Blog

Stamp Duty Land Tax (SDLT) has once again taken centre stage in the national conversation, with Rightmove pressing the Chancellor of the Exchequer for reforms in the upcoming Spring Budget. This tax, which varies across regions, has a significant impact on property purchases, particularly for first-time buyers. In England, there's a Stamp Duty threshold of £250,000 (£425,000 for first-time buyers), while in Wales, it's set at £225,000 (under Land Transaction Tax).

For those entering the property market for the first time, Stamp Duty can significantly influence their purchasing power. Recognizing this, first-time buyers must consider strategies to minimize their Stamp Duty liability, which may include widening their search areas for their inaugural home.

Recent analysis by Dataloft has shed light on the regional disparities in Stamp Duty burdens. Throughout 2023, 75% of homes across England and Wales were sold below the Stamp Duty threshold for first-time buyers. However, this figure varied dramatically across regions. In areas like Greater London, only 35% of homes fell below the threshold, while in counties like County Durham, a staggering 98% of homes were accessible to first-time buyers without incurring Stamp Duty.

What's particularly notable is the persistent north-south divide in property prices across the country. This divide presents a unique opportunity for first-time buyers, especially as hybrid working arrangements become increasingly prevalent. With remote work options becoming more permanent, individuals are now afforded the flexibility to consider relocation to areas where property prices are more favourable.

For prospective homeowners in Crawley, West Sussex, this data offers valuable insights. While the south may traditionally be associated with higher property prices, the evolving landscape of remote work opens doors for exploring options further north. By leveraging this opportunity, first-time buyers in Crawley can potentially widen their search radius, tapping into regions where properties are more affordable and Stamp Duty implications are less burdensome.

The implications of Stamp Duty reforms, as advocated by Rightmove, remain to be seen. However, the existing regional disparities underscore the importance of informed decision-making for first-time buyers. By staying abreast of market trends and understanding the broader landscape of property prices and taxes, individuals can navigate the complexities of the real estate market more effectively.

As the Spring Budget approaches, stakeholders in the property market, including first-time buyers, eagerly await potential changes in Stamp Duty regulations. In the meantime, proactive measures, such as considering relocation opportunities and leveraging remote work arrangements, can empower aspiring homeowners to make informed choices that align with their financial goals and aspirations.

- Details

- Hits: 314

As the chill of winter gradually fades away, nature awakens with a burst of colour and vitality, marking the arrival of spring. It's not just the flora and fauna that undergo a transformation during this time; the property market also experiences a significant upswing, making it an opportune moment for homeowners looking to sell their properties. In this article, we delve into why spring is often hailed as the prime season for home sales and explore some key statistics that underline its appeal.

The Spring Advantage

Springtime holds a special allure for both buyers and sellers in the property realm. There are several reasons why this season stands out as an optimal period to list your property:

Aesthetic Appeal: With flowers blooming, trees regaining their lush greenery, and the sun making more frequent appearances, the overall aesthetic of properties is enhanced during spring. This visual appeal can draw in prospective buyers, making them more inclined to envision themselves living in the space.

Improved Curb Appeal: As outdoor spaces come alive with colour and vitality, the curb appeal of homes tends to increase during spring. Well-maintained gardens, manicured lawns, and vibrant landscaping can leave a lasting impression on potential buyers, enticing them to explore further.

Favourable Weather: Unlike the extremes of winter or the scorching heat of summer, spring offers mild and pleasant weather conditions, which are conducive to property viewings. Buyers are more inclined to venture out and attend open houses without having to contend with adverse weather, facilitating smoother and more active engagement in the market.

Optimal Lighting: Longer daylight hours in spring provide ample natural light, showcasing properties in their best possible light. Bright, sunlit interiors can make spaces appear larger, airier, and more inviting, capturing the attention of discerning buyers.

Key Statistics

Data analysis from various sources sheds light on the significance of spring in the real estate calendar:

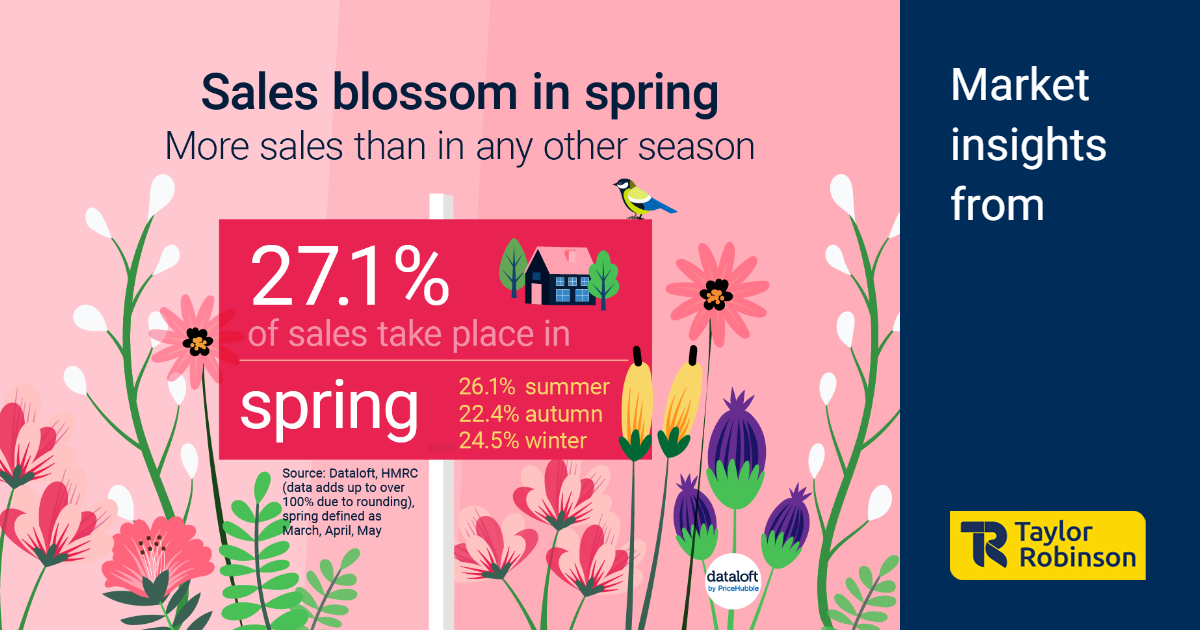

27% of Home Sales: Over the past five years, excluding 2020 due to the COVID-19 pandemic, spring has accounted for 27% of total home sales, surpassing all other seasons in terms of transaction volume.

Quicker Sale Times: Properties listed in spring tend to find new owners at a faster pace, with an average time on the market of just 51 days. This is notably swifter than the 61-day average observed during the winter months.

Heightened Buyer Demand: Current market trends indicate a 7% increase in buyer demand compared to the previous year. This heightened interest, combined with the intrinsic appeal of spring, creates a favourable environment for sellers seeking to capitalize on robust market conditions.

Final Thoughts

As the Property market gears up for the spring selling season, homeowners have a prime opportunity to showcase their properties in the best possible light and capitalize on heightened buyer demand. With its aesthetic charm, favourable weather, and accelerated sale times, spring continues to reign supreme as the preferred season for real estate transactions.

If you're considering selling your property, now is the time to act. Seize the moment and unlock the full potential of your home this spring. Call Taylor Robinson Estate Agents, the Crawley property experts, they we provide tailored assistance and expert guidance to navigate the market with confidence.

Source: #Dataloft, HMRC, Rightmove. Spring defined as March, April, May.

- Details

- Hits: 336

In the bustling town of Crawley, West Sussex, landlords are constantly navigating the ever-evolving rental market landscape. Understanding the dynamics of this market is crucial for maximizing returns and ensuring properties are tenanted efficiently. With data from Taylor Robinson Rental Market Analytics, let's delve into the trends shaping the rental scene over the past year.

Diverse Property Preferences

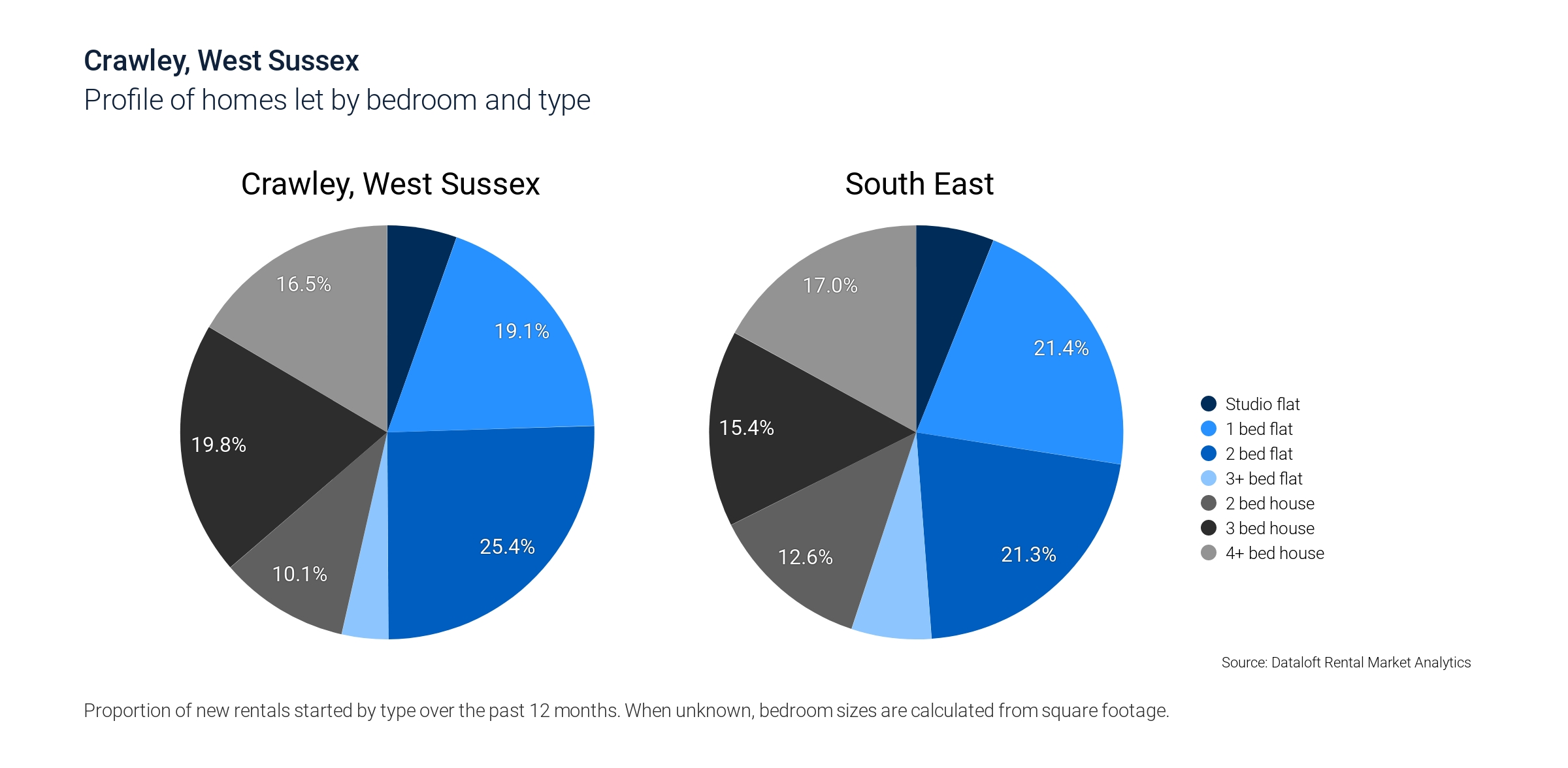

One striking observation is the diversity in property types preferred by renters. Two-bedroom flats emerge as the frontrunners, capturing a significant 25.4% share of all lets. Following closely behind are one-bedroom flats at 19.1%, with three-bedroom houses not far behind at 19.8%. This varied preference underscores the importance of offering a range of property types to cater to the diverse needs of tenants in Crawley.

Flats vs. Houses: A Balanced Ratio

A closer examination reveals an intriguing balance between flats and houses in the rental market. Flats slightly edge out houses, comprising 50.9% of all lets compared to 49.1% for houses. This equilibrium is reflective of Crawley's diverse population makeup, with families and individuals seeking different housing options to suit their lifestyles. Landlords should take note of this trend when considering property investments and portfolio management strategies.

The shortage of Studio Flats

In contrast to the popularity of larger flats and houses, studio flats lag behind, representing just 5.4% of all lets. This low uptake can be attributed to various factors, including their compact size and relatively higher rental costs. Studio flats, often favoured by single occupants or young professionals, may face stiff competition from larger properties offering more space and amenities. Landlords should carefully assess the demand for studio flats in Crawley before investing in such properties.

Speak with a Local Expert like Taylor Robinson

Armed with these insights, landlords in Crawley have a unique opportunity in the rental market. By staying abreast of trends and understanding tenant preferences, landlords can offer tailored letting services that meet the evolving needs of renters. Whether it's optimising property portfolios, setting competitive rental prices, or enhancing property amenities, being attuned to the nuances of the rental landscape is key to success in Crawley's thriving rental market.

In conclusion, the rental market in Crawley presents both opportunities and challenges for landlords. By leveraging data-driven insights and adopting a proactive approach to property management, landlords can navigate the rental landscape with confidence, maximizing returns and fostering tenant satisfaction.

- Details

- Hits: 271

In a bid to tackle the housing crisis gripping England, the Housing Secretary has unveiled bold initiatives aimed at maximizing the potential of brownfield land for residential development. Brownfield land, areas previously developed upon, is set to become a focal point for housing construction under the new proposals, with local authorities mandated to prioritise its development.

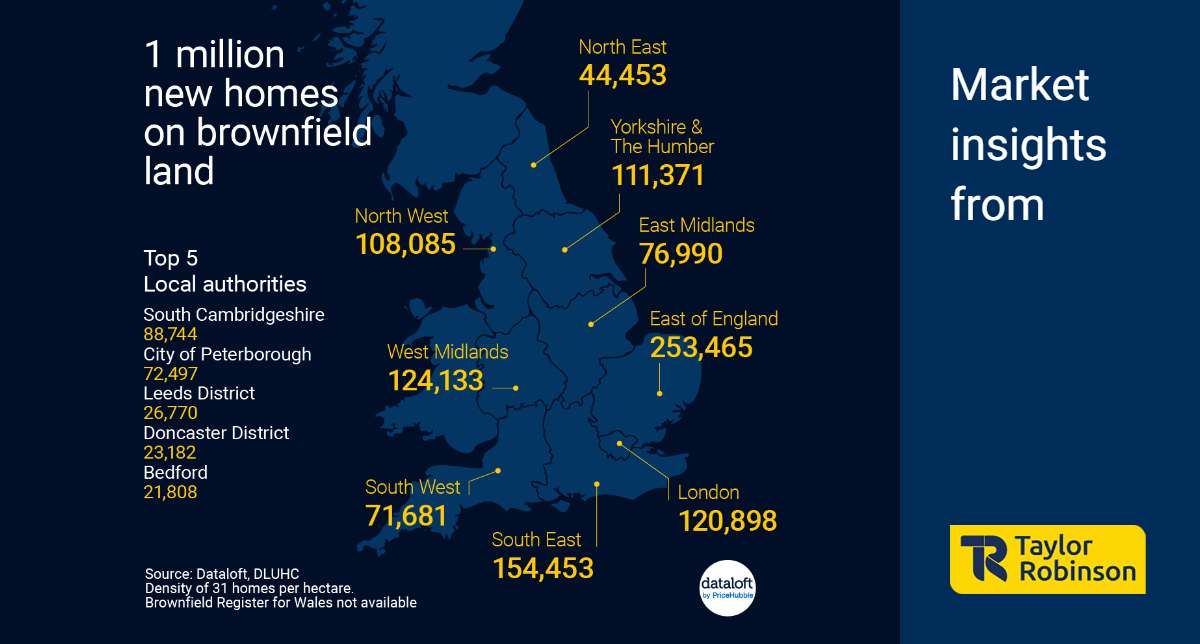

According to an analysis conducted by Dataloft, these plans could potentially unlock over 26,000 sites encompassing 34,375 hectares of land across England. With an average density of 31 properties per hectare, this equates to a staggering 1 million new homes if all identified sites are fully developed. This move marks a significant step towards addressing the housing shortage, providing much-needed accommodation for residents nationwide.

The data further reveals regional disparities in brownfield land availability. South Cambridgeshire and Peterborough emerge as areas with the most substantial potential, offering the possibility of over 160,000 new homes combined. The East of England tops the regional charts with 8,176 hectares of brownfield land, presenting an opportunity for approximately 250,000 new homes. Conversely, the North East lags with only 1,434 hectares of identified brownfield land, capable of accommodating around 44,000 new homes. These figures underscore the varying degrees of potential across different regions and emphasise the need for tailored approaches to address local housing needs effectively.

In addition to promoting brownfield development, the Housing Secretary's announcement includes plans to streamline the planning process for property extensions. A consultation has been proposed to explore the possibility of removing planning permission requirements for certain types of property extensions. This move aims to facilitate homeowners in improving and expanding their properties without the bureaucratic hurdles currently in place, potentially fostering a more dynamic housing market.

The proposed initiatives signify a concerted effort by the government to harness the untapped potential of brownfield land and accelerate the pace of housing construction. By prioritizing development on previously used sites and streamlining planning procedures, policymakers aim to not only alleviate the housing shortage but also revitalize urban areas and promote sustainable land use practices.

However, challenges such as infrastructure provision, environmental considerations, and community engagement must be carefully navigated to ensure the success and sustainability of these initiatives. Balancing the need for housing with the preservation of green spaces and heritage sites remains a critical aspect of urban planning.

As the proposals progress through consultation and implementation stages, stakeholders, including local authorities, developers, and communities, will play pivotal roles in shaping the future landscape of housing in England. Collaborative efforts and innovative solutions will be essential in realizing the vision of vibrant, inclusive, and sustainable communities across the nation.

- Details

- Hits: 262

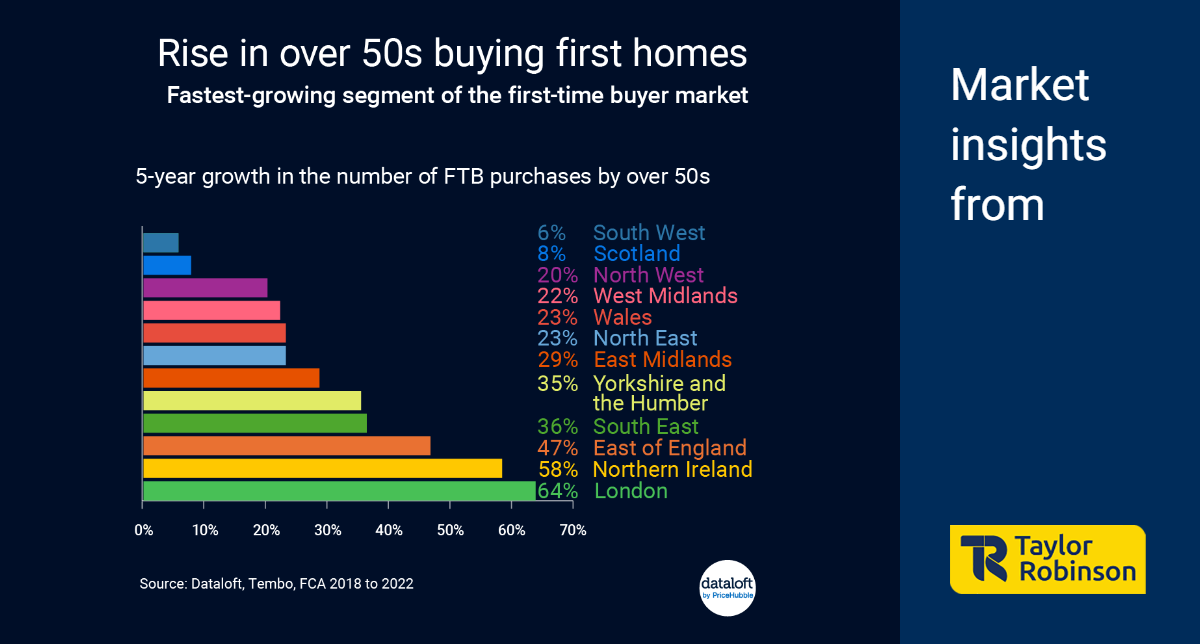

In a striking departure from conventional patterns, there has been a notable surge in individuals aged 50 and above stepping into the realm of first-time homebuyers. Recent data compiled by mortgage specialist Tembo in conjunction with property data company Dataloft reveals a staggering 30% increase in the number of over-50s purchasing their inaugural homes across the UK over the past five years. This contrasts starkly with a 7% decline in younger first-time buyers over the same period.

The trend is particularly pronounced in urban hubs like London, where the figure has soared by an impressive 64%. Moreover, regions such as the South East (36%), the East of England (47%), and even Northern Ireland (58%) have witnessed substantial upticks in this demographic's foray into homeownership.

This burgeoning phenomenon among the over-50 cohort is multi-faceted, reflecting several societal shifts and individual circumstances. Firstly, the prolongation of life expectancy coupled with improved health conditions has rendered individuals more financially stable and empowered to pursue homeownership later in life. Additionally, changing societal norms have seen many delaying major life milestones such as starting a family, thereby deferring the need for homeownership until later stages.

Moreover, the diminishing allure of the buy-to-let market, attributed to regulatory changes and economic uncertainties, has redirected investment intentions towards primary residence acquisition among this demographic. The confluence of these factors has culminated in a notable demographic shift within the property landscape.

The ramifications of this trend extend beyond mere statistical observations, significantly influencing the dynamics of the housing market. Foremost among these is the anticipated surge in demand for smaller, more affordable housing units tailored to the needs and preferences of older first-time buyers. Consequently, this demographic's entry into the market necessitates a re-evaluation of mortgage products and lending practices to accommodate the unique financial profiles and retirement considerations of older borrowers.

In essence, the surge in over-50s embarking on their maiden homeownership journey signals a profound evolution in demographic trends and lifestyle choices. As this demographic continues to assert its presence in the housing market, its impact is poised to reverberate through the property landscape, shaping housing policies, market dynamics, and consumer preferences in the years to come. This paradigm shift underscores the imperative for stakeholders to adapt and innovate in response to the evolving needs of an increasingly diverse and dynamic demographic profile of homebuyers.

- Details

- Hits: 254