pluckley, often lauded as the most haunted village in all of England, stands as a testament to the undying allure of the supernatural. Over the past decade, this ghostly hamlet has witnessed a haunting transformation in its property market. The average house prices in this spectral settlement have not merely inched upward; they have doubled, as if bewitched by the very spirits that call it home.

In a world where economic realities constantly shift and change, Halloween remains a steady and profitable beacon, casting its eerie glow over the UK property market. As we stand on the precipice of the unknown, one thing is for certain – the love for all things spooky, and the fascination with the uncanny, will continue to bewitch the British population, ensuring that Halloween's spectral reign over the real estate market persists for years to come. Who knows what haunted treasures the future may reveal, as the UK delves deeper into the mysteries of the supernatural while property prices continue to rise like the undead? Source: #Dataloft, Land Registry (12 months to October 2023), Finder.

Happy Halloween!!!!!!!

- Details

- Hits: 345

Restaurants are more than just places to enjoy a delicious meal; they are the lifeblood of our communities. The restaurant industry's growth, even in the face of economic challenges, exemplifies their importance. Local restaurants foster a sense of belonging, enhance well-being, and drive economic growth in their areas. Moreover, they serve as magnets for homebuyers, breathing new life into neighbourhoods that were once overlooked. In this article, we'll explore the significant impact of restaurants on our communities, using data and insights from 2022 to shed light on their influence, with a particular focus on Crawley's remarkable restaurant scene.

The Restaurant Resurgence

In the face of mounting cost-of-living pressures, it's remarkable to witness the continued growth of the restaurant industry. As of 2022, the United Kingdom boasted over 150,000 restaurants, marking an impressive 8% increase since 2019. This expansion isn't confined to one specific region; cities such as London, Manchester, Edinburgh, Glasgow, and Liverpool experienced particularly strong growth in their restaurant sectors. The resilience of this industry in the face of economic challenges is a testament to the enduring appeal and importance of restaurants within our communities.

Building a Sense of Community

One of the most striking findings is that a majority of people recognize the pivotal role that local restaurants play in fostering a sense of community. A survey conducted for OpenTable revealed that 64% of respondents believe that local restaurants are essential for building and maintaining that communal bond. This sentiment underlines the fact that restaurants are not merely places to eat, but spaces where people come together, share stories, and build connections. They often serve as hubs for community events, meetings, and celebrations, reinforcing their significance in the social fabric of a locality.

Enhancing Well-being

The impact of local restaurants extends beyond the communal aspect; it also significantly contributes to individual well-being. According to the same research, nearly a third of respondents reported that local restaurants, pubs, and cafes added value to their overall well-being. This effect is likely attributed to the way restaurants provide a space for relaxation, enjoyment, and escape from daily pressures. Dining out can be a therapeutic experience, offering a break from cooking at home and an opportunity to savour diverse culinary creations.

Economic Growth and Homebuyer Attraction

Aside from the social and personal benefits, local restaurants are potent drivers of economic growth and can have a substantial influence on the property market. A vibrant restaurant scene can be a significant draw for prospective homebuyers. Areas with a wide array of dining options are often perceived as more attractive, not only for the residents but also for businesses and investors. This increased interest can stimulate economic activity and create a cycle of development that benefits the entire community.

Crawley's Restaurant Scene Shines

Crawley, a town with a unique charm, is home to a thriving restaurant scene that stands out as a shining example of how local restaurants can flourish even in challenging economic times. The town's restaurant industry has experienced steady growth, reflecting the town's resilience and the unwavering support of its residents. This growth is a testament to the enduring appeal and importance of restaurants within Crawley's community, making it a standout destination for culinary experiences.

Building a Sense of Belonging in Crawley

In Crawley, local restaurants do more than just serve delicious meals; they foster a deep sense of belonging within the community. Residents and visitors alike are drawn to these culinary havens, which provide a space for people to come together, share stories, and build lasting connections. Crawley's restaurant scene often serves as a hub for community events, meetings, and celebrations, underlining its significance in the social fabric of the town.

Enhancing Well-being in Crawley

Beyond the sense of community, Crawley's restaurants make a significant contribution to individual well-being. They offer a retreat from the daily grind, a place to relax and savour diverse culinary creations. Dining out in Crawley is a therapeutic experience, offering respite from home cooking and an opportunity to enjoy the talents of local chefs. Residents in Crawley find solace and rejuvenation in the welcoming ambiance of their local eateries.

Economic Growth and Homebuyer Attraction in Crawley

Crawley's restaurants are not just enriching the community but also driving economic growth and piquing the interest of prospective homebuyers. A town with a vibrant restaurant scene is often perceived as more attractive, not only for residents but also for businesses and investors. This increased interest can stimulate economic activity and development, creating a thriving environment that benefits the entire community.

An Impressive Statistic

Crawley's commitment to its restaurant culture is exemplified by the fact that it boasts 3638 residents per restaurant, significantly higher than the regional average of 2074. This statistic highlights Crawley's dedication to providing an abundance of dining options, making it a standout location in the region.

Crawley's restaurants are more than places to eat; they are the lifeblood of our community, showcasing its uniqueness and charm. The continued growth of Crawley's restaurant industry, its power to foster a sense of belonging, enhance well-being, and drive economic growth, demonstrates the town's extraordinary appeal. As magnets for homebuyers, Crawley's restaurants make it an even more desirable place to live. In an ever-changing world, one thing remains clear: Crawley's restaurants will continue to be the heartbeat of our community, uniting people and enriching the spirit of our neighbourhoods. They have put Crawley firmly in the spotlight as a destination that values and celebrates its local restaurant scene.

- Details

- Hits: 502

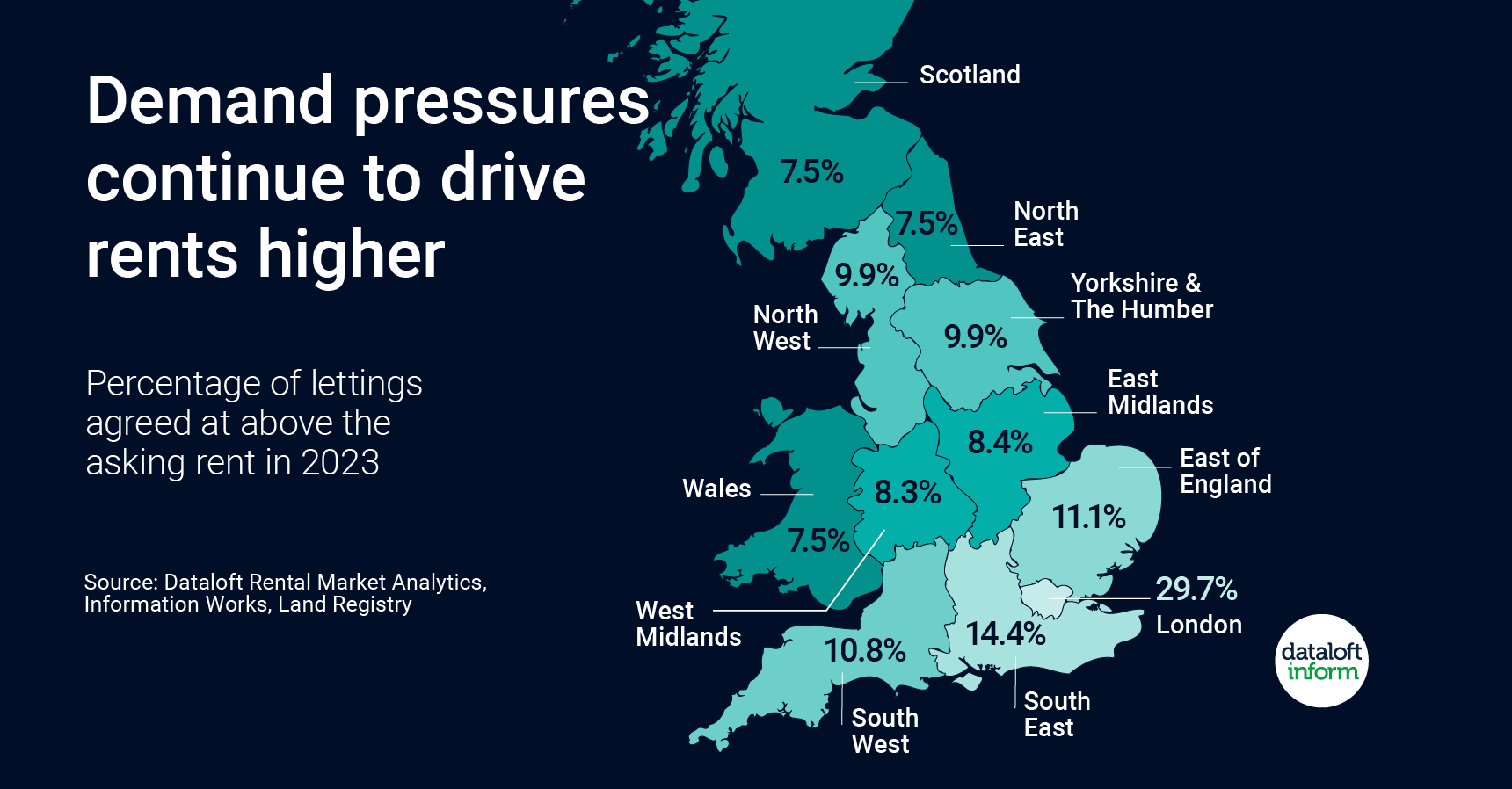

In 2023, the UK rental market has experienced a significant shift in dynamics, with almost one in six rental transactions being agreed at rental rates above the asking price. This is a stark contrast to 2019, where less than one in 15 rental agreements exceeded the listed rent. New analysis conducted by Dataloft has shed light on this phenomenon, revealing that similar pressures are being felt across the country. The most dramatic effects have been observed in London, where a staggering 30% of rentals were agreed upon at rates higher than the asking price. This article explores the factors driving this trend and the effects it has had on the Crawley rental market.

Rising Demand Outpaces Supply

One of the primary drivers behind the surge in rents is the persistently high demand for rental properties that has consistently outpaced supply since the onset of the COVID-19 pandemic. As remote work and flexible working arrangements became the norm, individuals and families have sought more spacious and comfortable living conditions. Consequently, the demand for rental properties, especially in areas with good access to amenities and transportation, has soared.

Effect on Rent Prices

This increase in demand has not only led to more competitive rental markets but has also driven up rental prices. Since 2019, average monthly rents in the UK have witnessed a staggering 41% increase, significantly outpacing the growth in house prices, which only grew by 25% over the same period. While this has had a broad impact on the rental market throughout the UK, the effect has been particularly pronounced in London and its surrounding areas.

London's Rental Market

In the capital city, London, the effect of this surge is most noticeable, with a staggering 30% of rentals being agreed upon at rates exceeding the asking price. The extreme competitiveness of London's rental market is primarily due to the city's allure, job opportunities, and diverse culture. Renters in London are not only willing but also often compelled to pay higher rents to secure the accommodation they desire. This situation has created a challenging environment for tenants, particularly in terms of affordability.

Regional Impact

Although London has experienced the most significant impact, other regions in the UK have also felt the ripple effect of the soaring rental prices. The wider South East, including areas near London, saw 14% of new rentals agreed upon at rates above the asking price. Furthermore, more than 10% of rental transactions in four other UK regions - the East of England, North West, South West, and Yorkshire & Humber - also surpassed the asking rent. These statistics indicate a nationwide trend driven by the fundamental imbalance between rental demand and supply.

Crawley's Rental Market

Crawley, has not been immune to these shifts in the rental market. While it may not experience the same extremes as London, the pressure on renters and the increase in rental prices have undoubtedly affected the town's rental market. As demand for rental properties in Crawley continues to grow, renters may find themselves facing higher monthly rental costs and increased competition for desirable accommodations.

The UK's rental market in 2023 is experiencing a historic shift, with more rental transactions being agreed upon at rates above the asking rent than ever before. This trend can be attributed to a surge in demand for rental properties that has consistently outpaced supply since the pandemic. As a result, rental prices have seen substantial increases, particularly in London and its surrounding areas, but the effects have been felt across the nation. In Crawley, like many other parts of the UK, renters are encountering increased competition and rising rental prices. It remains to be seen whether these trends will continue, but for now, they underscore the challenges facing renters in the current housing market.

- Details

- Hits: 420

In August 2023, the UK government made a significant decision by scrapping the regulation that would have required all newly rented properties to have an Energy Performance Certificate (EPC) rating of at least C by 2025. This move has generated quite a buzz in the property market, leaving both landlords and renters wondering about its implications. However, it appears that many landlords have already taken proactive steps to improve the energy efficiency of their properties, and the data shows that this investment is far from being in vain.

The Shift in Policy

The government's decision to abandon the 2025 EPC rating requirement has undoubtedly been met with mixed reactions. While some may view it as a relief, others argue that the regulation would have pushed the industry toward more energy-efficient housing. Nonetheless, it's essential to consider the reasons behind this policy shift and its potential impacts on the real estate landscape.

Landlord Investments in Energy Efficiency

Despite the policy change, it is heartening to note that four out of every five landlords have already taken steps to ensure compliance with the now-scrapped EPC rating requirement. This indicates that a substantial portion of landlords acknowledges the importance of energy-efficient properties and, in turn, the benefits they offer to both the environment and their tenants.

Furthermore, nearly half of the landlords surveyed have invested between £500 and £20,000 on improving or investing in their properties over the last year. This is a significant commitment to enhancing the energy efficiency of their rental units, which is a commendable move in the direction of a more sustainable future.

Future-Proofing Investments

While the policy may have shifted, the investments made by landlords in improving energy efficiency will not be in vain. Landlords with modern, energy-efficient properties are likely to attract more environmentally-conscious renters and be well-prepared for any future legislative changes.

The increasing awareness of environmental issues has led to a significant shift in tenant preferences. Over three-quarters of renters surveyed have indicated that an EPC rating is an important factor when considering a rental property. This reflects the growing demand for energy-efficient homes, as renters not only seek comfort but also want to reduce their carbon footprint.

Additionally, EPC ratings are also gaining importance in the property buying market. Over two-thirds of potential buyers express a keen interest in a property's EPC rating, as it factors into their decision-making process. This means that landlords who have invested in improving their properties' energy efficiency are likely to see greater demand from both renters and potential buyers, thereby increasing the overall value of their investments.

The scrapping of the regulation that would have mandated a minimum EPC rating of C for newly rented properties by 2025 may have caused uncertainty and debate within the property industry. However, the data shows that the impact of this change is not as dire as it may seem. Landlords have recognized the importance of energy-efficient properties and have already taken substantial steps to improve the energy performance of their rental units.

While the policy may have shifted, the investment made by landlords in creating more sustainable and energy-efficient homes will continue to benefit them. The growing awareness of environmental concerns and the demand for energy-efficient housing from both renters and buyers make these investments not only eco-friendly but also financially sound decisions. As a result, landlords who have embraced this trend will be well-prepared for any future legislative changes and can expect to see increased demand for their properties.

- Details

- Hits: 547