In the realm of economic forecasting, few sectors garner as much attention and speculation as the housing market. The ebb and flow of this market not only reflects the health of the economy but also plays a crucial role in shaping it. To gain insight into its trajectory, analysts often turn to a plethora of economic indicators. Monitoring these indicators not only provides a snapshot of the current state of affairs but also offers valuable hints about where the market might be headed in the future.

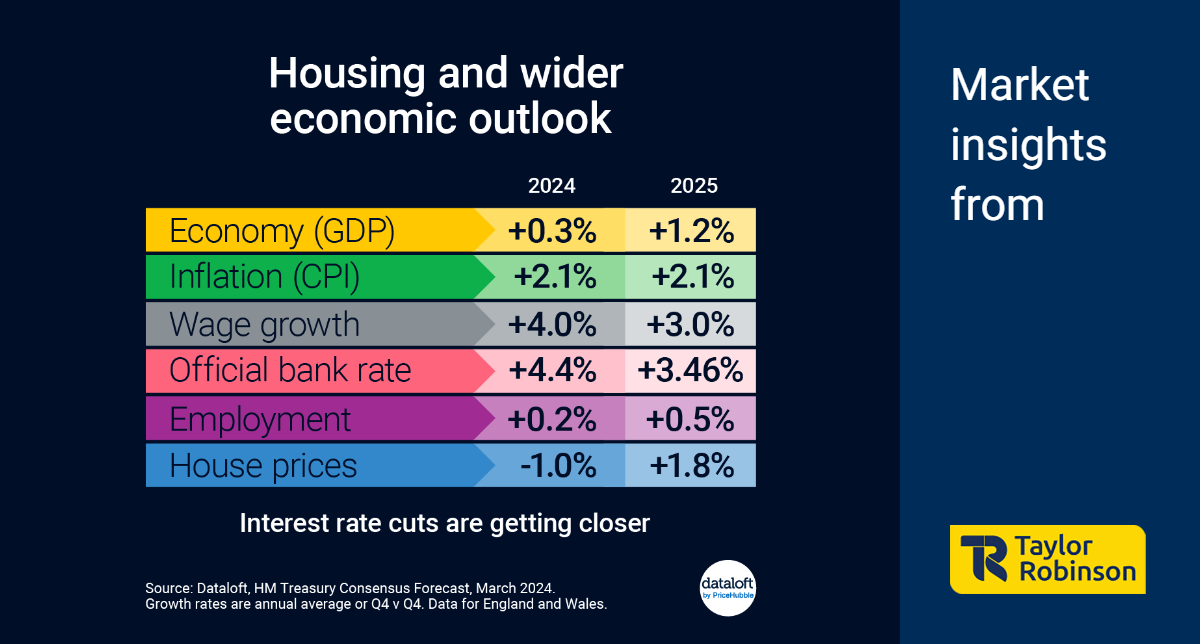

At the March meeting of the Bank of England, all eyes were on the bank rate, a pivotal factor influencing mortgage rates and, consequently, the housing market's dynamics. Despite holding steady at 5.25%, Governor's remarks hinted at an impending shift. "We are on the way," he announced, signalling a trajectory toward interest rate cuts. This aligns with consensus forecasts, which project the bank rate to dip to 4.4% by the fourth quarter of 2024.

A key driver behind this anticipated adjustment is the evolving inflation landscape. As inflationary pressures ease, the case for lower interest rates gains momentum. February's inflation data revealed a headline CPI rate of 3.4%, down from 4.0% the previous month. This decline suggests a moderation in price pressures, paving the way for a more accommodative monetary policy stance.

Projections from reputable sources, such as Dataloft and HM Treasury Consensus Forecast (March 2024), paint a promising picture. Consensus forecasts indicate that inflation is poised to hover close to the target rate of 2.0% by the fourth quarter of 2024. Such stability in inflation augurs well for the economy and bodes positively for future interest rate adjustments.

Understanding these economic indicators is akin to peering through a window into the housing market's future. The interplay between interest rates, inflation, and broader economic trends shapes the affordability and accessibility of housing, influencing both demand and supply dynamics. For prospective homebuyers, sellers, and investors, staying abreast of these indicators is paramount for making informed decisions in a dynamic and ever-evolving market landscape.

while the housing market's future may appear uncertain, insights gleaned from monitoring economic indicators offer valuable guideposts along the way. As interest rates adjust and inflation moderates, the trajectory of the housing market becomes clearer, empowering stakeholders to navigate challenges and capitalize on opportunities in the pursuit of their real estate endeavours.