Blog

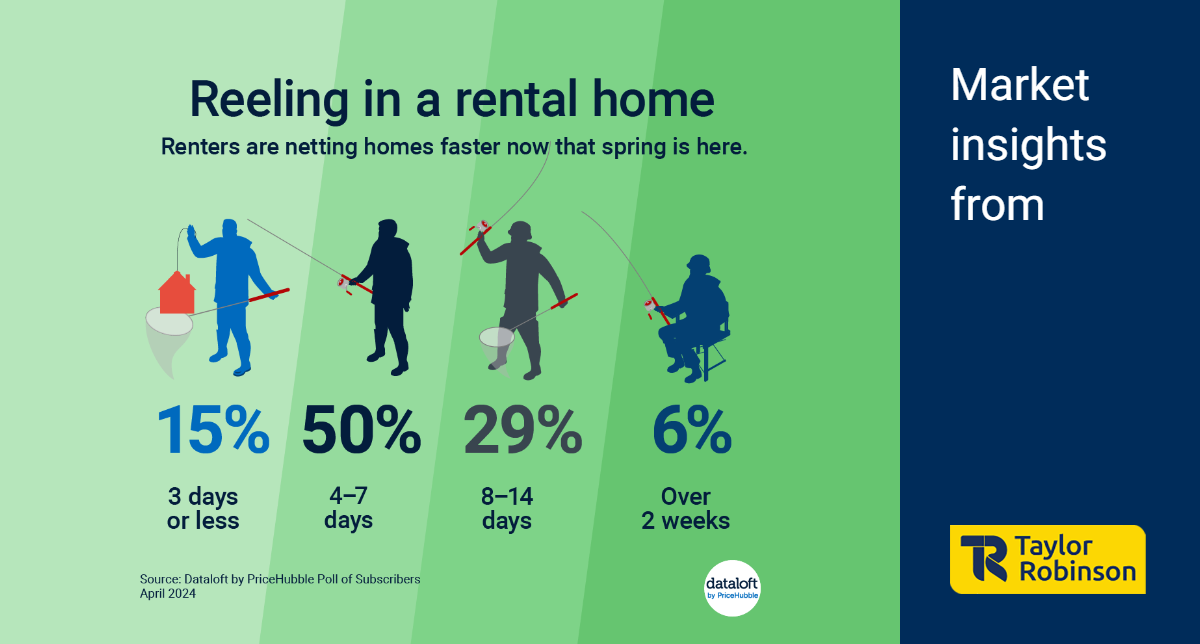

The latest data paints a vivid picture: the rental market is experiencing a significant surge in activity across the nation. According to a recent Dataloft poll, a staggering 65% of properties nationwide are being snapped up by eager renters within a mere week of being listed, with an impressive 15% finding tenants in just three days. This remarkable increase from earlier in the year underscores the rapid acceleration of the market, signalling a dynamic landscape for both renters and landlords alike.

Crawley, a town strategically positioned near Gatwick Airport, is no exception to this national trend. Offering a blend of urban convenience and suburban tranquillity, Crawley stands as an appealing location for renters seeking both accessibility and lifestyle amenities. As the rental market surges, Crawley reflects the broader national landscape, with properties swiftly finding tenants amid heightened demand.

Despite a slight decrease in overall demand for rented homes over the past year, competition remains fierce on a national scale. With over 15 enquiries for every available rental property, tenants are faced with the challenge of acting swiftly and potentially outbidding competitors to secure their desired accommodation. Conversely, landlords are reaping the benefits of this rapid turnover, enjoying the opportunity to secure reliable tenants quickly.

So, what does this mean for you?

For Renters:

Be prepared to act quickly in this competitive market. Research properties beforehand, have all necessary paperwork readily available, and be poised to submit an application as soon as a listing becomes available. By being proactive and prepared, you can increase your chances of securing your ideal rental property in a timely manner.

For Landlords:

Price your property competitively and consider offering incentives to attract high-quality tenants. With demand high and turnover rapid, acting swiftly on applications can help you secure reliable renters and minimize vacancies. By staying proactive and responsive, you can capitalize on the current market dynamics and optimize your rental income.

As the rental market continues to evolve, both tenants and landlords in Crawley and beyond can benefit from understanding and adapting to these trends. By staying informed and proactive, individuals on both sides of the rental equation can navigate the current climate with confidence and success.

- Details

- Hits: 22

The 44th London Marathon, thundering towards us on April 21st, is more than just a race. It's a crucible of athleticism, community spirit, and – in a city famous for its high cost of living – a significant financial prize.

With 50,000 runners expected, the streets will be a sea of determination. Among them, elite athletes will battle for glory in the men's and women's categories, both able-bodied and wheelchair. This year, the stakes are especially high: a staggering £243,000 prize pot awaits each category's winner – a cool £44,000.

This sum goes beyond bragging rights in a city like London. Here, the average weekly rent clocks in at £554, making the prize a life-changing windfall. That £44,000 translates to a whopping 79 weeks of rent – a security blanket for the victors.

But the prize money's impact varies across the city. Take Greenwich, the historic starting point. There, the prize could cover a remarkable 74 weeks' rent, offering a solid financial foundation. As the race snakes through diverse areas like Limehouse and the scenic Embankment, the prize remains substantial, representing 68 and 93 weeks' worth of rent, respectively.

However, the finish line at Buckingham Palace throws a twist. Here, amidst royal grandeur, the prize money equates to only 37 weeks' rent. This stark contrast highlights the stark economic realities within London itself.

These insights, powered by #Dataloft Rental Market Analytics, paint a richer picture of the London Marathon. It's not just about athletic feats; it's a microcosm of the city's pulse, where sports, economics, and geography intertwine.

As runners prepare and crowds gather, the 44th London Marathon promises to be more than just a race. It's a testament to human grit, a reflection of London's social fabric, and a story that extends far beyond the finish line.

- Details

- Hits: 130

As spring blooms across the United Kingdom, there's a flurry of excitement as the Easter Bunny prepares for his annual visit. This year, the beloved rabbit is poised to drop off over 80 million Easter eggs, delighting children and adults alike with chocolatey treats. To put this into perspective, that's nearly 80 times the number of home sales that occurred in the UK over the past year, totalling 1,011,280.

Easter is a cherished holiday for many Britons, and the anticipation is palpable as families prepare to celebrate. According to recent data, a staggering 84% of people in the UK are eagerly looking forward to Easter festivities in 2024. With such enthusiasm in the air, it's no surprise that projections indicate Britons will collectively spend over £2 billion on Easter-related expenses this year.

Delving deeper into the numbers, the average expenditure per person is estimated to be £53, reflecting the scale of the holiday's significance in the cultural and commercial landscape of the UK. These insights, sourced from #Dataloft, Finder.com, and HMRC, shed light on the economic impact and consumer behaviour surrounding Easter.

The Easter Bunny's annual delivery of chocolate eggs is not only a Christian tradition but also a significant economic event. From confectionery manufacturers to retailers, the holiday season represents a crucial period of sales and revenue. Moreover, Easter serves as a time for families and communities to come together, share meals, and create lasting memories.

However, beyond the indulgence of chocolate eggs and festive gatherings, Easter holds deep religious significance for many individuals. It commemorates the resurrection of Jesus Christ and is observed through various religious ceremonies and traditions.

As Easter approaches, streets are adorned with colourful decorations, shop windows showcase tempting treats, and communities organise events and activities to mark the occasion. Whether it's participating in an Easter egg hunt, attending church services, or simply enjoying quality time with loved ones, the spirit of Easter permeates every aspect of life in the UK.

Easter 2024 promises to be a time of joy, reflection, and celebration for people across the United Kingdom. With the Easter Bunny's generous delivery of over 80 million eggs and a projected expenditure of £2 billion, the stage is set for a memorable and eggstraordinary holiday season. As the nation eagerly awaits the arrival of Easter Sunday, one thing is certain – the Easter Bunny's magic continues to captivate hearts and minds, bringing smiles to faces young and old alike.

- Details

- Hits: 587

In the realm of economic forecasting, few sectors garner as much attention and speculation as the housing market. The ebb and flow of this market not only reflects the health of the economy but also plays a crucial role in shaping it. To gain insight into its trajectory, analysts often turn to a plethora of economic indicators. Monitoring these indicators not only provides a snapshot of the current state of affairs but also offers valuable hints about where the market might be headed in the future.

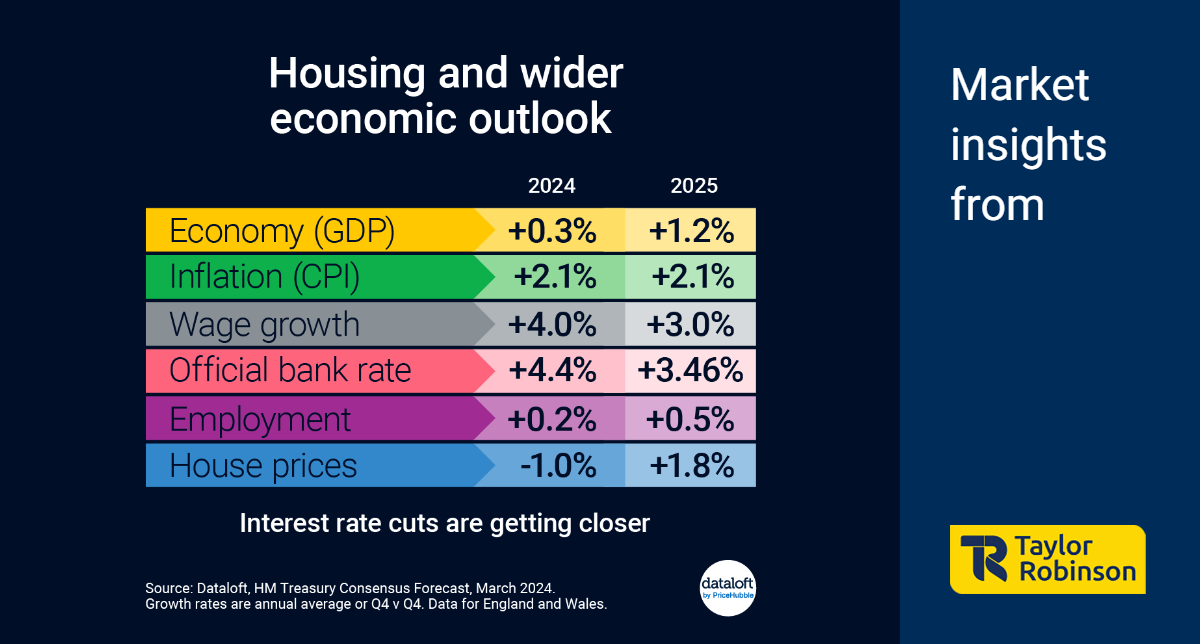

At the March meeting of the Bank of England, all eyes were on the bank rate, a pivotal factor influencing mortgage rates and, consequently, the housing market's dynamics. Despite holding steady at 5.25%, Governor's remarks hinted at an impending shift. "We are on the way," he announced, signalling a trajectory toward interest rate cuts. This aligns with consensus forecasts, which project the bank rate to dip to 4.4% by the fourth quarter of 2024.

A key driver behind this anticipated adjustment is the evolving inflation landscape. As inflationary pressures ease, the case for lower interest rates gains momentum. February's inflation data revealed a headline CPI rate of 3.4%, down from 4.0% the previous month. This decline suggests a moderation in price pressures, paving the way for a more accommodative monetary policy stance.

Projections from reputable sources, such as Dataloft and HM Treasury Consensus Forecast (March 2024), paint a promising picture. Consensus forecasts indicate that inflation is poised to hover close to the target rate of 2.0% by the fourth quarter of 2024. Such stability in inflation augurs well for the economy and bodes positively for future interest rate adjustments.

Understanding these economic indicators is akin to peering through a window into the housing market's future. The interplay between interest rates, inflation, and broader economic trends shapes the affordability and accessibility of housing, influencing both demand and supply dynamics. For prospective homebuyers, sellers, and investors, staying abreast of these indicators is paramount for making informed decisions in a dynamic and ever-evolving market landscape.

while the housing market's future may appear uncertain, insights gleaned from monitoring economic indicators offer valuable guideposts along the way. As interest rates adjust and inflation moderates, the trajectory of the housing market becomes clearer, empowering stakeholders to navigate challenges and capitalize on opportunities in the pursuit of their real estate endeavours.

- Details

- Hits: 311

The UK property market continues its upward trajectory as the average price of properties hitting the market experiences a notable increase of 1.5% in March. This increase outpaces the historic average uplift for this month, which typically hovers around 1%. The new figures, taking the average property price to £368,118, reflect a substantial rise of £5,279. This marks the third consecutive monthly increase and stands as the most significant uptick seen in the past 10 months, driven largely by heightened demand.

Despite this upward trend, property prices remain notably below the peak witnessed in May 2023, with an average shortfall of £4,776. This disparity creates a window of opportunity for prospective buyers who are sensing favourable conditions in the market. With prices still below the previous peak, many buyers are keen to capitalize on this moment, anticipating potential future gains in property value.

The increase in demand is palpable, with almost two-thirds of agents (64%) reporting three or more prospective buyers vying for each available property. Such high levels of interest indicate a competitive landscape, underscoring the urgency for buyers to act decisively.

However, amidst the enthusiasm, experts emphasize the importance of realistic pricing. While demand is driving prices upwards, overpricing properties could deter potential buyers and prolong their time on the market. Achieving the delicate balance between capitalizing on market momentum and setting realistic prices is crucial for sellers to maximize their returns.

These insights are drawn from a recent Dataloft Poll of Subscribers conducted in collaboration with Rightmove in March 2024. The survey provides valuable data indicating the current dynamics within the UK property market, shedding light on trends and sentiments among industry professionals.

March 2024 has seen a notable surge in property prices, fuelled by increased demand and market optimism. While buyers sense a window of opportunity with prices still below previous peaks, sellers must exercise caution in setting realistic prices to navigate the competitive landscape effectively. As the market continues to evolve, staying informed about prevailing trends and dynamics remains essential for all stakeholders involved in the property market so contact Taylor Robinson today if you are looking to sell you property in Crawley

- Details

- Hits: 268